BofA's Take: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

The Importance of Long-Term Perspective in Stock Market Investing

The stock market is inherently volatile. Short-term fluctuations, while dramatic at times, often fail to reflect the underlying long-term economic fundamentals. Focusing on short-term market movements when dealing with stretched stock market valuations is a recipe for poor investment decisions. A successful long-term investment strategy transcends these temporary dips and climbs.

- Past Market Corrections and Subsequent Growth: History demonstrates that market corrections, even significant ones, have historically been followed by periods of robust growth. Focusing on the long game allows investors to weather these storms and benefit from the eventual rebound.

- Long-Term Economic Growth Projections: Consider the broader economic landscape. Long-term projections for economic growth, technological advancement, and global expansion often outweigh the impact of short-term valuation adjustments. A long-term strategy aligns with these positive trends.

- Emotional Decision-Making: Fear and panic often drive poor investment choices. Reacting emotionally to short-term valuation changes, especially concerning stretched stock market valuations, can lead to selling low and buying high—precisely the opposite of a successful investment strategy.

BofA's Arguments for Continued Market Strength Despite High Valuations

BofA's research points to several factors that support a continued positive market outlook despite the seemingly high valuations. Their analysis suggests that certain mitigating factors outweigh the risks associated with stretched stock market valuations.

- Low Interest Rates: Historically low interest rates continue to provide a supportive environment for stock market growth. These low rates encourage borrowing and investment, fueling economic activity. (Source: BofA Global Research, [Insert relevant report link here]).

- Robust Corporate Earnings: Many companies are reporting strong earnings, indicating underlying economic strength. This robust performance can support higher stock valuations. (Source: BofA Global Research, [Insert relevant report link here]).

- Technological Innovation: Ongoing technological advancements are driving innovation across numerous sectors, fueling further economic growth and creating new investment opportunities. BofA highlights the technology sector as a particularly promising area. (Source: BofA Global Research, [Insert relevant report link here]).

- Strong Earnings Growth: Despite high valuations, strong earnings growth in many sectors is offsetting the impact, suggesting that current prices are not entirely unjustified.

Addressing the Risks Associated with Stretched Stock Market Valuations

While BofA's analysis is positive, it's crucial to acknowledge the inherent risks associated with stretched stock market valuations. Ignoring these risks would be irresponsible.

- Inflationary Pressures: Rising inflation can erode purchasing power and potentially impact corporate earnings, creating headwinds for stock market growth.

- Rising Interest Rates: A potential increase in interest rates could make borrowing more expensive, potentially slowing down economic growth and impacting stock valuations.

- Geopolitical Instability: Global events and geopolitical uncertainty can significantly affect market sentiment and investment decisions.

- Mitigating Risks Through Diversification: A well-diversified portfolio is crucial to mitigate these risks. Spreading investments across different asset classes reduces the impact of any single negative event. Implementing a robust risk management strategy is paramount.

How Investors Can Navigate the Current Market Environment

Based on BofA's analysis and a consideration of market risks, investors can adopt several strategies to navigate the current environment:

- Strategic Asset Allocation: Maintain a well-diversified portfolio across various asset classes (stocks, bonds, real estate, etc.), adjusting allocation based on risk tolerance and long-term goals.

- Investment Choices: Consider investments in sectors identified by BofA as having strong growth potential, but always conduct thorough due diligence.

- Monitoring Market Indicators: Stay informed about key economic indicators, interest rate changes, and geopolitical developments to make informed adjustments to your investment strategy.

Conclusion: Why Stretched Stock Market Valuations Shouldn't Deter Long-Term Investors

BofA's analysis suggests that while stretched stock market valuations are a legitimate concern, they shouldn't deter long-term investors. The combination of low interest rates, robust corporate earnings, and technological innovation provides a supportive environment for continued market growth. However, a balanced approach is vital. Understanding and mitigating the risks associated with high valuations through diversification and a well-defined investment strategy is crucial. Don't let concerns about stretched stock market valuations deter you from pursuing your long-term investment goals. Understand the full picture, consider BofA's insights, and build a resilient portfolio today.

Featured Posts

-

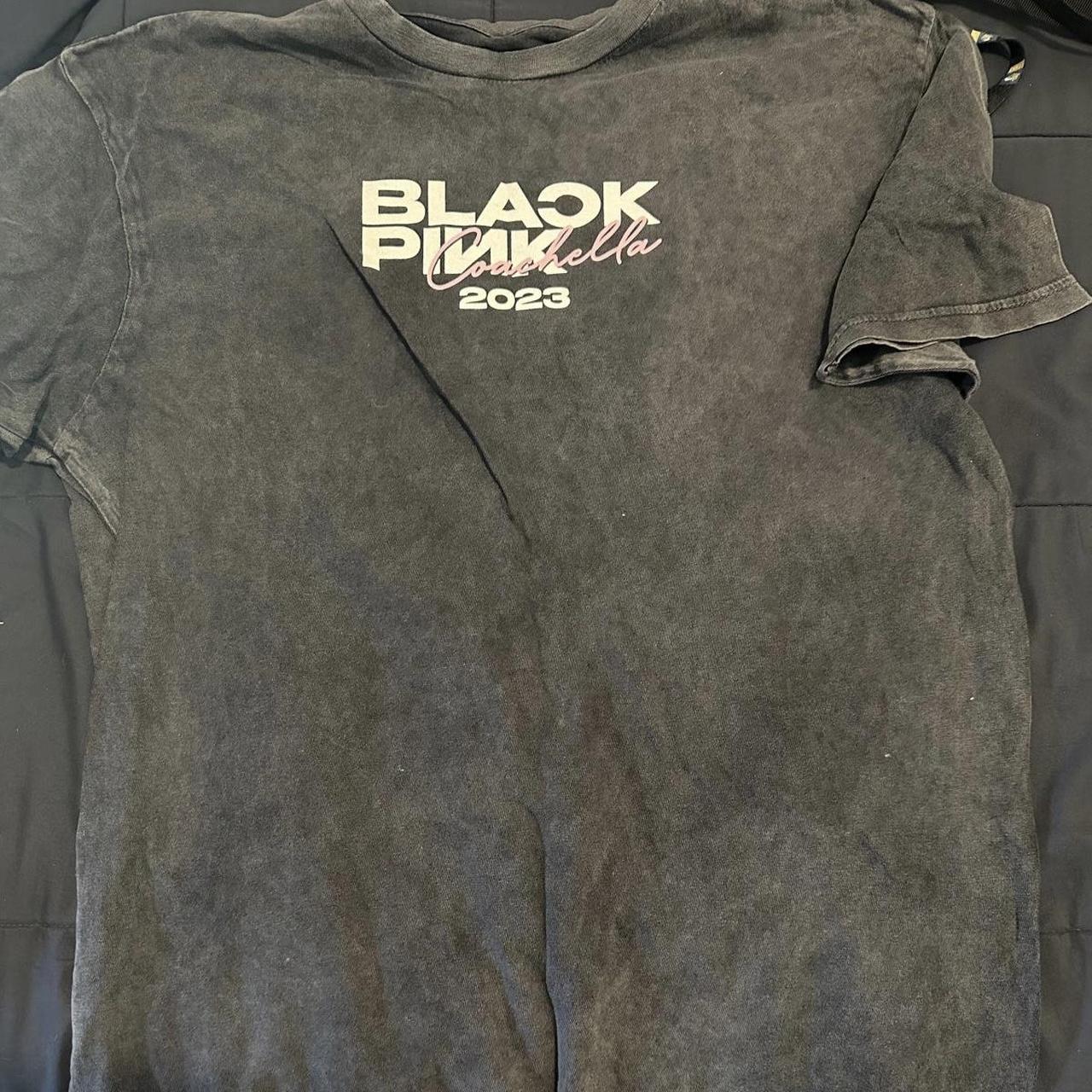

Find The Best Official Coachella 2025 Performer Merch On Amazon

Apr 25, 2025

Find The Best Official Coachella 2025 Performer Merch On Amazon

Apr 25, 2025 -

2025 Nfl Draft Profile Texas Wr Matthew Golden

Apr 25, 2025

2025 Nfl Draft Profile Texas Wr Matthew Golden

Apr 25, 2025 -

Find The Perfect Makeup Organiser Tips And Product Recommendations

Apr 25, 2025

Find The Perfect Makeup Organiser Tips And Product Recommendations

Apr 25, 2025 -

La Landlord Price Gouging Following Fires A Selling Sunset Star Speaks Out

Apr 25, 2025

La Landlord Price Gouging Following Fires A Selling Sunset Star Speaks Out

Apr 25, 2025 -

Navigating The Legal System After A Car Accident The Need For A Lawyer

Apr 25, 2025

Navigating The Legal System After A Car Accident The Need For A Lawyer

Apr 25, 2025