BofA's View: Understanding And Addressing Concerns About Stretched Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Valuations

BofA regularly publishes reports and analyses offering their assessment of prevailing market conditions. These reports often utilize a variety of valuation metrics to determine whether current prices are justified or represent overvaluation. Let's examine some key aspects of their assessment:

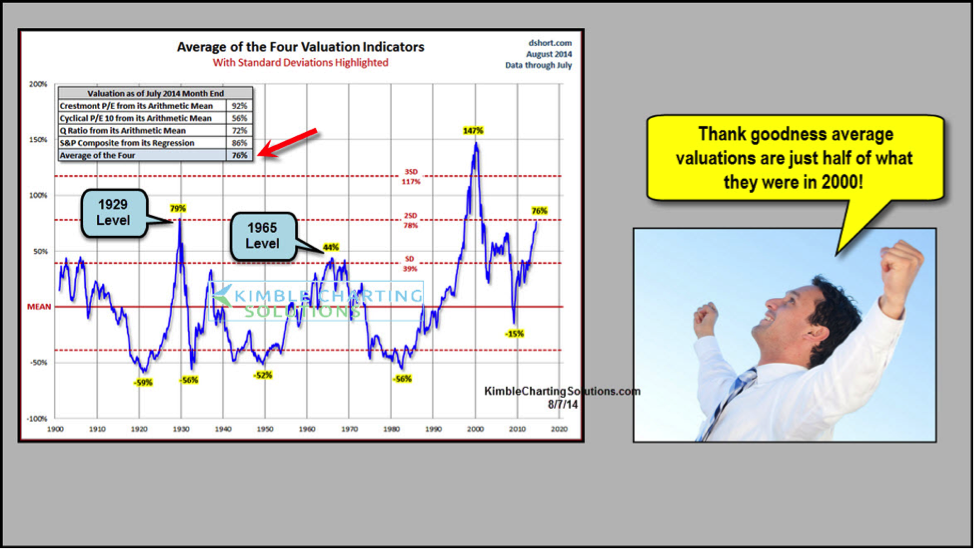

- Key Valuation Metrics: BofA employs several critical metrics, including the widely used Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), to gauge market valuations. They also consider other factors like revenue growth, profit margins, and industry-specific dynamics.

- BofA's Assessment of "Stretched" Valuations: BofA's assessment on whether valuations are truly "stretched" is nuanced and often depends on the specific sector and underlying economic conditions. While they may identify certain sectors as exhibiting elevated valuations compared to historical averages, they also consider factors that could justify these higher multiples, such as anticipated future growth or low interest rates.

- Sector-Specific Overvaluation/Undervaluation: BofA's reports frequently highlight sectors they believe are relatively overvalued or undervalued compared to their intrinsic worth. For example, past reports may have flagged technology stocks as potentially overvalued in certain periods due to rapid growth followed by slower growth and profit decline. Conversely, sectors with strong fundamentals and future growth prospects might be deemed undervalued. (Note: Specific sector calls are dynamic and change with market conditions; consult current BofA reports for up-to-date information).

- Data and Charts: BofA supports its analysis with comprehensive data and charts illustrating key valuation metrics, sector comparisons, and economic indicators, available in their research publications and online platforms.

Factors Contributing to Stretched Valuations (According to BofA)

BofA identifies several key factors contributing to the perceived high valuations in the market:

- Low Interest Rates: Historically low interest rates have pushed investors toward higher-yielding assets, including equities, boosting demand and driving up prices. This can inflate valuations, especially when future earnings aren't commensurate with current prices.

- Corporate Earnings Growth: Strong corporate earnings growth can support higher valuations. However, if growth slows or stagnates, while valuations remain elevated, it raises concerns about potential overvaluation. BofA closely monitors earnings reports and their sustainability.

- Investor Sentiment and Risk Appetite: Optimistic investor sentiment and a high risk appetite can lead to a "fear of missing out" (FOMO) mentality, driving up prices beyond fundamental justifications. Conversely, shifts in sentiment can quickly reverse this trend.

- Geopolitical Factors: Global political events, trade wars, and economic uncertainty can significantly influence investor behavior, leading to fluctuations in market valuations. BofA considers these geopolitical factors in its overall assessment.

- Macroeconomic Indicators: BofA closely examines macroeconomic indicators such as inflation, unemployment rates, and GDP growth to assess the overall economic health and its impact on market valuations.

BofA's Recommendations for Investors

Navigating a market with potentially stretched valuations requires a strategic approach. BofA often recommends the following:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors can reduce overall portfolio risk. Diversification helps mitigate losses in one sector by potentially positive performance in other asset classes.

- Sector-Specific Recommendations: Based on their valuation analysis, BofA may suggest focusing on undervalued sectors with strong long-term growth potential while limiting exposure to potentially overvalued ones. These recommendations change as market conditions evolve.

- Asset Allocation: BofA advises investors to carefully assess their risk tolerance and adjust their asset allocation accordingly. This involves determining the appropriate balance between stocks and bonds based on individual circumstances and market outlook.

- Risk Management Strategies: Implementing risk management techniques, such as stop-loss orders or hedging strategies, can help limit potential losses in case of a market downturn.

- Investment Products: BofA might recommend specific investment products, such as exchange-traded funds (ETFs) or mutual funds, that align with their market outlook and client risk profiles.

Addressing Investor Concerns and Risks

Investors understandably harbor concerns about investing in a market with potentially stretched valuations:

- Risks of Overvalued Assets: Investing in overvalued assets carries the risk of significant capital losses if prices correct. A decline in market sentiment or a slowdown in earnings growth could trigger a price correction.

- Assessing Risk Tolerance: It’s crucial to understand your personal risk tolerance before making any investment decisions. This involves evaluating your comfort level with potential losses and your long-term financial goals.

- Mitigating Potential Losses: Diversification, risk management strategies, and a long-term investment horizon can help mitigate potential losses.

- Long-Term Investment Planning: A well-defined long-term investment plan can help navigate short-term market fluctuations and achieve financial goals.

- BofA Resources: For more in-depth information and analysis, consult BofA's research reports and online resources. (Insert link to relevant BofA resources here, if available).

Conclusion: Navigating the Challenges of Stretched Stock Market Valuations with BofA's Insights

BofA's analysis of stretched stock market valuations highlights the importance of careful consideration of valuation metrics, macroeconomic factors, and investor sentiment. Their recommendations emphasize diversification, strategic asset allocation, and effective risk management as key tools for navigating this complex environment. Informed decision-making, grounded in thorough analysis, is crucial for achieving long-term investment success. To gain a deeper understanding of current market valuations and develop a robust investment strategy to manage the challenges presented by potentially stretched valuations, consult BofA's research and resources. (Insert link to relevant BofA resources here, if available).

Featured Posts

-

Value Shopping Guide Finding Cheap Stuff Thats Worth It

May 17, 2025

Value Shopping Guide Finding Cheap Stuff Thats Worth It

May 17, 2025 -

Seattle Mariners Ichiro Suzukis Continued Impact After Two Decades

May 17, 2025

Seattle Mariners Ichiro Suzukis Continued Impact After Two Decades

May 17, 2025 -

Ngoi Sao 17 Tuoi Nguoi Nga Lam Nen Lich Su Tai Indian Wells

May 17, 2025

Ngoi Sao 17 Tuoi Nguoi Nga Lam Nen Lich Su Tai Indian Wells

May 17, 2025 -

Trumps Military Events Exclusive Vip Experiences For Donors

May 17, 2025

Trumps Military Events Exclusive Vip Experiences For Donors

May 17, 2025 -

Anunobys 27 Puntos Llevan A Los Knicks A La Victoria Sobre Los Sixers Que Encajan Su Novena Derrota Consecutiva

May 17, 2025

Anunobys 27 Puntos Llevan A Los Knicks A La Victoria Sobre Los Sixers Que Encajan Su Novena Derrota Consecutiva

May 17, 2025