BofA's View: Why Overvalued Stocks Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Long-Term Perspective

BofA's overall stance on overvalued stocks centers on a long-term growth perspective. They acknowledge the existence of overvalued stocks in the market but argue that focusing solely on short-term valuations can be detrimental to long-term investment success. Their analysts emphasize that the potential for significant corporate earnings growth can ultimately outpace initial valuation concerns.

-

BofA's belief in the power of corporate earnings growth: BofA's research highlights the historical trend of strong companies exceeding expectations, demonstrating that earnings growth often justifies, even in retrospect, what might initially appear as an overvalued stock price. This is particularly true for companies with robust, sustainable business models.

-

Emphasis on identifying companies with strong fundamentals: BofA advocates for a thorough analysis of a company's financial health, competitive advantage, and future growth potential before making investment decisions. Focusing solely on the Price-to-Earnings ratio (P/E ratio) without considering other crucial aspects can lead to inaccurate conclusions.

-

Limitations of short-term market predictions: BofA's analysts caution against placing too much weight on short-term market fluctuations and predictions. Market sentiment can be highly volatile and often driven by factors unrelated to a company’s intrinsic value. Long-term investors should remain focused on the long-term trajectory of the businesses they hold.

"While market valuations can fluctuate, focusing on the underlying strength and growth potential of individual companies remains paramount for long-term investment success," states a recent BofA Securities report.

The Importance of Diversification in Mitigating Overvaluation Risk

A diversified investment portfolio acts as a crucial buffer against the risks associated with individual overvalued stocks. By spreading investments across various asset classes and sectors, investors can significantly reduce their overall portfolio's vulnerability to market downturns.

-

Benefits of a diversified asset mix: Holding a mix of stocks, bonds, real estate, and possibly alternative investments helps to balance risk and returns. When one asset class underperforms, others may offset those losses, limiting the overall negative impact on your portfolio.

-

Risk reduction through diversification: Diversification significantly lowers the impact of any single investment's poor performance. If one overvalued stock declines, its impact on the overall portfolio will be minimal compared to a portfolio concentrated in that single stock.

-

Protection against market fluctuations: Historically, diversified portfolios have shown greater resilience during periods of market volatility. A well-diversified portfolio is better positioned to withstand downturns caused by specific sector weakness or broad market corrections.

Studies consistently show that well-diversified portfolios outperform less diversified ones over the long run. For example, a study by Vanguard showed that diversified portfolios with both stocks and bonds had significantly lower volatility compared to portfolios invested solely in stocks.

Focusing on Fundamentals: Beyond Market Sentiment

Instead of being solely fixated on market valuations, investors should prioritize in-depth fundamental analysis. This involves examining a company's intrinsic value based on its financial health and future prospects.

-

Key financial metrics: Investors should focus on evaluating revenue growth, earnings per share (EPS), profit margins, debt levels, and cash flow. These metrics offer a more comprehensive picture of a company's financial strength than just its stock price.

-

Strong fundamentals support long-term growth: Companies with consistently strong fundamentals are often better equipped to weather market downturns and achieve long-term growth, regardless of temporary overvaluation.

-

Examples of strong fundamentals: Consider companies like Microsoft or Johnson & Johnson. Both have demonstrated strong fundamentals and long-term growth despite experiencing periods of perceived overvaluation in their stock prices.

Practical tips for fundamental analysis include: reviewing annual reports, examining financial statements, following industry trends, and researching a company's competitive landscape.

The Role of Inflation and Interest Rates in Stock Valuation

Macroeconomic factors like inflation and interest rates significantly influence stock valuations. However, these fluctuations shouldn't automatically trigger panic selling.

-

Inflation and interest rates' impact on profitability: High inflation can erode company profitability, while rising interest rates increase borrowing costs. Conversely, lower interest rates may stimulate growth and boost valuations.

-

Market overreaction: The market often overreacts to short-term changes in these economic indicators. A temporary spike in inflation doesn't necessarily mean a long-term decline in stock prices, especially for companies with strong pricing power and the ability to manage costs effectively.

-

Company adaptation to economic changes: Successful companies demonstrate the ability to adapt their business models and strategies to navigate changing economic environments. Analyzing how a company has historically responded to economic cycles can offer valuable insights into its resilience.

Historical data clearly shows a complex relationship between inflation, interest rates and stock market performance, often demonstrating that market reactions are not always perfectly aligned with economic fundamentals.

Identifying Undervalued Opportunities within an Overvalued Market

Even in a market perceived as overvalued, savvy investors can find undervalued opportunities. This requires a more nuanced approach to valuation and a willingness to undertake deeper research.

-

Relative valuation and sector-specific analysis: Comparing the valuation of a company within its sector can reveal potential undervaluation. While the overall market might be expensive, certain sectors or specific companies might offer compelling investment opportunities.

-

Thorough research and due diligence: Meticulous research is crucial to uncovering undervalued gems. This involves analyzing financial statements, understanding the competitive landscape, and assessing future growth potential.

-

Examples of undervalued opportunities: Undervalued stocks may exist in sectors that are currently out of favor or are perceived as having short-term challenges. Thorough analysis might reveal companies with undervalued assets or those undergoing strategic restructuring.

Conclusion

BofA's perspective on overvalued stocks emphasizes the importance of a long-term investment strategy, robust portfolio diversification, and thorough fundamental analysis. Short-term market fluctuations shouldn't dictate your long-term investment approach. Remember, the focus should be on the underlying strength and growth potential of the businesses you own.

Don't let concerns about overvalued stocks derail your long-term investment strategy. Review your portfolio, focusing on diversification and fundamental analysis, and consider seeking professional advice to ensure your investments align with your risk tolerance and long-term financial goals. Understanding BofA's view on overvalued stocks can help you make informed decisions and navigate the complexities of the market with confidence.

Featured Posts

-

Mystery Surrounds Missing British Paralympian In Las Vegas

Apr 29, 2025

Mystery Surrounds Missing British Paralympian In Las Vegas

Apr 29, 2025 -

Assessing The Influence Of Tax Credits On Minnesotas Film Sector

Apr 29, 2025

Assessing The Influence Of Tax Credits On Minnesotas Film Sector

Apr 29, 2025 -

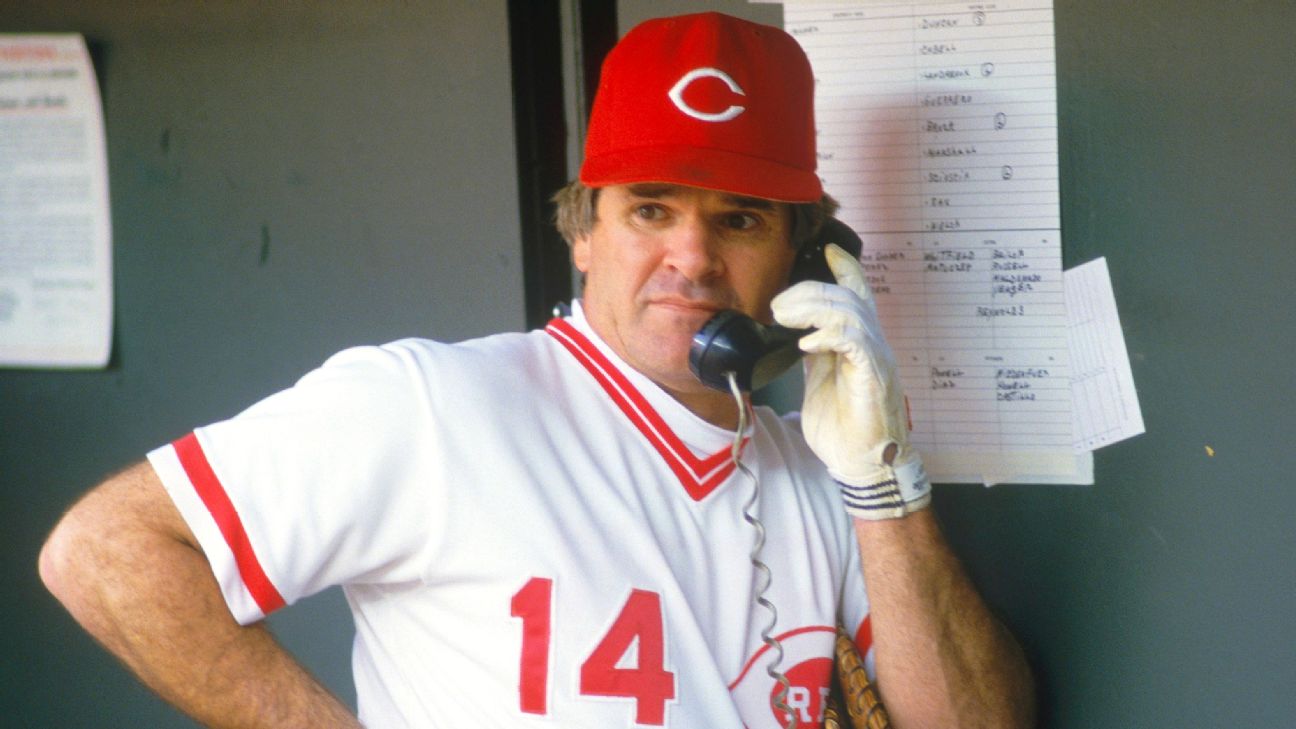

Trump To Pardon Pete Rose A Baseball Legends Presidential Pardon

Apr 29, 2025

Trump To Pardon Pete Rose A Baseball Legends Presidential Pardon

Apr 29, 2025 -

Urgent Search For Missing British Paralympian In Las Vegas

Apr 29, 2025

Urgent Search For Missing British Paralympian In Las Vegas

Apr 29, 2025 -

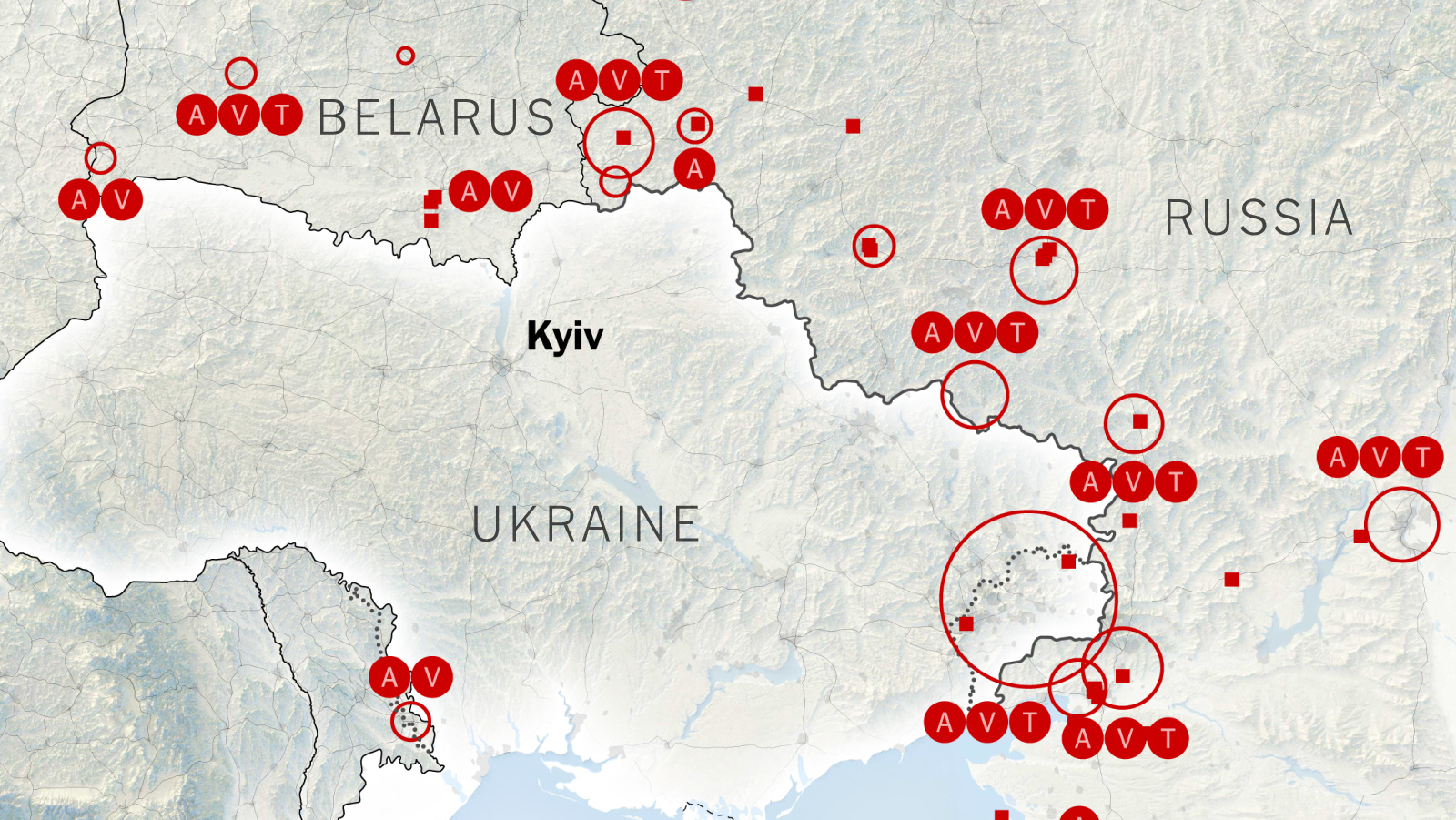

North Koreas Troop Deployment To Russia Implications For The Ukraine Conflict

Apr 29, 2025

North Koreas Troop Deployment To Russia Implications For The Ukraine Conflict

Apr 29, 2025