Bond Market Volatility: Analyzing The Tariff Shock

Table of Contents

The Mechanism of Tariff Shocks on Bond Markets

Tariffs, by their very nature, introduce significant disruptions into the global economic system, directly impacting the stability of the bond market. This impact manifests through several key mechanisms:

Inflationary Pressures

Tariffs increase the cost of imported goods, leading to higher consumer prices. This inflationary pressure can prompt central banks to raise interest rates to combat rising inflation, significantly impacting bond yields.

- Increased production costs: Businesses face higher input costs, leading to increased prices for consumers.

- Reduced consumer spending power: Higher prices erode purchasing power, potentially leading to slower economic growth.

- Potential for wage increases fueling further inflation: Businesses may pass increased costs onto employees, leading to higher wages, and a wage-price spiral.

Higher interest rates have an inverse relationship with bond prices. When interest rates rise, the yields on existing bonds become less attractive, causing their prices to fall. The potential for stagflation – a combination of slow economic growth and high inflation – further exacerbates the situation, creating uncertainty and volatility in the bond market.

Uncertainty and Risk Aversion

The imposition of tariffs creates economic uncertainty, impacting investor sentiment and leading to a flight to safety. Investors often seek refuge in government bonds, perceived as safer havens during times of economic turmoil. This increased demand can initially push bond prices up. However, this effect is frequently temporary, followed by corrections as the market adjusts to the new reality.

- Reduced investor confidence: Uncertainty about future economic prospects leads to decreased investment in riskier assets.

- Flight to safety: Investors move capital into perceived safe-haven assets, such as government bonds.

- Potential for short-term bond price increases followed by corrections: Initial price increases are often unsustainable in the long term.

This "flight-to-quality" phenomenon disproportionately affects different bond maturities. Short-term bonds may see less dramatic price swings than longer-term bonds due to their lower interest rate sensitivity. The role of credit rating agencies also becomes paramount; any downgrade in sovereign debt ratings can trigger further volatility.

Currency Fluctuations

Tariffs can significantly impact currency exchange rates, affecting the value of international bond holdings and investor decisions.

- Depreciation of domestic currency: Tariffs can lead to a weakening of the domestic currency as imports become more expensive.

- Appreciation of foreign currencies: Conversely, the currencies of countries unaffected by the tariffs may strengthen.

- Impact on foreign bond investments: Currency fluctuations directly impact the returns for investors holding international bonds.

These currency changes dramatically affect returns for international bond investors. For example, a depreciating domestic currency reduces the value of foreign bond holdings when converted back to the domestic currency. Hedging strategies, such as using currency futures or forwards, can help mitigate some of this risk, but they come with their own complexities and costs.

Impact on Different Bond Types

Tariff shocks differentially affect various types of bonds. Understanding these nuances is vital for effective portfolio management.

Government Bonds

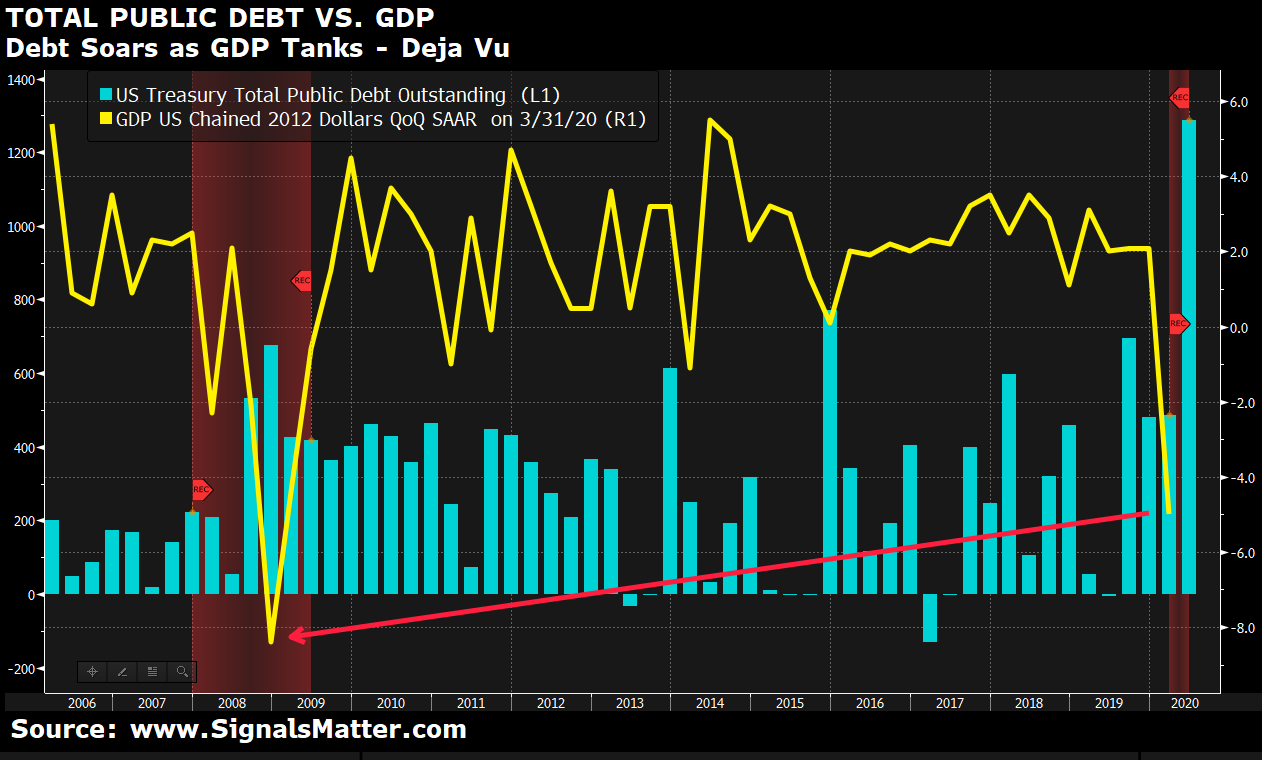

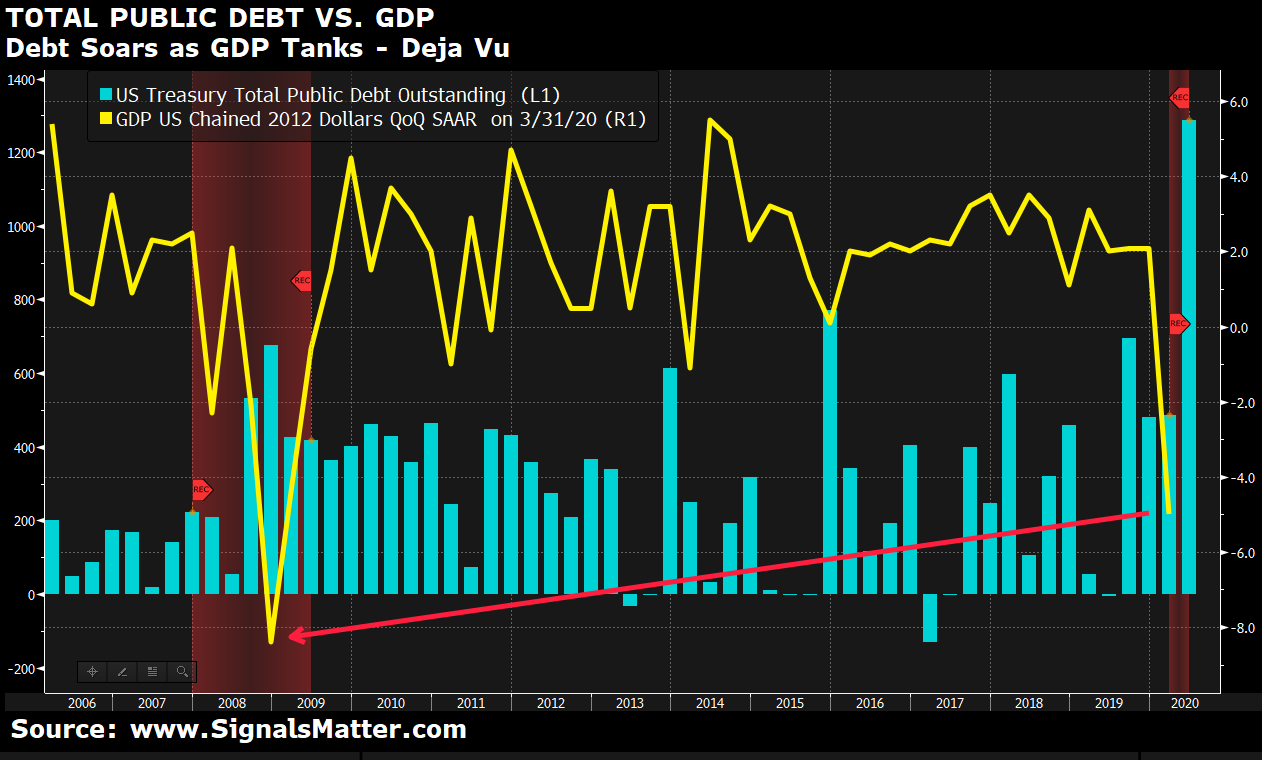

Government bond yields are significantly affected by tariff shocks. Increased government borrowing to offset potential economic slowdowns or fund increased deficits can push bond yields higher.

- Increased government borrowing to offset economic slowdown: Governments may need to borrow more to fund stimulus programs or social safety nets.

- Potential for higher bond yields due to increased supply: Increased supply of government bonds can depress prices and increase yields.

- Impact on sovereign debt ratings: Increased debt levels may lead to downgrades in sovereign credit ratings, further impacting bond yields.

The impact on short-term versus long-term government bonds differs; short-term bonds are generally less sensitive to long-term economic forecasts, while long-term bonds bear the brunt of uncertainty regarding future inflation and economic growth.

Corporate Bonds

Corporate bonds are also impacted, with sectors particularly vulnerable to tariff increases facing heightened risks.

- Impact on companies reliant on imports: Companies heavily reliant on imported materials or components face increased production costs, squeezing profit margins.

- Increased risk of defaults: Reduced profitability increases the risk of corporate defaults, impacting the value of their bonds.

- Potential for credit rating downgrades: Rating agencies may downgrade the creditworthiness of affected companies, leading to lower bond prices.

The sector-specific impact is significant. Manufacturing and retail sectors, for example, are often heavily reliant on imports and are therefore particularly susceptible to negative consequences of tariffs.

Emerging Market Bonds

Emerging markets are particularly vulnerable due to their reliance on trade and susceptibility to capital flight.

- Increased risk of currency depreciation: Emerging market currencies may depreciate sharply as investors flee the region.

- Capital outflow: Investors may withdraw capital from emerging markets, exacerbating economic instability.

- Potential for sovereign debt crises: Economic distress can trigger sovereign debt crises, leading to defaults on government bonds.

Investor confidence plays a crucial role. The potential for contagion effects—where instability in one emerging market spreads to others—adds further complexity and risk.

Strategies for Navigating Bond Market Volatility During Tariff Shocks

Investors can employ several strategies to mitigate the risks associated with bond market volatility stemming from tariff shocks.

Diversification

Diversifying bond holdings across different sectors, maturities, and geographies is crucial for risk reduction.

- Geographic diversification: Spreading investments across different countries reduces exposure to risks specific to one region.

- Sector diversification: Investing in bonds from various sectors helps to offset the impact of sector-specific shocks.

- Maturity diversification: Holding bonds with different maturities reduces sensitivity to interest rate changes.

A well-diversified portfolio can cushion the blow of unexpected events, limiting the potential for substantial losses.

Hedging

Hedging strategies can help mitigate currency risk and interest rate risk.

- Currency hedging using futures contracts or options: These tools can help protect against losses due to currency fluctuations.

- Interest rate swaps: These contracts can help manage interest rate risk by locking in a specific interest rate.

While hedging can provide a degree of protection, it's essential to understand that these strategies are not foolproof and can incur costs.

Active Management

Actively managed bond funds can adjust portfolios in response to changing market conditions.

- Active managers' ability to identify opportunities and mitigate risk: Skilled managers can identify undervalued bonds and adjust positions to benefit from market shifts.

- Access to specialized expertise: Active managers possess specialized expertise in analyzing market trends and assessing credit risks.

Active managers can react to tariff-induced volatility by adjusting their portfolio allocations, potentially capitalizing on opportunities arising from market dislocations.

Conclusion

Tariff shocks significantly impact bond market volatility through various mechanisms, including inflationary pressures, increased uncertainty, and currency fluctuations. Understanding these mechanisms is crucial for investors to assess and manage the risks associated with their bond portfolios. By employing strategies such as diversification, hedging, and active management, investors can better navigate the turbulent waters of bond market volatility caused by tariff-related uncertainty. Remember to actively monitor the evolving global trade landscape and adjust your bond portfolio accordingly to effectively manage bond market volatility during periods of tariff uncertainty.

Featured Posts

-

Is Black Gold Within Reach Analyzing Uruguays Offshore Drilling Prospects

May 12, 2025

Is Black Gold Within Reach Analyzing Uruguays Offshore Drilling Prospects

May 12, 2025 -

The Architecture And Design Of Mtv Cribs Mansions

May 12, 2025

The Architecture And Design Of Mtv Cribs Mansions

May 12, 2025 -

Has The Cbs Vma Simulcast Rendered Mtv Obsolete

May 12, 2025

Has The Cbs Vma Simulcast Rendered Mtv Obsolete

May 12, 2025 -

Impact Of The Cbs Vma Simulcast On Mtvs Ratings And Relevance

May 12, 2025

Impact Of The Cbs Vma Simulcast On Mtvs Ratings And Relevance

May 12, 2025 -

Rare Family Moment Boris And Carrie Johnsons Easter Son Video

May 12, 2025

Rare Family Moment Boris And Carrie Johnsons Easter Son Video

May 12, 2025