Bonds, Dow Futures, Bitcoin: Today's Market Movers

Table of Contents

Understanding the Bond Market's Influence

The bond market, a cornerstone of the global financial system, is significantly influenced by several key factors. Changes in these factors directly impact bond prices and, consequently, overall market sentiment. Understanding the relationship between bond yields, interest rates, and inflation is paramount for any investor.

Keywords: Bond Yields, Interest Rates, Federal Reserve, Inflation, Bond Prices

-

Impact of rising interest rates on bond prices: When central banks like the Federal Reserve raise interest rates, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This results in a decrease in the price of existing bonds. This inverse relationship is fundamental to understanding bond market dynamics.

-

The role of inflation expectations in bond market volatility: Inflation erodes the purchasing power of future bond payments. If investors anticipate higher inflation, they demand higher yields to compensate for this risk, leading to increased volatility in the bond market. Tracking inflation indices becomes crucial for predicting bond price movements.

-

How Federal Reserve policy decisions influence bond yields: The Federal Reserve's monetary policy decisions, particularly regarding interest rate targets and quantitative easing (QE) programs, directly affect bond yields. Announcements from the Fed can trigger significant shifts in bond prices, highlighting the importance of staying informed about central bank actions.

-

The correlation between bond yields and other asset classes: Bond yields often have an inverse relationship with other asset classes like stocks. When bond yields rise (reflecting increased risk aversion), stock prices may fall, and vice versa. Understanding this correlation helps diversify investment portfolios effectively.

Deciphering the Dow Futures' Signals

Dow futures contracts are derivative instruments whose price is tied to the Dow Jones Industrial Average (DJIA), a key indicator of US stock market performance. Trading Dow futures allows investors to speculate on the future direction of the DJIA, providing valuable insights into market sentiment and potential trends.

Keywords: Dow Jones Industrial Average, Futures Contracts, Stock Market, Market Sentiment, Economic Indicators

-

How Dow futures contracts work and their relationship to the Dow Jones Industrial Average: Dow futures contracts represent an agreement to buy or sell the DJIA at a specified price on a future date. Their price typically mirrors the DJIA, although fluctuations can occur due to factors such as leverage and market speculation.

-

Key economic indicators that influence Dow futures prices (e.g., GDP, employment data): Economic data releases, such as GDP growth figures, employment reports, and inflation data, significantly influence investor sentiment and, consequently, Dow futures prices. Positive economic news generally leads to higher Dow futures prices, while negative news can trigger declines.

-

The impact of geopolitical events on Dow futures trading: Global events, including political instability, international conflicts, and trade disputes, can significantly impact market sentiment and Dow futures trading. Uncertainty often leads to increased volatility and price fluctuations.

-

Interpreting price movements in Dow futures to anticipate stock market trends: Analyzing price movements in Dow futures can offer valuable insights into the anticipated direction of the broader stock market. Sharp increases in Dow futures often suggest positive market sentiment and potential upward movement in stock prices.

Navigating the Crypto Volatility: Bitcoin's Trajectory

Bitcoin, the pioneering cryptocurrency, has experienced significant price volatility since its inception. Its trajectory is influenced by a complex interplay of regulatory developments, technological advancements, and investor sentiment. Understanding these factors is critical for anyone navigating the crypto market.

Keywords: Bitcoin, Cryptocurrency, Crypto Market, Volatility, Blockchain Technology, Regulatory Uncertainty

-

The influence of regulatory announcements on Bitcoin's price: Regulatory pronouncements from governments and financial institutions can significantly impact Bitcoin's price. Favorable regulations tend to boost investor confidence and drive price increases, while negative news can lead to sharp declines.

-

The impact of technological upgrades and developments on Bitcoin's adoption: Technological advancements, such as scaling solutions and improved security features, can enhance Bitcoin's functionality and increase its adoption, positively influencing its price.

-

The role of institutional investors in shaping Bitcoin's price: The entry of institutional investors, such as hedge funds and asset management firms, into the cryptocurrency market has a significant impact on Bitcoin's price. Increased institutional investment generally leads to greater price stability and potentially higher valuations.

-

Understanding the inherent volatility of Bitcoin and managing risk: Bitcoin's price is highly volatile, subject to significant swings in short periods. Investors should understand this inherent risk and implement appropriate risk management strategies, such as diversification and stop-loss orders.

Conclusion

This article examined the interplay of forces affecting bonds, Dow futures, and Bitcoin, highlighting their interconnectedness within the broader financial landscape. Understanding these dynamics is crucial for informed investment decisions. The influence of interest rates, economic indicators, and regulatory environments significantly shapes the performance of these assets, making ongoing market analysis essential. Remember that investment decisions should be made after thorough research and consideration of individual risk tolerance.

Call to Action: Stay informed about the latest movements in these key market indicators – bonds, Dow futures, and Bitcoin – to make well-informed investment choices. Continue learning about today's market movers to optimize your investment strategy!

Featured Posts

-

Zimbabwe Vs Bangladesh Curran Anticipates Tough Second Test

May 23, 2025

Zimbabwe Vs Bangladesh Curran Anticipates Tough Second Test

May 23, 2025 -

Goroskopy I Predskazaniya Lyubov Rabota Finansy

May 23, 2025

Goroskopy I Predskazaniya Lyubov Rabota Finansy

May 23, 2025 -

Jonathan Groff A Tony Awards Milestone With Just In Time

May 23, 2025

Jonathan Groff A Tony Awards Milestone With Just In Time

May 23, 2025 -

Former Man Utd Players Downfall Personal Issues Cited

May 23, 2025

Former Man Utd Players Downfall Personal Issues Cited

May 23, 2025 -

Quebec Imposera Des Quotas De Contenu Francophone Aux Plateformes De Diffusion En Continu

May 23, 2025

Quebec Imposera Des Quotas De Contenu Francophone Aux Plateformes De Diffusion En Continu

May 23, 2025

Latest Posts

-

Review Jonathan Groffs Just In Time Captures The Spirit Of Bobby Darin

May 23, 2025

Review Jonathan Groffs Just In Time Captures The Spirit Of Bobby Darin

May 23, 2025 -

Just In Time Musical Review Groffs Performance And The Shows Success

May 23, 2025

Just In Time Musical Review Groffs Performance And The Shows Success

May 23, 2025 -

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025 -

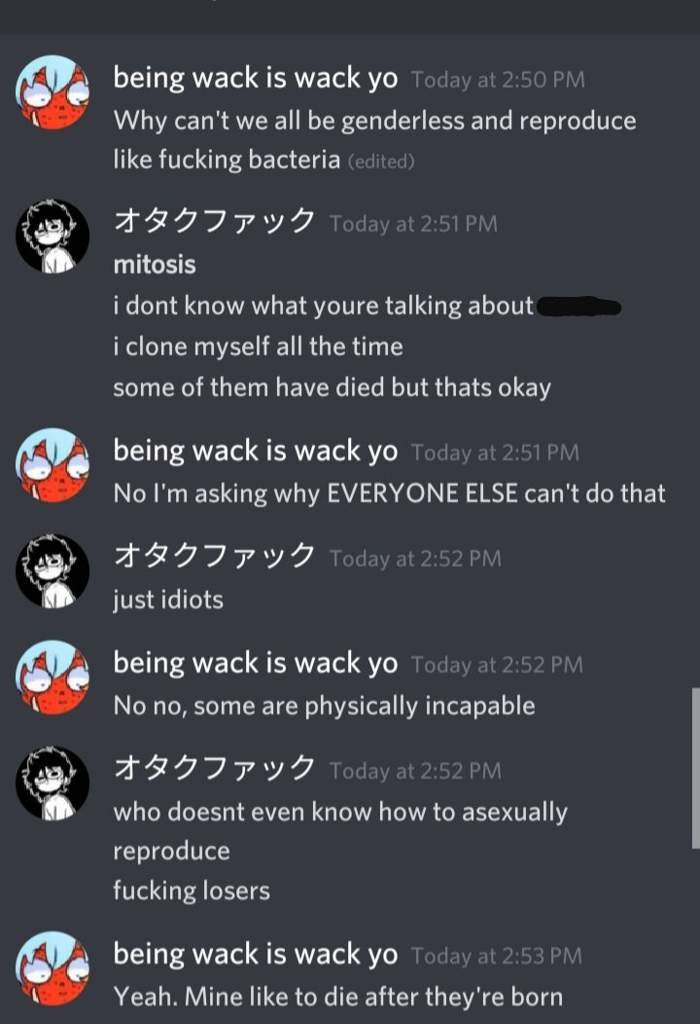

Jonathan Groff And Asexuality An Instinct Magazine Interview

May 23, 2025

Jonathan Groff And Asexuality An Instinct Magazine Interview

May 23, 2025 -

Jonathan Groffs Past An Open Conversation On Asexuality

May 23, 2025

Jonathan Groffs Past An Open Conversation On Asexuality

May 23, 2025