Boston Celtics Sold: Fans React To $6.1B Private Equity Buyout

Table of Contents

The Details of the Boston Celtics Sale

The sale of the Boston Celtics for a staggering $6.1 billion represents the highest price ever paid for an NBA franchise, surpassing previous records and highlighting the increasing value of professional sports teams. This landmark deal involved a significant private equity investment, shaking up the traditional ownership models seen within the league.

-

Sale Price and Significance: The $6.1 billion price tag underscores the immense financial power and potential return on investment seen in professional basketball. This sets a new benchmark for future NBA team valuations and signifies the booming interest from private equity firms in sports franchises.

-

Purchasing Group: While the specific details of the purchasing group may still be emerging, it is likely a consortium of investors with a strong financial backing and a potentially significant influence on the Celtics' future direction. Further information on the buyers is eagerly awaited by fans and analysts alike.

-

Wyc Grousbeck's Role: Long-time Celtics owner Wyc Grousbeck and his ownership group played a key role in negotiating the sale. While the specifics of their involvement remain unclear, their stewardship of the franchise over the years has undoubtedly contributed to its current value and attractiveness to potential buyers. The transition process will involve ensuring a smooth handover of ownership and operational responsibilities.

-

Ownership Transition and NBA Approval: The ownership transition process requires the approval of the NBA board of governors. This approval process involves a thorough vetting of the purchasing group and their plans for the franchise, to ensure compliance with league regulations and the stability of the team. The timeline for this process remains to be seen but is expected to be finalized within a reasonable timeframe.

-

Team Management and Front Office: While the details are still unfolding, there is speculation about potential changes in the team's management and front office staff. This is a key area for fans to watch as it directly impacts the team's on-court performance and overall operations.

Fan Reactions to the Boston Celtics Buyout

The $6.1 billion sale of the Boston Celtics has sparked a wave of diverse reactions from fans, spread across various social media platforms. While some express excitement about the future, others voice concerns about potential negative impacts.

-

Social Media Sentiment: Twitter, Facebook, Reddit, and other platforms have been flooded with comments from Celtics fans expressing a range of emotions. The reaction is a fascinating blend of optimism, anxiety, and speculation about the future.

-

Positive and Negative Sentiments: Positive reactions often focus on the potential for increased investment in player acquisition and improved team performance. Negative sentiments, however, center on potential ticket price increases, changes in team culture, and the overall impact on fan loyalty.

-

Fan Comments and Opinions: Many fans are expressing concerns about losing the familiar atmosphere and community feel associated with the Celtics. Others are cautiously optimistic, hoping for a successful transition and continued success on the court. The level of skepticism among some fans highlights the importance of effective communication from the new ownership group to maintain fan engagement.

-

Impact on Fan Loyalty: The long-term impact of the buyout on fan loyalty and engagement remains to be seen. The new ownership group will need to focus on building strong relationships with the fanbase and maintaining the team's connection to the community.

Potential Long-Term Impacts on the Boston Celtics

The private equity buyout of the Boston Celtics carries significant long-term implications for the franchise, including its financial stability, player recruitment, and competitiveness within the NBA.

-

Financial Implications: The influx of capital from the $6.1 billion sale creates significant financial flexibility. This could lead to increased investment in player salaries, team facilities, and other areas crucial for sustained success.

-

Roster Changes: The increased budget could lead to changes in the roster, potentially attracting high-profile free agents or facilitating trades for key players. This will be a crucial area to watch, as it directly impacts the team's ability to compete for championships.

-

Competitive Landscape: The Celtics already hold a strong position in the Eastern Conference, and this buyout could potentially enhance their competitiveness. However, other teams are also strengthening their rosters, meaning the Celtics will need to make strategic moves to maintain their edge.

-

Team Strategy and Management Philosophy: The new ownership group might introduce changes in the team's overall strategy and management philosophy. Fans will be keen to observe how these changes impact the team's playing style and the overall management approach.

The Broader Implications for the NBA

The Boston Celtics sale has significant implications for the NBA as a whole, influencing the valuation of other teams and showcasing the growing role of private equity in professional sports.

-

NBA Valuation: The record-breaking sale price dramatically increases the perceived value of NBA franchises, setting a new benchmark for future transactions and potentially attracting further investment from private equity firms.

-

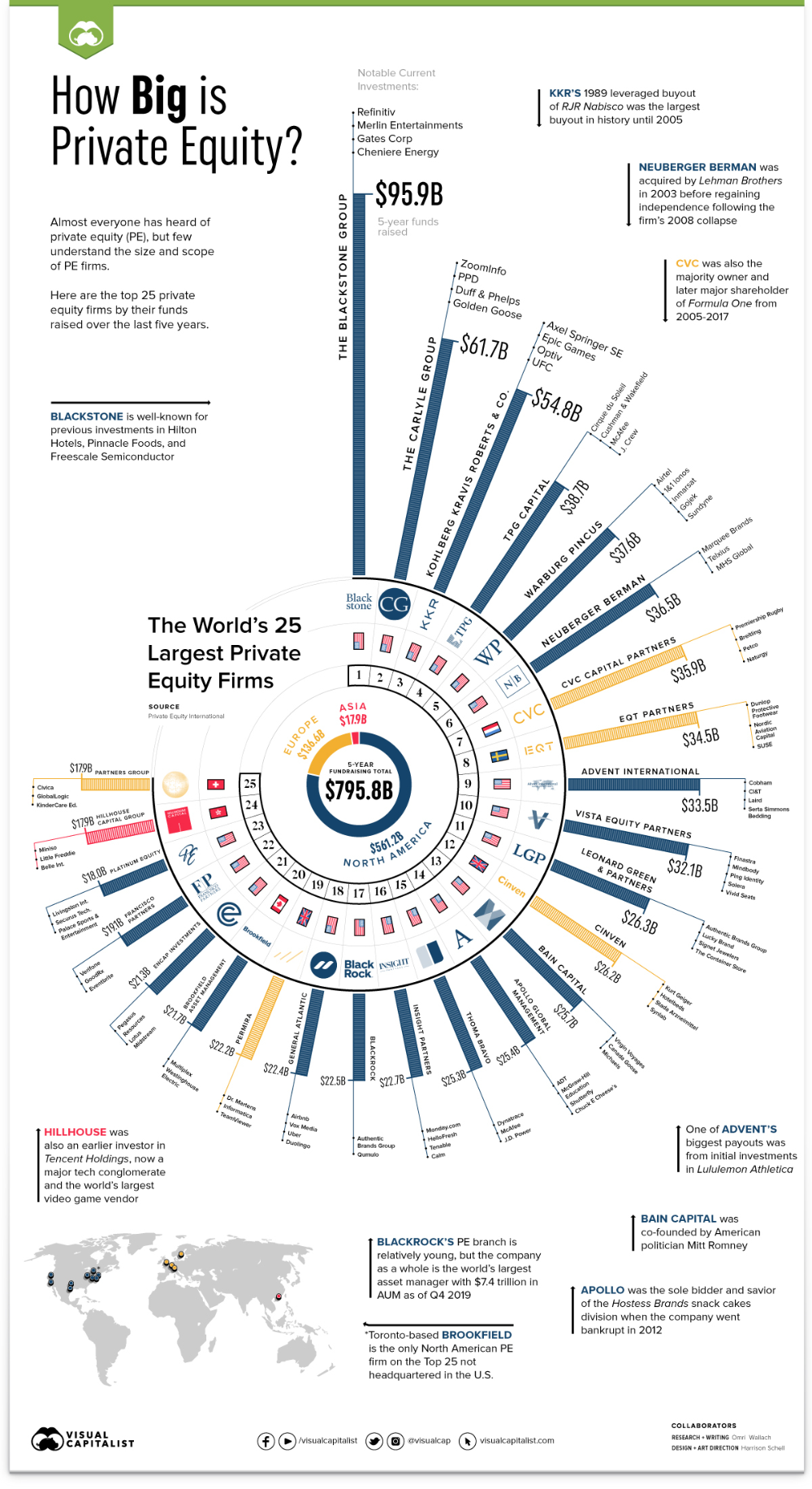

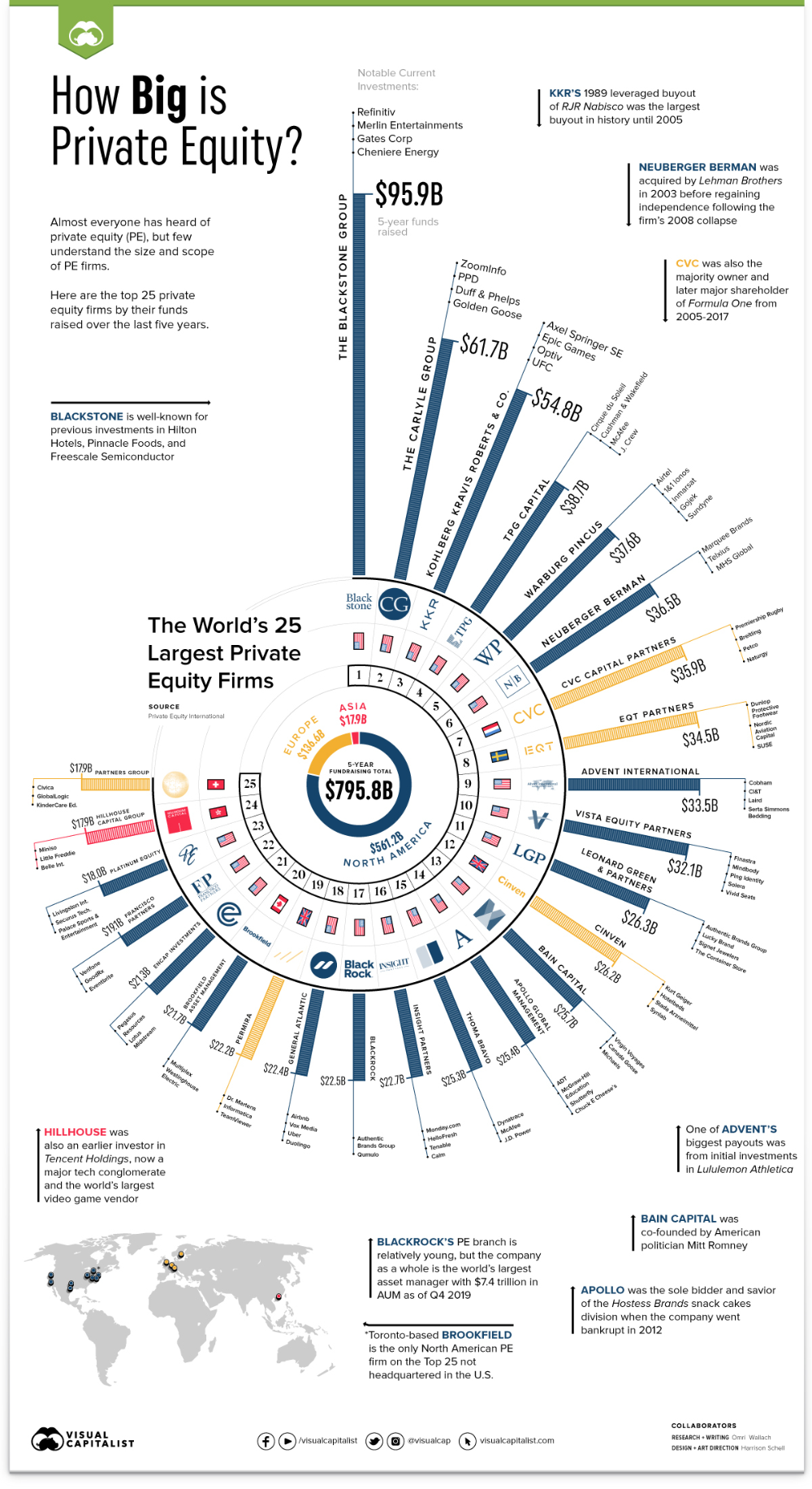

Private Equity Investment: This sale underscores the growing trend of private equity involvement in professional sports. It signifies the increasing attractiveness of sports teams as investment vehicles with strong potential for returns.

-

League Trends: This transaction sets a precedent that will likely influence future ownership structures and team valuations within the NBA, potentially leading to more private equity involvement and influencing the competitive landscape.

-

Potential Future Sales: The unprecedented sale price may trigger further large-scale transactions within the NBA, as other team owners consider selling their franchises for potentially enormous profits.

Conclusion

The sale of the Boston Celtics for $6.1 billion marks a significant moment in NBA history, highlighting the growing financial power of the league and the expanding role of private equity investment. The record-breaking price has generated mixed reactions among fans, with excitement about the potential for increased investment balanced by concerns about rising ticket prices and potential changes in team culture. The long-term implications for the Celtics and the broader NBA landscape remain to be seen, but this monumental transaction promises a period of significant change and uncertainty.

Stay tuned for further updates and analysis on the impact of the Boston Celtics sale, as we continue to monitor the situation and its long-term effects on the team and the NBA. Discuss your thoughts and reactions to the Celtics' private equity buyout in the comments section below. What are your predictions for the future of the Boston Celtics under new ownership?

Featured Posts

-

Rare Kid Cudi Items Command High Prices At Recent Auction

May 16, 2025

Rare Kid Cudi Items Command High Prices At Recent Auction

May 16, 2025 -

Padres 2025 Home Opener A Look At The San Diego Lineup

May 16, 2025

Padres 2025 Home Opener A Look At The San Diego Lineup

May 16, 2025 -

The Padres Historic Mlb Victory First Since 1889

May 16, 2025

The Padres Historic Mlb Victory First Since 1889

May 16, 2025 -

Tam Krwz Mdah Ke Jwtwn Pr Chrhne Ka Waqeh Awr As Ka Athr

May 16, 2025

Tam Krwz Mdah Ke Jwtwn Pr Chrhne Ka Waqeh Awr As Ka Athr

May 16, 2025 -

Everton Vina Vs Coquimbo Unido 0 0 Resumen Resultado Y Goles

May 16, 2025

Everton Vina Vs Coquimbo Unido 0 0 Resumen Resultado Y Goles

May 16, 2025