Boston Celtics Sold For $6.1B: Fans React To Private Equity Ownership

Table of Contents

The Financial Details of the Boston Celtics Sale

Sale Price and Valuation

The $6.1 billion price tag attached to the Boston Celtics sale represents a monumental leap in NBA franchise valuations. This figure surpasses previous record-breaking sales, solidifying the Celtics' position among the league's most valuable assets. Comparing this sale to previous NBA team sales reveals a significant percentage increase, reflecting the growing financial power of the league and the enduring appeal of historic franchises like the Celtics.

- Sale Price: $6.1 billion

- Previous Highest Sale: [Insert previous highest sale price and team]

- Percentage Increase: [Calculate the percentage increase compared to the previous highest sale]

- Sources: [Cite reputable financial news sources]

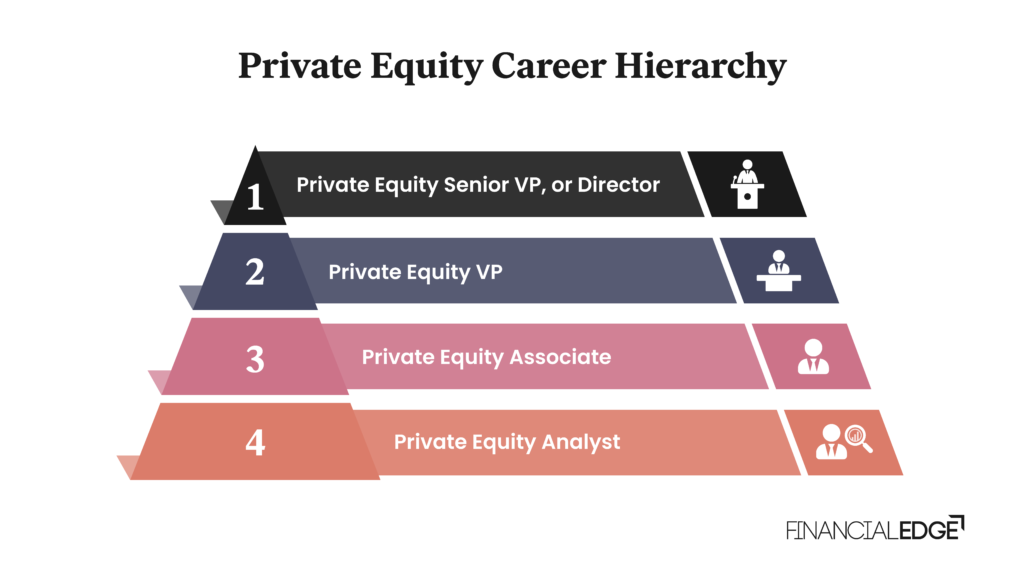

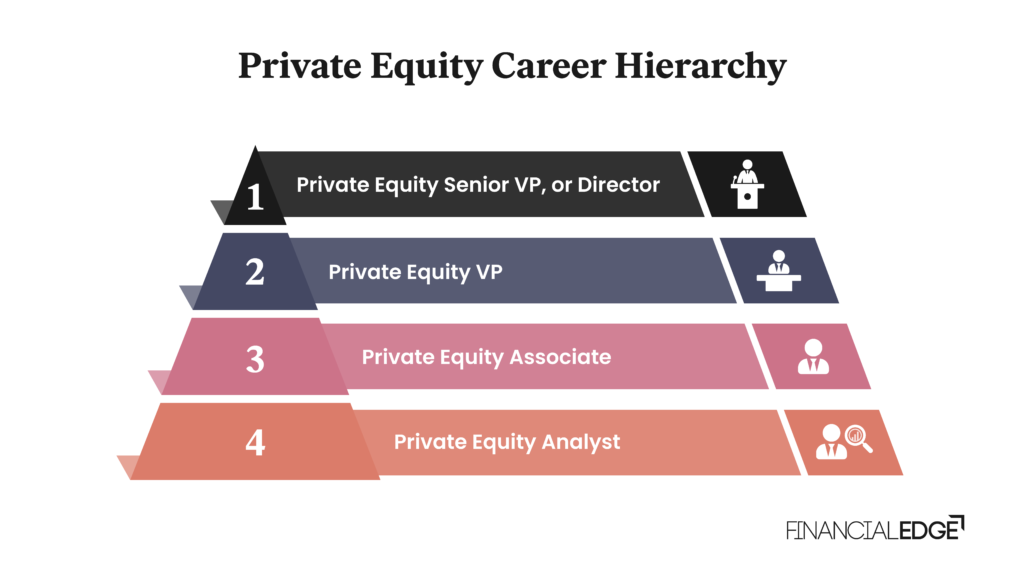

The Private Equity Firm's Investment Strategy

The acquisition of the Boston Celtics was undertaken by [Insert Private Equity Firm Name], a firm known for its significant investments in various sectors, including sports franchises. Their investment strategy typically focuses on [briefly describe their typical investment strategy, e.g., long-term growth, maximizing ROI]. Their previous investments in similar large-scale ventures demonstrate their expertise and financial capabilities.

- Firm Name: [Insert Name]

- Investment Portfolio: [Briefly list other notable investments]

- Stated Goals for the Celtics: [Summarize the firm's publicly stated goals for the Celtics, focusing on growth and profitability]

Implications for Celtics’ Future Finances

The sale’s impact on the Celtics' future finances is multifaceted. The substantial influx of capital could lead to increased spending on player acquisitions, improved facilities, and enhanced marketing initiatives. Conversely, the private equity firm's focus on maximizing returns might lead to cost-cutting measures in certain areas. The long-term financial outlook will depend on a number of factors, including the team's performance on the court and the overall economic climate.

- Potential for Increased Spending: Higher salaries, improved infrastructure.

- Potential for Cost-Cutting Measures: Reduced operational expenses, tighter budgets.

- Long-Term Financial Outlook: Dependent on performance, market conditions, and management decisions.

Potential Impacts on the Boston Celtics Team

Impact on Team Performance

The change in ownership could significantly influence the Celtics’ on-court performance. Increased investment could lead to the acquisition of top-tier talent, improving the team's competitive edge. However, the pressure to deliver strong returns on investment might lead to decisions prioritizing short-term gains over long-term team building, potentially impacting team cohesion and performance.

- Positive Impacts: Increased investment in players, improved training facilities, enhanced coaching staff.

- Potential Negative Impacts: Pressure to win quickly, potential for short-sighted decisions, focus on profitability over player development.

Changes in Team Management and Personnel

The transition to private equity ownership might bring about changes in the team’s management structure and personnel. New hires may be brought in to align with the firm's vision, potentially leading to shifts in team strategy and decision-making processes. Existing personnel may be retained, reassigned, or even let go.

- Potential for New Hires: New general manager, coaching staff changes, front office restructuring.

- Potential for Existing Personnel Changes: Reassignments, promotions, departures.

- Impact of Private Equity's Involvement: Increased emphasis on financial performance, potential influence on player acquisition strategy.

Impact on the Fan Experience

The fan experience is another area potentially impacted by the change in ownership. Ticket prices might increase, reflecting the higher valuation of the franchise. However, the increased revenue could also fund improvements to the fan experience, including upgraded stadium amenities, enhanced entertainment options, and improved community engagement initiatives.

- Potential for Price Increases: Higher ticket prices, potential increases in merchandise costs.

- Potential for Improved Fan Engagement: New fan events, improved stadium amenities, enhanced digital experiences.

- Potential Changes to Game-Day Experiences: New entertainment options, improved concessions, updated technology.

Fan Reactions to the Boston Celtics Sale

Social Media Sentiment

Social media platforms erupted with a flurry of reactions following the announcement of the Boston Celtics sale. Fans expressed a wide range of emotions, from cautious optimism to outright concern. Many expressed anxieties about potential ticket price increases and the influence of private equity on the team’s long-term vision. Others welcomed the influx of capital, hoping it would translate to improved team performance and a stronger competitive edge.

- Key Themes Emerging from Social Media: Concern over ticket prices, hope for improved team performance, skepticism towards private equity ownership.

- Overall Tone of Fan Sentiment: Mixed – a blend of optimism, concern, and skepticism.

Fan Forums and Online Discussions

Online Celtics fan forums and communities buzzed with intense discussions about the sale. Fans debated the potential positives and negatives of private equity ownership, expressing hopes for the team's future while voicing concerns about the potential impact on the team’s culture and fan accessibility.

- Key Concerns: Ticket price hikes, potential changes to the team's identity and culture, prioritization of profit over performance.

- Predominant Arguments: Debate centered on the balance between financial investment and maintaining a strong connection with the team's fanbase.

Potential Long-Term Impact on Fan Loyalty

The long-term impact of the Boston Celtics sale on fan loyalty remains to be seen. The success or failure of the private equity firm's stewardship will significantly determine fans' continued commitment. Consistent on-court success, coupled with a continued focus on fan engagement, will be key to maintaining the team's strong connection with its passionate fanbase.

- Potential for Increased Loyalty: Strong performance, improved fan engagement initiatives, and responsible management.

- Potential for Decreased Loyalty: Poor performance, increased ticket prices, perceived disregard for fan concerns.

Conclusion: The Future of the Boston Celtics After the $6.1 Billion Sale

The $6.1 billion sale of the Boston Celtics marks a pivotal moment in the franchise's history. While the financial implications are substantial, the potential impacts on the team's performance, management, and fan experience remain uncertain. Social media and online forums reveal a complex mix of fan reactions, ranging from cautious optimism to significant concerns. The success of this new chapter hinges on the private equity firm’s ability to balance financial gains with a commitment to on-court success and a strong, engaging relationship with the loyal Celtics fanbase. Share your opinions on the Boston Celtics sale and its implications in the comments section below! Use #BostonCelticsSale #NBASale #PrivateEquity to join the conversation.

Featured Posts

-

Trendovi U Kupovini Stanova Srbija I Inostranstvo

May 17, 2025

Trendovi U Kupovini Stanova Srbija I Inostranstvo

May 17, 2025 -

Andor First Look Delivers On 31 Years Of Star Wars Teases

May 17, 2025

Andor First Look Delivers On 31 Years Of Star Wars Teases

May 17, 2025 -

Who Replaces Anthony On Below Deck Down Under

May 17, 2025

Who Replaces Anthony On Below Deck Down Under

May 17, 2025 -

Fc Barcelona Espanyol Match 13 Injured In Apparent Accidental Car Crash

May 17, 2025

Fc Barcelona Espanyol Match 13 Injured In Apparent Accidental Car Crash

May 17, 2025 -

Trump And Arab Leaders An Examination Of Their Bonds

May 17, 2025

Trump And Arab Leaders An Examination Of Their Bonds

May 17, 2025