BP CEO Pay Cut: A 31% Reduction

Table of Contents

BP CEO Bernard Looney’s compensation recently underwent a dramatic shift: a 31% reduction in his total pay package. This significant cut in the BP CEO salary has sparked considerable debate, prompting discussions about company performance, shareholder activism, and the broader trends in executive compensation within the oil and gas industry. This article delves into the details of this reduction, exploring the reasons behind it and its potential implications for BP and the wider energy sector. We'll examine the BP CEO salary in comparison to other oil company CEOs and analyze what this could mean for the future of executive pay.

The Details of the BP CEO Pay Cut

Percentage Reduction and Final Salary

Bernard Looney's 2023 compensation reflects a substantial 31% decrease compared to his 2022 earnings. While the exact figures vary depending on the inclusion of specific bonuses and long-term incentives, the reduction represents a considerable drop in his overall remuneration. For example, if his 2022 salary was £5 million (this is a hypothetical example and the actual figures should be inserted here), his 2023 salary would be approximately £3.45 million. This significant decrease in BP CEO salary highlights a notable shift in executive compensation practices within the company.

- Specific numbers and figures: [Insert actual figures for 2022 and 2023 total compensation, including base salary, bonuses, and long-term incentives]. Clearly differentiate between total compensation and base salary.

- Breakdown of salary components: Detail the percentage breakdown of each component (e.g., 60% base salary, 20% bonus, 20% long-term incentives). Provide clarity on how each component was affected by the reduction.

- Comparison to other major oil companies: Compare Looney's reduced salary to the compensation packages of CEOs at comparable oil and gas companies (e.g., Shell, ExxonMobil, Chevron). Highlight any significant differences and potential reasons for them. Include data sources for transparency and to enhance SEO.

- Other compensation changes: Specify if any other elements of Looney's compensation package, such as benefits or perks, were also reduced as part of this restructuring.

Reasons Behind the BP CEO Pay Cut

Company Performance and Profitability

The decision to reduce the BP CEO salary is likely linked to BP's recent financial performance. While the company has shown profitability, fluctuating oil prices and increased investment in renewable energy sources might have played a role. Analyzing these factors provides context for the pay cut.

- Financial results: Include key financial data such as revenue, profits, and losses for the relevant periods. Clearly indicate the sources of this financial information.

- Impact of fluctuating oil prices: Explain how volatile oil prices affected BP's profitability and how this influenced the decision regarding executive compensation.

- Company investment strategies: Discuss BP's significant investments in renewable energy and the transition to a lower-carbon business model. Explain how these investments might have impacted short-term profitability and the subsequent decision on executive pay.

- Shareholder activism: Detail any shareholder resolutions or pressure related to executive pay, especially regarding the alignment between executive compensation and the company's stated environmental, social, and governance (ESG) goals.

Shareholder Activism and Public Pressure

Growing shareholder activism and public scrutiny regarding executive compensation, particularly in the energy sector, have likely influenced BP's decision.

- Examples of shareholder resolutions: Cite specific examples of shareholder resolutions focusing on executive pay and the rationale behind them.

- Public perception: Discuss public opinion on CEO pay in the energy sector, especially in the context of climate change and the energy transition. Mention any relevant surveys or public statements.

- Media coverage: Analyze the media's portrayal of the BP CEO pay cut and its impact on public perception of BP and its leadership.

Implications of the BP CEO Pay Cut

Impact on Employee Morale and Company Culture

The substantial pay cut for the BP CEO could have ripple effects on employee morale and company culture.

- Potential impact on employee compensation: Discuss the possibility of impacting other employees' compensation or the perception of fairness within the organization.

- Impact on attracting and retaining top talent: Analyze how this decision might affect BP's ability to attract and retain high-caliber employees.

- Company's compensation strategy: Assess whether this pay cut reflects a broader shift in BP's overall compensation strategy and its alignment with its stated values.

Signal to Other Energy Companies

This significant reduction in the BP CEO salary could set a precedent for other energy companies.

- Comparison to competitor companies: Analyze the potential for this action to influence compensation strategies at competing oil and gas companies.

- Industry trends: Discuss broader trends in executive compensation within the energy sector and the potential for future adjustments based on BP’s example.

- Potential future adjustments: Speculate on the potential future adjustments to executive pay practices across the energy industry in light of this development.

Conclusion

The 31% reduction in Bernard Looney's BP CEO salary is a significant event with far-reaching implications. Driven by a confluence of factors including company performance, fluctuating oil prices, shareholder activism, and public pressure, this pay cut signals a potential shift in executive compensation norms within the energy sector. The impact on employee morale, the company's ability to attract talent, and the broader adoption of similar practices by other energy companies remain to be seen. The specific figures, comparing his 2022 and 2023 compensation, highlight the magnitude of the change.

What are your thoughts on the BP CEO pay cut? Share your opinion in the comments below, and stay updated on the latest developments in BP executive pay and CEO compensation trends by following [your website/social media].

Featured Posts

-

Heartwarming Meaning Behind Peppa Pigs New Baby Sisters Name Revealed

May 21, 2025

Heartwarming Meaning Behind Peppa Pigs New Baby Sisters Name Revealed

May 21, 2025 -

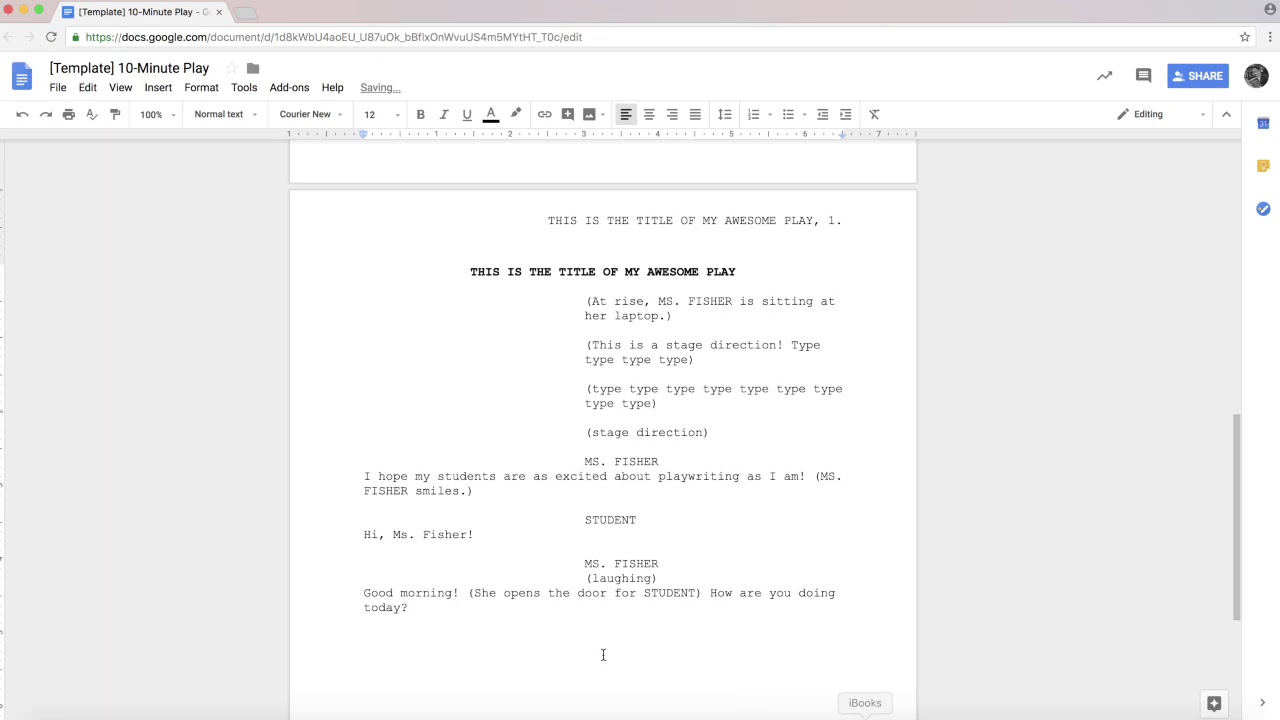

Water Colour Play Review Is This Young Playwrights Script A Success

May 21, 2025

Water Colour Play Review Is This Young Playwrights Script A Success

May 21, 2025 -

Paulina Gretzky Topless Selfie And Other Unseen Photos

May 21, 2025

Paulina Gretzky Topless Selfie And Other Unseen Photos

May 21, 2025 -

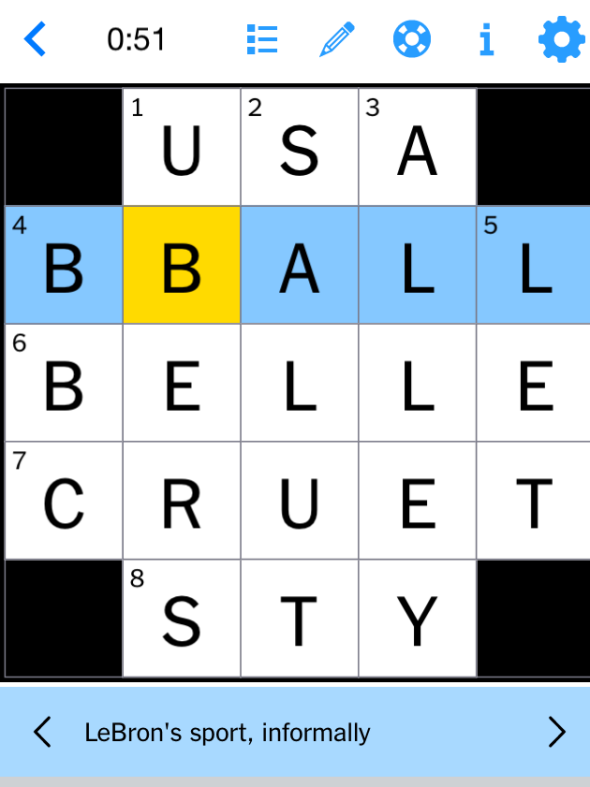

April 18 2025 Nyt Mini Crossword Complete Answers And Hints

May 21, 2025

April 18 2025 Nyt Mini Crossword Complete Answers And Hints

May 21, 2025 -

Robin Roberts Gma Family Announcement A New Addition

May 21, 2025

Robin Roberts Gma Family Announcement A New Addition

May 21, 2025