BP Chief Aims To Double Company Valuation: No US Listing Planned, According To FT

Table of Contents

BP's Strategy for Doubling Valuation

BP's plan to double its valuation hinges on a multifaceted approach encompassing renewable energy investment, operational efficiency, and strategic growth within traditional energy sectors.

Focus on Renewables and Energy Transition

BP is aggressively pursuing a transition to sustainable energy, investing heavily in renewable energy sources and related infrastructure. This aligns with the growing global demand for green energy and the increasing importance of Environmental, Social, and Governance (ESG) investing.

- Significant investments in solar and wind power: BP has committed billions to projects across the globe, aiming to significantly increase its renewable energy generation capacity within the next decade.

- Expansion of electric vehicle (EV) charging infrastructure: BP is rapidly building a network of EV charging stations, capitalizing on the burgeoning electric vehicle market. They aim to have X number of charging points operational by Y year.

- Strategic partnerships with renewable energy companies: Collaborations with innovative tech companies and established renewable energy players are accelerating BP's growth in the sector. Projected growth in this sector is estimated at Z% annually.

These initiatives are crucial for attracting ESG-conscious investors and positioning BP as a leader in the energy transition. The success of this strategy will directly impact its ability to meet its valuation target.

Operational Efficiency and Cost Reduction

Simultaneously, BP is focusing on improving operational efficiency and reducing costs across its operations. This involves optimizing existing infrastructure and implementing cutting-edge technologies to enhance profitability.

- Digitalization of operations: Implementing advanced analytics and automation to streamline processes and reduce operational expenses.

- Streamlining supply chains: Improving logistics and procurement processes to minimize waste and increase efficiency.

- Investing in advanced technologies: Utilizing artificial intelligence (AI) and machine learning (ML) to improve resource allocation and predictive maintenance.

By enhancing efficiency and reducing costs, BP aims to boost its return on investment (ROI) and ultimately increase its overall valuation.

Growth in Traditional Energy Sectors

While transitioning to renewables, BP isn't abandoning its traditional oil and gas operations. The company plans to maintain and grow its presence in these sectors, albeit with a focus on responsible and sustainable practices.

- Investing in high-yield oil and gas fields: BP continues to explore and develop new oil and gas reserves, prioritizing projects with strong returns and reduced environmental impact.

- Optimizing existing production facilities: Implementing technologies to enhance production efficiency and reduce greenhouse gas emissions from existing oil and gas operations.

- Strategic acquisitions: Selectively acquiring assets and companies to expand its footprint in key regions and strengthen its position in the traditional energy market.

Balancing growth in traditional energy with a strong push towards renewables is critical for BP to meet its valuation target while navigating the complex energy landscape.

Why No US Listing? Analyzing BP's Decision

BP's decision to forgo a US listing, as reported by the FT, is a strategic move with several potential explanations.

Regulatory Considerations and Market Conditions

Listing on a US exchange brings increased regulatory scrutiny from the Securities and Exchange Commission (SEC). The current regulatory environment for energy companies, particularly those involved in fossil fuels, could pose challenges. Negative market sentiment towards energy companies, especially those with significant fossil fuel operations, also plays a role.

- Compliance costs: Meeting SEC regulations can be expensive and complex for large international energy companies.

- Potential legal liabilities: Facing increased legal challenges related to climate change and environmental concerns.

- Investor perception: Negative investor sentiment concerning fossil fuels can depress share price.

Strategic Advantages of Remaining on Existing Exchanges

Staying listed on its current exchanges offers BP several advantages.

- Lower listing costs: Listing on the London Stock Exchange (LSE) and other existing exchanges involves significantly lower costs than listing on a major US exchange.

- Established relationships with investors: BP has strong relationships with investors on its current exchanges, providing easier access to capital.

- Familiarity with regulatory frameworks: The company already operates within the established regulatory frameworks of its current exchanges, reducing potential hurdles.

Investor Reactions and Market Outlook

BP's ambitious plan has met with a mixed response from analysts and investors.

Analyst Predictions and Market Response

Analyst predictions vary, with some expressing optimism about BP's strategy and others raising concerns about the feasibility of its ambitious valuation target. The share price has fluctuated in response to news and developments related to the plan.

- Positive outlook from some analysts: Analysts who support the plan highlight the potential of BP's renewable energy initiatives and operational efficiencies.

- Concerns raised by others: Skeptics question the feasibility of achieving such a substantial increase in valuation, given the challenges in the energy market.

- Share price volatility: BP's share price has shown volatility reflecting the uncertainty surrounding its ambitious plan.

Risks and Challenges

Several risks and challenges could hinder BP's progress.

- Geopolitical instability: Global political events and conflicts can significantly impact energy prices and market conditions.

- Fluctuating energy prices: Volatility in oil and gas prices can affect profitability and overall valuation.

- Intense competition: The energy sector is fiercely competitive, with both established players and new entrants vying for market share.

Conclusion: BP's Ambitious Path to Doubling Valuation: A High-Stakes Gamble?

BP's strategy to double its company valuation involves a bold bet on renewable energy, operational efficiency, and continued growth in traditional energy sectors. While the decision against a US listing might be strategically sound for reducing regulatory hurdles and leveraging existing investor relationships, the path ahead is fraught with challenges. Geopolitical instability, fluctuating energy prices, and intense competition present significant headwinds. The success of BP's ambitious plan hinges on effectively managing these risks while executing its multifaceted strategy. Stay tuned for updates on BP's progress in doubling its company valuation and learn more about the evolving energy landscape and sustainable investment options related to BP's energy transition strategies.

Featured Posts

-

Netflix This Week 7 Shows To Binge Watch May 18 24

May 22, 2025

Netflix This Week 7 Shows To Binge Watch May 18 24

May 22, 2025 -

Cyberattack Costs Marks And Spencer 300 Million Full Breakdown

May 22, 2025

Cyberattack Costs Marks And Spencer 300 Million Full Breakdown

May 22, 2025 -

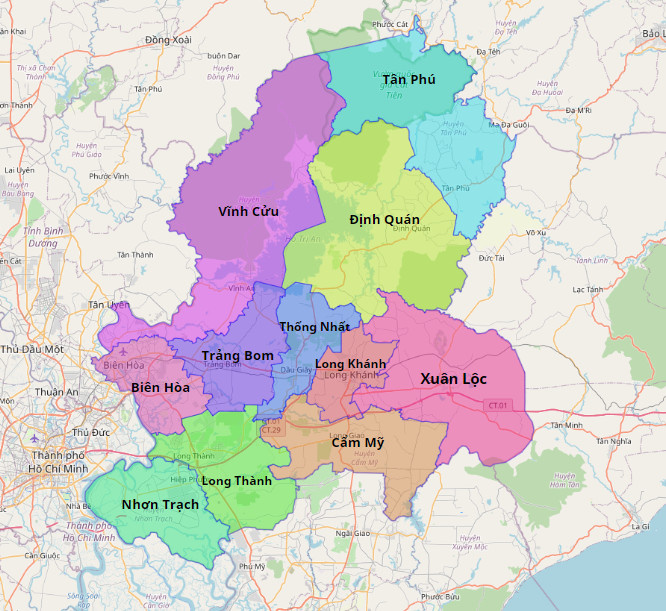

Cau Ma Da Dong Nai Binh Phuoc Thoi Diem Khoi Cong Va Tam Quan Trong

May 22, 2025

Cau Ma Da Dong Nai Binh Phuoc Thoi Diem Khoi Cong Va Tam Quan Trong

May 22, 2025 -

Why Did Core Weave Inc Crwv Stock Fall On Tuesday

May 22, 2025

Why Did Core Weave Inc Crwv Stock Fall On Tuesday

May 22, 2025 -

Did Blake Lively And Taylor Swift Repair Their Friendship Amidst Recent Lawsuit Reports

May 22, 2025

Did Blake Lively And Taylor Swift Repair Their Friendship Amidst Recent Lawsuit Reports

May 22, 2025