BP's Chief Executive Sees 31% Pay Drop

Table of Contents

The Magnitude of the Pay Cut and its Financial Implications

The recent announcement reveals a substantial decrease in the CEO's compensation package. While the exact figures haven't been fully disclosed publicly (pending official company statements), reports suggest a reduction in the region of [Insert estimated dollar amount] – a staggering 31% decrease. This translates to a significant shift in the CEO's overall compensation, impacting their annual earnings and potentially their lifestyle. Before the reduction, the compensation package likely included a base salary, substantial bonuses tied to company performance, and a significant portion in stock options. The impact on their overall wealth, while still considerable, represents a marked reduction.

This salary decrease also has implications for BP's overall financial performance. While a reduction in executive pay might seem insignificant compared to the company’s overall budget, it could be interpreted as a cost-cutting measure, potentially reflecting a challenging financial year or a strategic response to shareholder pressure for greater financial prudence. The long-term impact on shareholder returns remains to be seen but could be positive if it signals a broader commitment to efficiency.

- Previous Salary (estimated): [Insert estimated figure]

- Current Salary (estimated): [Insert estimated figure]

- Compensation Breakdown (estimated): Base Salary [Insert percentage]%, Bonus [Insert percentage]%, Stock Options [Insert percentage]%.

- Comparison with Competitors: A detailed comparison with CEO salaries at Shell, ExxonMobil, and other energy giants would provide crucial context.

Reasons Behind BP's CEO's Salary Decrease

Several factors might contribute to this unprecedented pay cut. Firstly, BP's recent financial performance could be a significant driver. Declining profits, missed targets, or underperformance compared to industry benchmarks might have prompted the board to reassess executive compensation.

Secondly, shareholder activism increasingly focuses on executive pay. If shareholders expressed concerns about the CEO’s compensation package, particularly in the context of the company's performance, the board may have responded by implementing a reduction. Pressure from activist investors to align executive pay with company performance is becoming increasingly prevalent.

Another factor could be BP's commitment to corporate social responsibility (CSR). A voluntary reduction in executive pay could be presented as a gesture of solidarity with employees and a commitment to responsible spending, especially pertinent in a sector facing scrutiny over its environmental impact.

Finally, the challenging market conditions within the energy sector, characterized by fluctuating oil prices and increased regulatory pressures, could have influenced the decision. A pay cut could reflect a cautious approach to managing costs during uncertain times.

- Company Performance Metrics: Reference specific KPIs such as profit margins, revenue growth, and environmental performance indicators.

- Shareholder Activism: Mention any publicly available information on shareholder resolutions or communications regarding executive compensation.

- BP's Official Statement: Link to any press releases or official communications from BP addressing the CEO's pay cut.

Wider Implications for Executive Compensation in the Energy Industry

BP's CEO's 31% pay cut might set a precedent for executive compensation in the energy industry. Other companies may reassess their own executive pay structures, particularly those facing similar challenges or pressure from shareholders. This could lead to a more moderate approach to executive compensation and greater alignment between pay and performance.

The move could also signify a shift in public perception of executive pay within the energy sector. The public increasingly scrutinizes executive compensation, particularly in industries viewed as contributing to climate change or engaging in practices deemed socially irresponsible. A high-profile pay cut might help to improve the sector’s image and foster trust.

However, attracting and retaining top talent might also be affected. A lower compensation ceiling could make it challenging for energy companies to compete with other sectors for skilled executives. A careful balance needs to be struck between responsible compensation and the need to attract and retain highly skilled leadership.

- Competitor Analysis: Provide a table comparing CEO compensation packages in major energy companies (Shell, ExxonMobil, etc.) before and after the BP announcement.

- Expert Opinions: Include quotes from industry analysts or experts commenting on the potential long-term effects of the pay cut.

- Corporate Governance Trends: Discuss the evolving landscape of executive pay and its relationship to corporate governance best practices.

Conclusion: Analyzing the Significance of BP's CEO's Pay Cut

In conclusion, BP's Chief Executive's 31% pay cut is a significant event with far-reaching implications. While the exact reasons remain to be fully clarified, factors such as company performance, shareholder pressure, CSR initiatives, and market conditions likely played a role. This drastic reduction could signal a potential shift in executive compensation practices within the energy sector, influencing both future salary packages and public perception of the industry. Whether this is an isolated incident or a harbinger of future trends remains to be seen. The long-term consequences for attracting and retaining top talent also warrant careful consideration.

We encourage you to share your thoughts on "BP's Chief Executive Sees 31% Pay Drop" and its significance in the comments section below. And for further insights into executive compensation within the energy industry, continue exploring our other articles on this critical topic.

Featured Posts

-

Mesas New Funbox Indoor Bounce Park Fun For The Whole Family

May 21, 2025

Mesas New Funbox Indoor Bounce Park Fun For The Whole Family

May 21, 2025 -

Australian Speed Record Attempt By British Ultrarunner

May 21, 2025

Australian Speed Record Attempt By British Ultrarunner

May 21, 2025 -

Predicting Rain Latest Updates On On And Off Shower Chances

May 21, 2025

Predicting Rain Latest Updates On On And Off Shower Chances

May 21, 2025 -

Mission Patrimoine 2025 En Bretagne Plouzane Et Clisson Restaures

May 21, 2025

Mission Patrimoine 2025 En Bretagne Plouzane Et Clisson Restaures

May 21, 2025 -

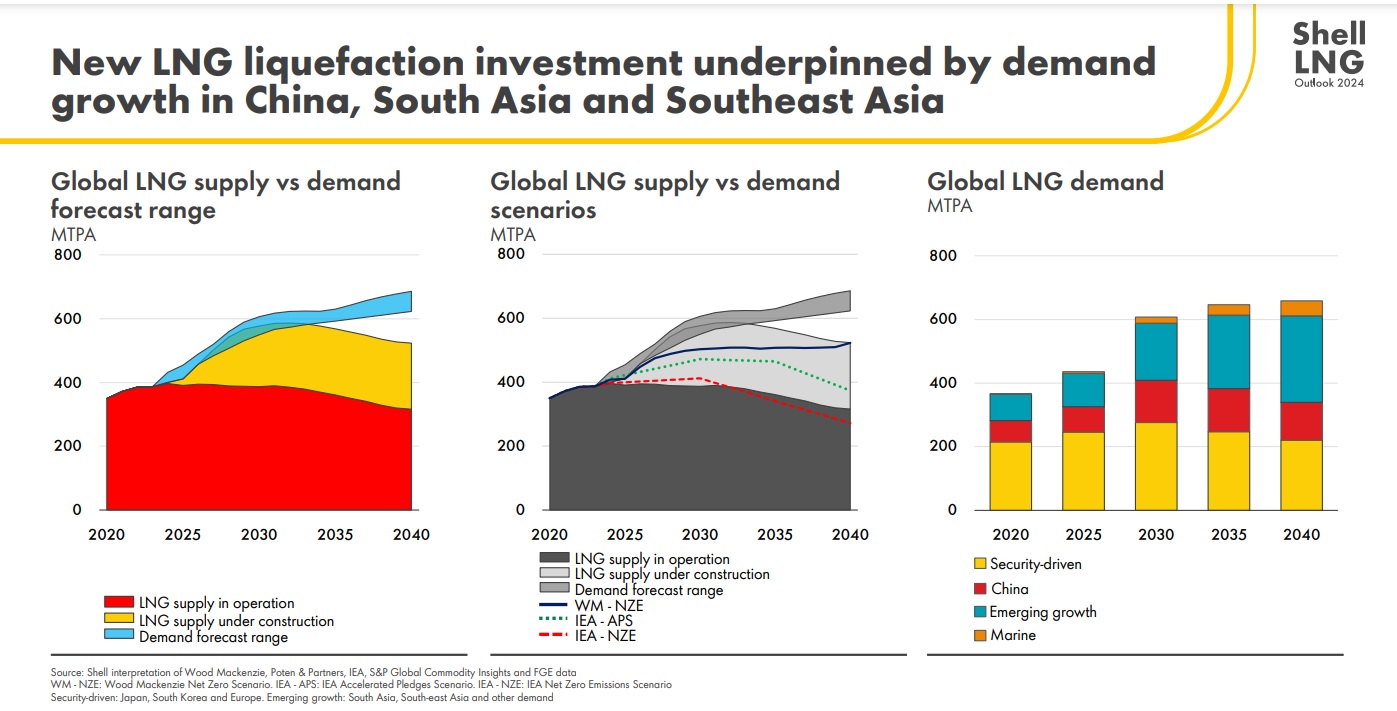

Increased Lng Demand In Taiwan The Post Nuclear Power Reality

May 21, 2025

Increased Lng Demand In Taiwan The Post Nuclear Power Reality

May 21, 2025