Broadcom's Proposed VMware Price Hike: A 1050% Cost Surge For AT&T

Table of Contents

The Acquisition and its Immediate Impact on Pricing

Broadcom's acquisition of VMware, finalized in October 2022, created an instant ripple effect throughout the enterprise software market. This monumental deal, valued at approximately $61 billion, signaled a significant shift in the power dynamics of the virtualization industry. However, the immediate fallout for AT&T, one of VMware's largest clients, has been dramatic. Reports indicate a staggering 1050% increase in their VMware licensing fees following the acquisition. While precise figures remain confidential, this magnitude of price increase represents an unprecedented cost shock.

- Acquisition Date: October 2022

- Initial Price of VMware Licensing for AT&T: (Information unavailable publicly, but it's safe to assume a substantially lower figure given the 1050% increase.)

- New Price of VMware Licensing post-acquisition: (Information unavailable publicly, but represents a massive cost increase for AT&T.)

- Percentage Increase: 1050%

AT&T's Response and Potential Strategies

Faced with such a dramatic increase, AT&T is likely exploring several avenues to mitigate the impact. While the company hasn't publicly commented extensively on the specific details, possible responses include:

- Renegotiation: AT&T will almost certainly attempt to renegotiate the terms of their VMware licensing agreement, leveraging their size and influence in the market.

- Exploring Alternative Solutions: The significant cost increase may prompt AT&T to investigate alternative virtualization platforms and technologies to reduce reliance on VMware. This could involve migrating to open-source solutions or exploring competing products.

- Internal Cost-Cutting: To offset the increased VMware costs, AT&T may need to implement internal cost-cutting measures across various departments. This could lead to restructuring or reduced spending in other areas.

- Potential Impact on AT&T's budget and future investments: The massive increase in VMware licensing costs could severely strain AT&T's budget, potentially forcing them to re-evaluate future investment strategies and capital expenditures.

Broader Implications for the Tech Industry

Broadcom's aggressive pricing strategy following the VMware acquisition raises significant concerns for the broader tech industry. This price hike sets a concerning precedent, impacting not only major corporations like AT&T but also smaller businesses reliant on VMware solutions.

- Impact on Smaller Businesses: Smaller companies may face crippling costs, forcing them to either absorb the increased expense, seek less expensive alternatives, or potentially even go out of business.

- Antitrust Concerns and Regulatory Scrutiny: The significant price increase has heightened antitrust concerns and may attract regulatory scrutiny. Investigations into potential anti-competitive practices are a possibility.

- Long-Term Effects on Software Licensing Costs: Broadcom's move could signal a broader trend towards increased software licensing costs, impacting various sectors reliant on enterprise software.

- Shift in Market Dynamics: The price hike could accelerate the shift towards open-source alternatives and foster competition in the virtualization market.

Analyzing Broadcom's Pricing Strategy

Broadcom's rationale behind such a dramatic price increase is multifaceted. Several factors likely contribute to this aggressive pricing strategy:

- Financial Motivations: The primary driver is likely the need to recoup the massive investment in acquiring VMware and maximize shareholder returns. Investor pressure to demonstrate profitability post-acquisition is substantial.

- Market Analysis: Broadcom may have analyzed the market and determined that it can command higher prices due to VMware's dominant market share and the relative lack of strong, readily available alternatives.

- Long-Term Implications: While the short-term gains are apparent, the long-term consequences of this pricing strategy remain uncertain. It could lead to decreased market share, increased regulatory scrutiny, and ultimately damage Broadcom's reputation.

Conclusion: Understanding Broadcom's VMware Price Hike and its Future Ramifications

The 1050% price hike imposed by Broadcom on AT&T for VMware licensing represents a watershed moment in the tech industry. The impact extends far beyond a single company, raising significant concerns about pricing practices post-acquisition, the future of software licensing, and the potential for increased regulatory oversight. The long-term consequences of this event, from the potential for antitrust actions to the wider impact on software pricing and market competition, remain to be seen. Staying informed about developments related to Broadcom's VMware price hike, and the subsequent impact on VMware price increases and Broadcom's acquisition impact, is crucial for understanding the future of VMware pricing and the enterprise software landscape. Continue researching and engaging with related news to stay ahead of this evolving situation.

Featured Posts

-

Proyek Giant Sea Wall Kolaborasi Pemerintah Dan Swasta

May 15, 2025

Proyek Giant Sea Wall Kolaborasi Pemerintah Dan Swasta

May 15, 2025 -

Anaheim Ducks Leo Carlsson Scores Twice In Narrow Overtime Defeat

May 15, 2025

Anaheim Ducks Leo Carlsson Scores Twice In Narrow Overtime Defeat

May 15, 2025 -

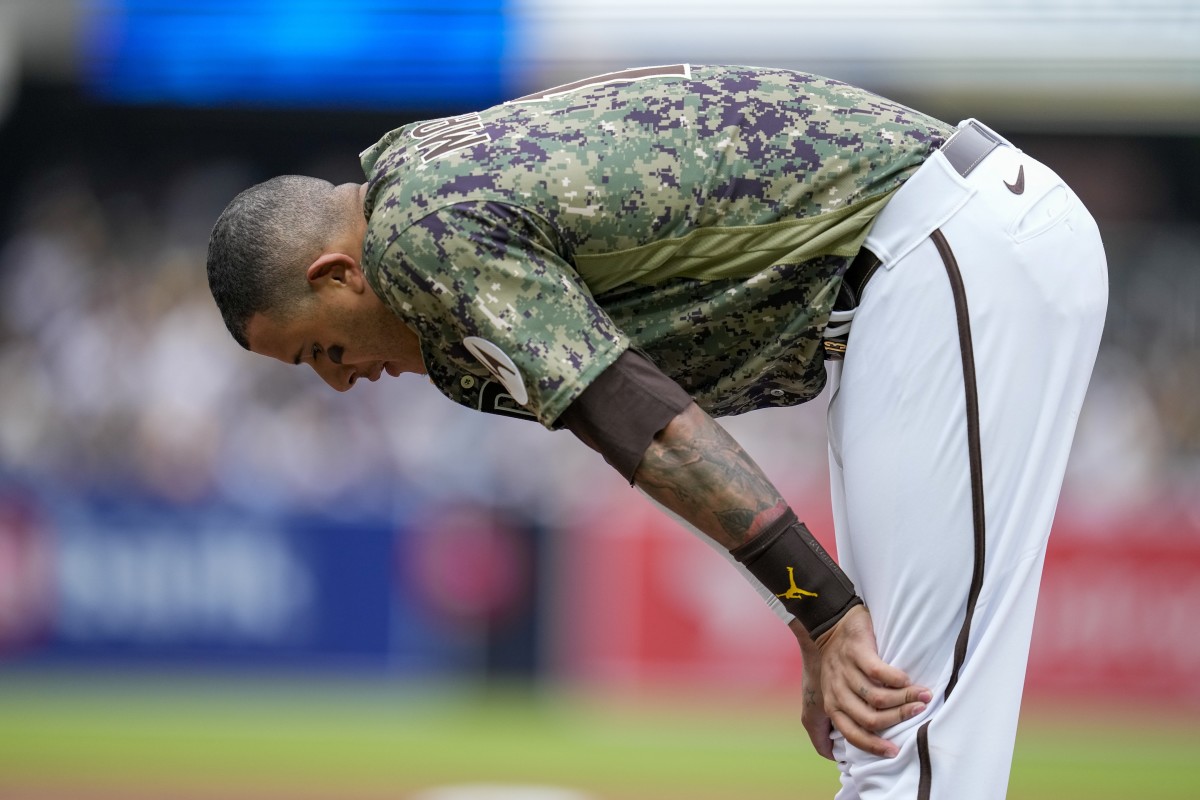

Padres Beat Athletics Claim Mlbs First 10 Win Mark

May 15, 2025

Padres Beat Athletics Claim Mlbs First 10 Win Mark

May 15, 2025 -

Pollution Et Eau Du Robinet Guide Complet Des Solutions De Filtration

May 15, 2025

Pollution Et Eau Du Robinet Guide Complet Des Solutions De Filtration

May 15, 2025 -

Warriors Optimistic About Butlers Game 3 Status

May 15, 2025

Warriors Optimistic About Butlers Game 3 Status

May 15, 2025