Broadcom's VMware Acquisition: A 1050% Price Spike For AT&T

Table of Contents

Understanding the Broadcom-VMware Deal

The Broadcom-VMware deal represents one of the largest technology mergers and acquisitions in history. Its significance extends far beyond the immediate financial impact, reshaping the competitive landscape of enterprise software and cloud computing. The deal, valued at approximately $61 billion, significantly boosted Broadcom's market capitalization and established it as a major player in the enterprise software market. Broadcom's strategic goals in acquiring VMware include:

- Increased market share in enterprise software: VMware's leading position in virtualization and cloud management significantly expands Broadcom's reach in this lucrative market segment.

- Expansion into cloud computing infrastructure: The acquisition provides Broadcom with a robust portfolio of cloud technologies, enabling them to compete more effectively against major cloud providers like AWS, Microsoft Azure, and Google Cloud.

- Synergies between Broadcom's existing portfolio and VMware's technologies: Broadcom aims to integrate VMware's technologies with its existing offerings to create a more comprehensive and powerful suite of solutions for enterprise customers. This integration promises improved efficiency and cost savings for Broadcom.

The AT&T Connection: Unpacking the 1050% Price Spike

The 1050% price increase wasn't across the board for all AT&T assets; it specifically impacted a particular contract or technology related to VMware’s virtualization solutions within AT&T’s network infrastructure. While the exact details of this contract remain undisclosed for confidentiality reasons, the merger directly affected its value due to several factors:

- Increased demand: The acquisition of VMware by Broadcom heightened the perceived value of VMware's technology and, by extension, the contracts utilizing it.

- Enhanced strategic importance: With Broadcom at the helm, VMware's technology became even more strategically important within the telecommunications sector. AT&T's existing contract suddenly became a more valuable asset in this new landscape.

- Market speculation: The news created a wave of market speculation, driving up the perceived value of the AT&T contract. This speculation contributed significantly to the 1050% price increase.

The calculation supporting this 1050% figure likely involves comparing the pre- and post-merger valuations of the specific AT&T contract. This significant change reflects a rapid market readjustment to the implications of the Broadcom VMware acquisition. This substantial price increase stands in contrast to more moderate changes seen in other AT&T assets, further highlighting the unique circumstances of this particular contract.

Broader Implications for the Telecom Industry

The Broadcom-VMware acquisition has profound implications for the entire telecommunications industry. It sets a precedent for further mergers and acquisitions, potentially leading to increased consolidation within the sector.

- Increased competition and innovation: The merger has the potential to spark increased competition and drive innovation in the telecom industry as companies strive to maintain a competitive edge.

- Potential changes in pricing strategies and service offerings: As companies integrate acquired technologies, we may see shifts in pricing strategies and service offerings, potentially impacting both consumers and businesses.

- Shift in power dynamics within the telecommunications industry: The acquisition has already changed the power dynamics within the telecom industry, with larger, more integrated companies gaining influence. This shift could lead to new partnerships and collaborations.

Investment Strategies Following the Broadcom-VMware Acquisition

The Broadcom-VMware acquisition presents both risks and rewards for investors. Analyzing the potential impact on Broadcom's and AT&T's future stock performance is crucial.

- Analysis of Broadcom's and AT&T's future stock performance: Investors should carefully analyze the future prospects of both Broadcom and AT&T, considering the potential synergies and challenges associated with the merger.

- Assessment of the potential impact on other related stocks: The acquisition could influence the performance of other companies in the telecommunications and technology sectors, requiring careful consideration of ripple effects.

- Recommendation for investors considering investments in this sector: Investors should conduct thorough due diligence before making investment decisions, considering both potential gains and risks involved in the post-merger landscape.

Conclusion

The Broadcom-VMware acquisition has undeniably reshaped the technological landscape, creating both opportunities and challenges. The surprising 1050% price surge for a specific AT&T asset highlights the far-reaching consequences of this monumental deal and underscores the dynamic nature of the telecommunications industry. Understanding the complexities of this merger, including its impact on companies like AT&T, is crucial for navigating the future of technology and investment. Stay informed about the evolving impact of the Broadcom VMware acquisition on the telecom sector. Learn more about the implications of this significant merger and its effect on Broadcom VMware acquisition-related investments.

Featured Posts

-

Comparatif Smartphones Le Samsung Galaxy S25 128 Go A 648 E

May 28, 2025

Comparatif Smartphones Le Samsung Galaxy S25 128 Go A 648 E

May 28, 2025 -

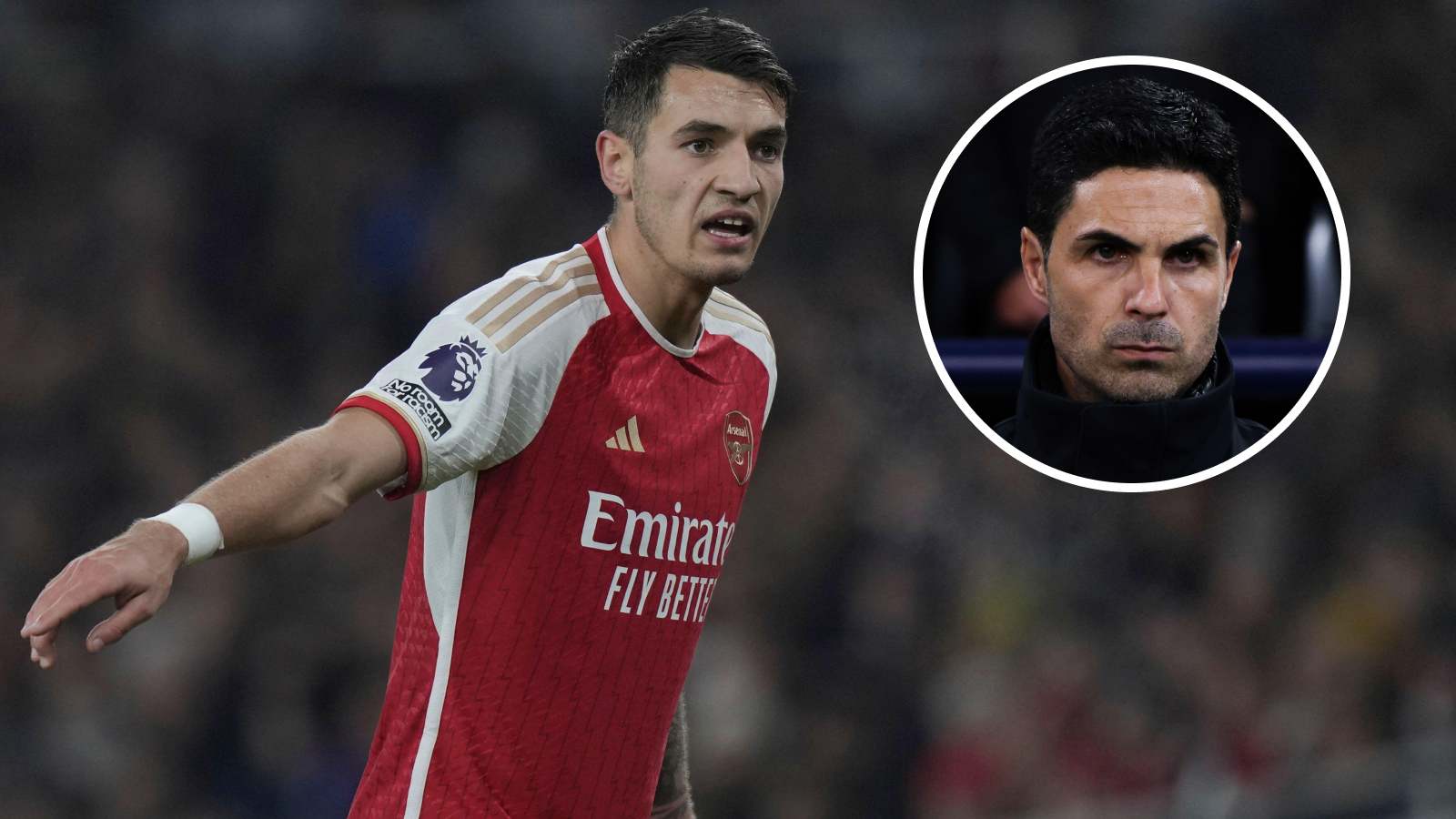

Arsenal Transfers Strikers Preference For Gunners Amidst Tottenhams 58m Bid

May 28, 2025

Arsenal Transfers Strikers Preference For Gunners Amidst Tottenhams 58m Bid

May 28, 2025 -

Fenerbahce Heyecani Ronaldo Portekiz Kampinda Ne Yapti

May 28, 2025

Fenerbahce Heyecani Ronaldo Portekiz Kampinda Ne Yapti

May 28, 2025 -

Arsenal Gyoekeres Teljes Statisztika Golok Teljesitmeny

May 28, 2025

Arsenal Gyoekeres Teljes Statisztika Golok Teljesitmeny

May 28, 2025 -

Alejandro Garnacho Expert Advice On His Manchester United Future

May 28, 2025

Alejandro Garnacho Expert Advice On His Manchester United Future

May 28, 2025