Broadcom's VMware Acquisition: AT&T Exposes A Potential 1,050% Cost Surge

Table of Contents

AT&T's VMware Dependence and the Cost Implications

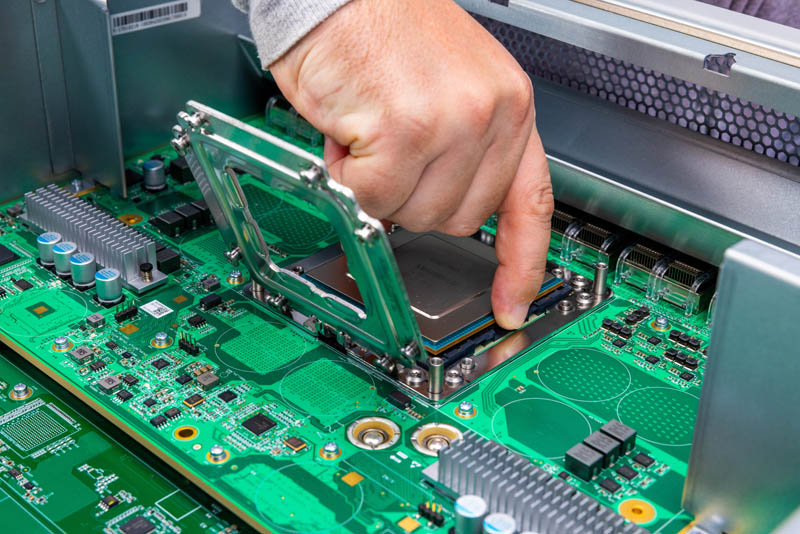

AT&T's extensive use of VMware virtualization technologies is well-documented. Their reliance on VMware's vSphere, vCenter, and other products forms a critical part of their massive IT infrastructure, supporting everything from network operations to customer services. This heavy dependence leaves them particularly vulnerable to any price increases implemented by Broadcom post-acquisition.

- AT&T's current VMware infrastructure: Reports suggest AT&T utilizes VMware across thousands of servers and data centers, supporting a vast array of critical applications and services. The scale of their deployment is immense, making them a significant VMware customer.

- Current VMware spending: While precise figures remain undisclosed, AT&T's current annual spending on VMware products and services likely runs into tens, if not hundreds, of millions of dollars.

- Projected cost increase: The rumored 1,050% cost increase stems from analysts' projections based on Broadcom's past acquisition strategies. Broadcom is known for its aggressive cost-cutting measures and potential for significant price hikes following mergers. This translates to a potentially catastrophic financial burden for AT&T.

- Broadcom vs. VMware pricing: Before the acquisition, VMware offered a relatively flexible pricing model with options for various licensing tiers. Broadcom’s historical track record suggests a move towards a more standardized, and potentially higher, pricing structure with less room for negotiation. This shift could significantly impact AT&T's bottom line.

Keywords: AT&T VMware costs, Broadcom pricing, VMware virtualization, enterprise software costs

Broadcom's Acquisition Strategy and Potential for Price Increases

Broadcom has a history of acquiring companies and subsequently increasing the prices of their products. This pattern raises serious concerns about the potential for a significant price hike for VMware's suite of virtualization products.

- Past acquisitions and price changes: Analyzing Broadcom's past acquisitions reveals a trend of price increases for acquired products, often justified by improvements in features or support, but frequently exceeding market expectations.

- Motivations for price increases: Broadcom's potential motivations for raising VMware's prices include maximizing profitability from a newly acquired asset and establishing market dominance, potentially squeezing out competitors.

- Legal challenges and regulatory scrutiny: The significant price increases following Broadcom's acquisitions have attracted regulatory scrutiny in the past, raising the potential for antitrust concerns and legal challenges regarding their pricing strategies.

Keywords: Broadcom acquisitions, Broadcom pricing strategy, post-merger pricing, antitrust concerns

The Broader Impact on the Cloud Computing Landscape

The Broadcom-VMware merger has far-reaching implications for the entire cloud computing ecosystem and the competitive landscape.

- Impact on major cloud providers: The increased cost of VMware virtualization could indirectly impact AWS, Azure, and GCP, as their clients might face higher operating costs, leading to potential shifts in cloud adoption strategies.

- Market consolidation: The merger has the potential to further consolidate the virtualization market, potentially limiting choices for businesses and potentially harming innovation.

- Alternatives and migration strategies: Companies reliant on VMware are now actively exploring alternatives such as open-source virtualization platforms like KVM or Xen, or other commercial solutions, prompting a wave of migration projects.

Keywords: Cloud computing costs, VMware alternatives, cloud virtualization, market consolidation

Risks and Opportunities for Businesses

Businesses heavily reliant on VMware face significant risks but also some potential opportunities in this changing landscape.

- Cost-cutting strategies: Businesses can explore various cost-cutting strategies, including optimizing their VMware deployments, negotiating better licensing agreements, or adopting a hybrid cloud model.

- Switching to alternative platforms: Migrating to alternative virtualization platforms might offer cost savings but also presents challenges related to compatibility, retraining, and potential downtime.

- Negotiating with Broadcom: While challenging, negotiating favorable contracts with Broadcom remains a viable option, especially for large enterprises with significant bargaining power.

Conclusion

The Broadcom's VMware acquisition presents a critical challenge for businesses relying on VMware technologies, with the potential for substantial cost increases – as high as 1,050% for companies like AT&T. The implications extend beyond individual organizations, affecting the broader cloud computing market and potentially leading to increased consolidation. Businesses need to proactively assess their reliance on VMware and consider alternatives or negotiate aggressively with Broadcom to mitigate the potentially devastating impact of Broadcom's VMware acquisition. Don't wait until the price surge hits; proactively assess your options regarding Broadcom's VMware acquisition today.

Featured Posts

-

Katanoisi Tis Anastasis Toy Lazaroy Sta Ierosolyma

May 19, 2025

Katanoisi Tis Anastasis Toy Lazaroy Sta Ierosolyma

May 19, 2025 -

Accountability For Stolen Dreams The Case Of The Restaurant Owner

May 19, 2025

Accountability For Stolen Dreams The Case Of The Restaurant Owner

May 19, 2025 -

Ahtfalat Alqyamt Fy Dyr Sydt Allwyzt Ebr Tqryr Alwkalt Alwtnyt Llielam

May 19, 2025

Ahtfalat Alqyamt Fy Dyr Sydt Allwyzt Ebr Tqryr Alwkalt Alwtnyt Llielam

May 19, 2025 -

A Restaurant Owners Pursuit Of Accountability After A Theft

May 19, 2025

A Restaurant Owners Pursuit Of Accountability After A Theft

May 19, 2025 -

Marcus And Martinus Announce Dublin Show At The Academy

May 19, 2025

Marcus And Martinus Announce Dublin Show At The Academy

May 19, 2025