Broadcom's VMware Acquisition: AT&T Faces 1,050% Price Increase

Table of Contents

The Broadcom-VMware Merger: A Giant Leap in Networking Power

Broadcom's acquisition of VMware represents a massive consolidation in the enterprise software and networking markets. This merger unites Broadcom's leading position in semiconductor and networking hardware with VMware's dominant role in virtualization and cloud infrastructure software. The combined entity boasts unparalleled market power, raising concerns about potential anti-competitive practices and price increases across VMware's extensive product suite. This deal has significant implications for businesses reliant on VMware solutions, with potential knock-on effects on the broader tech landscape.

- Broadcom's strategic objectives for acquiring VMware: Gaining control over a crucial segment of the enterprise software market, expanding its hardware-software portfolio, and leveraging VMware's technology to enhance its offerings in cloud computing and networking.

- VMware's key product offerings affected by the price hike: vSphere (server virtualization), NSX (network virtualization), and vRealize (cloud management) are among the key products experiencing significant price increases.

- Broadcom's history of acquisitions and their impact on pricing: Broadcom has a history of acquiring companies and subsequently raising prices on key products. This pattern fuels concerns about the VMware acquisition leading to similar price hikes across its product portfolio.

AT&T's 1050% Price Increase: A Case Study in Monopoly Concerns

The reported 1050% price increase faced by AT&T following the Broadcom-VMware merger is staggering. This dramatic jump in costs underscores the potential for significant market power abuse and highlights the vulnerability of large enterprises reliant on VMware's products. The impact on AT&T's operational costs and bottom line is substantial, potentially affecting service pricing and overall profitability.

- AT&T's reliance on VMware products within its infrastructure: AT&T utilizes VMware's virtualization technologies extensively in its vast network infrastructure. This heavy reliance makes it particularly susceptible to price increases.

- Potential impact on AT&T's operational costs and profitability: The 1050% increase represents a considerable financial burden, forcing AT&T to absorb the costs or potentially pass them on to customers through higher service prices.

- Comparison to price increases experienced by other telecom companies: While the exact figures remain unclear for other companies, many telecom providers who rely heavily on VMware technology are expected to face substantial price increases, making AT&T's case a significant warning sign for the industry.

Antitrust Concerns and Regulatory Scrutiny

The Broadcom-VMware merger has ignited significant antitrust concerns. The combined entity's market dominance raises fears of monopolistic practices and the potential for stifling competition. Regulatory bodies, including the FTC and the EU Commission, are likely to scrutinize the merger and its impact on pricing.

- Arguments for and against antitrust action: Proponents of antitrust action point to the potential for anti-competitive pricing and reduced innovation. Opponents may argue that the merger leads to synergies that benefit consumers in the long run.

- Potential consequences for Broadcom if antitrust violations are found: Potential consequences range from forced divestitures to substantial fines and even the potential unwinding of the merger.

- The role of regulatory bodies in preventing monopolistic practices: Regulatory bodies have a crucial role in ensuring fair competition and preventing the abuse of market power by dominant companies.

Future Implications for the Telecom Industry and Enterprise Software

The Broadcom-VMware merger's ripple effects are likely to be felt throughout the telecom and enterprise software sectors. Other companies reliant on VMware products may face similar, albeit perhaps less dramatic, price increases. This could lead to increased operational costs, reduced profitability, and potentially, higher prices for consumers.

- Potential for similar price increases across other VMware clients: While AT&T's experience is extreme, other large telecom companies and businesses heavily reliant on VMware's virtualization technology are expected to experience significant price increases.

- Strategies for telecom companies to mitigate the impact of rising VMware costs: Telecom companies might explore alternative virtualization solutions, negotiate more favorable contracts, or explore internal cost-cutting measures.

- The long-term implications of this merger for industry competition: The merger could lead to reduced competition, limiting innovation and potentially harming consumers in the long term. Increased VMware pricing could also incentivize the development and adoption of open-source alternatives.

Conclusion: Navigating the Post-Merger Landscape – Understanding the Broadcom VMware Acquisition’s Impact

The Broadcom-VMware acquisition has profound implications, most notably the substantial price increase imposed on AT&T. This case study highlights the potential for significant market power abuse following mergers of this scale and the importance of robust antitrust regulation. The long-term impact on the telecom industry, enterprise software sector, and consumers remains to be seen. However, it's critical to monitor developments regarding the Broadcom VMware acquisition and its effects on VMware pricing, Broadcom's impact on VMware, and the ongoing regulatory scrutiny. Stay informed about the evolving situation to understand the implications for your business and the wider tech landscape.

Featured Posts

-

La Brascada Ingredientes Y Elaboracion Del Bocadillo Valenciano

May 31, 2025

La Brascada Ingredientes Y Elaboracion Del Bocadillo Valenciano

May 31, 2025 -

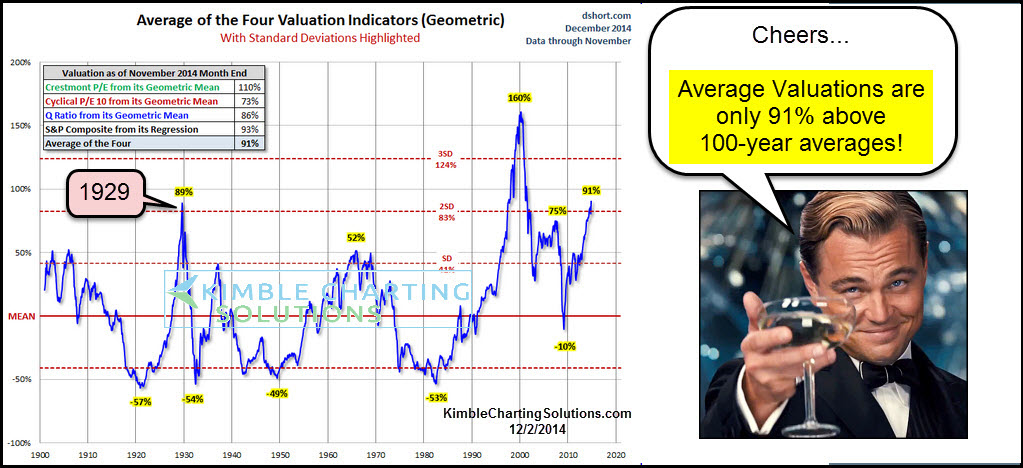

Understanding Stock Market Valuations Bof As Analysis

May 31, 2025

Understanding Stock Market Valuations Bof As Analysis

May 31, 2025 -

Wherry Vets Bungay Bid Approved Suffolk Practice Expansion

May 31, 2025

Wherry Vets Bungay Bid Approved Suffolk Practice Expansion

May 31, 2025 -

Vatican City To Host Grand Finale Of Giro D Italia 2025

May 31, 2025

Vatican City To Host Grand Finale Of Giro D Italia 2025

May 31, 2025 -

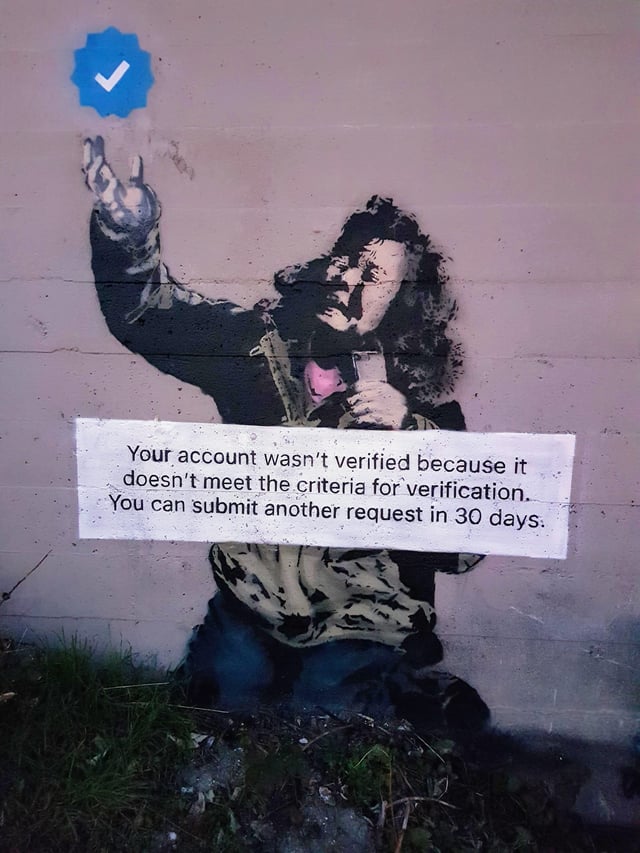

Finding A Banksy Your Guide To Verification And Next Steps

May 31, 2025

Finding A Banksy Your Guide To Verification And Next Steps

May 31, 2025