Broadcom's VMware Acquisition: AT&T Highlights A Staggering 1,050% Price Hike

Table of Contents

The 1050% Price Hike: A Deeper Dive

AT&T's Public Statement and its Significance

AT&T's public announcement of the dramatic price increase is unprecedented and highly significant. While specific details of the contract remain confidential, the sheer magnitude of the increase – a 1050% jump – has raised serious concerns across the industry. This disclosure is important because it suggests that other VMware customers may face similarly drastic price hikes, potentially disrupting their IT budgets and operations.

-

Quote from AT&T’s statement regarding the price increase: While the exact wording isn't publicly available in full detail, news reports indicate statements expressing significant concern about the unforeseen cost increases associated with the Broadcom VMware acquisition.

-

Analysis of AT&T’s reliance on VMware products: AT&T, a massive telecommunications company, relies heavily on VMware's virtualization technology for its network infrastructure and internal operations. This makes them a significant VMware customer, and their experience is likely indicative of the potential impact on other large enterprises.

-

Speculation on why AT&T made the information public: AT&T's public statement might be a strategic move to pressure Broadcom to renegotiate the terms, to alert other businesses about potential cost increases, or to potentially gather support for regulatory action against the merger's anti-competitive practices.

Understanding the Cost Breakdown

The 1050% increase is likely a complex issue with multiple contributing factors. It's unlikely to be a simple across-the-board price hike. Instead, the significant increase may be due to a combination of factors:

-

Breakdown of potential cost components: The overall cost likely includes several elements, such as software licensing fees, support and maintenance contracts, and potentially new bundled services introduced post-acquisition.

-

Comparison of previous VMware pricing models to the new model: Before the Broadcom acquisition, VMware had a relatively established pricing structure. Post-acquisition, this structure might have changed significantly, introducing new licensing models or significantly increasing the cost of existing components.

-

Possible explanations for the significant price difference: The drastic increase could be attributed to factors such as Broadcom's pursuit of higher profit margins after the acquisition, changes in licensing models designed to generate more revenue, or a strategic shift to prioritize higher-paying customers.

Implications for Businesses and the Broader Market

Impact on Enterprise Budgeting and IT Planning

This unprecedented price hike has profound implications for businesses reliant on VMware solutions. It forces a complete reassessment of IT budgets and long-term planning.

-

Case studies (hypothetical or real, if available): A hypothetical example: A mid-sized company with a $1 million annual VMware licensing cost would now face a $10.5 million bill – a budget-breaking increase forcing significant operational changes.

-

Discussion on potential budget reallocations and cost-cutting measures: Companies will be forced to make difficult choices, potentially delaying other IT projects, reducing staff, or seeking alternative cost-saving measures.

-

Impact on future investment decisions in VMware technology: The dramatic price increase may deter future investment in VMware technologies, pushing companies toward more cost-effective solutions.

The Broader Antitrust Concerns

The Broadcom-VMware merger and subsequent price hikes raise significant antitrust concerns.

-

Discussion of the merger's impact on market competition: The merger has reduced competition in the virtualization market, potentially allowing Broadcom to dictate pricing and limit consumer choice.

-

Mention of any ongoing investigations or regulatory scrutiny: Regulatory bodies in various jurisdictions may be investigating the merger and its implications for competition and pricing.

-

Exploration of potential long-term implications for the software market: This incident could set a worrying precedent for future mergers and acquisitions in the tech industry, potentially leading to increased prices and reduced choice for consumers.

Alternatives and Mitigation Strategies for Businesses

Exploring VMware Alternatives

Businesses facing exorbitant VMware price hikes need to consider alternatives.

-

List of leading VMware alternatives: Several open-source solutions (like Proxmox VE) and commercial virtualization platforms (like Microsoft Hyper-V, Citrix XenServer) offer comparable functionalities.

-

Comparative analysis of features, costs, and suitability for different business needs: Careful evaluation of alternatives is crucial to identify the best fit based on specific requirements and budget constraints.

Negotiating with Broadcom and VMware

Businesses should explore all avenues to negotiate better licensing agreements.

-

Tips for successful contract negotiations: This includes thorough contract review, leveraging industry benchmarks, and understanding the complexities of the new licensing model.

-

Strategies for leveraging market power and industry standards: Consolidating purchasing power through industry alliances or seeking support from regulatory bodies can strengthen negotiating positions.

Conclusion

AT&T's staggering 1050% price hike following Broadcom's acquisition of VMware serves as a stark warning. The implications are far-reaching, affecting IT budgets, long-term planning, and potentially sparking antitrust concerns. Understanding the contributing factors and exploring alternative solutions are crucial. Businesses must proactively assess their VMware licensing costs, explore alternative virtualization technologies, and engage in strategic negotiations to mitigate the potentially crippling impact. Don't be caught off guard – investigate your options related to the Broadcom VMware acquisition and prepare for the future of enterprise software pricing. The future of VMware licensing and the impact of the Broadcom acquisition demands careful consideration and proactive planning.

Featured Posts

-

Horoscopo De Marzo 2025 Predicciones De La Semana Del 4 Al 10

May 24, 2025

Horoscopo De Marzo 2025 Predicciones De La Semana Del 4 Al 10

May 24, 2025 -

Artfae Daks Alalmany Mwshr Ela Teafy Alaqtsad Alawrwby

May 24, 2025

Artfae Daks Alalmany Mwshr Ela Teafy Alaqtsad Alawrwby

May 24, 2025 -

This Weeks Hottest R And B Leon Thomas And Flo Dominate

May 24, 2025

This Weeks Hottest R And B Leon Thomas And Flo Dominate

May 24, 2025 -

Dylan Dreyer And Brian Ficheras Family Celebrates Good News

May 24, 2025

Dylan Dreyer And Brian Ficheras Family Celebrates Good News

May 24, 2025 -

La Strategie De La Chine Pour Intimider Et Faire Taire Les Dissidents En France

May 24, 2025

La Strategie De La Chine Pour Intimider Et Faire Taire Les Dissidents En France

May 24, 2025

Latest Posts

-

Stitchpossibles 2025 Release A Potential Box Office Blockbuster

May 24, 2025

Stitchpossibles 2025 Release A Potential Box Office Blockbuster

May 24, 2025 -

Memorial Day 2025 Sales Your Guide To The Best Deals

May 24, 2025

Memorial Day 2025 Sales Your Guide To The Best Deals

May 24, 2025 -

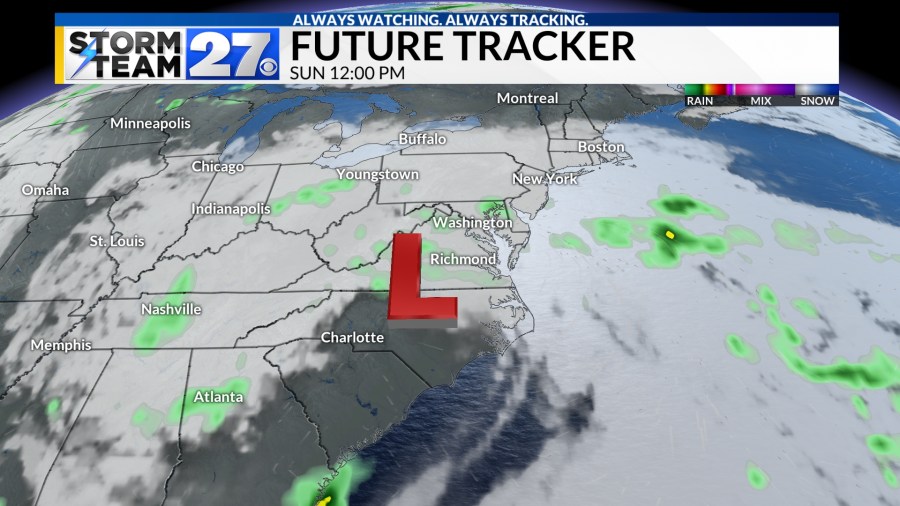

Nyc Memorial Day Weekend Weather Will It Rain

May 24, 2025

Nyc Memorial Day Weekend Weather Will It Rain

May 24, 2025 -

Box Office Battle Brewing Stitchpossibles Potential For A Record Breaking 2025 Weekend

May 24, 2025

Box Office Battle Brewing Stitchpossibles Potential For A Record Breaking 2025 Weekend

May 24, 2025 -

Cheaper Gas This Memorial Day Weekend Predictions And Analysis

May 24, 2025

Cheaper Gas This Memorial Day Weekend Predictions And Analysis

May 24, 2025