Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Surge

Table of Contents

Understanding the Broadcom-VMware Merger

Broadcom's $61 billion acquisition of VMware, finalized in late 2022, was a landmark event in the tech industry. Broadcom, known for its semiconductor components, saw VMware's virtualization and cloud computing solutions as a strategic asset to expand its enterprise software portfolio. The merger aimed to create synergies by integrating VMware's software with Broadcom's existing hardware and infrastructure offerings. This integration holds significant implications for the entire tech sector, but particularly for telecommunications giants like AT&T, heavily reliant on VMware's technology.

- VMware's Key Role: VMware provides essential virtualization and cloud management solutions widely used by telecommunication companies for network infrastructure management, data center optimization, and application deployment.

- Market Dominance: VMware holds a significant market share in the virtualization space, making its technology crucial for many telecoms' operations.

- Broadcom's Integration Strategy: Broadcom plans to integrate VMware's software into its existing offerings, potentially creating a powerful end-to-end solution for enterprise clients.

AT&T's Price Increase: The Direct Impact

The Broadcom-VMware merger has directly impacted AT&T's costs. Reports indicate a substantial price increase, although the exact figures remain partially undisclosed due to the complexities of commercial agreements. This increase is attributed to several factors, including renegotiated licensing agreements, increased costs for VMware products and services, and the potential for bundled offerings at higher prices. The magnitude of the price surge underscores the critical role VMware technology plays in AT&T's operations.

- Services Affected: The price increase affects various AT&T services that rely heavily on VMware's infrastructure, potentially impacting everything from network management to cloud-based offerings.

- Impact on Profitability: The increased cost of VMware solutions directly affects AT&T's profitability, forcing the company to either absorb the costs or pass them onto its customers, potentially leading to reduced customer satisfaction and increased churn.

- AT&T's Response: AT&T has not publicly commented extensively on the specific price increases but acknowledged increased operating costs linked to the industry shift following the acquisition.

Wider Implications for the Telecom Industry

The impact of Broadcom's VMware acquisition extends far beyond AT&T. Other major telecommunication companies that rely heavily on VMware’s virtualization and cloud solutions are likely to experience similar, although potentially varied, price increases. This could lead to a domino effect, impacting the competitiveness and profitability of the entire sector.

- Other Telecoms Affected: Companies like Verizon, T-Mobile, and other global telecom players could face similar challenges regarding cost increases and contract negotiations with Broadcom post-merger.

- Long-Term Consequences: Higher costs could lead to increased prices for consumers and businesses, potentially slowing down technological adoption and innovation in the telecom industry.

- Expert Opinions: Analysts predict increased consolidation within the telecom industry, with companies needing to adapt to the changing cost structures to maintain profitability and market share.

Regulatory Scrutiny and Antitrust Concerns

The sheer size and scope of Broadcom's VMware acquisition have naturally drawn significant regulatory scrutiny. Antitrust concerns exist due to Broadcom's potential dominance in various interconnected technology markets following the integration. Investigations are ongoing in multiple jurisdictions, focusing on potential market monopolies and competitive practices.

- Ongoing Investigations: Several government agencies are closely investigating the acquisition to assess its impact on competition and consumers.

- Potential Repercussions: If antitrust violations are found, Broadcom could face significant fines and potential divestment of certain assets to remedy the competitive harm.

- Role of Government Agencies: Regulators worldwide are playing a crucial role in ensuring fair competition and preventing market manipulation resulting from such massive mergers.

Conclusion: Navigating the Aftermath of Broadcom's VMware Acquisition

Broadcom's VMware acquisition marks a significant turning point for the technology industry, with far-reaching consequences, particularly for the telecom sector. AT&T's substantial price increase serves as a stark illustration of the immediate impact of this mega-merger. The potential for similar price hikes across the industry, coupled with the ongoing regulatory scrutiny, underscores the importance of closely monitoring this evolving situation. Stay informed about the latest developments surrounding Broadcom's VMware acquisition and its implications for the telecom sector. Follow reputable tech news outlets for updates.

Featured Posts

-

Marc Fiorentino Et Sa Carte Blanche Un Regard Critique

Apr 23, 2025

Marc Fiorentino Et Sa Carte Blanche Un Regard Critique

Apr 23, 2025 -

Middle Managers The Bridge Between Leadership And Employees And Why They Matter

Apr 23, 2025

Middle Managers The Bridge Between Leadership And Employees And Why They Matter

Apr 23, 2025 -

Pavel Pivovarov Anonsiroval Sovmestniy Merch S Aleksandrom Ovechkinym

Apr 23, 2025

Pavel Pivovarov Anonsiroval Sovmestniy Merch S Aleksandrom Ovechkinym

Apr 23, 2025 -

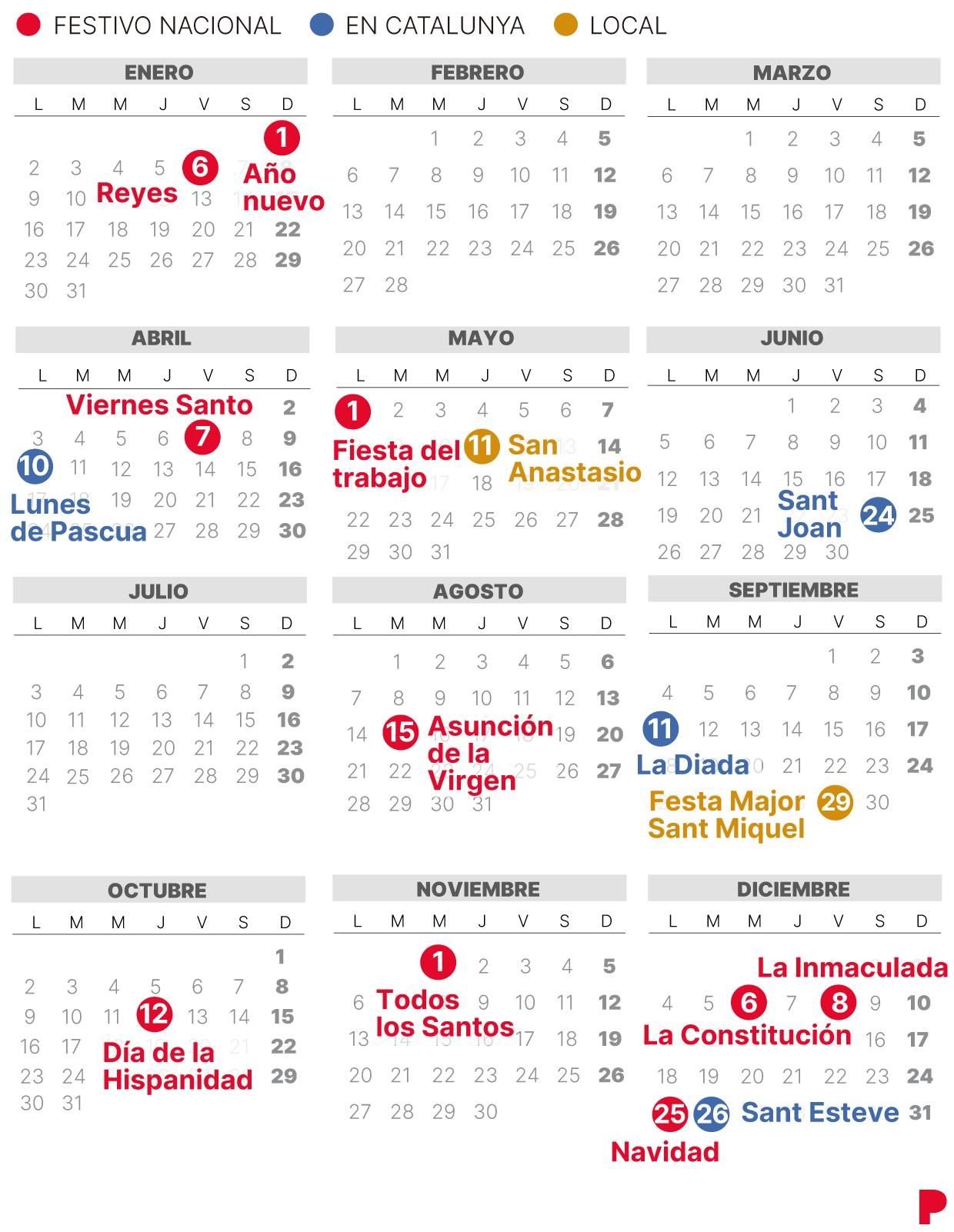

Calendario Laboral 2024 El Puente Del 21 De Abril Y Otros Festivos

Apr 23, 2025

Calendario Laboral 2024 El Puente Del 21 De Abril Y Otros Festivos

Apr 23, 2025 -

Dealerships Double Down On Opposition To Electric Vehicle Regulations

Apr 23, 2025

Dealerships Double Down On Opposition To Electric Vehicle Regulations

Apr 23, 2025