Brookfield's Approach To Opportunistic Investments In A Dislocated Market

Table of Contents

Brookfield Asset Management is a global leader in alternative asset management, renowned for its ability to navigate volatile markets and generate strong returns. This article delves into Brookfield's unique approach to opportunistic investments during periods of market dislocation, examining their strategies and the factors contributing to their consistent success. We'll explore how they identify and capitalize on undervalued assets, manage risk effectively, and achieve significant returns even in challenging economic environments. Understanding Brookfield's methods offers valuable insights for investors seeking to navigate the complexities of a dislocated market.

Identifying Undervalued Assets in a Dislocated Market

Brookfield's success hinges on its unparalleled ability to pinpoint mispriced assets in a dislocated market. This requires more than just market awareness; it demands deep, granular understanding and a proactive approach. Their process involves extensive market research, employing specialized teams for rigorous due diligence, and leveraging a vast network of global relationships to access exclusive opportunities.

-

Extensive market analysis using proprietary data and insights: Brookfield doesn't rely solely on publicly available data. They utilize sophisticated analytical tools and proprietary data sources to identify underlying value often missed by other investors. This allows them to anticipate market shifts and identify emerging opportunities before the wider market recognizes them.

-

Focus on fundamental analysis, rather than short-term market sentiment: Brookfield takes a long-term perspective. They prioritize fundamental analysis of an asset's intrinsic value, disregarding short-term market fluctuations and noise. This approach allows them to identify undervalued assets that are temporarily mispriced due to market panic or uncertainty.

-

Experienced teams specializing in various asset classes (real estate, infrastructure, private equity): Their expertise spans a diverse range of asset classes, enabling them to identify opportunities across sectors. Dedicated teams with specialized knowledge in real estate, infrastructure, private equity, and renewable energy allow for a comprehensive assessment of potential investments.

-

Strategic partnerships to access exclusive investment opportunities: Brookfield cultivates strong relationships with developers, owners, and other market participants, granting them access to off-market opportunities and exclusive deals not available to the public. This network provides a significant competitive advantage.

Brookfield's Risk Management Framework for Opportunistic Investments

While opportunistic investments inherently involve higher risk, Brookfield's success lies in its sophisticated risk management framework designed to mitigate potential downsides. This framework is not merely reactive; it's a proactive, multi-layered approach that integrates throughout the entire investment lifecycle.

-

Conservative use of leverage to limit financial risk: Brookfield avoids excessive leverage, preferring to maintain a strong balance sheet even during periods of aggressive investment. This conservative approach ensures financial stability and resilience in the face of unexpected market downturns.

-

Diversification across asset classes and geographies: Brookfield avoids concentrating investments in any single asset class or geographic region. This diversification strategy reduces overall portfolio risk and minimizes the impact of localized or sector-specific market shocks.

-

Stress testing portfolio resilience under various adverse economic conditions: Before committing to an investment, Brookfield rigorously stress-tests its portfolio under various adverse economic scenarios. This forward-looking approach helps to identify potential vulnerabilities and adjust investment strategies accordingly.

-

Robust legal and regulatory compliance frameworks: Brookfield adheres to the highest standards of legal and regulatory compliance, minimizing legal and reputational risks. This rigorous approach ensures long-term sustainability and investor confidence.

Capitalizing on Market Volatility through Strategic Timing and Value Investing

Brookfield's long-term investment horizon is a key differentiator. Their ability to capitalize on market volatility stems from their commitment to value investing and strategic timing. They patiently wait for the right opportunities, understanding that market dislocations create compelling entry points for undervalued assets.

-

A long-term investment philosophy focused on creating sustainable value: Brookfield prioritizes long-term value creation over short-term gains. This patient approach allows them to weather market fluctuations and realize the full potential of their investments.

-

Patience and discipline to wait for the right opportunities: Brookfield doesn't rush into investments. They carefully analyze opportunities and only invest when the risk-reward profile aligns with their long-term strategy.

-

Expertise in identifying long-term trends and anticipating market shifts: Brookfield possesses deep market expertise, enabling them to identify emerging trends and anticipate market shifts, positioning them to capitalize on future opportunities.

-

Effective capital allocation strategies to maximize returns: Brookfield's disciplined capital allocation strategy ensures that investments are made only in opportunities with the highest potential for long-term returns.

Specific Examples of Brookfield's Successful Opportunistic Investments:

-

Acquisition of distressed real estate portfolios during the 2008 financial crisis: Brookfield strategically acquired numerous undervalued real estate assets at significant discounts, generating substantial returns as the market recovered.

-

Investments in infrastructure assets during periods of economic uncertainty: Brookfield recognized the long-term value of infrastructure investments, acquiring assets at attractive prices during periods of market volatility, generating steady cash flows and capital appreciation.

-

Strategic acquisitions of private equity firms experiencing financial distress: By acquiring distressed private equity firms, Brookfield gained access to valuable underlying assets at discounted prices, creating significant value through operational improvements and strategic repositioning.

Conclusion

Brookfield's remarkable success in opportunistic investing during market dislocations is a result of a carefully crafted strategy combining deep market understanding, rigorous risk management, a long-term value investing approach, and extensive industry connections. Their ability to identify undervalued assets, manage risk effectively, and capitalize on market volatility is a testament to their expertise and disciplined approach. This strategy allows them to consistently generate significant returns, even in the most challenging economic environments.

Call to Action: Learn more about how Brookfield leverages its expertise in opportunistic investments and how you can potentially benefit from their strategies in a dislocated market. Explore Brookfield's investment offerings and discover the potential for significant returns through carefully managed opportunistic investments.

Featured Posts

-

Fydyw Alshmrany Ythdth En Tsryhat Jysws Bshan Flamnghw

May 08, 2025

Fydyw Alshmrany Ythdth En Tsryhat Jysws Bshan Flamnghw

May 08, 2025 -

Celtics Vs Nets Jayson Tatums Status For Tonights Game

May 08, 2025

Celtics Vs Nets Jayson Tatums Status For Tonights Game

May 08, 2025 -

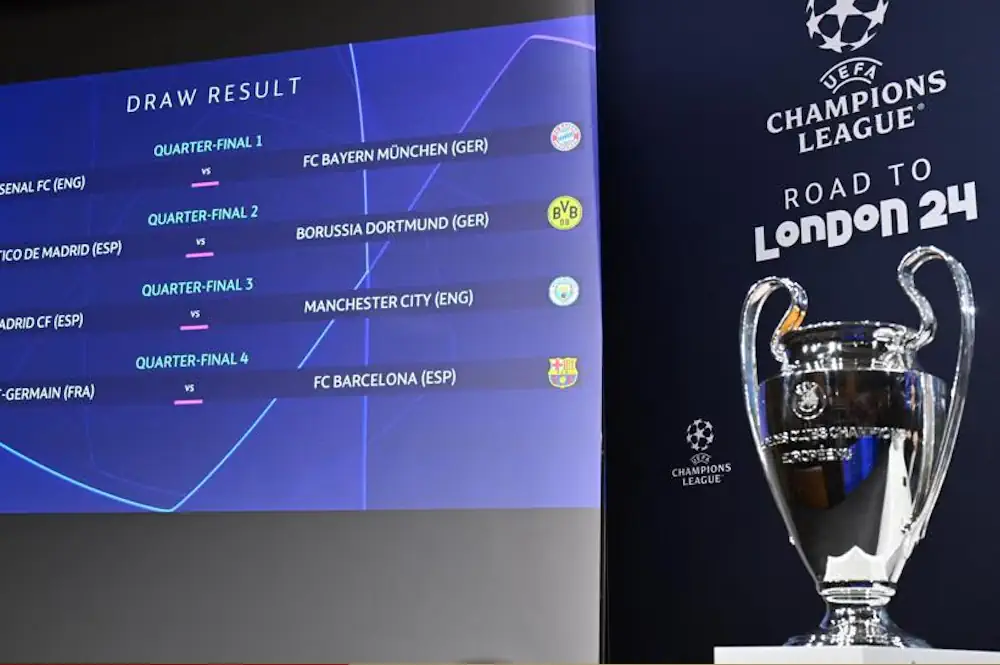

Liga Chempionov 2024 2025 Predmatcheviy Obzor Igr Arsenal Ps Zh I Barselona Inter

May 08, 2025

Liga Chempionov 2024 2025 Predmatcheviy Obzor Igr Arsenal Ps Zh I Barselona Inter

May 08, 2025 -

6aus49 Lotto Ergebnisse Ziehung Vom 19 April 2025

May 08, 2025

6aus49 Lotto Ergebnisse Ziehung Vom 19 April 2025

May 08, 2025 -

U S Intelligence Agencies Increase Greenland Surveillance

May 08, 2025

U S Intelligence Agencies Increase Greenland Surveillance

May 08, 2025