BSE Stock Market Surge: Stocks That Jumped 10%+ Today

Table of Contents

The Bombay Stock Exchange (BSE) witnessed a dramatic surge today, with several stocks experiencing double-digit percentage gains. This unexpected rally has sent ripples through the Indian financial markets, leaving investors wondering about the reasons behind this significant jump and the potential implications for the future. This article highlights the top performers of this BSE stock market surge, examining the reasons behind their impressive growth and analyzing the broader market implications. We'll delve into specific stocks that jumped over 10%, providing insights into their performance and potential future trajectories. Understanding these market shifts is crucial for investors navigating the dynamic BSE landscape.

Top BSE Stocks with 10%+ Gains Today

Several stocks on the BSE experienced remarkable growth today, exceeding the 10% mark. Here are some of the top performers:

-

ABC Ltd. (+15%):

- Sector: Technology

- News/Events: Announced a groundbreaking new product launch, exceeding analysts' expectations.

- Closing Price: ₹575

- Future Potential: The strong positive market reaction suggests significant growth potential, but investors should monitor future performance closely.

-

XYZ Corp. (+12%):

- Sector: Pharmaceuticals

- News/Events: Received positive clinical trial results for a new drug.

- Closing Price: ₹820

- Future Potential: This positive news significantly boosted investor confidence, though long-term success depends on regulatory approvals.

-

PQR Industries (+11%):

- Sector: Infrastructure

- News/Events: Won a major government contract.

- Closing Price: ₹345

- Future Potential: Securing this large contract positions PQR for significant revenue growth in the coming quarters.

-

RST Metals (+10.5%):

- Sector: Metals and Mining

- News/Events: Benefited from rising global commodity prices.

- Closing Price: ₹210

- Future Potential: The surge is partly due to external factors, so continued growth depends on maintaining these favorable commodity market trends.

Analyzing the Market Surge: Factors Contributing to the BSE Rally

Several interconnected factors likely contributed to today's impressive BSE rally. Understanding these nuances is crucial for interpreting the market's behavior and predicting future trends.

- Positive Economic Indicators: Recent positive GDP growth figures and improved inflation data boosted investor confidence, leading to increased investment activity.

- Government Policies: A recent government announcement regarding infrastructure spending had a positive effect on related sectors.

- Global Market Trends: Positive global market trends, particularly in Asian markets, also contributed to the upbeat sentiment.

- Sector-Specific News: Strong performance in certain sectors, such as technology and pharmaceuticals, acted as a catalyst for broader market gains.

- Investor Sentiment and Speculation: A combination of positive news and general market optimism fueled speculation and increased buying pressure, pushing prices higher.

Understanding the Risks and Potential for Future Growth

While today's BSE stock market surge is encouraging, it's crucial to remember that the market is inherently volatile. Investors must prioritize risk management and cautious investing strategies.

- Volatility: Stock prices can fluctuate significantly, and today's gains do not guarantee future success.

- Diversification: Diversifying investments across different sectors and asset classes is essential to mitigate risk.

- Due Diligence: Thorough research and due diligence are crucial before investing in any stock.

- Potential Downsides: Unexpected economic downturns or negative company-specific news can quickly reverse positive trends.

- Investment Strategies: Consider both short-term and long-term investment goals when making decisions.

Expert Opinion on the BSE Surge

"Today's BSE surge reflects a combination of positive economic fundamentals and sector-specific catalysts," says renowned financial analyst, Mr. Rohan Sharma. "However, investors should approach this with caution and not get carried away by short-term gains. A long-term perspective and diversified portfolio remain crucial."

Conclusion

Today's BSE market surge saw several stocks experience impressive gains exceeding 10%, driven by a combination of factors including positive economic indicators and sector-specific news. The strong performance of specific stocks, like ABC Ltd. and XYZ Corp., highlights the impact of positive company-specific news. However, investors should remember the importance of careful analysis and risk management before making any investment decisions. Understanding the nuances of market dynamics is crucial for successful investing in the BSE. The volatility inherent in the stock market necessitates a balanced and informed approach.

Call to Action: Stay informed about future market movements and discover more about high-performing BSE stocks. Continue tracking the BSE stock market surge and other key market indicators to make informed investment choices. Follow [Your Website/Platform] for regular updates and in-depth analysis of the BSE.

Featured Posts

-

Ovechkin Noviy Rekord Po Golam V Pley Off N Kh L

May 15, 2025

Ovechkin Noviy Rekord Po Golam V Pley Off N Kh L

May 15, 2025 -

The Truth Behind Amber Heards Twins And The Elon Musk Connection

May 15, 2025

The Truth Behind Amber Heards Twins And The Elon Musk Connection

May 15, 2025 -

Golden State Warriors Jimmy Butler Leads Victory Against Houston Rockets

May 15, 2025

Golden State Warriors Jimmy Butler Leads Victory Against Houston Rockets

May 15, 2025 -

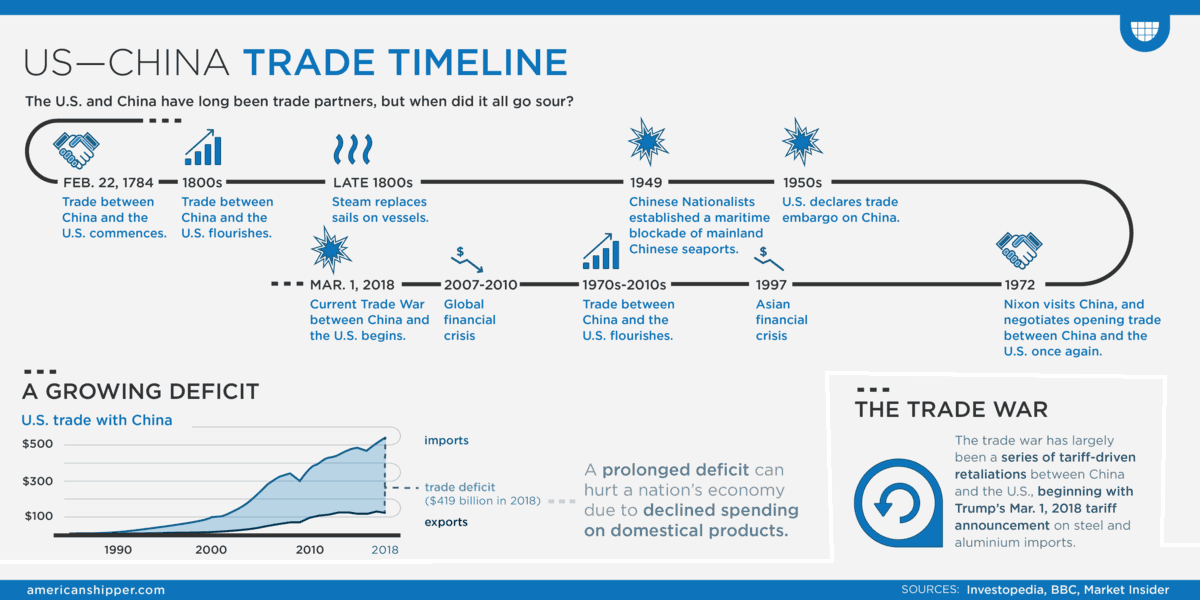

The Us China Trade War Who Conceded First And Why

May 15, 2025

The Us China Trade War Who Conceded First And Why

May 15, 2025 -

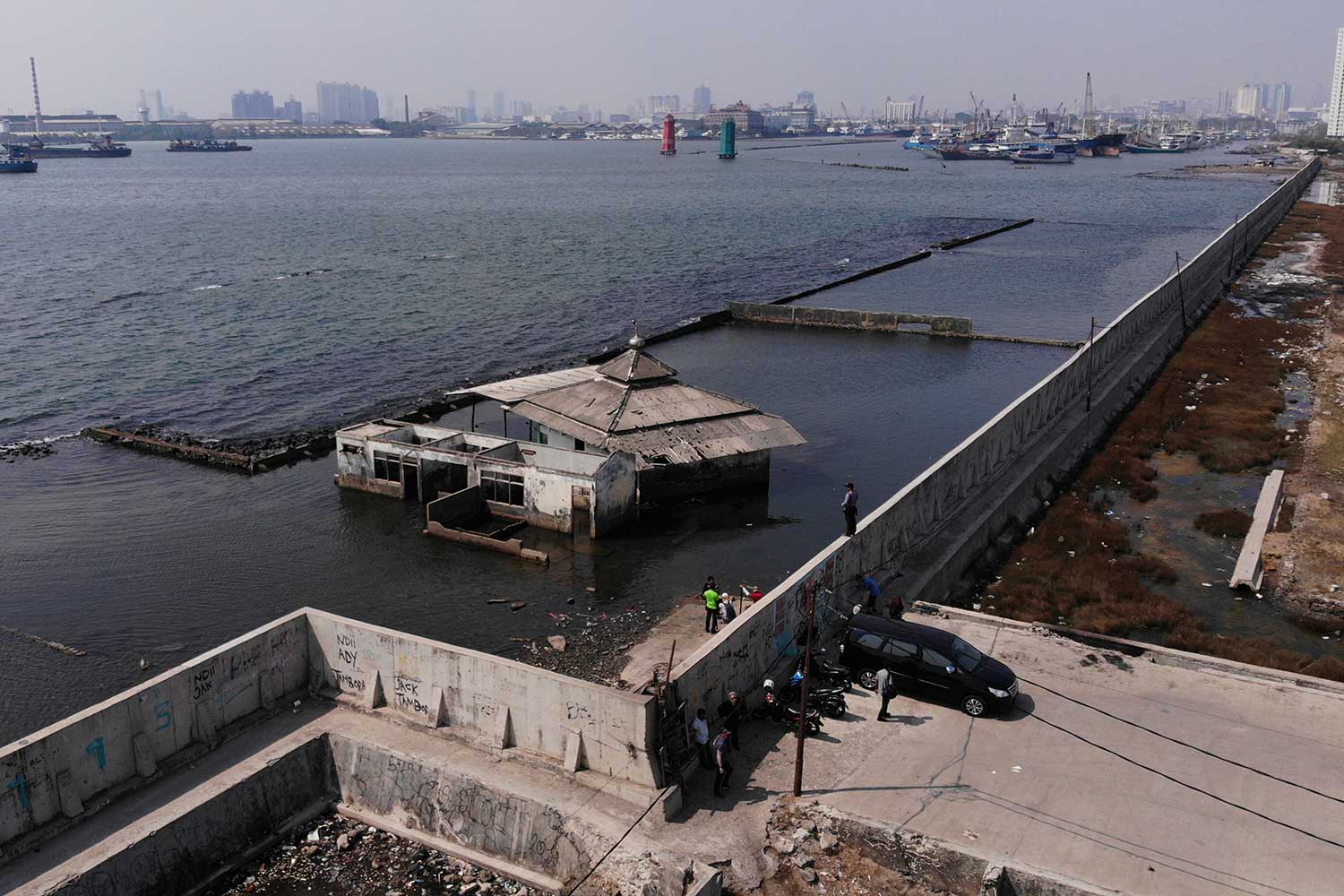

Investasi Swasta Dalam Proyek Giant Sea Wall Pemerintah

May 15, 2025

Investasi Swasta Dalam Proyek Giant Sea Wall Pemerintah

May 15, 2025