Buffett's Departure: What's Next For Berkshire Hathaway's Apple Investment?

Table of Contents

Succession Planning at Berkshire Hathaway and its Impact on Apple

Berkshire Hathaway's succession plan, placing Greg Abel and Ajit Jain in prominent roles, is central to understanding the future of its Apple investment. While both Abel and Jain are highly respected within the company, their investment philosophies may differ subtly from Buffett's. Buffett's approach, characterized by long-term value investing and a focus on understandable businesses, has been instrumental in Berkshire's success. However, Abel and Jain might bring their own perspectives, potentially leading to shifts in investment strategy.

- Potential shifts in investment strategy: Will Berkshire Hathaway maintain its focus on established, large-cap companies like Apple, or explore opportunities in newer, potentially higher-growth sectors? A move towards more tech-focused investments is possible, but a more conservative approach is equally plausible.

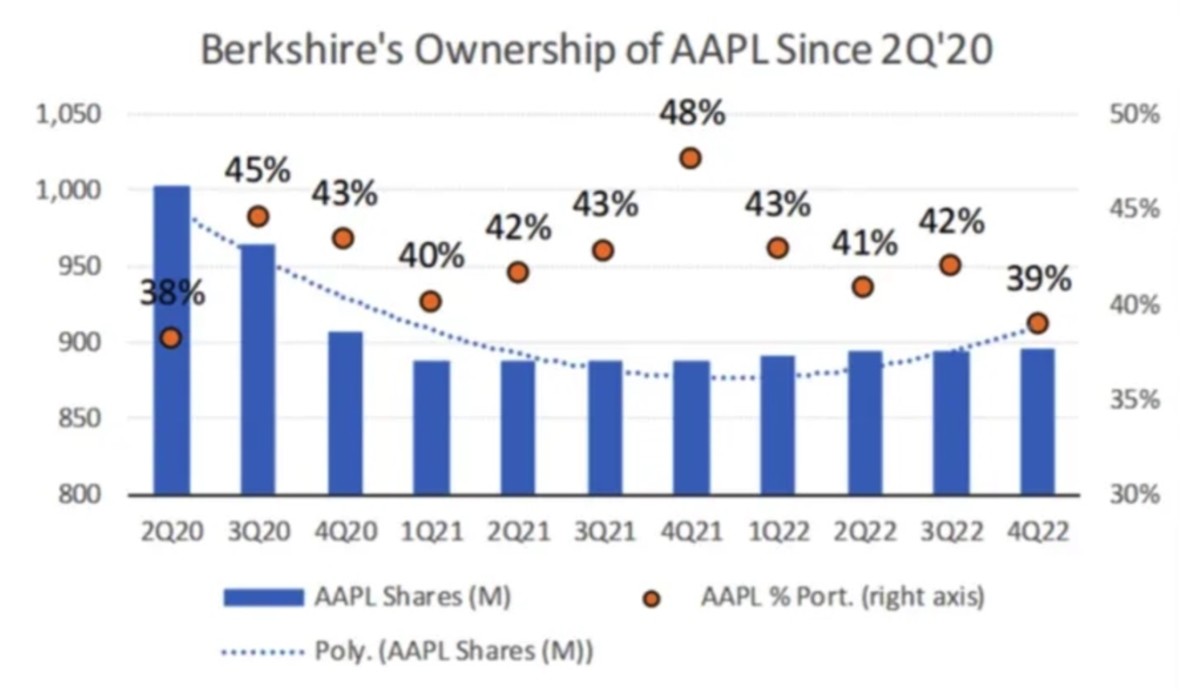

- Will the Apple investment remain a core holding? Given its size and historical performance, it's highly probable that Apple will remain a significant part of Berkshire's portfolio. However, the extent of this holding could change.

- Possibility of partial divestiture or increased holdings: Berkshire might strategically reduce its Apple stake to diversify its portfolio or increase its holdings if Apple's prospects remain strong. The decision will depend heavily on the market conditions and the assessment of Apple's future valuation.

- How the board's decision-making process might affect the Apple investment: The board's collective wisdom and risk appetite will play a crucial role in shaping decisions about the Apple investment, ensuring a well-informed and calculated approach.

Analyzing Apple's Current Market Position and Future Prospects

Apple's continued success is intrinsically linked to the fate of Berkshire Hathaway's investment. Apple currently enjoys a dominant market share in several key product categories, possesses a robust financial position, and continues to innovate with new products and services. The growth drivers for Apple, such as its expanding services business (including Apple Music and iCloud), its wearable technology (Apple Watch and AirPods), and potential advancements in areas like augmented reality, are significant factors to consider.

However, Apple faces challenges. Intense competition, economic slowdowns, and evolving regulatory environments represent potential risks.

- Key performance indicators (KPIs) for Apple that influence Berkshire's decision: Metrics like revenue growth, profit margins, market share, and customer loyalty are crucial indicators that Berkshire will closely monitor.

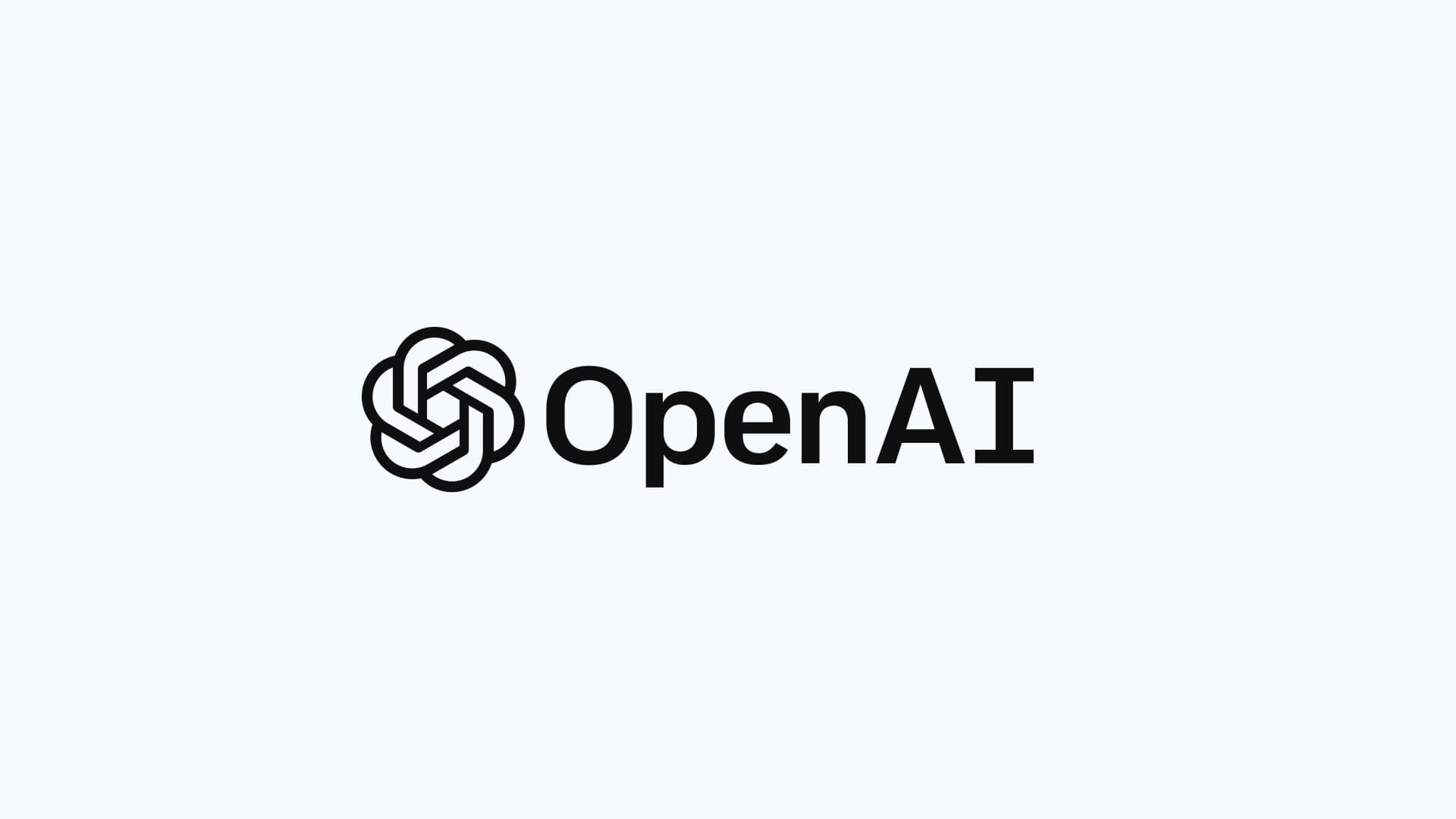

- Analysis of Apple's valuation and potential future growth: Berkshire will carefully analyze whether Apple's current valuation accurately reflects its long-term growth potential.

- Impact of macroeconomic factors on Apple's performance: Global economic conditions, inflation, and interest rates will all influence Apple's performance and, consequently, Berkshire's investment strategy.

The Market's Reaction to Buffett's Departure and its Influence on Apple's Stock Price

Buffett's influence on market sentiment is undeniable. News of his reduced role at Berkshire Hathaway has already triggered some market reactions. Historically, Berkshire's investment decisions in Apple have significantly impacted Apple's stock price. Therefore, any future changes in Berkshire's Apple holdings are likely to generate considerable market volatility.

- Historical correlation between Berkshire's actions and Apple's stock performance: A detailed analysis of past correlations can provide insights into potential future reactions.

- Analysis of investor sentiment towards Apple post-Buffett: Investor confidence in Apple post-Buffett will be a key factor driving stock price movements.

- Potential short-term and long-term implications for Apple's stock: Short-term volatility is likely, but the long-term impact will depend on Apple's performance and Berkshire's overall investment strategy.

Alternative Investment Strategies for Berkshire Hathaway Post-Buffett

Post-Buffett, Berkshire Hathaway might adopt different investment strategies. This could involve diversification into new sectors, a shift in risk tolerance, or a heightened focus on ESG factors. These changes could indirectly affect the Apple investment by altering the overall portfolio allocation.

- Exploration of new sectors for investment: Berkshire might explore sectors like renewable energy, biotechnology, or artificial intelligence.

- Potential for increased or decreased risk tolerance: The new leadership might favor a more aggressive or conservative investment approach.

- The role of ESG (Environmental, Social, and Governance) factors in future investments: ESG considerations could influence investment decisions across the entire portfolio, including Apple.

Conclusion: The Future of Berkshire Hathaway's Apple Investment – A Continuing Story

The future of Berkshire Hathaway's Apple investment remains uncertain. While Apple's strong fundamentals suggest continued success, the impact of Buffett's departure and the evolving investment philosophy at Berkshire Hathaway introduce significant variables. The success of Berkshire's succession plan and the adaptability of its investment strategy will play crucial roles in determining the long-term fate of this massive investment. Staying informed about Berkshire Hathaway's Apple investment requires continuous monitoring of key players, market trends, and financial news. Stay informed about the evolving situation of Berkshire Hathaway's Apple investment by following reputable financial news sources and continuing to analyze the key players and factors involved.

Featured Posts

-

I O And Io A Comparative Analysis Of Google And Open Ai Technologies

May 25, 2025

I O And Io A Comparative Analysis Of Google And Open Ai Technologies

May 25, 2025 -

Euroleague I Monako Epikratei Sto Parisi Enimeromeni Bathmologia

May 25, 2025

Euroleague I Monako Epikratei Sto Parisi Enimeromeni Bathmologia

May 25, 2025 -

Demnas Gucci Debut Initial Reactions And Future Prospects

May 25, 2025

Demnas Gucci Debut Initial Reactions And Future Prospects

May 25, 2025 -

Amira Al Zuhair A Highlight Of Zimmermanns Paris Fashion Week Presentation

May 25, 2025

Amira Al Zuhair A Highlight Of Zimmermanns Paris Fashion Week Presentation

May 25, 2025 -

Analyzing News Corp Identifying Underappreciated And Undervalued Segments

May 25, 2025

Analyzing News Corp Identifying Underappreciated And Undervalued Segments

May 25, 2025