Bullion's Rise Amidst Trade Wars: Analyzing The Gold Price Rally

Table of Contents

Safe Haven Demand Fuels Gold Price Surge

Gold has long been recognized as a safe haven asset, a reliable store of value during times of economic uncertainty and geopolitical instability. When investors perceive heightened risk – be it from trade wars, political upheaval, or market volatility – they flock to gold as a hedge against potential losses. This increased demand directly fuels the gold price surge.

- Increased geopolitical risks: The ongoing trade wars between major global economies, coupled with political instability in various regions, have significantly increased investor anxiety. This uncertainty drives capital flows towards perceived safe havens, such as gold.

- Diversification strategy: Investors are actively seeking to diversify their portfolios, moving away from the volatility often associated with equities and bonds. Gold, with its historically low correlation to other asset classes, becomes an attractive option for risk mitigation.

- Central bank gold purchases: Central banks worldwide have been increasing their gold reserves, further bolstering demand. This strategic move reflects a growing confidence in gold as a reliable asset in a turbulent global landscape.

- Negative real interest rates: In many developed economies, real interest rates (nominal interest rates minus inflation) are negative or near zero. This makes holding cash less attractive, increasing the appeal of non-yielding assets like gold.

Data from the World Gold Council shows a significant increase in gold demand in recent quarters, directly correlating with escalating trade tensions. For example, [Insert specific data and statistics here, referencing reliable sources like the World Gold Council or reputable financial news outlets]. This surge in demand is a primary driver of the recent gold price rally.

Weakening Dollar Strengthens Gold Prices

Gold prices and the US dollar share an inverse relationship. A weaker dollar generally translates to higher gold prices, and vice versa. This is because gold is priced in US dollars; therefore, when the dollar weakens against other currencies, gold becomes relatively cheaper for buyers using those currencies, increasing demand and subsequently pushing prices upward.

- Dollar weakness: Trade war uncertainty often leads to a weakening of the US dollar as investors seek refuge in other currencies or assets perceived as less risky.

- Mechanism of influence: A weaker dollar increases the purchasing power of those holding other currencies, making gold more affordable and driving up demand.

- Exchange rate impact: [Insert current exchange rate data and explain its impact on gold prices. For example, "The recent decline in the dollar index by X% has contributed to a Y% increase in the gold price."]

Inflationary Pressures and Gold's Hedge

Trade wars often lead to supply chain disruptions and increased production costs, contributing to inflationary pressures. Gold has historically served as a hedge against inflation, maintaining its value even as the purchasing power of fiat currencies erodes.

- Supply chain disruptions: Trade disputes can disrupt global supply chains, leading to shortages and higher prices for goods.

- Inflationary impact: This inflationary environment increases the demand for assets that hold their value, such as gold.

- Inflation and gold demand: As inflation expectations rise, investors often turn to gold as a safeguard against the loss of purchasing power.

- Data correlation: [Insert data showing the correlation between inflation rates and gold prices, referencing reputable sources].

Analyzing the Impact of Specific Trade Wars on Bullion Prices

The US-China trade war, for instance, has significantly impacted gold prices. [Explain the timeline, specific events, and their impact on the gold price. Include references to relevant news articles and financial reports]. Similarly, [Analyze another specific trade dispute and its impact].

Future Outlook for Gold Prices and the Impact of Ongoing Trade Conflicts

Predicting the future trajectory of gold prices is inherently challenging, but considering ongoing trade conflicts, several factors point to continued upward pressure.

- Resolution or escalation: The outcome of current trade negotiations – whether they lead to resolutions or further escalations – will significantly impact the gold price.

- Other economic factors: Changes in interest rates, global economic growth, and other macroeconomic indicators will also play a crucial role.

- Potential price ranges: Based on the current factors, a reasonable range for gold prices in the near future might be [provide a reasonable price range with justification].

- Expert opinions: [Mention different expert opinions on the future performance of gold, referencing credible financial analysts].

Conclusion: Navigating the Bullion Market During Trade Wars

The current gold price rally is fueled by a confluence of factors: safe haven demand amidst trade war uncertainty, a weakening US dollar, and inflationary pressures. Understanding the intricate relationship between global trade dynamics and gold investment is crucial for navigating the bullion market effectively. As trade wars continue to shape the global economic landscape, investing in gold, or a diversified portfolio including bullion, presents a strategic opportunity for risk mitigation and potential long-term growth. Learn more about gold price analysis and consider including gold as part of your safe haven investment strategy. Start exploring bullion investment options today.

Featured Posts

-

Trump Casts Doubt On Ukraines Nato Future Examining The Reasons

Apr 26, 2025

Trump Casts Doubt On Ukraines Nato Future Examining The Reasons

Apr 26, 2025 -

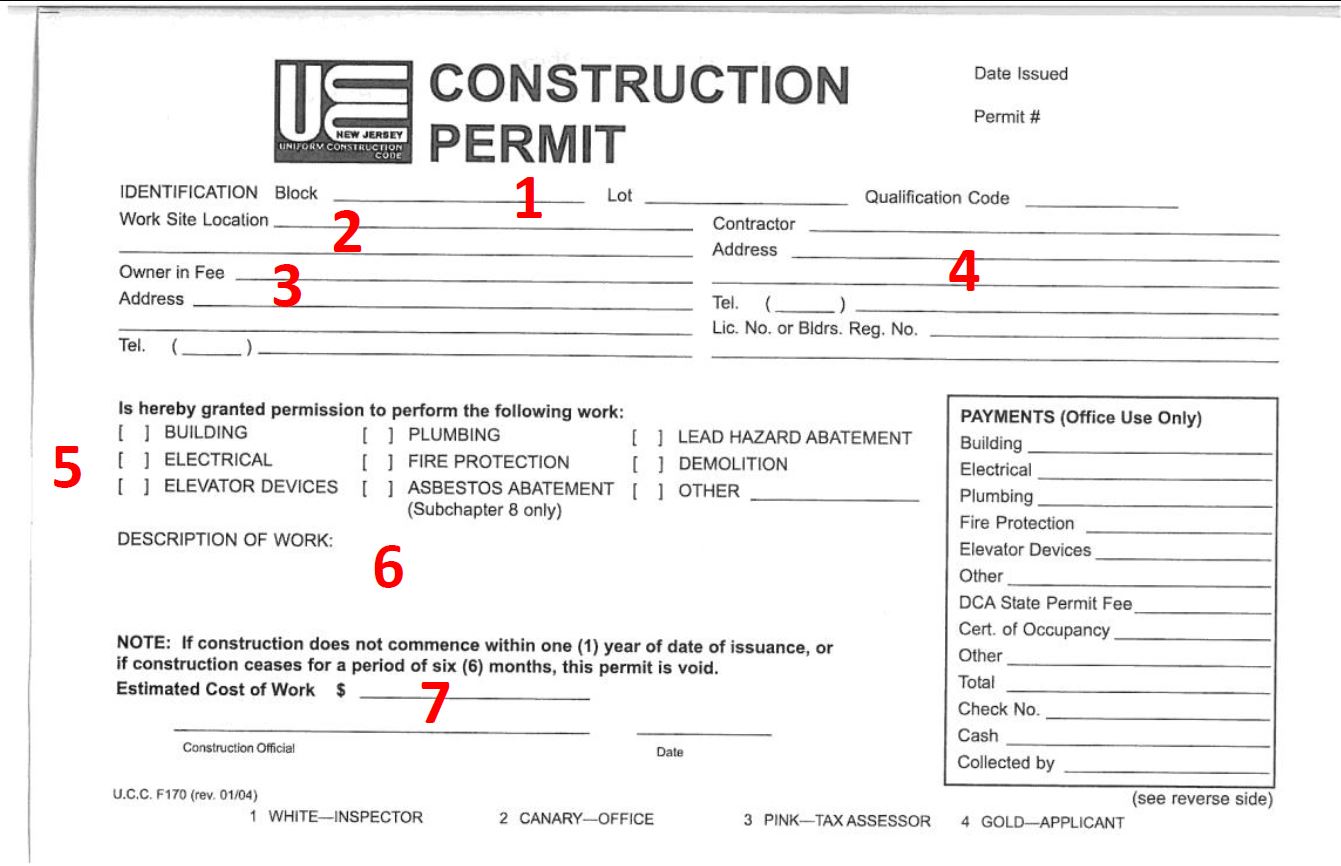

Recent Building Permits Issued In Macon County

Apr 26, 2025

Recent Building Permits Issued In Macon County

Apr 26, 2025 -

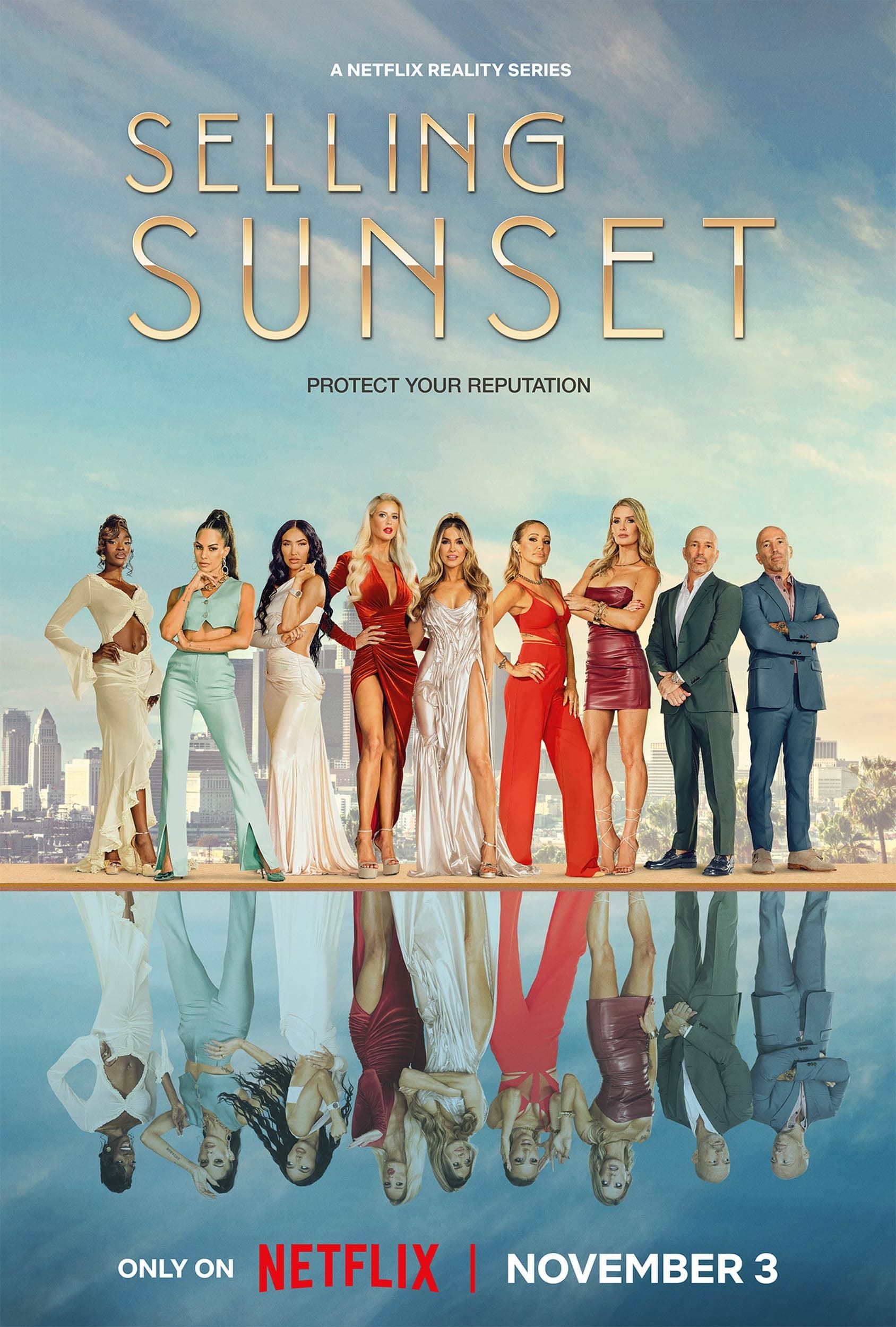

La Landlord Price Gouging A Selling Sunset Stars Perspective On The Fire Aftermath

Apr 26, 2025

La Landlord Price Gouging A Selling Sunset Stars Perspective On The Fire Aftermath

Apr 26, 2025 -

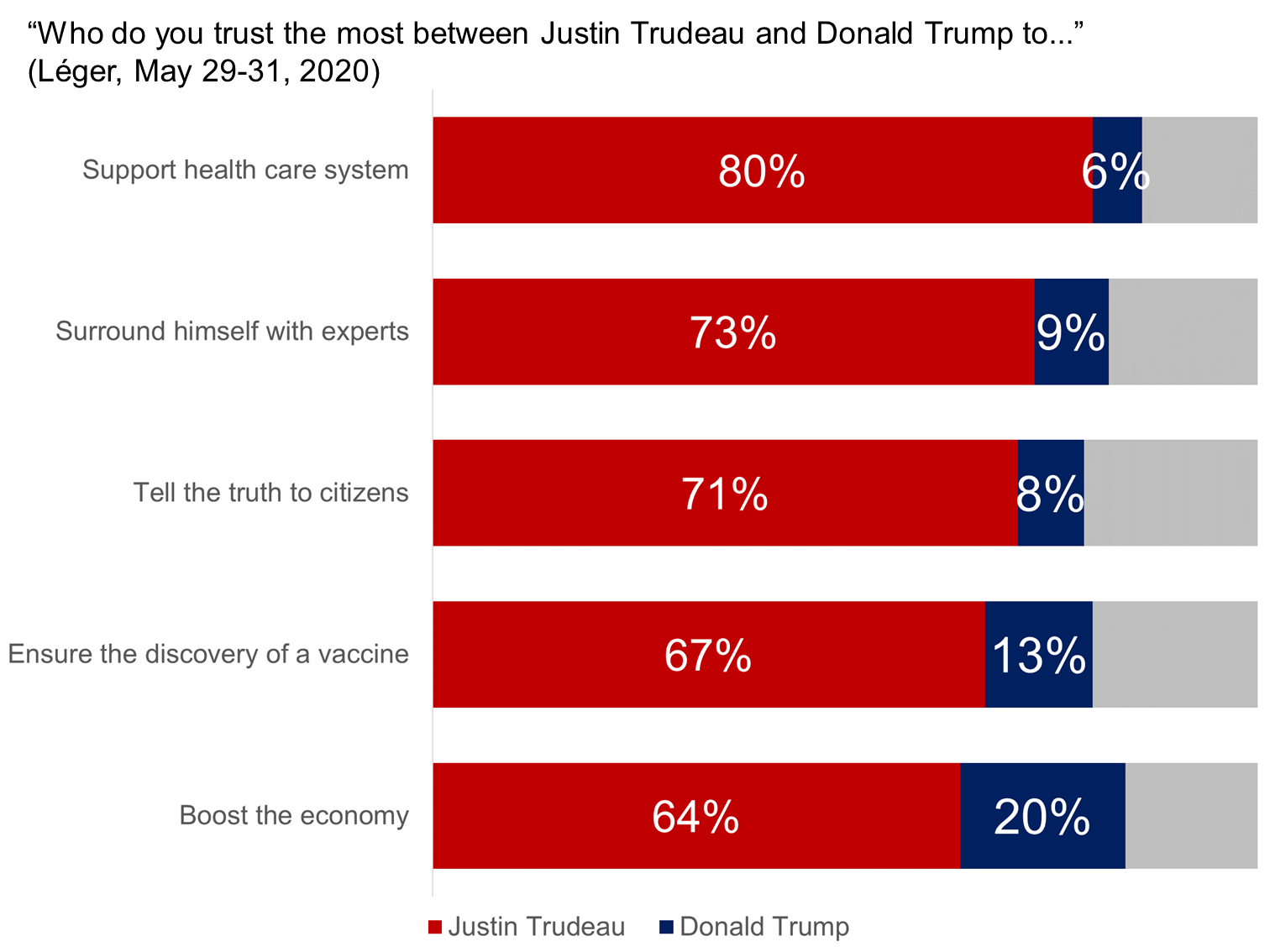

Analyzing Trumps Unexpected Impact On Canadian Election Politics

Apr 26, 2025

Analyzing Trumps Unexpected Impact On Canadian Election Politics

Apr 26, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Coverage

Apr 26, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Coverage

Apr 26, 2025

Latest Posts

-

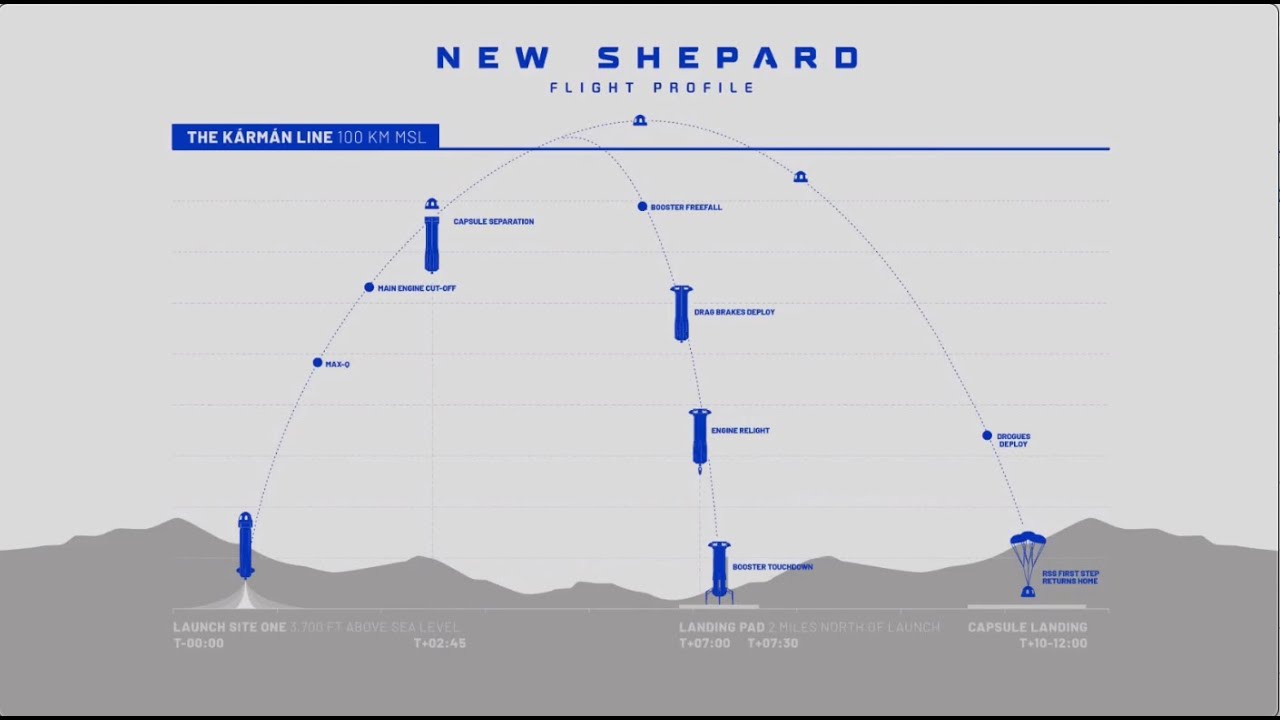

Blue Origin Flight Young Thug Not Among Passengers

May 10, 2025

Blue Origin Flight Young Thug Not Among Passengers

May 10, 2025 -

Young Thug Addresses Not Like U Name Drop Following Prison Release

May 10, 2025

Young Thug Addresses Not Like U Name Drop Following Prison Release

May 10, 2025 -

Young Thugs Reaction To Not Like U Name Drop Post Prison Release

May 10, 2025

Young Thugs Reaction To Not Like U Name Drop Post Prison Release

May 10, 2025 -

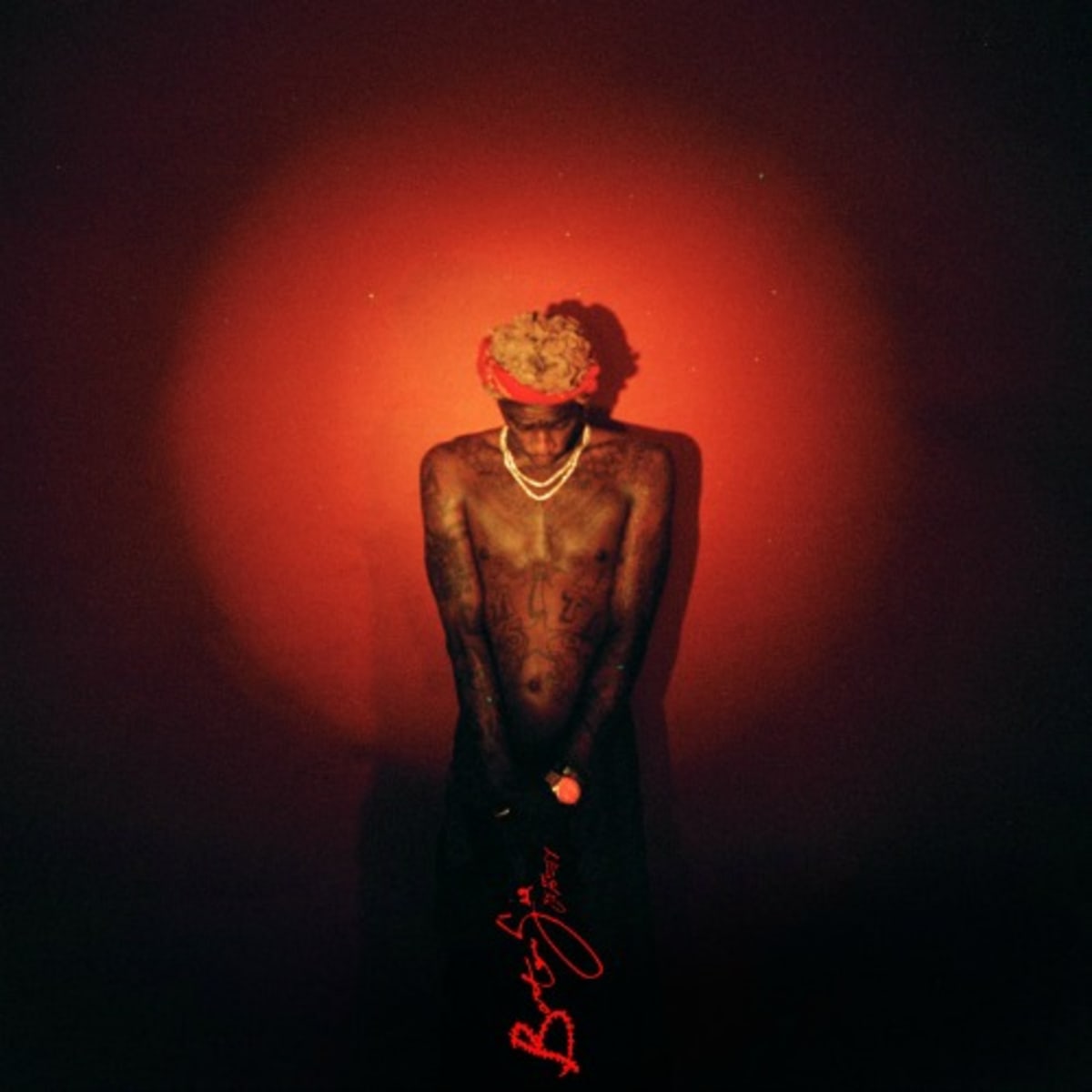

The Back Outside Album Updates On Young Thugs Highly Anticipated Project

May 10, 2025

The Back Outside Album Updates On Young Thugs Highly Anticipated Project

May 10, 2025 -

Young Thugs Back Outside Album Anticipation Builds For The New Release

May 10, 2025

Young Thugs Back Outside Album Anticipation Builds For The New Release

May 10, 2025