Buy-and-Hold: Understanding The Long-Term Investment Challenges

Table of Contents

Market Volatility and its Impact on Buy-and-Hold Strategies

Market volatility, the inherent fluctuation in asset prices, is a significant challenge for buy-and-hold investors. Sharp price drops, or market corrections, can be emotionally challenging, leading to impulsive decisions that undermine the long-term strategy. Fear and greed, powerful emotions in the investment world, often drive investors to sell during downturns (fear) or chase hot stocks during rallies (greed). This reactive behavior deviates from the core principle of buy-and-hold: patience and long-term perspective.

- Examples of significant market corrections: The dot-com bubble burst of 2000 and the 2008 financial crisis are prime examples. Investors who panicked and sold during these periods missed out on substantial gains in the subsequent recoveries.

- Strategies for mitigating emotional responses: Dollar-cost averaging (investing a fixed amount at regular intervals) helps reduce the impact of volatility. A well-defined investment plan, based on your risk tolerance and financial goals, provides a roadmap to stick to during turbulent times.

- Importance of a well-defined investment plan: Before you begin, create a detailed plan outlining your investment goals, risk tolerance, and the asset allocation strategy that aligns with your personal circumstances. Sticking to this plan is crucial for successful long-term investing.

The Importance of Diversification in a Buy-and-Hold Portfolio

Diversification is paramount in mitigating risk within a buy-and-hold portfolio. Spreading investments across different asset classes (stocks, bonds, real estate, commodities) reduces the impact of poor performance in any single asset. Sector diversification further strengthens the portfolio, protecting against industry-specific downturns.

- Examples of diversified portfolios: A portfolio equally weighted across stocks, bonds, and real estate generally demonstrates a lower risk profile than one solely invested in stocks.

- How to assess portfolio diversification: Regularly review your asset allocation. Are your investments spread sufficiently across various sectors and asset classes? Tools and software are available to help analyze portfolio diversification.

- The role of professional financial advice: A financial advisor can help you build a diversified portfolio tailored to your individual risk tolerance and financial goals. They offer expertise and objectivity to navigate the complexities of diversification.

Long-Term Tax Implications of Buy-and-Hold Investing

Buy-and-hold strategies often involve long-term capital gains, which are taxed at lower rates than short-term gains. However, understanding the tax implications is crucial for maximizing your returns. Tax-efficient investment strategies, such as utilizing tax-advantaged accounts (like 401(k)s and IRAs), can significantly reduce your tax burden.

- Different tax brackets and their effect on capital gains: Your tax bracket determines the percentage of your capital gains you'll pay in taxes. Higher brackets mean higher tax liabilities.

- Strategies for minimizing tax liabilities: Tax-loss harvesting (selling losing investments to offset gains) and strategic asset location (placing certain assets in tax-advantaged accounts) are effective strategies.

- Consulting a tax advisor: A qualified tax professional can provide personalized advice on minimizing your tax liability related to your long-term investments.

Overcoming Inflation's Erosion of Purchasing Power

Inflation, the steady increase in the general price level of goods and services, erodes the purchasing power of your investments over time. To counteract this, investors need strategies to protect their portfolio's real value.

- Understanding the Consumer Price Index (CPI): The CPI measures the average change in prices paid by urban consumers for a basket of consumer goods and services. Monitoring the CPI helps gauge the rate of inflation.

- Investments that perform well during inflationary periods: Real estate, commodities (like gold), and inflation-protected securities (TIPS) often maintain their value during inflationary periods.

- Regular portfolio review and rebalancing: Regularly rebalancing your portfolio ensures your asset allocation remains aligned with your goals and helps adjust for inflation's effects.

The Challenge of Staying Disciplined with a Buy-and-Hold Approach

The psychological challenges of buy-and-hold investing are significant. Sticking to a long-term strategy requires patience, discipline, and a long-term perspective, especially during market downturns. Emotional intelligence plays a crucial role in resisting the urge to make impulsive decisions based on fear or greed.

- Strategies for maintaining discipline: Regular portfolio reviews, setting clear financial goals, and visualizing your long-term objectives can help maintain discipline.

- The role of emotional intelligence: Understanding your emotional responses to market fluctuations and developing strategies to manage them is crucial.

- Seeking support from a financial advisor or mentor: Professional guidance can provide valuable support and accountability in maintaining a disciplined approach.

Successfully Navigating the Buy-and-Hold Landscape

Buy-and-hold investing presents several significant challenges: market volatility, the need for proper diversification, long-term tax implications, the erosion of purchasing power due to inflation, and the psychological demands of maintaining discipline. However, when these challenges are addressed proactively through careful planning, diversification, tax optimization, and a disciplined approach, a well-planned buy-and-hold strategy can be highly rewarding. Mastering the buy-and-hold approach requires understanding these challenges and developing effective buy-and-hold strategies to mitigate risks and maximize long-term returns. Before adopting a buy-and-hold strategy, carefully consider the long-term implications and seek professional financial advice if needed to ensure your approach aligns with your personal financial goals and risk tolerance, leading to successful long-term investing.

Featured Posts

-

Eala Ready For Grand Slam Debut In Paris

May 26, 2025

Eala Ready For Grand Slam Debut In Paris

May 26, 2025 -

Qtl Afrad Asrth Wdfnhm Ttwrat Sadmt Fy Qdyt Almjrm Alfrnsy Alharb

May 26, 2025

Qtl Afrad Asrth Wdfnhm Ttwrat Sadmt Fy Qdyt Almjrm Alfrnsy Alharb

May 26, 2025 -

Hasil Latihan Bebas 1 Moto Gp Inggris Marquez Dominasi Masalah Teknis Ganggu Pembalap

May 26, 2025

Hasil Latihan Bebas 1 Moto Gp Inggris Marquez Dominasi Masalah Teknis Ganggu Pembalap

May 26, 2025 -

Ai Startup Cohere Fights Back Against Copyright Infringement Claims

May 26, 2025

Ai Startup Cohere Fights Back Against Copyright Infringement Claims

May 26, 2025 -

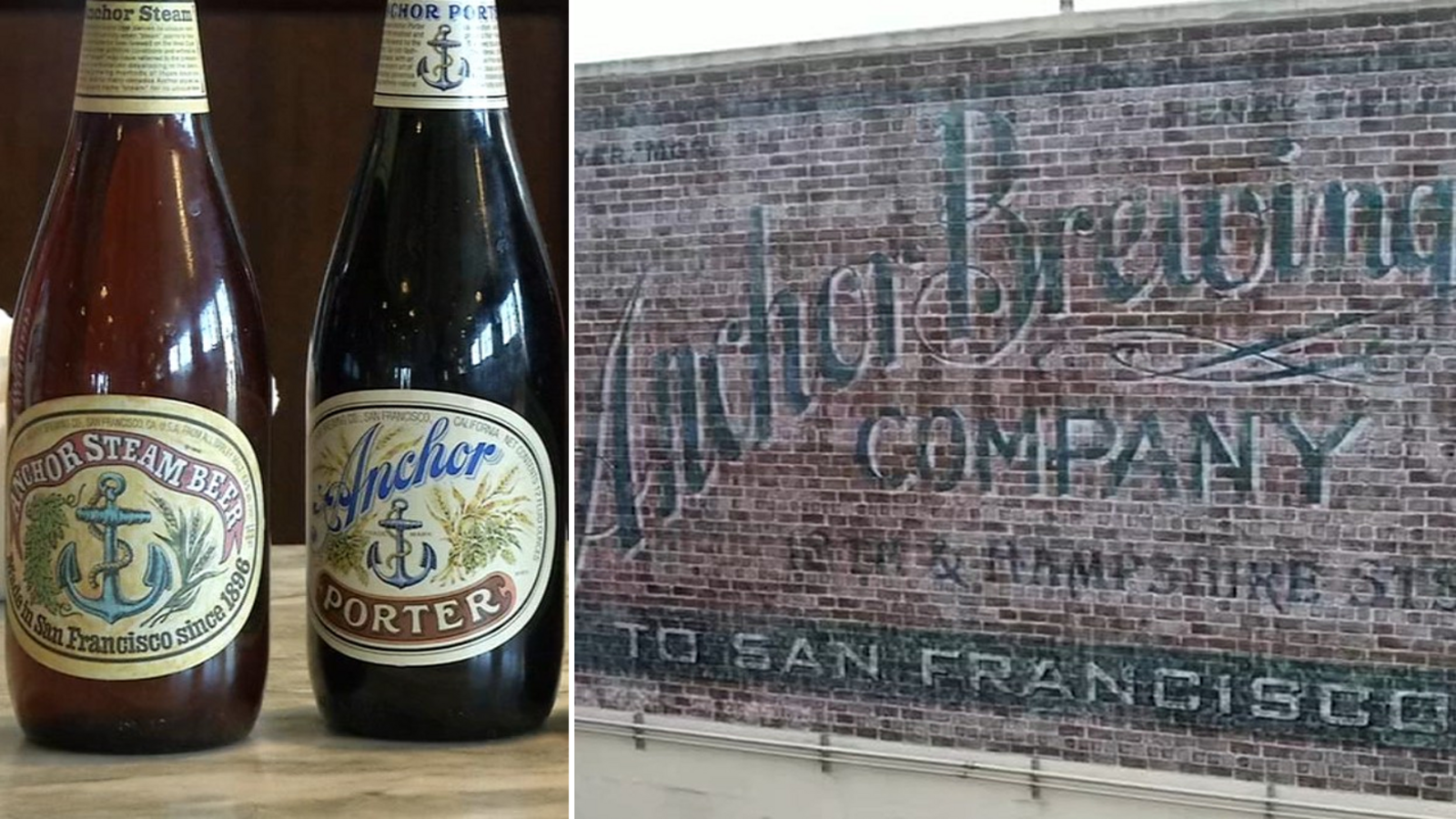

127 Year Old Anchor Brewing Company To Close Its Doors

May 26, 2025

127 Year Old Anchor Brewing Company To Close Its Doors

May 26, 2025