Buy Palantir Stock Before May 5th? Expert Opinions And Predictions

Table of Contents

Palantir's Recent Financial Performance and Future Projections

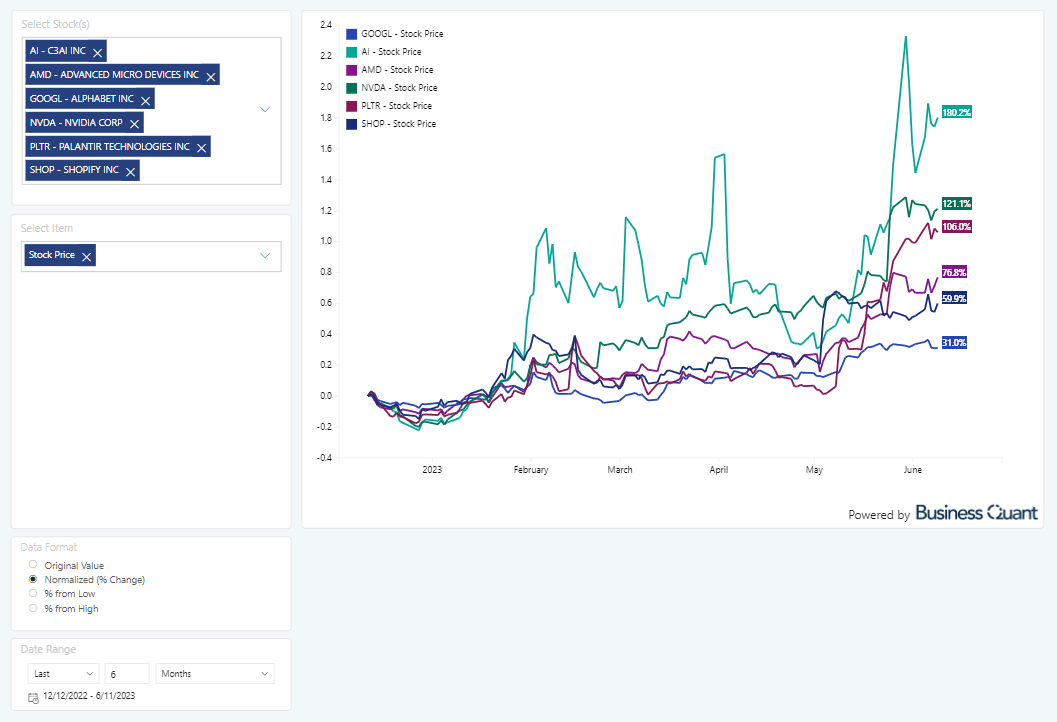

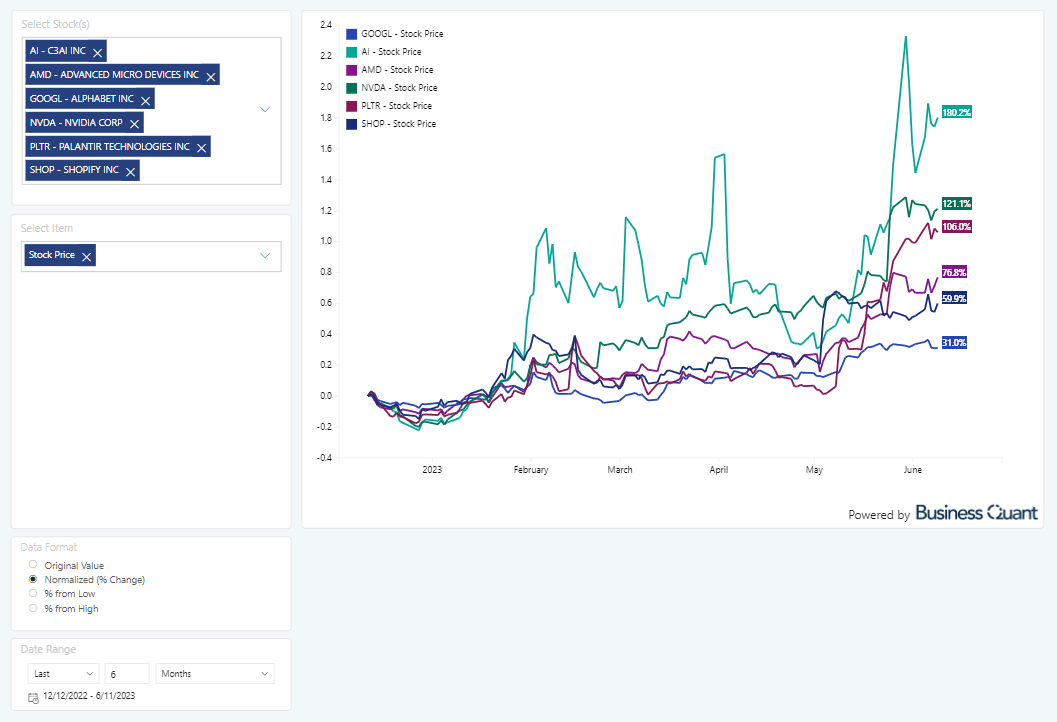

Palantir's performance leading up to May 5th will heavily influence investor sentiment. Let's examine the factors shaping its trajectory.

Q1 2024 Earnings Report Analysis

Palantir's Q1 2024 earnings report will be a key data point. Analyzing its key takeaways is essential to assess the stock's immediate prospects. We'll be looking at:

- Revenue Growth: A strong increase in revenue would signal robust demand for Palantir's products and services.

- Earnings Per Share (EPS): Improved EPS demonstrates profitability and efficiency.

- Analyst Ratings: Post-earnings, analyst ratings and consensus will offer insights into their outlook for the stock. A significant upgrade or downgrade would impact the price.

- Comparison to Previous Quarters: Year-over-year and quarter-over-quarter comparisons will reveal growth trends and momentum.

Long-Term Growth Potential

Palantir's long-term prospects hinge on several crucial factors:

- AI Integration: Palantir is heavily investing in AI, positioning itself to capitalize on the booming AI market. Success in this area will be crucial for future growth.

- Government Contracts: Government contracts form a significant portion of Palantir's revenue. Maintaining and securing these contracts is key to consistent growth.

- New Product Launches: Successful product launches expand the company's offerings and attract new customers.

- Expansion into New Markets: Expanding into new markets can diversify revenue streams and drive long-term growth.

- Competition: Intense competition in the big data analytics market presents a significant challenge.

Upcoming Catalysts

Events leading up to May 5th could significantly impact Palantir's stock price. These include:

- Product Launches: New product releases could generate excitement and drive investor interest.

- Partnerships: Strategic partnerships could expand Palantir's reach and market penetration.

- Industry Conferences: Presentations and announcements at industry events can influence market perception.

Expert Opinions and Analyst Predictions

Understanding the consensus among financial analysts is vital for informed decision-making.

Consensus Among Analysts

While individual analyst opinions vary, the overall consensus among analysts regarding Palantir stock (as of the writing of this article) should be examined. Look for reports from reputable firms such as Goldman Sachs, Morgan Stanley, etc. Note: Analyst ratings and recommendations are constantly changing.

- Buy Ratings: Analysts who issue "buy" ratings typically believe the stock is undervalued and has significant growth potential.

- Sell Ratings: "Sell" ratings suggest that the stock is overvalued or faces significant challenges.

- Hold Ratings: "Hold" ratings imply a neutral outlook, suggesting that investors should neither buy nor sell.

Bullish vs. Bearish Arguments

The arguments for and against investing in Palantir before May 5th are diverse:

- Bullish Arguments: Strong growth potential fueled by AI integration, government contracts, and expanding market share are key bullish arguments. Some argue the current valuation is attractive.

- Bearish Arguments: Concerns about high valuation, competition from established players, and potential regulatory hurdles are key bearish factors.

Risk Assessment and Investment Considerations

Investing in any stock, including Palantir, involves inherent risks.

Market Volatility and Risk Factors

- Market Downturns: Broader market downturns can significantly impact even strong companies like Palantir.

- Geopolitical Events: Global political instability can influence investor sentiment and market performance.

- Competition: Intense competition in the big data analytics space is a persistent risk.

- Regulatory Changes: Changes in government regulations could affect Palantir's business.

Diversification and Portfolio Management

- Diversification: Never put all your eggs in one basket. Diversifying your portfolio across different asset classes reduces overall risk.

- Risk Tolerance: Understand your own risk tolerance before investing in volatile stocks like Palantir.

- Investment Strategy: Align your investment strategy with your long-term financial goals and risk tolerance.

Conclusion: Should You Buy Palantir Stock Before May 5th?

The decision of whether to buy Palantir stock before May 5th requires careful consideration of its recent financial performance, future projections, expert opinions, and inherent risks. While Palantir exhibits significant growth potential, market volatility and competitive pressures remain. The information presented here offers a glimpse into the factors influencing the stock's price, but it does not constitute financial advice.

Carefully consider the information presented before deciding whether to buy Palantir stock before May 5th, or at any time. Conduct your own in-depth research and consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Edmontons Nordic Spa Dreams Closer To Reality Council Approves Rezoning

May 10, 2025

Edmontons Nordic Spa Dreams Closer To Reality Council Approves Rezoning

May 10, 2025 -

Madhyamik 2025 Result How To Check Merit List And Your Score

May 10, 2025

Madhyamik 2025 Result How To Check Merit List And Your Score

May 10, 2025 -

Vegas Golden Nayts Overtaym Triumf Nad Minnesotoy V Pley Off

May 10, 2025

Vegas Golden Nayts Overtaym Triumf Nad Minnesotoy V Pley Off

May 10, 2025 -

White House Cocaine Incident Secret Service Investigation Update

May 10, 2025

White House Cocaine Incident Secret Service Investigation Update

May 10, 2025 -

Uk Citys Caravan Invasion Is It Turning Into A Ghetto

May 10, 2025

Uk Citys Caravan Invasion Is It Turning Into A Ghetto

May 10, 2025