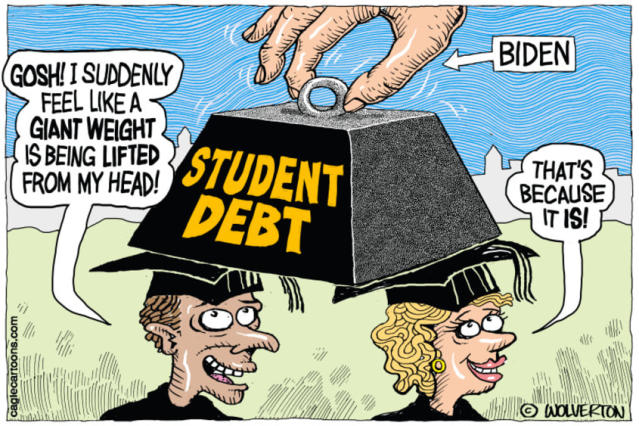

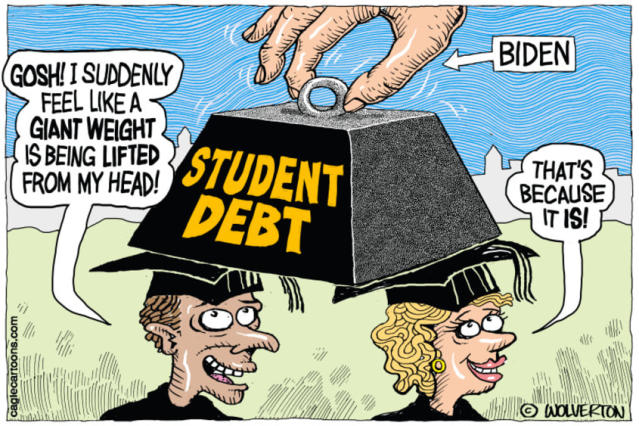

Buying A House With Student Loan Debt: Is It Possible?

Table of Contents

Assessing Your Financial Situation

Before you even begin browsing listings, a thorough assessment of your financial health is crucial. This involves understanding your debt-to-income ratio (DTI), analyzing your student loan repayment plan, and evaluating your savings and credit score.

Understanding Your Debt-to-Income Ratio (DTI)

Your debt-to-income ratio is a key factor lenders consider when determining your mortgage eligibility. DTI represents the percentage of your gross monthly income that goes towards debt repayment. A lower DTI generally increases your chances of mortgage approval and securing a favorable interest rate.

-

Strategies to Lower DTI:

- Aggressively pay down high-interest student loans.

- Increase your income through a side hustle or promotion.

- Consider refinancing your student loans to a lower interest rate.

- Explore options for consolidating your student loan debt.

-

Resources for Calculating DTI: Many online calculators are available to help you determine your DTI. Use these tools to track your progress as you work towards improving your ratio.

Analyzing Your Student Loan Repayment Plan

The type of student loan repayment plan you're on significantly impacts your monthly expenses and, consequently, your DTI. Standard repayment plans, income-driven repayment (IDR) plans, and graduated repayment plans all have different implications for your home buying prospects.

-

Pros and Cons of Various Repayment Plans: Understand the terms, interest accrual, and long-term costs associated with each plan. IDR plans offer lower monthly payments but may lead to higher total interest paid over the life of the loan.

-

Determining the Best Repayment Plan for Homebuyers: Consult with a financial advisor or student loan counselor to determine which plan best aligns with your home buying goals. Consider the impact on your DTI and your ability to save for a down payment.

Building Savings and Improving Credit Score

A strong credit score and sufficient savings are essential for securing a mortgage. Lenders prefer borrowers with a high credit score (ideally above 700) and enough savings for a substantial down payment (ideally 20%, but less may be possible with certain loan programs) and closing costs.

-

Tips for Improving Credit Score:

- Pay all bills on time, every time.

- Keep credit utilization low (ideally below 30%).

- Avoid applying for new credit frequently.

- Correct any errors on your credit report.

-

Strategies for Saving for a Down Payment:

- Create a realistic budget and track your spending.

- Explore side hustles to supplement your income.

- Consider utilizing savings accounts or investment accounts designed for home buying.

Exploring Mortgage Options

With your financial situation assessed, it's time to explore different mortgage options. Several loan programs cater to borrowers with student loan debt.

Types of Mortgages for Borrowers with Student Loan Debt

Several mortgage types can be suitable, each with its own set of requirements and advantages.

-

FHA Loans: These government-insured loans typically require lower down payments and credit score requirements than conventional loans, making them potentially accessible to borrowers with student loan debt.

-

VA Loans: Offered to eligible veterans and military service members, VA loans often require no down payment and have competitive interest rates.

-

Conventional Loans: While often requiring a larger down payment and higher credit scores, conventional loans may still be an option for those with manageable student loan debt and a strong financial profile.

-

Eligibility Requirements for Each Mortgage Type: Carefully research the specific requirements for each loan type to determine your eligibility.

Finding a Lender Who Understands Student Loan Debt

Finding a lender experienced in working with borrowers who have student loan debt is paramount. They can guide you through the complexities of the process and help you find the most suitable loan option.

-

Questions to Ask Potential Lenders: Ask about their experience working with borrowers with student loans, the types of mortgages they offer, and their understanding of income-driven repayment plans.

-

Resources for Finding Lenders Specializing in Student Loan Debt: Online resources and financial advisors can help you locate lenders who are familiar with your specific situation.

Strategies for Success

Successfully navigating the home buying process with student loan debt requires strategic planning and execution.

Negotiating a Favorable Interest Rate

Negotiating lower interest rates on both your student loans and your mortgage can significantly reduce your overall costs.

-

Tips for Improving Negotiating Power: A strong credit score and a substantial down payment can increase your negotiating leverage.

-

Understanding Interest Rate Components: Familiarize yourself with the factors that influence interest rates to effectively negotiate.

Prioritizing Debt Reduction

Strategically paying down student loan debt while simultaneously saving for a down payment is crucial.

-

Debt Snowball vs. Debt Avalanche Method: Consider which debt reduction strategy best suits your financial situation and personality.

-

Tips for Budgeting and Prioritizing Debt Repayment: Create a detailed budget to allocate funds effectively towards debt reduction and down payment savings.

Seeking Financial Advice

Consulting with a financial advisor specializing in student loan debt and homeownership can provide invaluable guidance.

-

Questions to Ask a Financial Advisor: Discuss your financial situation, debt management strategies, mortgage options, and long-term financial goals.

-

Resources for Finding a Qualified Financial Advisor: Seek referrals from trusted sources or utilize online resources to find a financial advisor with expertise in student loan debt and homeownership.

Conclusion

Buying a house with student loan debt presents unique challenges, but it’s certainly possible. By carefully assessing your financial situation, exploring mortgage options tailored to your circumstances, and employing effective debt management strategies, you can make your dream of homeownership a reality. Don't let student loan debt derail your dreams of homeownership. Start planning today by assessing your financial situation, exploring mortgage options, and seeking expert advice. Buying a house with student loan debt is possible with careful planning and the right strategies. Begin your journey towards homeownership today!

Featured Posts

-

Motocross Enduro And More The Latest Moto News From Gncc Mx Sx And Flat Track

May 17, 2025

Motocross Enduro And More The Latest Moto News From Gncc Mx Sx And Flat Track

May 17, 2025 -

Mariners Giants Injury Updates Key Players Out For April 4 6 Series

May 17, 2025

Mariners Giants Injury Updates Key Players Out For April 4 6 Series

May 17, 2025 -

Reddit Service Interruption Impacts Thousands Globally

May 17, 2025

Reddit Service Interruption Impacts Thousands Globally

May 17, 2025 -

North Dakotas Richest Receives Msum Honorary Degree

May 17, 2025

North Dakotas Richest Receives Msum Honorary Degree

May 17, 2025 -

Best Bitcoin Casino 2024 Jack Bit Review And Instant Withdrawal Guide

May 17, 2025

Best Bitcoin Casino 2024 Jack Bit Review And Instant Withdrawal Guide

May 17, 2025