CAC 40: Weekly Close In Negative Territory Despite Overall Stability (March 7, 2025)

Table of Contents

Analyzing the CAC 40's Weekly Performance

Key Factors Contributing to the Negative Close

The CAC 40's negative weekly close, despite its relatively stable intra-week performance, can be attributed to a combination of internal and external factors.

-

Internal Factors: Several major CAC 40 companies reported disappointing earnings, particularly within the luxury goods sector. These results, falling short of analyst expectations, triggered sell-offs and contributed to the overall downward pressure on the index. For example, [Specific Company A] announced lower-than-anticipated profits due to [reason], impacting investor confidence. Similarly, [Specific Company B]'s revised guidance for the upcoming quarter fueled concerns about future performance within the sector.

-

External Factors: Global market trends played a significant role. Rising interest rates in several key economies, including the Eurozone, continue to create uncertainty for investors. The ongoing geopolitical tensions surrounding [Specific geopolitical event], while seemingly distant, also injected a degree of risk aversion into the market, influencing investment decisions.

-

Key Contributing Factors:

- Disappointing earnings from luxury goods sector companies.

- Concerns regarding inflation impacting consumer spending in France and Europe.

- Geopolitical uncertainty related to the ongoing situation in [Specific geopolitical event].

- Increased regulatory scrutiny impacting certain sectors within the CAC 40.

Despite the Negative Close, Market Stability Remains

Despite the negative weekly close, the CAC 40 demonstrated remarkable stability throughout the week. Daily fluctuations remained minimal, indicating a degree of resilience within the market. This contrasts sharply with the final negative close, suggesting a late-week shift in investor sentiment or a reaction to specific news events.

Data points supporting this market stability include relatively low trading volume throughout the week, indicating a lack of significant panic selling or buying. Furthermore, other major European indices displayed similar patterns of stability, suggesting that the negative CAC 40 close was not a reflection of a broader European market downturn. Finally, the limited impact from negative global news events prior to the week's close reinforces this assessment.

- Indicators of Market Stability:

- Relatively low trading volume throughout the week.

- Stable performance of other major European indices (e.g., DAX, FTSE 100).

- Limited impact from negative global news events.

- A relatively low VIX (volatility index) reading for the French market.

Impact on Investors and Investment Strategies

Short-Term Implications

The negative CAC 40 close might trigger short-term profit-taking by some investors, particularly those with a shorter-term investment horizon. This could lead to increased market volatility in the coming days. However, the underlying market stability suggests that the negative close might not signal a major downturn.

- Short-Term Investor Reactions:

- Potential for short-term profit-taking.

- Increased caution among investors with shorter-term strategies.

- Opportunities for strategic buying for long-term investors seeking entry points.

Long-Term Outlook for the CAC 40

The long-term outlook for the CAC 40 remains relatively positive, contingent upon several factors. Continued economic growth in France, coupled with supportive government policies, is crucial for sustained market performance. Furthermore, a global economic recovery, should it materialize, would undoubtedly boost investor confidence and positively impact the CAC 40.

- Factors Influencing Future CAC 40 Performance:

- Continued economic growth in France and the Eurozone.

- Government policies and investment incentives for specific sectors.

- The overall trajectory of the global economic recovery.

- Progress in addressing geopolitical uncertainties.

Conclusion

The CAC 40 concluded the week with a negative close, a surprising outcome considering the overall market stability observed throughout the trading period. While disappointing earnings from some sectors and external factors contributed to the negative finish, the broader market showed resilience and a lack of significant volatility. Understanding the nuanced performance of the CAC 40, even during seemingly contradictory market behavior, is crucial.

Call to Action: Understanding the nuances of the CAC 40's performance, even in seemingly contradictory situations, is crucial for effective investment strategies. Stay informed about the latest CAC 40 updates and market analysis to make informed decisions about your investments. Continue monitoring the CAC 40 index and French stock market performance for further insights to navigate the ever-evolving landscape of the French economy and its impact on investment opportunities.

Featured Posts

-

Live Updates Pedestrian Struck By Vehicle On Princess Road Emergency Response Underway

May 24, 2025

Live Updates Pedestrian Struck By Vehicle On Princess Road Emergency Response Underway

May 24, 2025 -

Amira Al Zuhairs Stunning Zimmermann Debut At Paris Fashion Week

May 24, 2025

Amira Al Zuhairs Stunning Zimmermann Debut At Paris Fashion Week

May 24, 2025 -

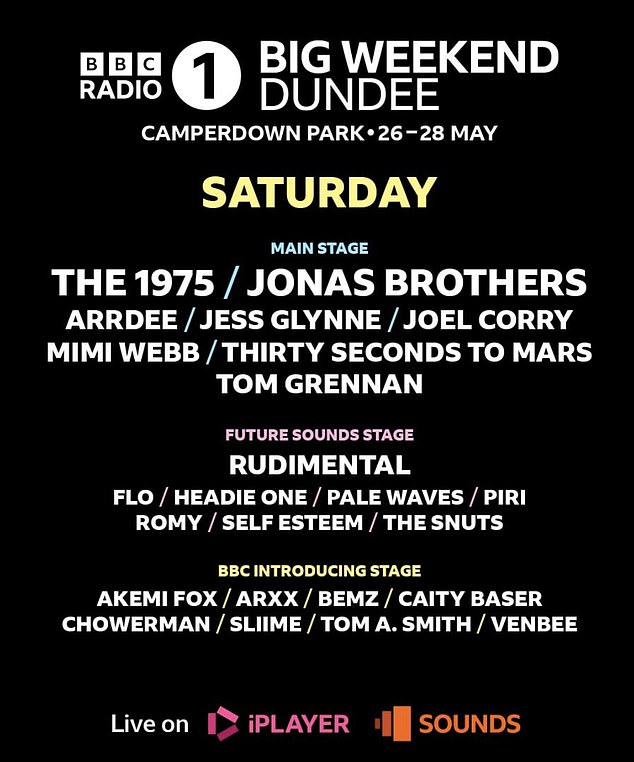

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets Complete Guide

May 24, 2025

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets Complete Guide

May 24, 2025 -

Demnas Vision For Gucci A Look At Upcoming Collections

May 24, 2025

Demnas Vision For Gucci A Look At Upcoming Collections

May 24, 2025 -

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025