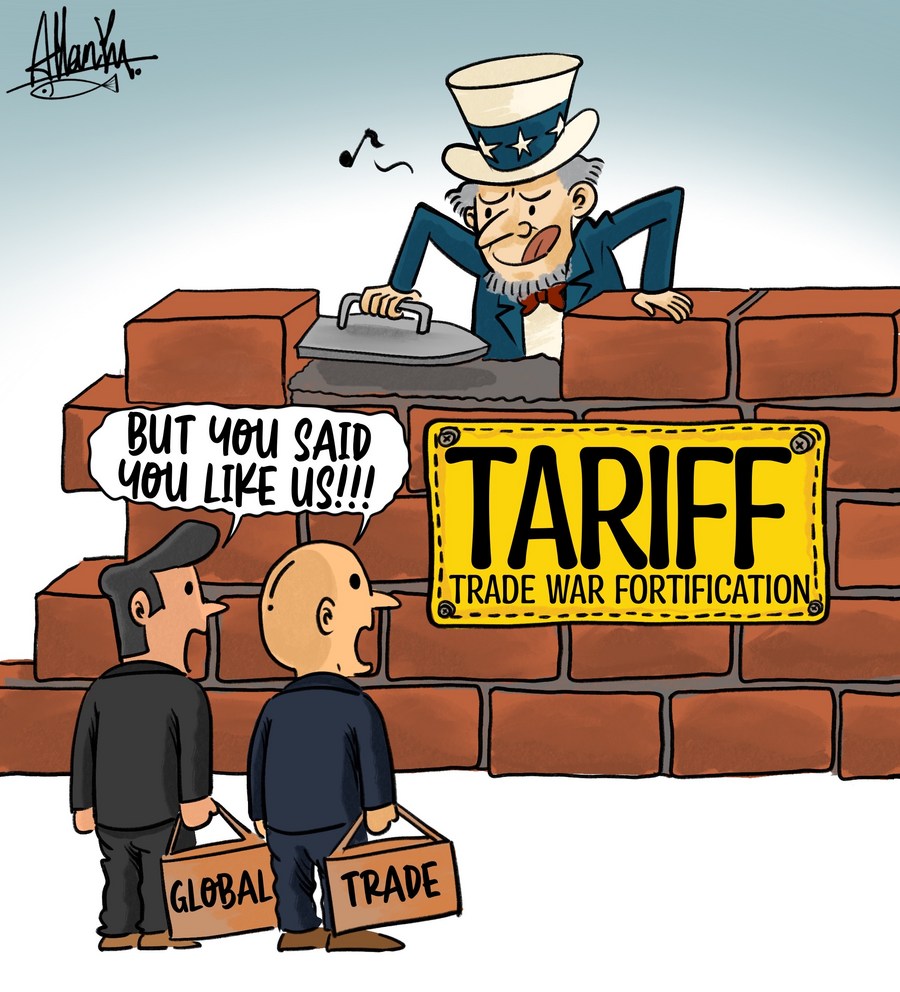

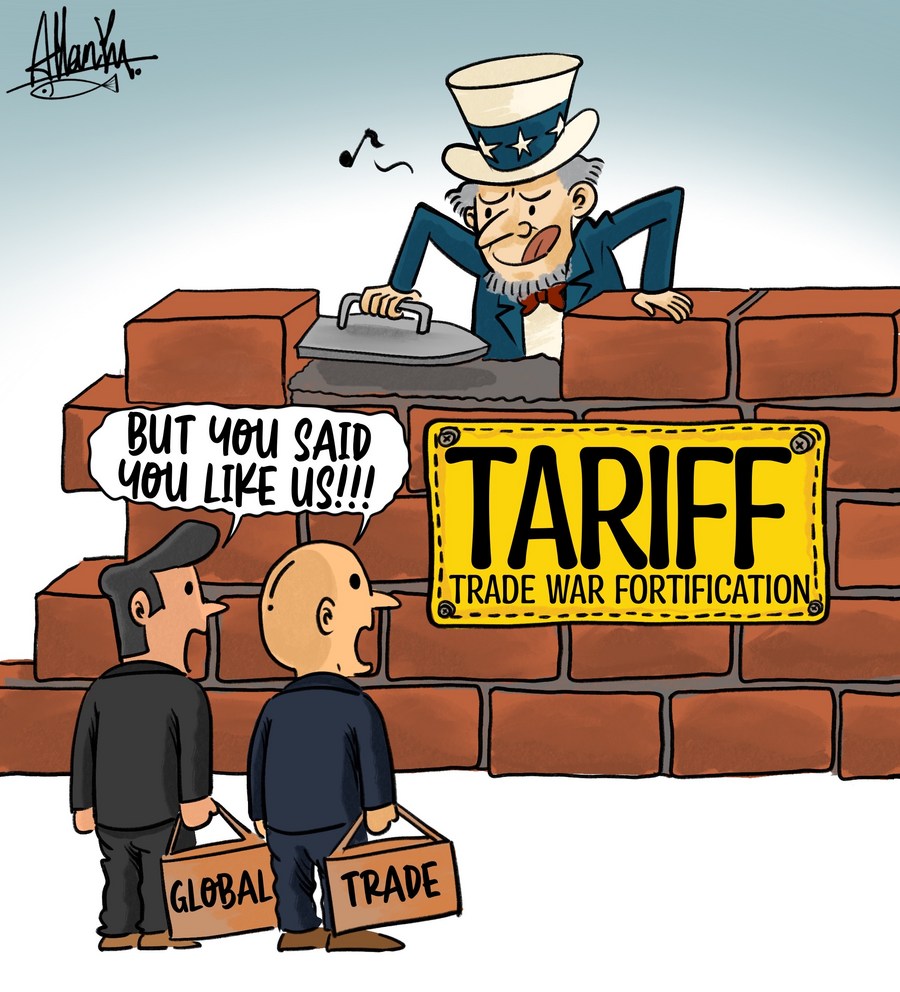

California's $16 Billion Revenue Deficit: A Consequence Of Trump's Tariffs

Table of Contents

The Impact of Trump's Tariffs on California's Economy

Trump's tariffs, implemented as part of a protectionist trade strategy, had far-reaching consequences for the global economy, and California was significantly impacted. Tariffs, essentially taxes on imported goods, led to increased prices for consumers, reduced consumer spending, and ultimately, fueled trade wars with other nations. This global instability had a particularly harsh impact on California's export-oriented economy.

Agriculture: A Hard Hit Sector

California's agricultural sector, a cornerstone of the state's economy, suffered immensely under the weight of these tariffs. Products like wine, almonds, and dairy, key exports for California, faced significant challenges in international markets.

- Increased export costs due to tariffs: Retaliatory tariffs imposed by other countries on California agricultural products dramatically increased the cost of exporting these goods, making them less competitive globally.

- Reduced demand for California agricultural products in international markets: Higher prices due to tariffs led to a decrease in demand from importing countries, resulting in surplus products and losses for California farmers.

- Farm bankruptcies and job losses in the agricultural sector: The combination of increased costs and reduced demand forced many farms into bankruptcy, leading to significant job losses across the agricultural sector and related industries.

- Examples of specific products and countries affected: For example, California wine exports to the European Union faced increased tariffs, impacting vineyards and related businesses. Similarly, almond exports to China, a major importer, experienced significant reductions due to retaliatory tariffs.

Manufacturing and Trade: A Double Blow

California's manufacturing sector also felt the sting of Trump's tariffs. The increased cost of imported materials, coupled with reduced competitiveness in global markets, led to significant challenges.

- Increased costs of imported materials: Many California manufacturers rely on imported components and materials. Tariffs on these imports increased production costs, making California-made goods less price-competitive.

- Reduced competitiveness of California-made goods in global markets: Higher production costs due to tariffs made California's manufactured goods less attractive in international markets, impacting exports and overall profitability.

- Factory closures and job losses in manufacturing: Faced with increased costs and reduced demand, many California manufacturers were forced to close their doors, resulting in substantial job losses across various industries.

- Examples of specific industries affected: The technology and automotive sectors, both major contributors to California's economy, experienced notable disruptions in their supply chains and reduced export opportunities.

The Ripple Effect on Related Industries

The negative impact on agriculture and manufacturing extended far beyond those sectors. Related industries, such as transportation, logistics, and retail, experienced a knock-on effect.

- Decreased transportation needs due to reduced trade: Reduced exports led to a decline in demand for transportation services, impacting trucking companies, shipping firms, and related businesses.

- Reduced retail sales due to higher prices and lower consumer spending: Increased prices on goods due to tariffs resulted in lower consumer spending, impacting retail sales and creating a ripple effect throughout the economy.

- Job losses in related industries: The contraction in transportation, logistics, and retail sectors resulted in further job losses across the California economy.

California's Fiscal Response to the Revenue Deficit

Facing a $16 billion revenue deficit, California has attempted to address the shortfall through a variety of measures, though none fully compensate for the economic damage.

- Budget cuts in various sectors: The state government implemented significant budget cuts across various sectors, impacting vital public services like education and healthcare.

- Increased taxes or fees: To bolster revenue, the state considered, and in some cases implemented, increases in taxes or fees, placing an additional burden on California residents and businesses.

- Potential borrowing or deficit financing: The state explored borrowing options or deficit financing to cover the shortfall, although this approach carries long-term financial implications.

- Political ramifications and debates surrounding budget solutions: The budget crisis has fueled intense political debates surrounding the best approach to address the shortfall, highlighting the complexities of managing public finances during an economic downturn.

Long-Term Economic Consequences and Future Outlook

The long-term implications of this $16 billion revenue deficit are significant and pose a serious challenge to California's economic future.

- Potential for slower economic growth: The ongoing economic fallout from the tariffs is expected to result in slower economic growth for years to come.

- Impact on state services (e.g., education, healthcare): Budget cuts necessitated by the revenue shortfall could significantly impair the quality and accessibility of essential state services.

- Long-term effects on employment and investment: The job losses and economic uncertainty could discourage investment and hinder long-term employment opportunities.

- The need for economic diversification and resilience: The crisis underscores the need for California to diversify its economy and build resilience against future economic shocks.

Conclusion

California's $16 billion revenue deficit stands as a stark reminder of the far-reaching consequences of protectionist trade policies. The impact of Trump's tariffs on California's agriculture, manufacturing, and related industries has been devastating, leading to job losses, reduced economic growth, and a significant budget shortfall. Understanding the complex relationship between trade policy and economic stability is crucial for developing effective strategies to mitigate future economic crises. We must advocate for sound economic policies that prioritize free and fair trade to avoid future instances of the devastating impact of tariffs, such as those seen with California’s $16 billion revenue deficit. Learn more about the long-term effects of trade wars and how to protect California's economy by [link to relevant resource or further reading].

Featured Posts

-

King Of Davos An Examination Of His Decline And Fall

May 16, 2025

King Of Davos An Examination Of His Decline And Fall

May 16, 2025 -

San Diego Padres Vs New York Yankees Prediction 7 Game Winning Streak Analysis

May 16, 2025

San Diego Padres Vs New York Yankees Prediction 7 Game Winning Streak Analysis

May 16, 2025 -

Hl Yjmehma Alhb Twm Krwz Wana Dy Armas Wfrq Alsn Alkbyr

May 16, 2025

Hl Yjmehma Alhb Twm Krwz Wana Dy Armas Wfrq Alsn Alkbyr

May 16, 2025 -

Steams Free Game Offering A Critical Look

May 16, 2025

Steams Free Game Offering A Critical Look

May 16, 2025 -

Suri Cruise Tom Cruises Unconventional Post Natal Response

May 16, 2025

Suri Cruise Tom Cruises Unconventional Post Natal Response

May 16, 2025