Call For Regulatory Reform: Indian Insurers And Bond Forwards

Table of Contents

Current Regulatory Framework Shortcomings

The existing regulatory framework governing the use of bond forwards by Indian insurers suffers from several critical shortcomings, creating a breeding ground for risk and uncertainty.

Lack of Clear Guidelines

The current regulations lack clarity on permissible investment strategies involving complex derivatives like bond forwards. This ambiguity leads to inconsistencies in risk management practices across different insurers, creating an uneven playing field and increasing systemic risk.

- Absence of specific limits on exposure to bond forwards: Insurers lack clear guidance on the maximum permissible exposure to bond forwards relative to their capital base, potentially leading to excessive risk-taking.

- Lack of standardized reporting requirements for bond forward positions: The absence of standardized reporting makes it difficult for regulators (like IRDAI) to gain a comprehensive overview of the sector's overall exposure to bond forward risks.

- Ambiguity regarding the valuation of bond forward contracts: Inconsistencies in valuation methodologies across insurers can lead to inaccurate risk assessments and potential misreporting. This lack of standardization makes it difficult to compare risk profiles across different firms.

Inadequate Supervisory Oversight

The regulatory framework also fails to provide adequate supervisory oversight of insurers’ use of bond forwards. This deficiency increases the potential for misuse and excessive risk-taking, undermining the stability of the entire sector.

- Insufficient resources dedicated to monitoring complex derivative usage: The regulatory authority lacks the necessary resources and expertise to effectively monitor the complex derivative transactions of numerous insurers.

- Lack of robust stress-testing methodologies for bond forward portfolios: The current framework lacks comprehensive stress tests that can accurately assess the potential impact of adverse market scenarios on insurers' bond forward portfolios.

- Delayed intervention in cases of potential regulatory breaches: Slow response times to potential breaches can allow problems to escalate, potentially leading to larger-scale crises.

Systemic Risk Concerns

The deficiencies in the current regulatory framework translate into significant systemic risks for the Indian insurance sector, potentially impacting broader financial stability.

- Contagion risk from defaults on bond forward contracts: A default by one insurer on its bond forward obligations could trigger a domino effect, impacting other insurers and potentially destabilizing the market.

- Potential for cascading failures if multiple insurers experience significant losses: Simultaneous losses among multiple insurers could create a systemic crisis, severely impacting the financial system.

- Negative impact on investor confidence and capital flows: Concerns about the regulatory framework could deter investors, reducing capital flows into the insurance sector and hindering its growth.

Proposed Regulatory Reforms

To address the shortcomings and mitigate systemic risks, several crucial regulatory reforms are urgently needed.

Enhanced Transparency and Disclosure

Implementing stricter disclosure requirements will significantly improve transparency and accountability within the sector.

- Mandating the disclosure of risk metrics related to bond forward positions: Insurers should be required to regularly disclose key risk metrics, such as Value at Risk (VaR) and expected shortfall, related to their bond forward positions.

- Regular reporting of bond forward holdings to the regulatory authority (IRDAI): Frequent and standardized reporting will provide the IRDAI with real-time insights into the sector's exposure to bond forward risks.

- Independent audits of insurers’ risk management frameworks for bond forwards: Independent audits will ensure that insurers are adhering to best practices and maintaining adequate risk management controls.

Strengthened Supervisory Mechanisms

The IRDAI needs enhanced capabilities to effectively supervise insurers' use of bond forwards.

- Increased frequency of inspections and on-site reviews: More frequent inspections will allow for early detection of potential problems and quicker intervention.

- Implementation of advanced risk monitoring systems: The IRDAI should leverage advanced technologies to monitor insurers’ activities and identify potential risks more effectively.

- Enhanced training programs for regulators on managing derivative risks: Specialized training will enhance the regulatory authority’s capacity to understand and effectively oversee complex derivative instruments.

Improved Risk Management Frameworks

Insurers themselves need to adopt more robust risk management practices.

- Establishment of clear internal limits on bond forward positions: Insurers should establish and enforce internal limits on their exposure to bond forwards to manage their risk profiles effectively.

- Development of comprehensive risk management policies and procedures: This includes clear guidelines for hedging strategies, risk measurement, and stress testing.

- Regular review and update of risk management models: Insurers need to continuously update their risk management models to incorporate changes in market conditions and regulatory requirements.

Conclusion

The current regulatory framework governing the use of bond forwards by Indian insurers presents significant systemic risks. Urgent reforms are necessary to ensure the long-term stability and growth of the sector. Implementing enhanced transparency and disclosure, strengthening supervisory mechanisms, and improving risk management frameworks are crucial steps towards achieving this goal. Addressing the shortcomings in Indian Insurers Bond Forwards Regulation is not only a regulatory imperative but also essential for safeguarding the financial stability of the Indian economy. We need a comprehensive overhaul of the Indian Insurers Bond Forwards Regulation to mitigate risks and unleash the full potential of this vital sector. Let's advocate for robust regulatory changes now.

Featured Posts

-

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025 -

Strong Parks Streaming Fuel Disneys Upgraded Profit Outlook

May 10, 2025

Strong Parks Streaming Fuel Disneys Upgraded Profit Outlook

May 10, 2025 -

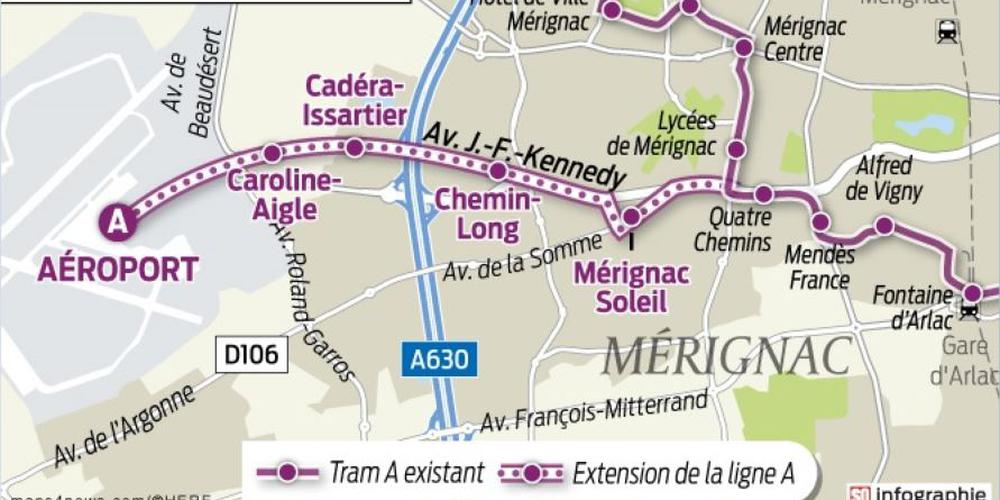

3e Ligne De Tram A Dijon La Concertation Publique Adoptee

May 10, 2025

3e Ligne De Tram A Dijon La Concertation Publique Adoptee

May 10, 2025 -

Preparing For Real Id Enforcement A Summer Travelers Checklist

May 10, 2025

Preparing For Real Id Enforcement A Summer Travelers Checklist

May 10, 2025 -

Major Music Festival With Olly Murs Set For Beautiful Castle Near Manchester

May 10, 2025

Major Music Festival With Olly Murs Set For Beautiful Castle Near Manchester

May 10, 2025