Calm Start For Frankfurt's DAX Following Record Performance

Table of Contents

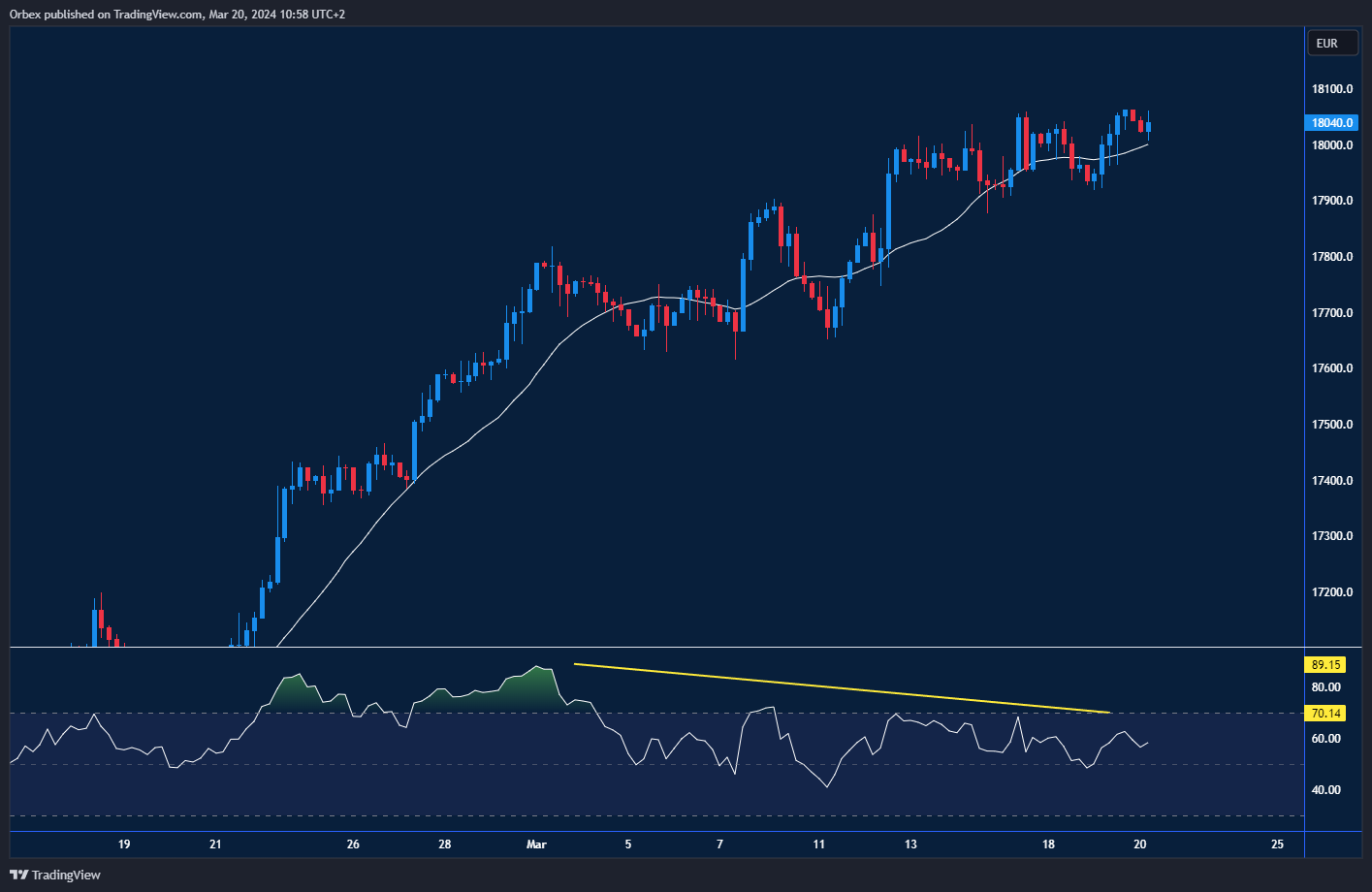

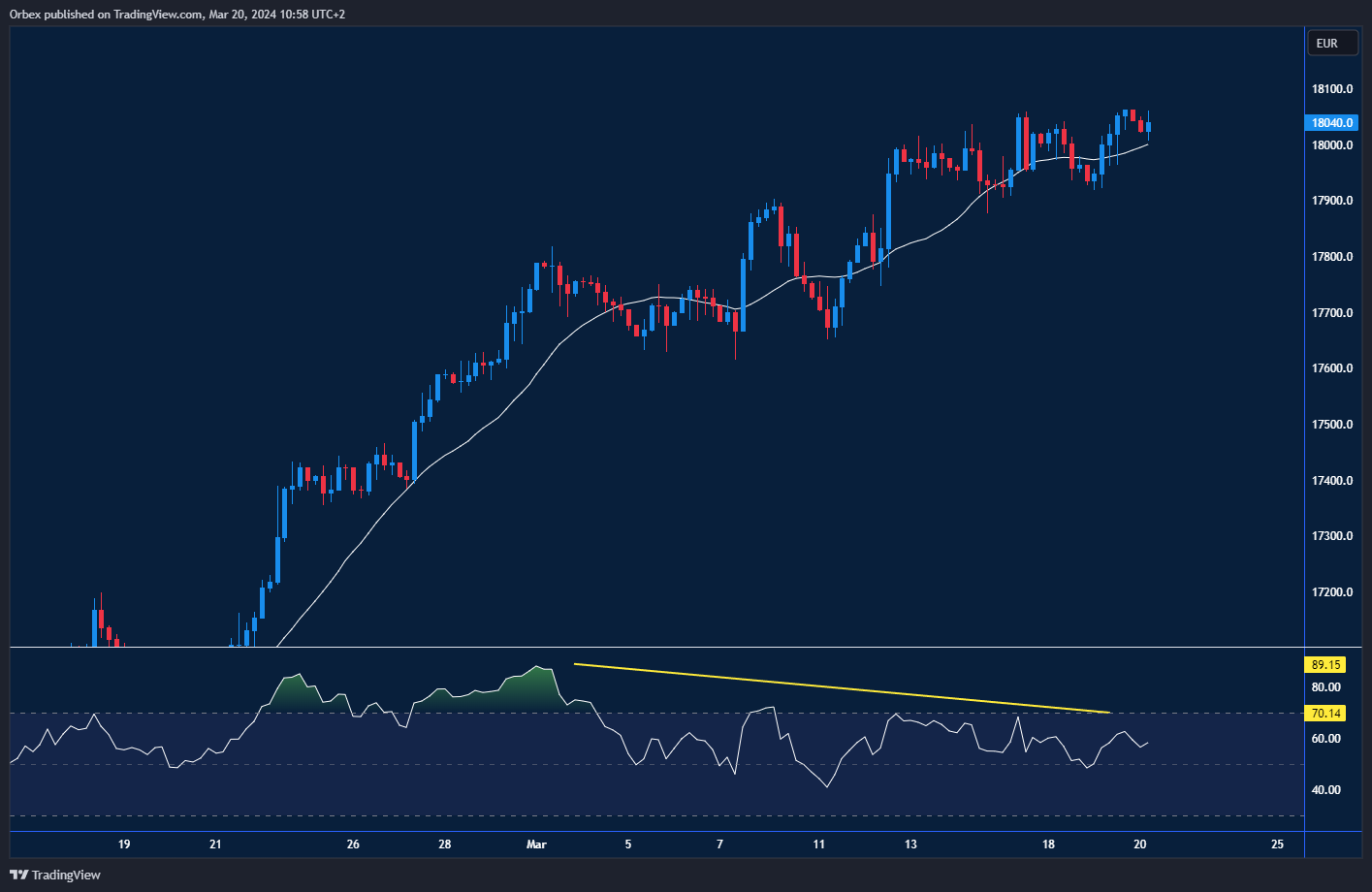

DAX Index: A Detailed Look at the Current Trading

The Frankfurt DAX opened today at 16,250 points, a 0.2% decrease compared to yesterday's closing value of 16,278. While this represents a minor dip, it's a significant contrast to the exhilarating upward trend observed recently. The index hit an all-time high of 16,400 points just last Friday. The current trading volume is slightly below average, suggesting a degree of market hesitancy.

- Opening Value: 16,250 points

- Percentage Change from Previous Day's Close: -0.2%

- Comparison to Recent All-Time High: -150 points (-0.9%)

- Trading Volume Analysis: Lower than average, indicating potential cautiousness among investors.

Factors Influencing the DAX's Calm Start

Several factors are likely contributing to the DAX's more cautious opening today. Global economic headwinds, investor sentiment, and the performance of specific companies within the index are all playing a role.

- Global Economic Factors: Rising inflation in many key economies, coupled with aggressive interest rate hikes by central banks, continues to create uncertainty in the global market. Geopolitical instability also adds to the overall risk aversion.

- Inflation concerns impacting consumer spending.

- Interest rate hikes increasing borrowing costs for businesses.

- Geopolitical tensions creating market volatility.

- Investor Sentiment: After the recent surge to record highs, some investors may be taking profits, leading to a temporary decline in buying pressure. Risk aversion is also playing a role, with investors potentially seeking safer investments.

- Profit-taking after recent gains.

- Increased risk aversion due to global uncertainties.

- Shift towards less volatile asset classes.

- Specific Company Performance: The performance of individual companies within the DAX significantly impacts the overall index. Recent earnings reports or news related to specific DAX-listed companies may be contributing to the current market mood. For example, any negative news regarding major automotive manufacturers or technology companies could exert downward pressure.

- Impact of individual company earnings reports.

- Influence of sector-specific news and announcements.

- Potential for company-specific corrections.

Analysis of Key DAX Sectors and Their Performance

Analyzing individual sectors within the DAX reveals a mixed picture. While some sectors are demonstrating resilience, others are exhibiting weakness.

- Automotive Sector: This sector experienced a slight decline, potentially influenced by ongoing supply chain disruptions and the global chip shortage. (-0.5% change).

- Technology Sector: The technology sector showed mixed performance, with some companies performing well while others experienced moderate declines. (+0.1% change).

- Financials Sector: This sector exhibited relative strength, potentially buoyed by rising interest rates. (+0.3% change).

- Reasons Behind Sector-Specific Performance: These variations are largely due to sector-specific trends, company-specific news, and differential sensitivity to global economic conditions.

Predictions and Outlook for Frankfurt's DAX

Predicting the future performance of any stock market index is inherently challenging. However, based on the current factors, a cautious outlook is warranted.

- Short-Term Outlook (next few days/weeks): The DAX is likely to experience some volatility in the short term, influenced by global economic news and investor sentiment. A period of consolidation around the current levels is possible before a more decisive directional move emerges.

- Long-Term Outlook (next few months/year): The long-term outlook remains positive, driven by the underlying strength of the German economy and the resilience of many DAX-listed companies. However, significant external shocks could impact this trajectory.

- Potential Catalysts for Future Growth or Decline: Positive catalysts include improvements in global economic conditions and strong earnings reports from key DAX companies. Negative catalysts include escalating geopolitical tensions and worsening inflation.

Conclusion

The Frankfurt DAX has experienced a relatively calm start to the trading week, a notable shift from its recent record-breaking run. Several contributing factors, including global economic uncertainties, investor sentiment, and the performance of individual sectors, are influencing this subdued market opening. While the short-term outlook remains uncertain, the long-term fundamentals of the German economy suggest continued positive potential for the DAX.

Stay updated on the latest developments impacting Frankfurt's DAX and make informed investment decisions. Subscribe to our newsletter for regular market analysis and insights on the DAX index, German stock market news, and analyses of Frankfurt’s key market indicators. [Link to Newsletter Signup]

Featured Posts

-

Macrons Party Proposes Hijab Ban For Minors In Public Spaces

May 25, 2025

Macrons Party Proposes Hijab Ban For Minors In Public Spaces

May 25, 2025 -

Atletico Madrid Espanyol Maci Hakemin Tartismali Kararlari

May 25, 2025

Atletico Madrid Espanyol Maci Hakemin Tartismali Kararlari

May 25, 2025 -

Addressing The Pilbara Controversy Rio Tintos Perspective

May 25, 2025

Addressing The Pilbara Controversy Rio Tintos Perspective

May 25, 2025 -

Lino En Otono Inspiracion De Charlene De Monaco

May 25, 2025

Lino En Otono Inspiracion De Charlene De Monaco

May 25, 2025 -

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 25, 2025

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 25, 2025