Can Trump's Policies Push Bitcoin (BTC) Above $100,000? A Price Prediction Analysis

Table of Contents

Trump's Economic Policies and Their Impact on Bitcoin

Fiscal Policy and Inflation

Trump's history of fiscal expansion, characterized by significant tax cuts and increased government spending, could potentially fuel inflation. High inflation often erodes the purchasing power of fiat currencies, leading investors to seek alternative stores of value. Bitcoin, with its fixed supply of 21 million coins, is frequently viewed as a hedge against inflation.

- Increased government spending leading to potential inflation.

- Bitcoin as a store of value during inflationary periods.

- Potential for increased Bitcoin adoption as a safe haven asset, driving up the BTC price.

The relationship between inflation and Bitcoin price isn't always straightforward. While inflation can drive demand, other factors also influence the market. However, a significant inflationary environment could certainly contribute to a surge in Bitcoin's price, potentially pushing it towards or beyond $100,000.

Regulatory Uncertainty and its Effect on Cryptocurrency

Trump's administration showed a mixed approach to cryptocurrency regulation. While there wasn't a clear, unified regulatory framework, the lack of heavy-handed intervention allowed the market to develop relatively freely. This lack of regulatory clarity, however, also created uncertainty, impacting institutional investment. A second Trump term could bring either increased clarity or further uncertainty, with significant consequences for the Bitcoin price.

- Potential for increased regulatory clarity boosting institutional confidence and the BTC price.

- Risk of stricter regulations potentially hindering Bitcoin's growth and suppressing its price.

- Impact of regulatory uncertainty on Bitcoin volatility, creating both opportunities and risks for investors.

A clear and favorable regulatory environment could attract significant institutional investment, potentially driving the Bitcoin price substantially higher. Conversely, overly strict regulations could dampen enthusiasm and limit growth.

Trade Wars and Geopolitical Instability

Trump's "America First" approach led to trade wars and increased geopolitical instability. Periods of global uncertainty often see investors flocking to safe-haven assets, including Bitcoin. The inherent decentralization and limited government control of Bitcoin make it an attractive option during times of political and economic turmoil.

- Increased global uncertainty driving demand for Bitcoin as a safe haven asset.

- Potential for Bitcoin to benefit from safe-haven flows during trade disputes, impacting the BTC price positively.

- Impact of geopolitical tensions on Bitcoin's price – increased volatility but potential for upward movement.

A return to protectionist trade policies or further escalation of geopolitical tensions could again boost Bitcoin's appeal as a safe haven, potentially contributing to a rise in price.

Other Factors Influencing Bitcoin's Price Beyond Trump's Policies

Technological Advancements

Bitcoin's underlying technology continues to evolve. Advancements like the Lightning Network aim to improve scalability and transaction speeds, addressing some of Bitcoin's limitations. These improvements can lead to increased adoption and, consequently, higher prices.

- Lightning Network improving transaction speed and cost-effectiveness.

- Layer-2 solutions enhancing Bitcoin's scalability and usability.

- Technological innovations impacting Bitcoin adoption and price, potentially pushing the BTC price upwards.

Technological improvements enhance Bitcoin's functionality, making it more attractive to both individuals and institutions, thus potentially impacting the Bitcoin price prediction positively.

Market Sentiment and Investor Behavior

Market sentiment and investor psychology play a crucial role in Bitcoin's price volatility. Factors such as FOMO (Fear Of Missing Out), media narratives, and the actions of large institutional investors all contribute to price fluctuations.

- Impact of media coverage and social sentiment on Bitcoin price.

- Role of institutional investors in driving Bitcoin adoption and price appreciation.

- Influence of retail investor behavior on price volatility, including the impact of FOMO and panic selling.

Positive market sentiment fueled by adoption, technological advancements, or regulatory clarity can dramatically impact the Bitcoin price prediction and potentially push BTC to new highs.

Price Prediction Analysis and Conclusion

Considering the potential impacts of Trump's policies (or lack thereof), technological advancements, and market sentiment, predicting Bitcoin's price is complex. A bullish scenario, with pro-growth policies, regulatory clarity, and continued technological advancement, could see Bitcoin exceeding $100,000. A bearish scenario, involving increased regulation, geopolitical instability, or negative market sentiment, could see a lower price trajectory. However, the inherent volatility of the cryptocurrency market makes any precise prediction challenging.

Conclusion

Trump's potential policies could significantly influence Bitcoin's price, but other factors, such as technological progress and overall market sentiment, also play crucial roles. While predicting whether Bitcoin will hit $100,000 is inherently speculative, understanding the interplay of these elements is key. Continue researching Bitcoin price prediction analyses and stay informed about political and economic developments to navigate the volatile cryptocurrency market effectively. Understanding the potential impact of Trump's policies on Bitcoin, along with other market forces, is crucial for informed investment decisions related to the BTC price and Bitcoin price prediction.

Featured Posts

-

Ella Mai And Jayson Tatum Commercial Fuels Speculation About Babys Arrival

May 08, 2025

Ella Mai And Jayson Tatum Commercial Fuels Speculation About Babys Arrival

May 08, 2025 -

Pavle Grbovic I Prelazna Vlada Reakcija Na Predlozene Opcije

May 08, 2025

Pavle Grbovic I Prelazna Vlada Reakcija Na Predlozene Opcije

May 08, 2025 -

Hollywood Production Halts As Sag Aftra Joins Wga On Picket Lines

May 08, 2025

Hollywood Production Halts As Sag Aftra Joins Wga On Picket Lines

May 08, 2025 -

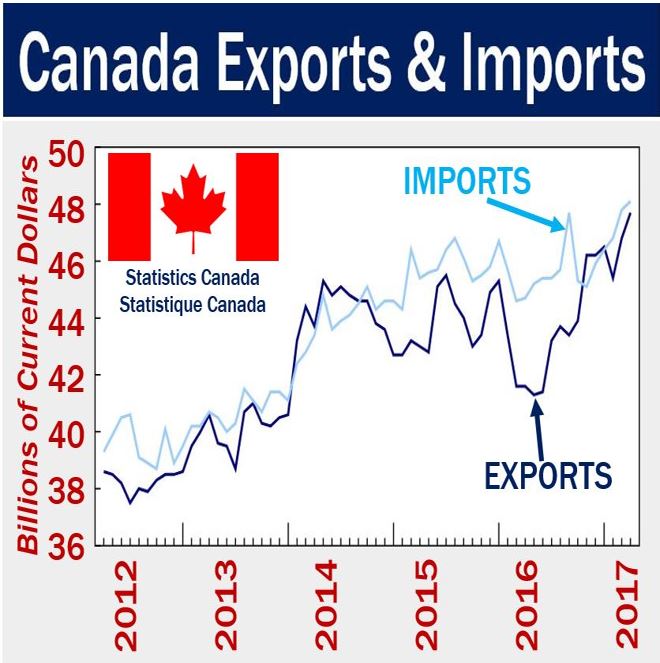

Canadian Trade Deficit A 506 Million Improvement

May 08, 2025

Canadian Trade Deficit A 506 Million Improvement

May 08, 2025 -

Crypto News Separating Fact From Fiction In A Volatile Market

May 08, 2025

Crypto News Separating Fact From Fiction In A Volatile Market

May 08, 2025