Can XRP (Ripple) Investments Secure Your Financial Future? A Comprehensive Analysis

Table of Contents

Understanding XRP and its Potential

What is XRP?

XRP is a cryptocurrency designed to facilitate fast and inexpensive cross-border payments. Unlike Bitcoin, which relies on a proof-of-work consensus mechanism, XRP operates on a unique, energy-efficient system. Its core function is to act as a bridge currency, enabling seamless transactions between different financial institutions using RippleNet. This system boasts incredibly low transaction fees and remarkably fast transaction speeds, making it a compelling alternative to traditional banking systems for international transfers. Keywords like "XRP cryptocurrency," "Ripple technology," "cross-border payments," "low transaction fees," and "fast transactions" highlight its key advantages.

Ripple's Technological Advantages

RippleNet, Ripple's payment network, is a key driver of XRP's potential. It leverages blockchain technology but employs a different consensus mechanism than many other cryptocurrencies, focusing on scalability and speed. This has attracted significant interest from financial institutions globally, leading to several key partnerships. The potential for widespread institutional adoption is a significant factor influencing XRP's value proposition. The ongoing development and integration of Ripple's technology within existing financial infrastructures further bolster its long-term prospects. Keywords such as "RippleNet," "institutional adoption," "blockchain technology," "decentralized finance (DeFi)," and "scalability" are central to understanding its technological edge.

- Key Partnerships: Ripple has collaborated with major banks and financial institutions worldwide, including Santander and SBI Holdings.

- SEC Lawsuit: The ongoing legal battle with the Securities and Exchange Commission (SEC) presents a significant uncertainty, impacting XRP's price and investor sentiment. The outcome of this case will likely have a profound impact on the future of XRP.

- Technological Advancements: Ripple continues to develop and improve its technology, focusing on enhanced scalability, security, and interoperability.

Assessing the Risks of XRP Investment

Volatility and Market Fluctuations

The cryptocurrency market is notoriously volatile. XRP's price, like other cryptocurrencies, is subject to significant fluctuations driven by market sentiment, regulatory news, and technological advancements. This inherent volatility presents a substantial investment risk. Understanding and accepting this risk is crucial before investing in XRP. Keywords such as "cryptocurrency volatility," "market risk," "price fluctuation," and "investment risk" highlight the inherent uncertainties.

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies is still evolving, creating significant uncertainty for investors. The SEC lawsuit against Ripple is a prime example of this regulatory ambiguity, posing a considerable legal risk for XRP investors. The outcome of this lawsuit and future regulatory actions could significantly impact XRP's price and future trajectory. Keywords such as "regulatory uncertainty," "SEC lawsuit," "crypto regulation," and "legal risks" underscore this crucial aspect.

- Impact of Negative News: Negative news, such as regulatory crackdowns or security breaches, can lead to sharp drops in XRP's price.

- Portfolio Diversification: Diversification is crucial to mitigate risk. Never invest more than you can afford to lose in any single asset, especially a volatile one like XRP.

- Other Risks: Exchange hacks, scams, and technical glitches are additional risks associated with cryptocurrency investments.

Building a Diversified Investment Strategy with XRP

XRP as Part of a Broader Portfolio

Investing in XRP should never be your sole investment strategy. It's crucial to diversify your portfolio across different asset classes to reduce overall risk. XRP can be a part of a well-diversified portfolio, but it should represent only a small percentage of your total investments. Keywords like "portfolio diversification," "risk management," "asset allocation," and "long-term investment" are key to responsible investing.

Understanding Your Risk Tolerance

Before investing in XRP or any cryptocurrency, it’s crucial to understand your risk tolerance. Are you comfortable with the possibility of significant price fluctuations and potential losses? Your investment goals and financial situation should guide your investment decisions. Aligning your investments with your risk tolerance is paramount. Keywords: "risk tolerance," "investment goals," and "financial planning."

- Diversification Suggestions: Consider diversifying into stocks, bonds, real estate, and other asset classes to balance your portfolio.

- Investment Amounts: Invest only what you can afford to lose. Start with small amounts and gradually increase your investment as you gain more experience and confidence.

- Professional Advice: Consult a qualified financial advisor before making any significant investment decisions.

The Future of XRP and its Investment Potential

Long-Term Growth Prospects

The future of XRP and the broader cryptocurrency market is uncertain. However, the potential for long-term growth remains a significant factor for many investors. Increased adoption of blockchain technology and growing demand for faster, cheaper cross-border payments could drive XRP's value. Keywords like "long-term investment," "future of cryptocurrency," "growth potential," and "XRP price prediction" (used cautiously) represent the long-term view. It's important to avoid making specific price predictions.

Technological Advancements and Adoption

The continuous development and improvement of blockchain technology, as well as increasing adoption by financial institutions and businesses, are crucial factors influencing XRP's long-term potential. Technological advancements and wider acceptance could unlock new use cases beyond international payments and significantly boost XRP's value. Keywords: "blockchain development," "crypto adoption," and "innovation."

- Potential Use Cases: XRP’s technology could be applied to various sectors, potentially expanding its utility and value.

- Institutional Adoption: Continued growth in institutional adoption could significantly boost XRP's price and stability.

- Ecosystem Developments: Keep an eye on ongoing developments within the Ripple ecosystem and advancements in the XRP Ledger.

Conclusion:

XRP offers intriguing possibilities but comes with substantial risks. Investing in XRP is not a guaranteed path to securing your financial future. Instead, it should be considered a carefully calculated part of a diversified investment strategy, only after thorough research and understanding of your risk tolerance. Remember to consult with a financial advisor before making any investment decisions. Learn more about managing your financial future with diversified investments that include assessing the potential of XRP and other cryptocurrencies responsibly.

Featured Posts

-

Navigating The Cryptosphere Why Reliable News Matters

May 08, 2025

Navigating The Cryptosphere Why Reliable News Matters

May 08, 2025 -

Surge In Dwp Home Visits Impact On Benefit Claimants

May 08, 2025

Surge In Dwp Home Visits Impact On Benefit Claimants

May 08, 2025 -

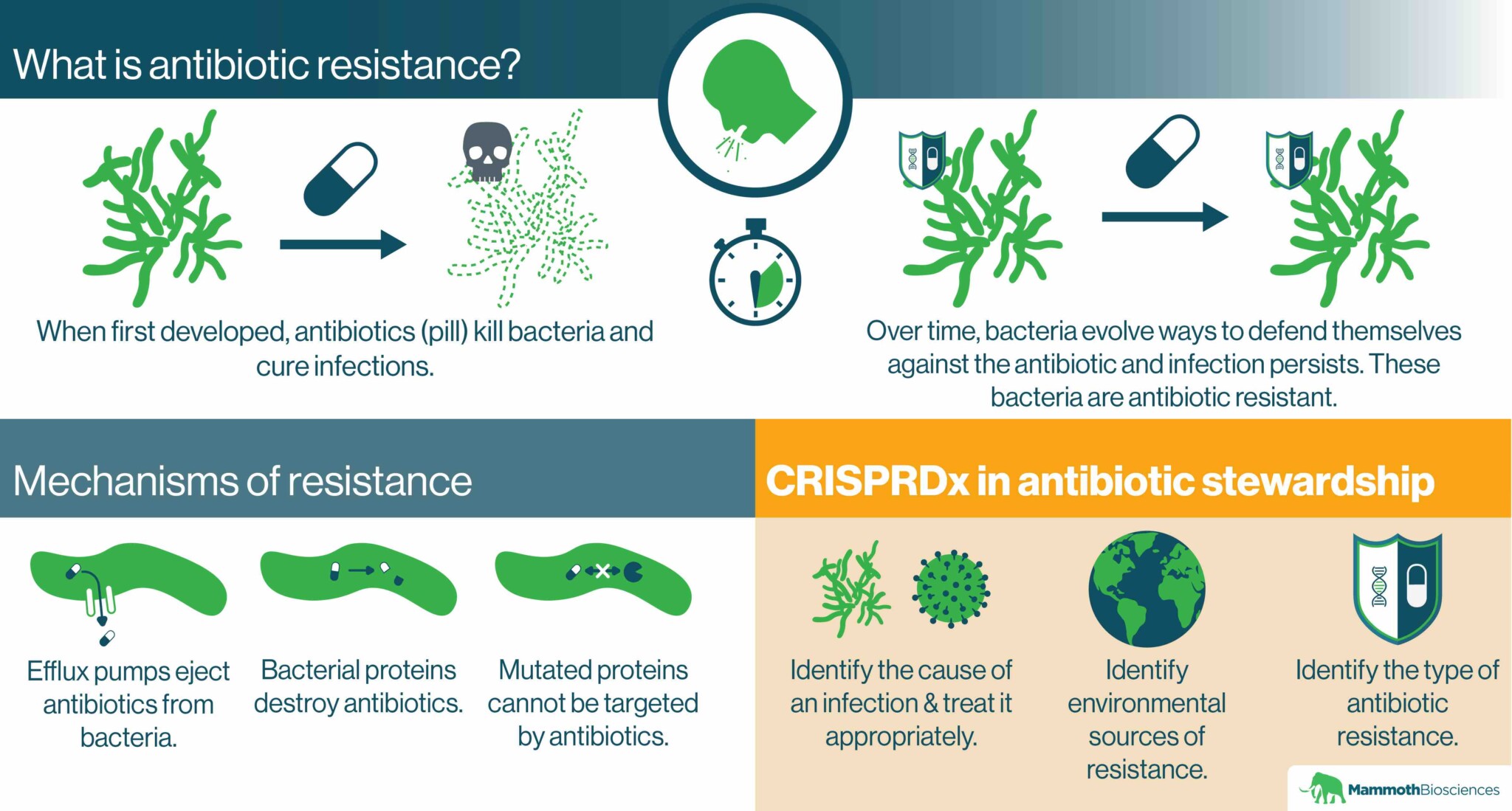

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025 -

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Aj Ky Tqrybat

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Aj Ky Tqrybat

May 08, 2025 -

Lahwr Myn Mhngayy Ka Twfan Chkn Mtn Awr Byf Ky Brhty Hwyy Qymtyn Awr An Pr Qabw Pane Ke Tryqe

May 08, 2025

Lahwr Myn Mhngayy Ka Twfan Chkn Mtn Awr Byf Ky Brhty Hwyy Qymtyn Awr An Pr Qabw Pane Ke Tryqe

May 08, 2025