Canada Election: Conservatives Vow To Cut Taxes, Shrink Deficits

Table of Contents

Proposed Tax Cuts

The Conservative Party's proposed tax cuts represent a core element of their election platform. These cuts target both personal and corporate income tax rates, aiming to boost economic activity and create jobs.

Personal Income Tax Reductions

The Conservatives propose a significant reduction in personal income tax rates across various income brackets. While specific percentage reductions may vary depending on the final platform, their general approach involves lowering the overall tax burden for Canadians.

- Example: A family earning $80,000 annually might see a tax reduction of approximately $1,000, while a higher-income earner could experience savings of several thousand dollars. (Note: These are illustrative examples; actual savings will depend on the final details of the proposed legislation.)

- Criticism: Critics argue that such substantial cuts could significantly reduce government revenue, potentially impacting funding for essential social programs and infrastructure projects. Concerns have been raised regarding the potential impact on healthcare and education budgets.

- Data: The Conservative Party typically releases detailed economic modelling to support their claims, often projecting increased economic activity offsetting revenue losses. Independent analyses of these projections should be sought from reputable economic sources for a balanced perspective.

Corporate Tax Cuts

The Conservative plan also includes reductions in the corporate tax rate. The party contends that lowering this rate will incentivize business investment, stimulate job creation, and boost overall economic growth.

- Example: A small business might reinvest tax savings into expanding its operations, hiring additional staff, or investing in new technologies. Larger corporations could see increased profitability, leading to higher investment and potential wage increases.

- SMEs: The Conservatives often highlight the specific benefits for small and medium-sized enterprises (SMEs), arguing that reduced tax burdens will enable them to compete more effectively and contribute to job growth.

- Concerns: Critics express concerns that corporate tax cuts may disproportionately benefit large corporations and not necessarily translate into widespread job creation or wage increases. Furthermore, reduced corporate taxes could lessen government revenue, potentially affecting social programs.

Other Tax Measures

Beyond personal and corporate income tax cuts, the Conservative platform may include other tax measures. These might involve adjustments to the Goods and Services Tax (GST)/Harmonized Sales Tax (HST), changes to capital gains taxes, or modifications to specific excise taxes. Specifics of these measures are typically clarified closer to the election.

- GST/HST: Potential adjustments to GST/HST rates are usually debated, with potential impacts on consumer spending and overall inflation.

- Capital Gains: Changes to capital gains taxes could impact investment decisions and potentially affect the wealth of higher-income earners.

Deficit Reduction Strategies

While promising significant tax cuts, the Conservatives also outline strategies to reduce the national deficit. These strategies typically combine spending cuts and initiatives to promote economic growth.

Spending Cuts

To achieve deficit reduction, the Conservatives typically propose cuts to government spending in specific areas. These cuts often target programs deemed less efficient or less essential.

- Examples: Proposed cuts might include reductions in specific departmental budgets, adjustments to social programs, or a streamlining of government operations. Specific details are typically outlined in the party's official platform.

- Job Losses: Concerns arise about the potential for job losses within government and related sectors due to spending cuts. The impact on public services is also a major area of public debate.

- Efficiency: The party usually emphasizes plans to improve efficiency and reduce waste within government to compensate for spending cuts, arguing that improved performance will offset potential negative impacts.

Economic Growth Initiatives

The Conservatives typically argue that their tax cuts and other economic initiatives will stimulate growth, ultimately leading to increased tax revenue and a reduction in the deficit.

- Examples: These initiatives may include investments in infrastructure projects, deregulation to encourage business investment, or targeted tax incentives for specific industries.

- Job Creation: The party typically highlights projected job creation as a key benefit of their economic growth strategies. Increased employment leads to higher tax revenues, contributing to deficit reduction.

- Risks: The projected benefits are subject to economic conditions and unforeseen events. Economic growth is not always guaranteed, and the success of these initiatives depends on many factors.

Debt Management Strategies

Beyond spending cuts and economic growth initiatives, the Conservatives may propose additional strategies for managing the national debt.

- Examples: These might include refinancing existing debt at lower interest rates, selling off government assets, or exploring other innovative financial strategies.

Analysis and Potential Impacts

The Conservative Party's proposed plan has significant potential impacts on the Canadian economy and society. A thorough analysis requires careful consideration of both positive and negative consequences.

Economic Impact

The economic consequences of the proposed tax cuts and deficit reduction plan are a subject of ongoing debate.

- Employment: While the Conservatives predict job creation through economic growth, critics might highlight potential job losses resulting from spending cuts. The net effect on employment remains uncertain.

- Inflation: Significant tax cuts could potentially fuel inflation if demand increases outpace supply.

- Economic Growth: The effectiveness of stimulating economic growth through tax cuts is a subject of ongoing debate among economists. Some argue it is highly effective, while others suggest its impact is less significant. Independent analyses of the party's economic models are crucial for objective assessment.

Social Impact

The social implications of the Conservative plan are equally significant.

- Social Programs: Spending cuts could lead to reductions in funding for social programs, such as healthcare, education, and social welfare initiatives. This could disproportionately affect vulnerable populations.

- Differing Opinions: The social impacts of the plan are highly contested, with differing perspectives on the relative importance of tax cuts versus social program funding.

Conclusion

The Conservative Party's platform for the Canada Election centers around substantial tax cuts and a plan for deficit reduction. This involves a combination of proposed tax reductions for individuals and corporations, coupled with spending cuts and economic growth initiatives. While promising economic stimulation and taxpayer relief, the plan also faces criticisms regarding potential impacts on social programs and the overall sustainability of the deficit reduction strategy. The potential positive and negative economic and social impacts require careful consideration. The upcoming Canada Election presents a critical choice for Canadian voters. Understanding the Conservative Party's platform on tax cuts and deficit reduction, including its potential implications for the economy and society, is crucial before casting your vote. Stay informed about the Canada Election and the various parties’ plans for tax cuts and deficit reduction to make an educated decision. Further research into the specifics of the Conservative platform regarding Canada Election policies is encouraged.

Featured Posts

-

Saudi Arabia And India Partner To Build Two New Oil Refineries

Apr 24, 2025

Saudi Arabia And India Partner To Build Two New Oil Refineries

Apr 24, 2025 -

Five Point Plan From Canadian Auto Dealers Addresses Us Trade War Threat

Apr 24, 2025

Five Point Plan From Canadian Auto Dealers Addresses Us Trade War Threat

Apr 24, 2025 -

Is The Lg C3 77 Inch Oled Tv Worth It A Comprehensive Review

Apr 24, 2025

Is The Lg C3 77 Inch Oled Tv Worth It A Comprehensive Review

Apr 24, 2025 -

Car Dealers Intensify Opposition To Electric Vehicle Mandates

Apr 24, 2025

Car Dealers Intensify Opposition To Electric Vehicle Mandates

Apr 24, 2025 -

The Untold Story Of Chalet Girls Work Lifestyle And Challenges In European Ski Resorts

Apr 24, 2025

The Untold Story Of Chalet Girls Work Lifestyle And Challenges In European Ski Resorts

Apr 24, 2025

Latest Posts

-

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

May 10, 2025

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

May 10, 2025 -

Resistance Grows Car Dealerships Challenge Ev Mandate

May 10, 2025

Resistance Grows Car Dealerships Challenge Ev Mandate

May 10, 2025 -

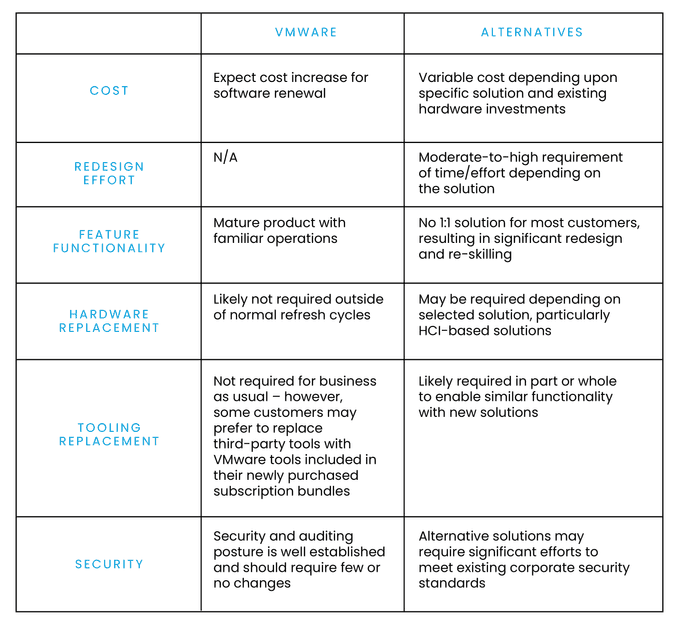

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Increase

May 10, 2025

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Increase

May 10, 2025 -

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Pricing Proposal

May 10, 2025

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Pricing Proposal

May 10, 2025 -

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 10, 2025

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 10, 2025