Canada's Economic Outlook: Recession Fears Despite Tariff Reductions

Table of Contents

Persistent Inflation and Interest Rate Hikes

Persistent inflation in Canada is significantly impacting consumer spending and business investment. The rising cost of living, fueled by factors ranging from supply chain disruptions to global energy price increases, is eroding purchasing power. Consumers are forced to cut back on discretionary spending, impacting various sectors of the economy. Simultaneously, businesses face increased operational costs, making investment in expansion or new projects less attractive.

The Bank of Canada has responded aggressively to combat inflation with a series of interest rate hikes. This monetary policy, while aimed at curbing inflation, has the unintended consequence of increasing borrowing costs for businesses and consumers. Higher interest rates make it more expensive to finance mortgages, business loans, and consumer debt, further dampening economic activity.

- High inflation erodes purchasing power. The real value of wages is declining, leaving consumers with less disposable income.

- Increased interest rates slow economic growth. Higher borrowing costs discourage investment and consumer spending.

- Mortgage rates are impacting the housing market. Rising interest rates are cooling the previously red-hot Canadian housing market.

- Business investment is hampered by uncertainty. Businesses are hesitant to invest in expansion amid economic uncertainty.

These factors combined paint a picture of slowing economic growth in Canada. The effectiveness of the Bank of Canada's monetary policy in controlling inflation without triggering a recession remains to be seen. Understanding the interplay between Inflation Canada, Interest Rates Canada, and the Bank of Canada's Monetary Policy Canada is crucial for navigating the current economic climate.

The Impact of Global Economic Slowdown

Canada's economy is heavily reliant on exports, making it vulnerable to global economic downturns. The potential for recessions in major trading partners, particularly the US, poses a significant threat to Canadian economic growth. Reduced demand for Canadian goods and services from these key markets would have a substantial negative impact on various sectors, including manufacturing, energy, and agriculture.

- Reduced demand for Canadian goods and services. A global slowdown directly translates to decreased export revenue for Canadian businesses.

- Supply chain disruptions continue to impact businesses. Global instability continues to create uncertainty and bottlenecks in the supply chain.

- Geopolitical instability adds to economic uncertainty. Events such as the war in Ukraine contribute to global volatility and impact Canadian trade and investment.

The interconnectedness of the global economy means that even seemingly isolated events can have significant ripple effects on Canada. Analyzing the interplay between Global Recession, Canadian Exports, potential Trade Wars, and Geopolitical Risk is key to understanding the vulnerability of the Canadian economy.

The Effectiveness of Tariff Reductions

Recent tariff reductions, aimed at stimulating trade and boosting economic activity, offer a potential counterbalance to the negative factors mentioned above. These reductions, often negotiated through trade agreements like the USMCA, aim to improve market access for Canadian goods and services. However, the extent to which these reductions will mitigate the current economic headwinds remains to be seen.

- Analysis of specific tariff reductions and their sectors of impact. Some sectors may benefit significantly more than others from these changes.

- Discussion of trade agreements and their contribution to economic growth. Trade agreements like the USMCA are crucial for facilitating trade and fostering economic growth.

- Examination of potential delays in realizing the full benefits of tariff reductions. The positive effects of tariff reductions may not be immediately apparent and may take time to fully materialize.

While Canada Trade and Tariff Reduction initiatives offer hope, their impact needs to be evaluated alongside the other economic forces at play. The effectiveness of these policies will depend on various factors, including the overall global economic climate and the speed at which businesses adapt to the changed trade landscape.

Housing Market Weakness

The Canadian housing market, once a significant driver of economic growth, is experiencing a significant slowdown. High interest rates and decreased consumer confidence are contributing to declining housing prices in major cities across the country. This cooling market has implications that extend beyond the real estate sector itself, impacting related industries such as construction, furniture, and renovations.

- Declining housing prices in major cities. A correction in the overheated housing market is underway.

- Reduced housing starts and construction activity. Fewer new homes are being built, impacting employment in the construction sector.

- Impact on related industries (e.g., furniture, renovations). Decreased housing activity leads to lower demand for related goods and services.

The weakening Canadian Housing Market, coupled with falling Housing Prices Canada and reduced Real Estate Canada activity, adds another layer of complexity to the already challenging economic outlook.

Conclusion

While tariff reductions offer a potential boost to the Canadian economy, persistent inflation, rising interest rates, and a global economic slowdown create significant headwinds. The cooling housing market further contributes to the risk of recession. The Canadian economy faces a complex and uncertain future.

Call to Action: Stay informed about Canada's economic outlook and the latest developments affecting your business and personal finances. Continuously monitor updates on inflation, interest rates, and trade policies to navigate the complexities of Canada's economic landscape. Understanding Canada's economic outlook is crucial for making informed decisions. Keep an eye on the Canadian Economic Forecast for the latest analysis and projections.

Featured Posts

-

Spartak Rostov Razgromnaya Pobeda Krasno Belykh V 23 M Ture Rpl

Apr 23, 2025

Spartak Rostov Razgromnaya Pobeda Krasno Belykh V 23 M Ture Rpl

Apr 23, 2025 -

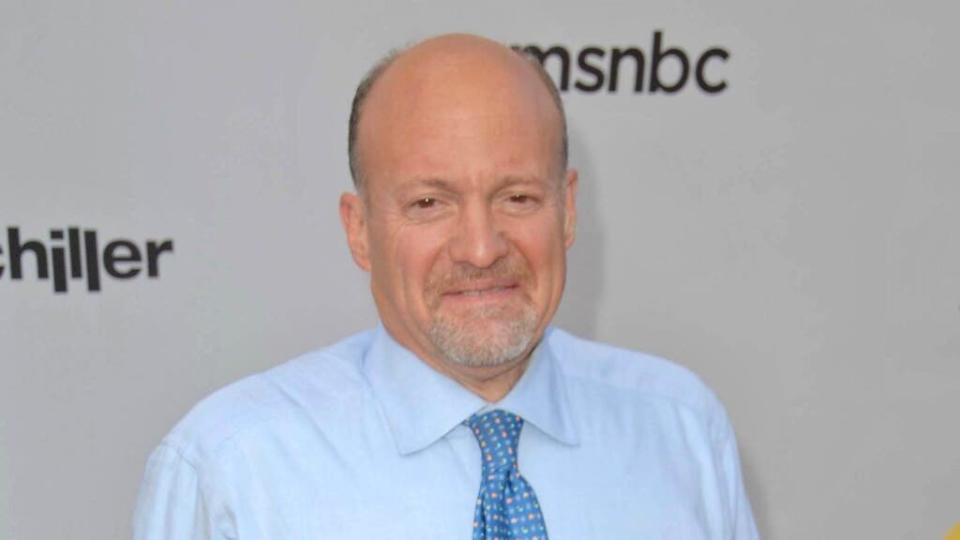

Elections Legislatives Allemandes A J 6 Les Enjeux Cles

Apr 23, 2025

Elections Legislatives Allemandes A J 6 Les Enjeux Cles

Apr 23, 2025 -

Kecocokan Jodoh Weton Senin Legi Dan Rabu Pon Panduan Primbon Jawa

Apr 23, 2025

Kecocokan Jodoh Weton Senin Legi Dan Rabu Pon Panduan Primbon Jawa

Apr 23, 2025 -

La Carte Blanche L Uvre De Marc Fiorentino

Apr 23, 2025

La Carte Blanche L Uvre De Marc Fiorentino

Apr 23, 2025 -

Illness Sidelines Terry Francona Brewers Game Missed

Apr 23, 2025

Illness Sidelines Terry Francona Brewers Game Missed

Apr 23, 2025