Canada's Economic Sovereignty: Diversifying Beyond U.S. Investment

Table of Contents

The Current State of US-Canada Economic Relations

High Levels of US Investment

Canada has long been a popular destination for US foreign direct investment (FDI). A substantial proportion of FDI in Canada originates from the United States, permeating numerous key sectors. This significant influx of capital has undeniably contributed to Canada's economic growth, but it also presents vulnerabilities.

- Statistics: US FDI in Canada consistently represents a significant percentage of total FDI, often exceeding [Insert relevant statistic here, e.g., 50%]. This dominance is particularly noticeable in sectors like energy (oil and gas), manufacturing (automobiles), and finance.

- Examples: Major US companies with extensive operations in Canada include [List examples, e.g., Ford, General Motors, ExxonMobil]. Their presence signifies the deep integration of the two economies.

Trade Dependence on the US

Canada's reliance on the US as its primary trading partner is another crucial aspect of its economic relationship with its neighbour. The vast majority of Canadian exports and imports are transacted with the US, creating a significant degree of interdependence.

- Statistics: [Insert relevant statistics here, e.g., Percentage of Canadian exports and imports destined for/originating from the US]. This high percentage underlines Canada's considerable trade dependence on the US market.

- Examples: Specific trade dependencies can be observed in sectors like agriculture (e.g., grains, lumber), energy, and manufacturing. Any disruption to this trade could have a significant impact on the Canadian economy.

Potential Risks of Over-Reliance

The inherent risks associated with this heavily US-centric economic model are substantial. Economic downturns or policy shifts in the US can have immediate and significant repercussions for Canada. Political instability south of the border also poses a threat.

- Examples: [Provide historical examples, e.g., the impact of the 2008 financial crisis on the Canadian economy]. These events highlighted the vulnerability of a heavily intertwined economy.

- Potential Scenarios: Future risks include potential protectionist trade policies in the US, fluctuations in the US dollar, and economic uncertainty stemming from geopolitical events affecting the US.

Strategies for Diversifying Investments and Trade

Attracting Investment from Other Countries

To mitigate the risks associated with over-reliance on US investment, Canada needs to actively pursue diversification. Attracting FDI from diverse global sources, such as Asia, Europe, and other parts of the Americas, is paramount.

- Strategies: Successful investment attraction strategies include targeted marketing campaigns, streamlined regulatory processes, and offering attractive tax incentives for foreign investors.

- Canada's Strengths: Canada possesses several strengths to attract investors: a skilled workforce, abundant natural resources (e.g., minerals, timber), a stable political climate, and a well-developed infrastructure.

Fostering Domestic Innovation and Entrepreneurship

Reducing reliance on foreign investment necessitates strengthening domestic industries and fostering a vibrant entrepreneurial ecosystem. Supporting Canadian innovation is crucial for long-term economic resilience.

- Government Initiatives: Investment in research and development (R&D), government grants for small and medium-sized enterprises (SMEs), and tax breaks for innovative businesses are essential components of this strategy.

- Support for SMEs: SMEs are the backbone of many economies; robust support systems, including access to funding and mentorship, are vital for their growth and contribution to economic diversification.

Strengthening Trade Relationships Beyond the US

Diversifying trade partnerships is as crucial as diversifying investment sources. Expanding trade relationships with countries outside North America is key to reducing reliance on the US market.

- Potential Partners: Countries in Asia (e.g., Japan, South Korea, China), Europe (e.g., the UK, Germany), and Latin America offer significant opportunities for trade expansion.

- Trade Agreements: Leveraging existing and pursuing new trade agreements (e.g., CPTPP) will open up new markets and reduce trade barriers. Focusing on sectors where Canada possesses a competitive advantage will maximize the impact of these initiatives.

Challenges to Achieving Economic Sovereignty

Geographical Proximity to the US

Canada's geographical proximity to the US presents both opportunities and challenges. The close proximity naturally leads to strong economic ties, but it also makes it difficult to completely decouple from the US economy.

Regulatory and Policy Harmonization

Maintaining distinct regulatory frameworks while fostering international trade presents a complex challenge. Finding a balance between protecting domestic interests and promoting international cooperation is crucial.

Attracting and Retaining Skilled Workers

Attracting and retaining a skilled workforce is fundamental to supporting economic diversification and innovation. Competitive salaries, immigration policies that attract talent, and investment in education and training are critical.

Conclusion

Canada's economic sovereignty demands a proactive approach to diversifying its investment portfolio and reducing its over-reliance on the US. While maintaining strong ties with the US remains beneficial, strategic action is paramount to mitigate risks and build a more resilient, independent economy. By actively pursuing strategies to attract investment from diverse global sources, cultivate domestic innovation, and strengthen trade relationships beyond the US, Canada can significantly enhance its economic security and achieve greater autonomy. The path to genuine economic sovereignty requires a concerted effort from the government, businesses, and all Canadians. Let's work together to strengthen Canada's economic independence and build a more diverse and resilient future by actively pursuing strategies to enhance Canada's economic sovereignty.

Featured Posts

-

South African Mother Convicted Six Year Old Daughter Kidnapped And Sold

May 29, 2025

South African Mother Convicted Six Year Old Daughter Kidnapped And Sold

May 29, 2025 -

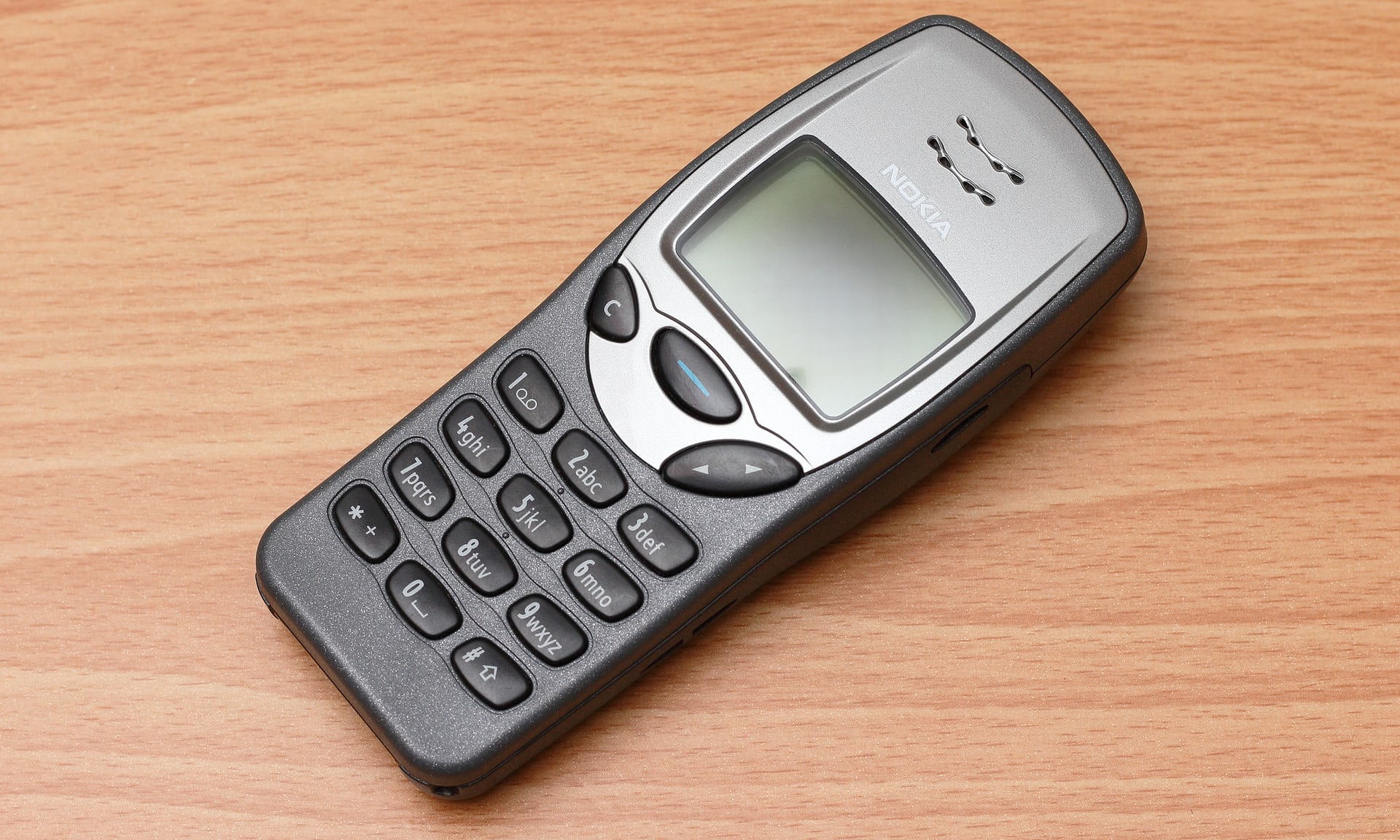

Regi Nokia Telefonok Meglepo Erteke

May 29, 2025

Regi Nokia Telefonok Meglepo Erteke

May 29, 2025 -

New York Rangers Coaching Change Laviolettes Tenure Ends

May 29, 2025

New York Rangers Coaching Change Laviolettes Tenure Ends

May 29, 2025 -

Bayern Munich Liverpool And Manchester United Rejected

May 29, 2025

Bayern Munich Liverpool And Manchester United Rejected

May 29, 2025 -

Terugkeer Heitinga Bij Ajax De Laatste Updates

May 29, 2025

Terugkeer Heitinga Bij Ajax De Laatste Updates

May 29, 2025