Canadian 10-Year Mortgages: Low Popularity Explained

Table of Contents

The Interest Rate Risk Factor: A Major Detriment to 10-Year Mortgages

The primary deterrent for many Canadians considering a 10-year mortgage is the inherent interest rate risk. Locking into a fixed interest rate for a decade means committing to that rate regardless of market fluctuations. In a volatile interest rate environment, this can be a significant gamble.

If interest rates fall during your 10-year term, you'll miss out on the opportunity to refinance at a lower rate and potentially save thousands of dollars over the life of your mortgage. Conversely, if rates rise, you're locked in, potentially paying more than you would have with a shorter-term mortgage.

- Higher potential long-term cost: If rates decrease significantly during your 10-year term, you could end up paying considerably more than borrowers who opted for shorter-term mortgages and refinanced at lower rates.

- Difficulty refinancing: Unexpected financial hardship could make it difficult to manage higher payments, and refinancing a 10-year mortgage can be complex and costly.

- Economic uncertainty: Predicting interest rate movements over a decade is impossible. Unforeseen economic downturns or shifts in monetary policy could significantly impact your mortgage payments.

Financial Flexibility: The Allure of Shorter-Term Mortgages

Shorter-term mortgages, typically 5-year terms, offer significantly more financial flexibility. This flexibility is a key reason why they dominate the Canadian mortgage market. With a 5-year mortgage, you can refinance at the end of the term, taking advantage of potentially lower interest rates. You also have greater control over your monthly payments and the ability to adjust your mortgage strategy as your financial situation evolves.

- Greater control over payments: Shorter terms provide more frequent opportunities to adjust your payment schedule, potentially lowering your monthly expenses or accelerating your mortgage payoff.

- Renegotiation opportunities: Refinancing allows you to negotiate better terms, potentially securing a lower interest rate or a more favorable amortization period.

- Adaptability to changing circumstances: Life throws curveballs. Shorter-term mortgages provide the adaptability needed to handle job changes, unexpected expenses, or changes in family circumstances.

Borrower Preferences and Market Dynamics: Understanding Canadian Mortgage Choices

Understanding the low uptake of 10-year mortgages requires looking at both psychological and market factors. Many Canadians prioritize predictability and prefer the shorter-term certainty of a 5-year mortgage. This preference is reinforced by the market dominance of 5-year terms, creating a self-fulfilling prophecy.

- Preference for short-term commitments: Canadians often prefer shorter-term financial commitments, feeling more comfortable with a shorter timeframe for fixed payments.

- Lack of awareness: Many borrowers lack awareness of the potential long-term benefits of 10-year mortgages, focusing instead on the immediate costs and risks.

- Influence of financial advisors: Mortgage brokers and financial advisors often promote shorter-term options, potentially due to higher commission structures or a perceived lower risk for the borrower.

Prepayment Penalties: A Significant Consideration for 10-Year Mortgages

Prepayment penalties are a critical factor to consider when comparing mortgage terms. Breaking a 10-year mortgage early can result in substantially higher penalties compared to a shorter-term mortgage. These penalties can significantly impact your financial flexibility and make it a costly decision to change your mortgage before the term is over.

- Higher penalties: The longer the term, the greater the potential penalty for early repayment. This can deter borrowers from considering longer-term options, even if the interest rate is attractive.

- Reduced flexibility: The high cost of breaking a 10-year mortgage significantly reduces your financial flexibility, making it a less attractive option for those who anticipate potential life changes.

- Variable penalty structures: Prepayment penalty structures vary widely between lenders, making it crucial to compare options before committing to a 10-year mortgage.

Alternative Mortgage Options: Bridging the Gap

While 10-year fixed-rate mortgages aren't for everyone, alternative options offer a compromise. Adjustable-rate mortgages (ARMs) offer lower initial rates but carry the risk of fluctuating payments. Hybrid mortgages combine fixed and variable rates, providing a balance between stability and potential savings. Exploring these options can help you find a solution that aligns with your risk tolerance and financial goals.

Conclusion: Making Informed Decisions about Canadian 10-Year Mortgages

The low popularity of Canadian 10-year mortgages stems from a combination of factors: the significant interest rate risk, the appeal of greater financial flexibility offered by shorter terms, borrower preferences for shorter-term commitments, and substantial prepayment penalties. While 10-year mortgages may not be suitable for all borrowers, they can offer long-term savings under specific circumstances. Before deciding on a mortgage term, carefully evaluate your individual financial situation, long-term goals, and risk tolerance. Seek professional financial advice to determine whether a Canadian 10-year mortgage, a shorter-term mortgage, or an alternative option is the right choice for you. Remember, making an informed decision about your mortgage is crucial for your long-term financial well-being.

Featured Posts

-

Free Streaming Gypsy Rose Life After Lockup Season 2 Episode 1 Online

May 06, 2025

Free Streaming Gypsy Rose Life After Lockup Season 2 Episode 1 Online

May 06, 2025 -

Nikes Super Bowl Commercial Featuring Doechii A Deep Dive

May 06, 2025

Nikes Super Bowl Commercial Featuring Doechii A Deep Dive

May 06, 2025 -

Obtaining Sabrina Carpenter Skins In Fortnite Tips And Tricks

May 06, 2025

Obtaining Sabrina Carpenter Skins In Fortnite Tips And Tricks

May 06, 2025 -

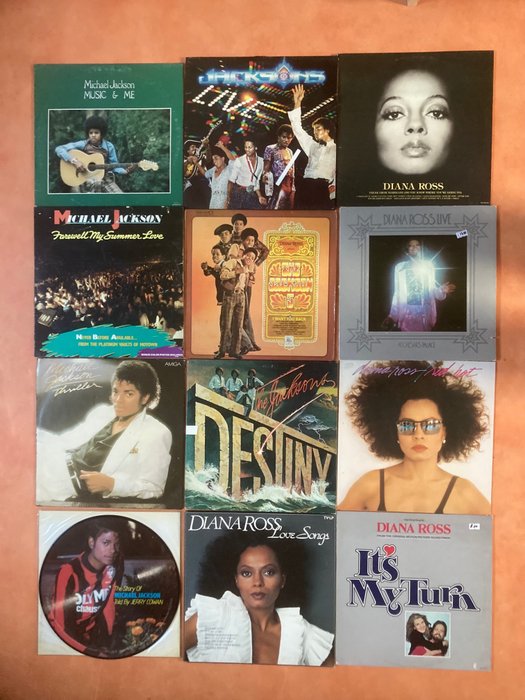

Remembering A 70s Television Legend His Work With The Jacksons And Diana Ross

May 06, 2025

Remembering A 70s Television Legend His Work With The Jacksons And Diana Ross

May 06, 2025 -

Sin Arnolda Svarcenegera Otvoreno O Prezimenu I Karijeri

May 06, 2025

Sin Arnolda Svarcenegera Otvoreno O Prezimenu I Karijeri

May 06, 2025