Canadian Dollar Overvalued: Economists Urge Swift Action

Table of Contents

The Indicators Pointing to an Overvalued Canadian Dollar

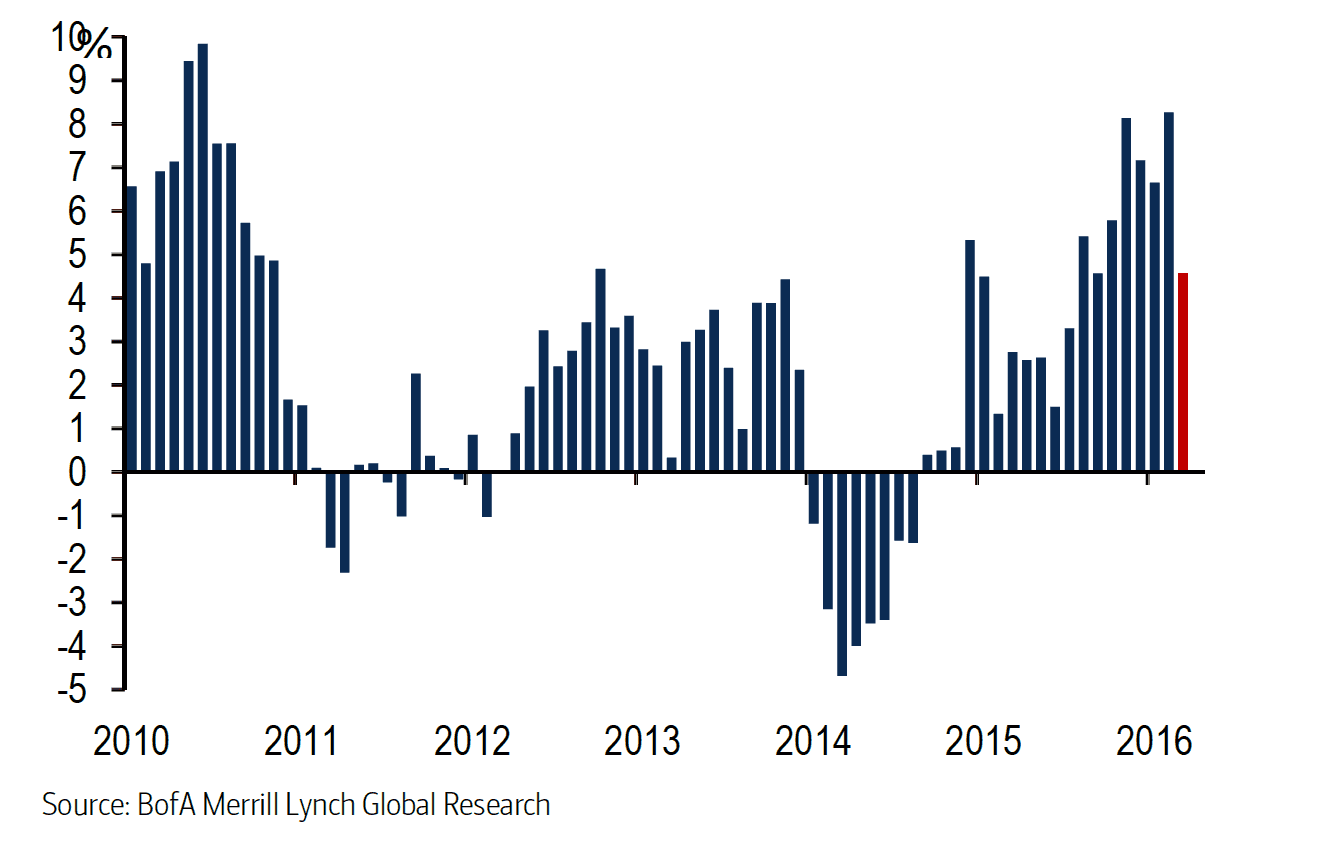

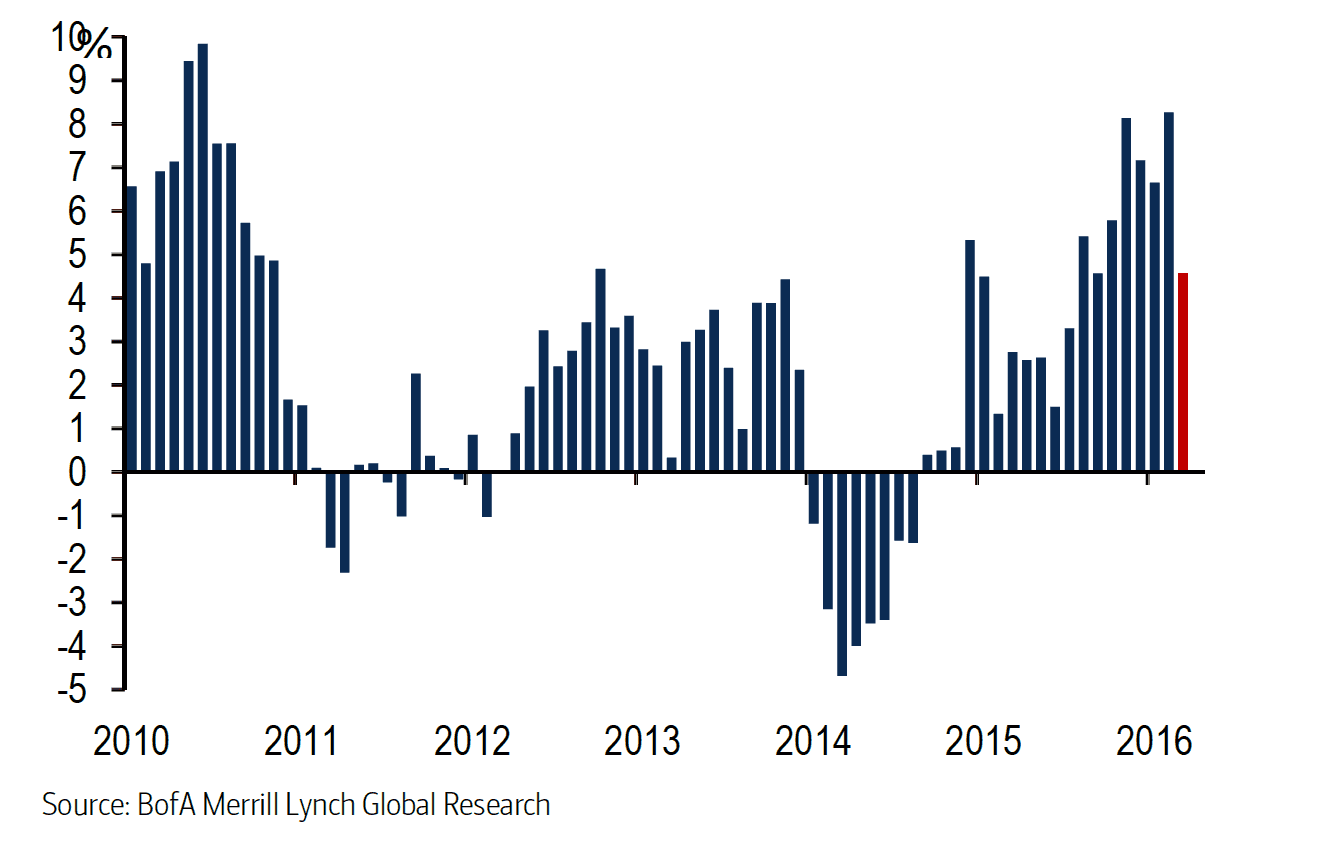

Several key indicators suggest that the Canadian dollar is currently overvalued, threatening the long-term health of the Canadian economy.

Trade Deficit and Competitiveness

A strong Canadian dollar makes Canadian exports more expensive in international markets, directly impacting their competitiveness. This leads to a widening trade deficit as imports become relatively cheaper.

- Industries Affected: The manufacturing sector, particularly automotive parts and machinery, and resource extraction industries like forestry and mining, are significantly impacted by a strong CAD. These sectors often rely heavily on exports.

- Data Points: Statistics Canada data consistently reveals a growing trade deficit correlated with periods of CAD strength. For example, in [Insert recent month/quarter], the trade deficit reached [Insert statistic], highlighting the negative impact of a strong Canadian dollar.

Interest Rate Differentials and Capital Flows

Higher interest rates in Canada compared to other major economies attract foreign investment, driving up demand for the Canadian dollar. This influx of capital further strengthens the CAD, potentially exacerbating existing inflation concerns.

- Interest Rate Comparison: Currently, the Bank of Canada's benchmark interest rate is [Insert current rate], higher than rates in many other G7 nations. This differential attracts foreign capital seeking higher returns.

- Impact of FDI: Significant foreign direct investment (FDI) flows into Canada further contribute to an appreciation of the CAD, pushing it beyond levels supported by fundamental economic factors.

Purchasing Power Parity (PPP) Analysis

Purchasing Power Parity (PPP) is a theory that compares different countries' currencies through a "basket of goods" approach. It suggests that exchange rates should adjust to equalize the price of identical goods and services in different countries. If the CAD's value deviates significantly from its PPP, it indicates overvaluation or undervaluation.

- PPP Calculation: PPP is calculated by comparing the cost of a standardized basket of goods in different countries, converting the prices to a common currency.

- Data Points: Recent PPP analyses suggest that the Canadian dollar is overvalued compared to its purchasing power relative to the US dollar and other major currencies. [Insert data source and relevant statistic here].

The Economic Consequences of an Overvalued Canadian Dollar

The consequences of an overvalued Canadian dollar are far-reaching and detrimental to the Canadian economy.

Job Losses and Economic Slowdown

Reduced export competitiveness due to a strong CAD leads directly to job losses in export-oriented industries. This ultimately contributes to an overall economic slowdown.

- Industries Facing Job Losses: Manufacturing, resource extraction, and related sectors are particularly vulnerable. The decline in exports translates to decreased production and, consequently, layoffs.

- Unemployment and GDP Growth: Periods of CAD overvaluation are often correlated with higher unemployment rates and slower GDP growth. [Insert relevant statistic showing correlation between CAD strength and economic indicators].

Inflationary Pressures

While a strong CAD initially makes imports cheaper, this can mask underlying inflationary pressures. As the economy adjusts, these pressures can lead to future price increases.

- Import Price Effects: The immediate effect of a strong CAD is reduced import prices. However, this can lead to complacency and prevent necessary adjustments in domestic pricing strategies.

- Impact on CPI: While the Consumer Price Index (CPI) might show lower inflation in the short term due to cheaper imports, this can be followed by a period of higher inflation once the effects of the CAD weaken.

Impact on Government Revenue

A weaker CAD impacts government revenue. Lower exports result in reduced tax collection from export-oriented industries, thus reducing the government's ability to invest in crucial programs and services.

- Relationship Between CAD and Government Revenue: A strong correlation exists between the value of the CAD and government revenue from corporate income tax and goods and services tax (GST) collected from exporting businesses. A weaker CAD directly impacts these revenue streams.

Economists' Recommended Actions to Address the Overvalued Canadian Dollar

Addressing the overvalued Canadian dollar requires a multi-pronged approach involving monetary and fiscal policies, as well as a focus on economic diversification.

Intervention by the Bank of Canada

The Bank of Canada has several policy tools at its disposal to manage the CAD's value. These include adjusting interest rates and potentially intervening in the foreign exchange market.

- Interest Rate Adjustments: Lowering interest rates could reduce the attractiveness of Canadian investments, leading to a depreciation of the CAD. However, this might also fuel inflation.

- Foreign Exchange Market Intervention: The Bank of Canada could directly intervene by selling CAD and buying other currencies, but this is a less frequently used approach.

Fiscal Policy Measures

The Canadian government can implement fiscal policies to support struggling export industries.

- Subsidies and Tax Breaks: Providing subsidies or offering tax breaks to businesses in export-oriented sectors can help offset the negative impact of a strong CAD.

- Investment in Diversification: Government investment in research and development for new technologies and industries can help reduce the reliance on traditional export sectors.

Diversification of the Canadian Economy

Reducing dependence on resource-based exports is critical. A more diversified economy is less vulnerable to fluctuations in global commodity prices and exchange rate changes.

- Diversification Strategies: Investing in advanced manufacturing, technology, and high-value services can help diversify the Canadian economy and make it more resilient to external shocks.

Conclusion: Addressing the Overvalued Canadian Dollar – A Call to Action

The evidence strongly suggests that the Canadian dollar is currently overvalued, posing significant risks to the Canadian economy. The consequences of inaction include job losses, economic slowdown, and inflationary pressures. Addressing the Canadian dollar overvaluation is crucial for maintaining long-term economic stability and prosperity. Understanding the implications of an overvalued Canadian dollar is essential for businesses, policymakers, and citizens alike. We urge readers to stay informed about developments regarding the Canadian dollar and advocate for appropriate policy responses from the Bank of Canada and the government to mitigate the negative impacts of this overvaluation. Further research into the implications of the Canadian dollar's current strength is strongly encouraged.

Featured Posts

-

Nathan Fillions Brief But Brilliant Performance In Saving Private Ryan

May 08, 2025

Nathan Fillions Brief But Brilliant Performance In Saving Private Ryan

May 08, 2025 -

Andor Season 2 The Absence Of A Trailer Sparks Intense Online Debate

May 08, 2025

Andor Season 2 The Absence Of A Trailer Sparks Intense Online Debate

May 08, 2025 -

Beyond The Bodysuit Analyzing Rogues Costume Evolution In X Men

May 08, 2025

Beyond The Bodysuit Analyzing Rogues Costume Evolution In X Men

May 08, 2025 -

Analyzing Ethereums Price Wyckoff Accumulation And The Road To 2 700

May 08, 2025

Analyzing Ethereums Price Wyckoff Accumulation And The Road To 2 700

May 08, 2025 -

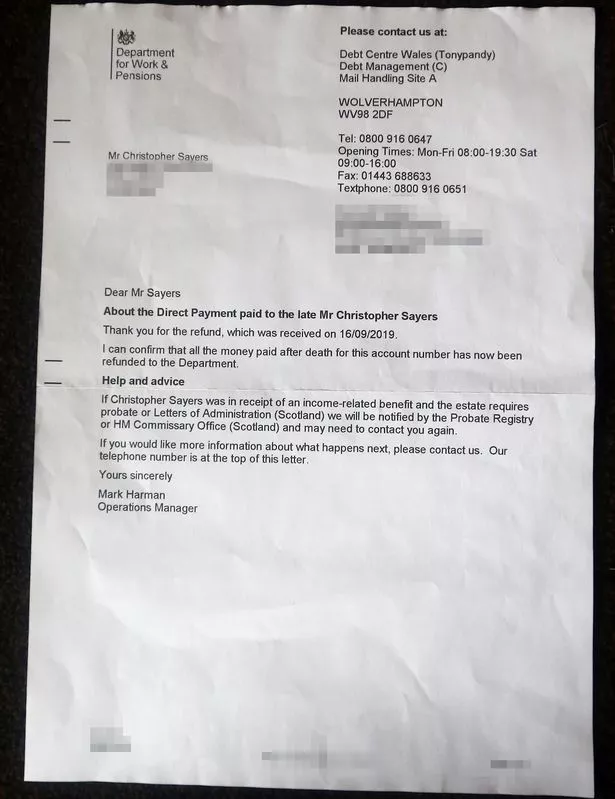

Dwp Letter Missing Potential 6 828 Benefit Penalty

May 08, 2025

Dwp Letter Missing Potential 6 828 Benefit Penalty

May 08, 2025