Canadian Dollar Plunges Despite US Dollar Gains

Table of Contents

Factors Contributing to the Canadian Dollar's Decline

Several interconnected factors contribute to the recent weakening of the Canadian dollar. Analyzing these elements provides a clearer picture of the current situation and potential future movements in the forex market.

Weakening Canadian Economy

Several economic indicators point towards a slowdown in the Canadian economy, putting downward pressure on the CAD. This weakness relative to the robust US economy further exacerbates the exchange rate decline.

- Lower-than-expected GDP growth: Recent reports from Statistics Canada show GDP growth lagging behind projections, signaling a potential economic slowdown.

- Persistent inflation: While inflation rates are showing signs of easing, they remain stubbornly high, forcing the Bank of Canada to maintain a tighter monetary policy. This impacts consumer spending and overall economic activity.

- Rising interest rates impacting consumer spending: The Bank of Canada's efforts to curb inflation through interest rate hikes have dampened consumer spending, impacting economic growth and the value of the CAD.

Strong US Dollar

The strength of the US dollar is a major factor influencing the CAD/USD exchange rate. The USD's robust performance globally puts further pressure on the already weakening Canadian dollar.

- Higher US interest rates: The Federal Reserve's aggressive interest rate hikes to combat inflation make US dollar-denominated assets more attractive to international investors, increasing demand for the USD.

- Safe-haven status of the USD: In times of global economic uncertainty, investors often flock to the US dollar as a safe-haven currency, further bolstering its value.

- Strong US economic performance: The relatively strong performance of the US economy compared to Canada's contributes to the increased demand for the USD, impacting the CAD/USD exchange rate. This is particularly relevant in the context of current geopolitical instability.

Commodity Prices and Oil Dependence

Canada's economy is heavily reliant on commodity exports, particularly oil. Fluctuations in global commodity prices, therefore, significantly impact the Canadian dollar.

- Decreased oil demand: Reduced global demand for oil, potentially due to a global economic slowdown or shifts towards renewable energy, directly impacts Canada's export revenue and the CAD.

- Global supply chain disruptions: Ongoing supply chain issues continue to create volatility in commodity markets, impacting oil prices and consequently the Canadian dollar.

- Impact on Canadian export revenue: Lower oil prices translate to reduced export revenue for Canada, weakening the Canadian dollar relative to other currencies, including the USD. The correlation between oil prices and the CAD/USD exchange rate is readily apparent in recent historical data. (Include a relevant chart or graph here if possible).

Bank of Canada Monetary Policy

The Bank of Canada's monetary policy decisions play a crucial role in influencing the value of the Canadian dollar. Recent actions have had a significant impact on the CAD/USD exchange rate.

- Interest rate hikes: The Bank of Canada has implemented several interest rate hikes to combat inflation, but these measures can also slow down economic growth and impact the CAD.

- Quantitative tightening: The Bank of Canada's quantitative tightening policies further contribute to a tighter monetary environment, influencing the CAD's value.

- Impact on investment flows: Monetary policy decisions influence investment flows into and out of Canada, affecting the demand for the Canadian dollar in the forex market. Future interest rate changes will undoubtedly continue to impact the CAD.

Impact of the Canadian Dollar Plunge

The weakening Canadian dollar has wide-ranging consequences for various sectors of the Canadian economy.

Implications for Canadian Businesses

A weaker CAD presents both challenges and opportunities for Canadian businesses.

- Increased import costs: Businesses importing goods and services face higher costs due to the weaker Canadian dollar, potentially impacting profitability and pricing strategies.

- Reduced export competitiveness: While a weaker CAD can boost export volumes in the short term, it also makes Canadian goods more expensive for international buyers, reducing competitiveness.

- Potential for higher inflation: Increased import costs can contribute to higher inflation within Canada, further impacting consumers and businesses.

Impact on Canadian Consumers

The weakening CAD directly affects Canadian consumers in several ways.

- More expensive travel abroad: The weaker Canadian dollar makes travel to other countries more expensive for Canadian citizens.

- Higher prices for imported goods: Consumers will face higher prices for imported goods due to the weaker CAD, impacting purchasing power.

Investment Implications

The currency fluctuation also creates significant implications for investors.

- Impact on foreign direct investment: The weaker CAD may attract foreign direct investment but could also make it more expensive for Canadian companies to invest abroad.

- Stock market volatility: Currency fluctuations often lead to increased volatility in the stock market, creating both risks and opportunities for investors.

- Potential opportunities for currency traders: Currency traders may find opportunities in the volatile CAD/USD exchange rate, but this requires expertise and risk management.

Conclusion

The recent plunge of the Canadian dollar against the US dollar is a complex issue stemming from a combination of factors, including a weakening Canadian economy, a strong US dollar, fluctuations in commodity prices, and the Bank of Canada's monetary policy. Understanding these interconnected elements is vital for businesses, investors, and consumers alike. The implications are far-reaching, impacting everything from import/export costs to travel expenses and investment decisions.

Keep an eye on the Canadian dollar's movements and consider seeking professional financial advice to navigate this volatile market. You can find helpful resources and currency converters online to stay updated on the latest exchange rates.

Featured Posts

-

Broadcoms Proposed V Mware Price Hike At And T Reports A 1050 Cost Surge

Apr 25, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1050 Cost Surge

Apr 25, 2025 -

Chinas Elevated Pain Threshold A Long Term Strategy Against Trumps Policies

Apr 25, 2025

Chinas Elevated Pain Threshold A Long Term Strategy Against Trumps Policies

Apr 25, 2025 -

The Best Childproof Makeup Storage Options For Your Home

Apr 25, 2025

The Best Childproof Makeup Storage Options For Your Home

Apr 25, 2025 -

Tony Hsiehs Unexpected Will A New Chapter In The Zappos Ceos Estate

Apr 25, 2025

Tony Hsiehs Unexpected Will A New Chapter In The Zappos Ceos Estate

Apr 25, 2025 -

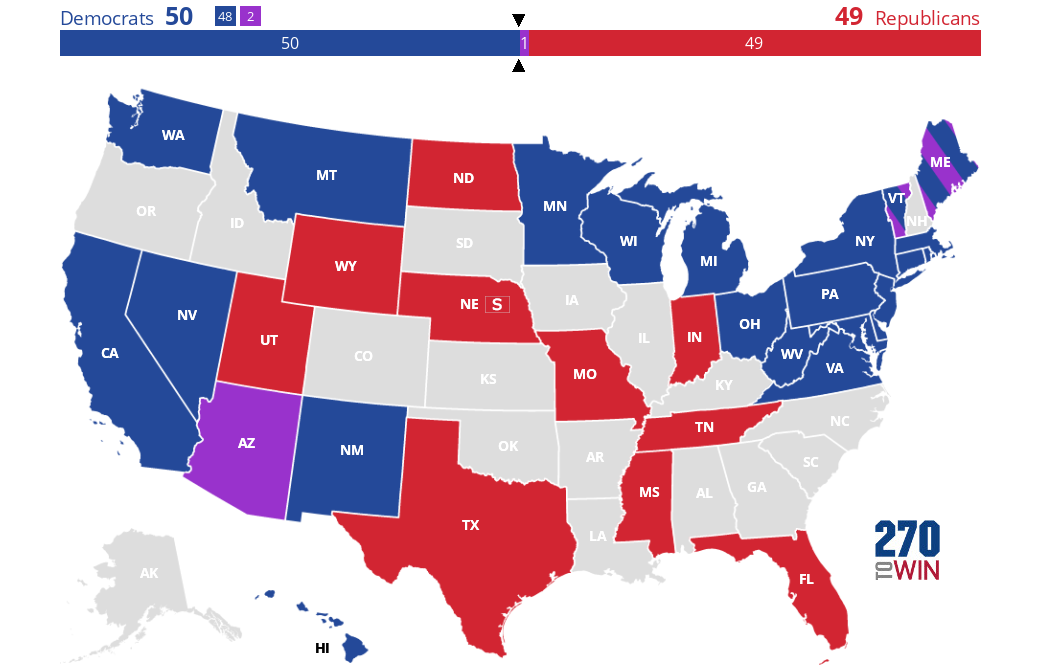

Montana Senate Control Democrats And Republicans Vie For Power

Apr 25, 2025

Montana Senate Control Democrats And Republicans Vie For Power

Apr 25, 2025