Canadian Economists Predict Deeper Recession Despite Lower Tariffs

Table of Contents

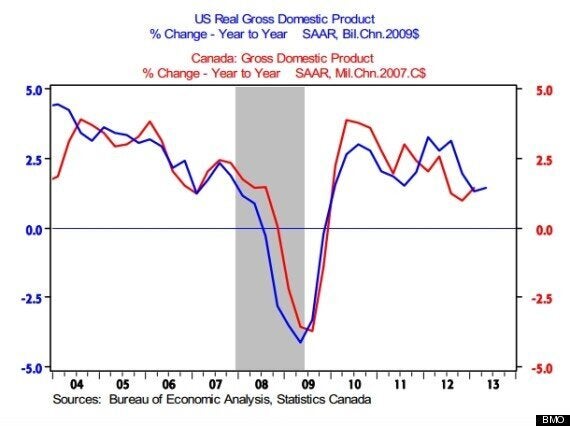

Weakening Global Economy Impacts Canada

The global economic landscape is significantly impacting Canada's economic trajectory, contributing to the predicted deeper recession. Several key factors are at play.

Global Supply Chain Disruptions

Persistent supply chain bottlenecks continue to plague Canadian businesses, leading to increased costs and reduced output. These disruptions are not simply a short-term problem; they are a significant drag on economic growth.

- Increased shipping costs: The cost of transporting goods has skyrocketed, impacting the price of everything from consumer goods to raw materials. This added expense reduces profit margins for businesses and contributes to inflation.

- Shortages of key materials: Many industries are facing shortages of essential components, forcing production cuts and delaying projects. This impacts manufacturing output and overall economic productivity.

- Factory closures due to supply shortages: In some cases, factories have been forced to temporarily or permanently close due to an inability to secure necessary inputs, leading to job losses and further economic contraction.

Reduced Global Demand

Lower global demand for Canadian exports significantly impacts key sectors, triggering a ripple effect throughout the Canadian economy.

- Falling commodity prices: Prices for key Canadian exports, such as oil, lumber, and agricultural products, have fallen, reducing revenue for producers and impacting related industries.

- Decreased exports to major trading partners: Reduced demand from major trading partners, including the United States and China, further dampens economic growth. This weakens export-oriented sectors, and reduces overall economic output.

- Impact on employment in export-oriented industries: The decline in exports is leading to job losses and increased unemployment in sectors heavily reliant on international trade.

Inflationary Pressures Remain High

While lower tariffs may offer some marginal relief, high inflation continues to significantly erode consumer spending and business investment. This remains a key driver of the pessimistic outlook for the Canadian economy.

- Rising interest rates: The Bank of Canada's efforts to combat inflation by raising interest rates are increasing borrowing costs for businesses and consumers, further dampening economic activity.

- Decreased consumer confidence: High inflation erodes consumer purchasing power and leads to decreased consumer confidence, resulting in reduced spending.

- Impact of inflation on household budgets: Rising prices for essential goods and services are squeezing household budgets, limiting disposable income and further reducing consumer spending.

Domestic Factors Exacerbating the Recession

Beyond global challenges, several domestic factors are also contributing to the anticipated deeper Canadian recession. These internal vulnerabilities are compounding the negative effects of global economic headwinds.

High Household Debt Levels

Canadians carry substantial levels of debt, making them highly vulnerable to economic shocks. Rising interest rates are increasing the burden of this debt, significantly impacting the economy.

- Rising interest rates increase debt servicing costs: Higher interest rates increase monthly payments on mortgages, loans, and credit card debt, reducing disposable income for households.

- Impacting disposable income: Increased debt servicing costs leave less money for spending and investment, further dampening economic activity.

- Potential for increased mortgage defaults: Rising interest rates increase the risk of mortgage defaults, potentially triggering a further downturn in the housing market and the broader economy.

Housing Market Correction

The previously overheated Canadian housing market is now experiencing a significant correction, impacting consumer wealth and spending. This correction is a key factor driving the prediction of a deeper recession.

- Falling house prices: Declining house prices reduce household wealth, leading to decreased consumer confidence and spending.

- Reduced construction activity: The slowdown in the housing market leads to reduced construction activity, impacting related industries and employment.

- Impact on related industries (e.g., real estate, furniture): The housing market correction ripples through the economy, affecting industries closely tied to housing construction and sales.

Labour Market Uncertainty

While unemployment remains relatively low, uncertainty about future job security is impacting consumer spending and investment. This uncertainty contributes to a climate of caution and reduced economic activity.

- Potential for job losses in struggling sectors: Sectors vulnerable to the economic downturn face potential job losses, further impacting consumer confidence.

- Impact on consumer confidence: Uncertainty about job security leads to decreased consumer confidence and reduced spending.

- Decrease in investment in human capital: Businesses may postpone investments in employee training and development due to economic uncertainty.

Lower Tariffs: Limited Impact on Recessionary Pressures

While the recent decrease in tariffs is a positive development, its impact on mitigating the predicted recession is likely to be limited. The scale of the tariff reductions is simply insufficient to offset the powerful headwinds facing the Canadian economy.

Insufficiency of Tariff Reductions

The magnitude of the tariff reductions is too small to significantly impact the overall economic situation.

- Limited impact on overall inflation: The reduction in tariffs has had a minimal effect on overall inflation, which remains a major concern.

- Minimal effect on consumer spending due to other economic pressures: Other economic factors, such as high interest rates and debt levels, are overriding the positive effects of lower tariffs on consumer spending.

- Inadequate stimulus for business investment: The tariff reductions have not provided sufficient stimulus to encourage significant business investment.

Focus on Other Economic Policies

Addressing the predicted Canadian recession requires a broader approach than simply reducing tariffs. A multifaceted strategy is needed to effectively stimulate the economy.

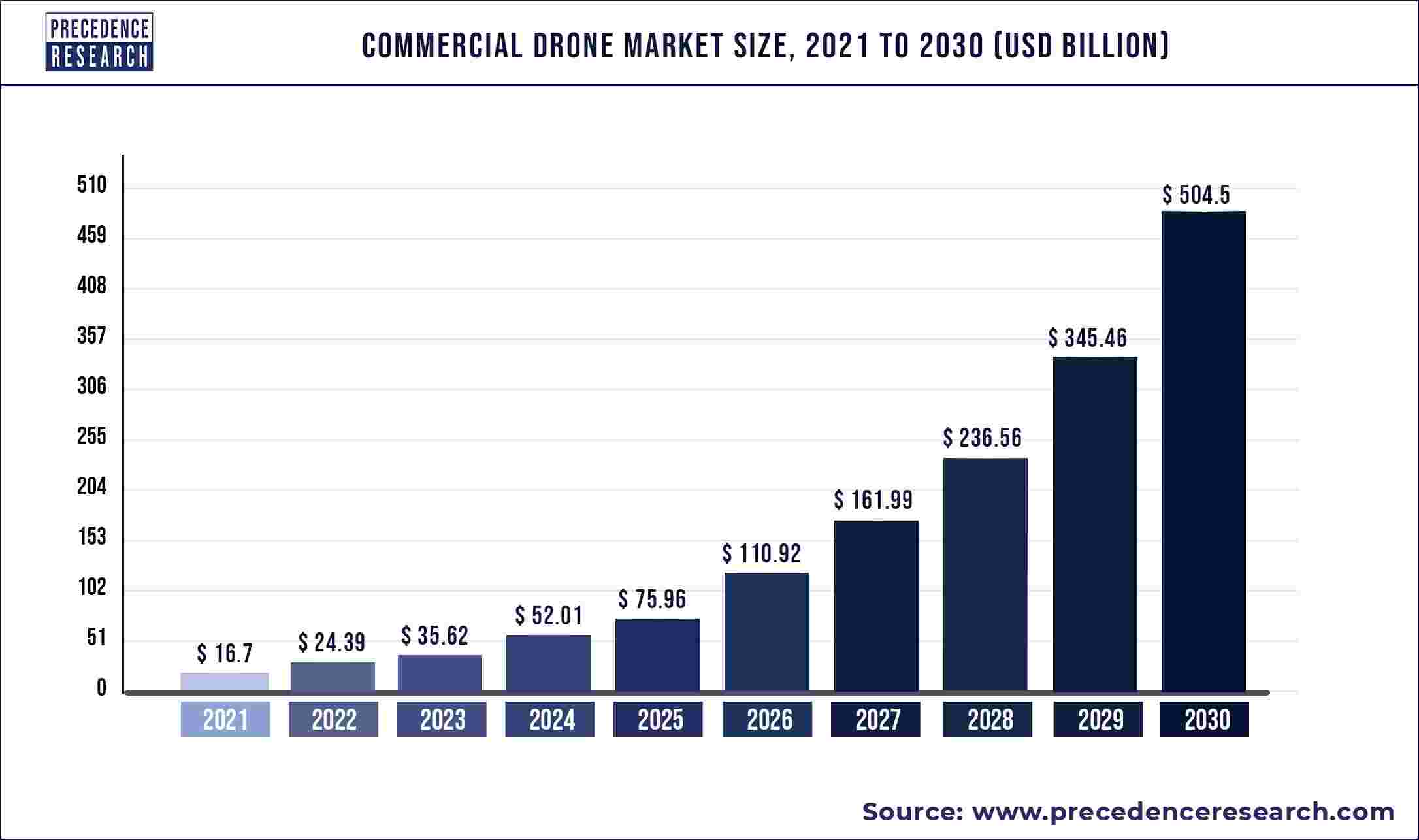

- Government investment in infrastructure: Government investment in infrastructure projects can create jobs and stimulate economic activity.

- Targeted support for struggling industries: Providing targeted support to industries particularly hard hit by the economic downturn can help mitigate job losses and prevent further economic contraction.

- Measures to address inflation: Effective measures to address inflation are crucial to restoring consumer confidence and encouraging spending and investment.

Conclusion

Leading Canadian economists predict a deeper recession than previously anticipated, despite recent tariff reductions. Several interconnected factors, including a weakening global economy, high household debt, and a cooling housing market, are contributing to this pessimistic outlook. Lower tariffs, while beneficial, are insufficient to counteract these powerful headwinds. The severity of this potential Canadian recession requires careful navigation and proactive strategies from both the government and individuals.

Understanding the complexities of the predicted Canadian recession is crucial for businesses and individuals alike. Stay informed about the latest economic developments and prepare for the challenges presented by this potential Canadian recession. Follow our blog for updates on the Canadian recession and related economic news.

Featured Posts

-

Pascal Boulanger Et La Fpi L Avenir Du Secteur Immobilier

Apr 23, 2025

Pascal Boulanger Et La Fpi L Avenir Du Secteur Immobilier

Apr 23, 2025 -

Five Key Economic Points From The English Language Leaders Debate

Apr 23, 2025

Five Key Economic Points From The English Language Leaders Debate

Apr 23, 2025 -

Retail Shakeup Finding New Homes For Inventory After Hudsons Bay Store Closures

Apr 23, 2025

Retail Shakeup Finding New Homes For Inventory After Hudsons Bay Store Closures

Apr 23, 2025 -

Bmw And Porsche In China Market Share Competition And Future Outlook

Apr 23, 2025

Bmw And Porsche In China Market Share Competition And Future Outlook

Apr 23, 2025 -

Iftar Ve Sahur Saatleri Ankara 3 Mart 2024 Pazartesi

Apr 23, 2025

Iftar Ve Sahur Saatleri Ankara 3 Mart 2024 Pazartesi

Apr 23, 2025