Canadian Private Investment Opportunities Targeted By CAAT Pension Plan

Table of Contents

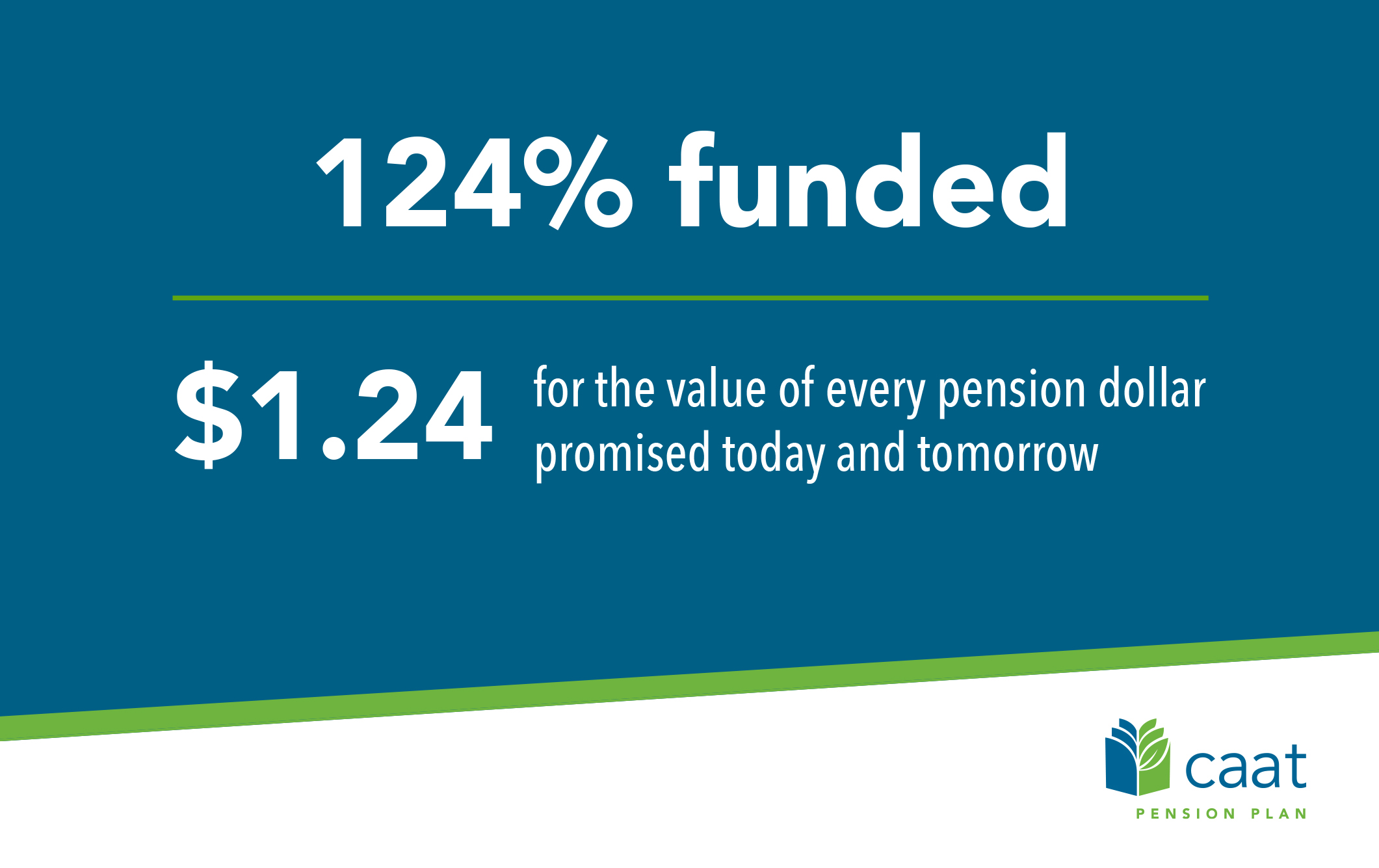

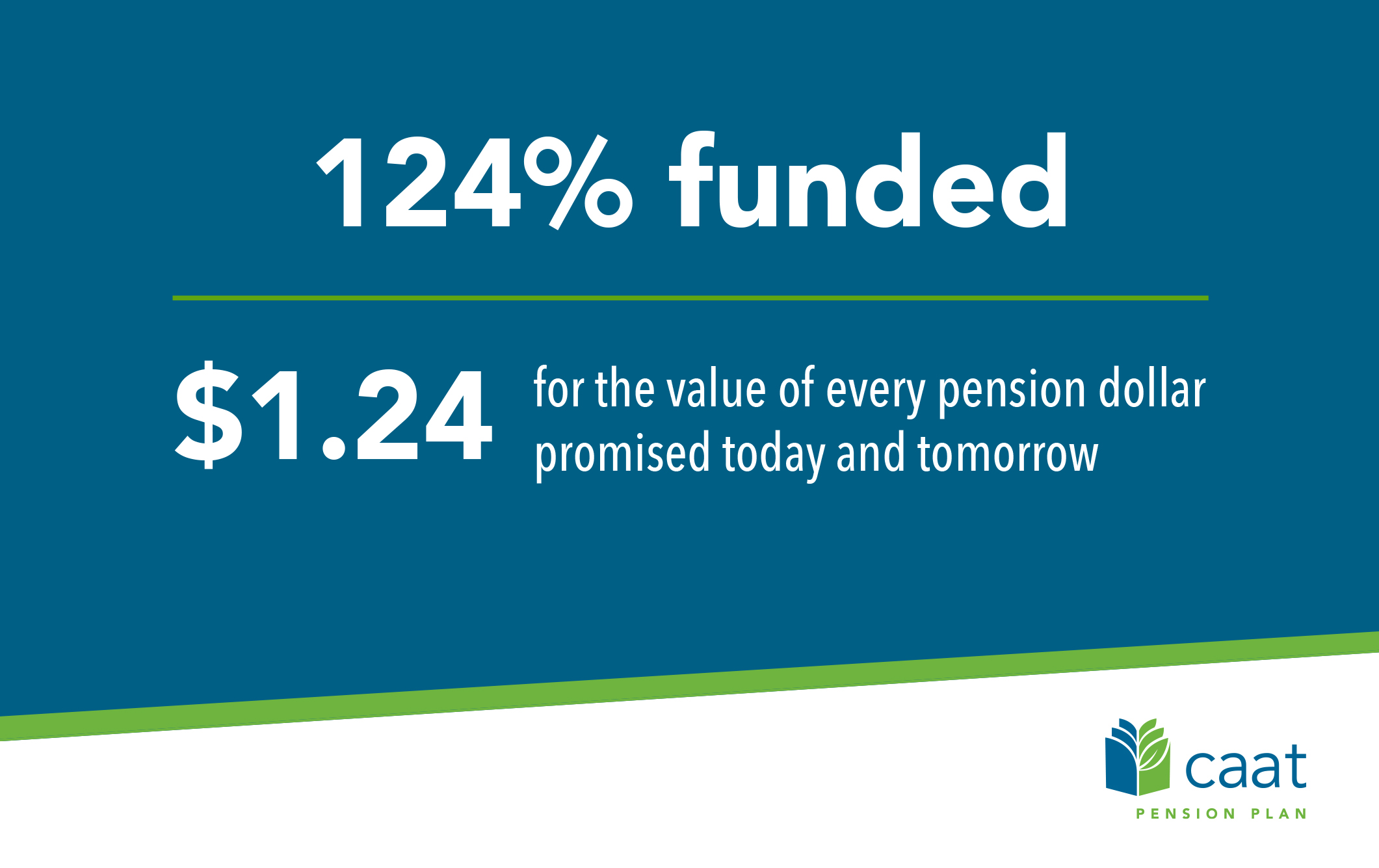

CAAT Pension Plan, a defined benefit pension plan covering academic, administrative, and research staff at the University of Toronto, is known for its sophisticated and long-term investment strategy. Its mandate is to prudently manage assets to ensure the long-term financial security of its members. This article will explore how CAAT’s pursuit of Canadian private investment opportunities contributes to this mandate.

CAAT's Investment Strategy and Focus on Private Equity in Canada

CAAT's investment strategy is built upon a foundation of diversification and long-term value creation. The plan recognizes the potential of private investments to deliver superior returns compared to publicly traded assets. This strategic prioritization of private investments stems from several key advantages:

- Higher Potential Returns: Private equity investments often offer the potential for significantly higher returns than publicly traded equities, particularly during periods of strong economic growth.

- Diversification Benefits: Private equity investments provide diversification beyond traditional asset classes, reducing overall portfolio risk. The illiquidity of private investments can act as a buffer against market volatility.

- Long-Term Investment Horizon Alignment: The long-term nature of private equity investments aligns perfectly with CAAT's long-term investment horizon, allowing for a patient approach to value creation.

- Access to Illiquid Assets: Private markets provide access to a wider range of investment opportunities, including illiquid assets that may be overlooked by public market investors.

Types of Canadian Private Investments Targeted by CAAT

CAAT's Canadian private investment strategy is diversified across several key sectors:

Real Estate

CAAT demonstrates a significant interest in Canadian real estate, focusing on various sectors to ensure diversification and mitigate risks. This includes:

- Industrial Real Estate: Driven by the growth of e-commerce and logistics, CAAT likely invests in modern warehousing and distribution facilities in major urban centers across Canada.

- Residential Real Estate: Investing in residential properties, particularly in high-growth areas, provides exposure to a stable and essential asset class. A focus on sustainable and energy-efficient buildings is likely.

- Commercial Real Estate: Investments in office buildings, retail spaces, and mixed-use developments in key Canadian cities offer strong potential for long-term appreciation.

- Geographic Focus: Investments are likely concentrated in major metropolitan areas like Toronto, Vancouver, Calgary, and Montreal, as well as strategically located secondary markets with high growth potential. Specific provinces experiencing strong population growth may also be prioritized. Examples of real estate investments, while often kept confidential, may be alluded to in CAAT’s annual reports.

Infrastructure

CAAT recognizes the importance of investing in essential infrastructure projects vital to the Canadian economy. This includes:

- Renewable Energy: Investments in wind, solar, and hydro power projects align with both financial returns and environmental sustainability goals.

- Transportation: Opportunities in transportation infrastructure, including toll roads, airports, and public transit systems, offer stable, long-term cash flows.

- Utilities: Investments in water, electricity, and gas distribution networks provide essential services and predictable returns. The focus here is likely on projects with strong regulatory frameworks and long-term contracts.

Private Equity in Various Sectors

CAAT actively invests in Canadian private equity across a range of sectors, employing rigorous due diligence and risk management strategies:

- Technology: Investments in promising Canadian technology companies, particularly those focused on disruptive technologies or software-as-a-service (SaaS) models, offer high growth potential.

- Healthcare: The aging population and increasing demand for healthcare services make this sector an attractive investment opportunity for CAAT.

- Natural Resources: While subject to commodity price fluctuations, strategic investments in Canadian natural resource companies with sustainable practices may offer long-term value. CAAT’s focus is likely on companies with strong management teams and a commitment to ESG principles.

Risk mitigation strategies employed by CAAT likely include thorough due diligence, portfolio diversification, and proactive management of investments.

Factors Driving CAAT's Interest in the Canadian Private Investment Market

Several key factors contribute to CAAT's strong interest in the Canadian private investment market:

- Low Interest Rate Environment: Historically low interest rates have made traditional fixed-income investments less attractive, prompting pension funds to seek higher-yielding alternatives.

- Strong Canadian Economic Growth (Historically): Periods of robust economic growth in specific sectors create favorable conditions for private investment opportunities.

- Government Policies: Government initiatives aimed at stimulating private investment and infrastructure development create a supportive regulatory environment.

- ESG Considerations: Environmental, Social, and Governance (ESG) factors are increasingly important in CAAT's investment decisions. The plan actively seeks out investments that align with its sustainability goals. This includes favouring companies with strong environmental performance, ethical labor practices, and robust corporate governance.

Conclusion: Securing Future Returns Through Canadian Private Investment Opportunities

CAAT's investment strategy demonstrates a clear commitment to Canadian private investments across real estate, infrastructure, and various private equity sectors. This diversified approach, driven by factors such as low interest rates, economic growth potential, and a focus on ESG principles, aims to secure strong long-term returns for its members. The advantages of private equity investments—higher potential returns, diversification, and alignment with a long-term investment horizon—make this a compelling strategy for pension funds like CAAT. Interested in learning more about lucrative Canadian private investment opportunities and how leading pension funds like CAAT approach this asset class? Explore the strategies employed by top-tier pension funds to secure strong, long-term returns.

Featured Posts

-

Brewers Vs Giants Flores And Lee Shine In San Francisco Win

Apr 23, 2025

Brewers Vs Giants Flores And Lee Shine In San Francisco Win

Apr 23, 2025 -

Oakland Athletics Secure 3 1 Win Against Milwaukee Brewers

Apr 23, 2025

Oakland Athletics Secure 3 1 Win Against Milwaukee Brewers

Apr 23, 2025 -

Chourios Power Display Leads Brewers To Victory Over Rockies

Apr 23, 2025

Chourios Power Display Leads Brewers To Victory Over Rockies

Apr 23, 2025 -

Nutriscore Dans Le Morning Retail Les Meilleures Options Pour Un Petit Dejeuner Sain

Apr 23, 2025

Nutriscore Dans Le Morning Retail Les Meilleures Options Pour Un Petit Dejeuner Sain

Apr 23, 2025 -

Us Holiday Calendar 2025 Federal And Non Federal Holidays

Apr 23, 2025

Us Holiday Calendar 2025 Federal And Non Federal Holidays

Apr 23, 2025