Canadian Regulators Halt Diversity And Climate Disclosure Amid Backlash

Table of Contents

The Reasons Behind the Halt

The decision to halt mandatory diversity and climate disclosure wasn't sudden; it's the culmination of mounting pressure and concerns from various stakeholders. Several key factors contributed to this reversal:

Political Backlash

Significant political opposition to mandatory ESG reporting formed a cornerstone of the backlash. Arguments centered around concerns about government overreach and the perceived excessive economic burden placed on Canadian businesses, particularly small and medium-sized enterprises (SMEs).

- Several prominent politicians publicly voiced concerns about the regulations, arguing they were overly burdensome and unnecessary.

- Powerful lobbying efforts from affected industries, including oil and gas, played a significant role in shaping the political landscape.

- Critics questioned the reliability and consistency of ESG data, highlighting the potential for “greenwashing” – the practice of making misleading or unsubstantiated claims about environmental performance.

Concerns Regarding Data Reliability and Standardization

The lack of standardized methodologies for collecting and reporting ESG data presented a considerable challenge. Inconsistencies in reporting frameworks created concerns about the comparability and reliability of the information, impacting investor confidence.

- Different reporting frameworks exist, leading to discrepancies in how companies report their environmental and social performance.

- The absence of globally accepted standards for ESG reporting makes it difficult to compare Canadian companies with their international counterparts.

- This lack of standardization increases the risk of greenwashing and makes it difficult for investors to make informed decisions based on ESG factors.

Economic Impact Concerns

Opponents of mandatory reporting raised concerns about potentially significant negative economic consequences. These concerns primarily focused on the increased compliance costs for businesses.

- The costs associated with implementing new reporting systems, auditing ESG data, and ensuring compliance can be substantial, especially for SMEs.

- Some argue that these increased costs could reduce competitiveness for Canadian companies compared to those operating in jurisdictions with less stringent regulations.

- Concerns were raised about the potential for job losses and reduced investment in certain sectors due to increased regulatory burdens.

Implications of the Halt

The decision to halt mandatory diversity and climate disclosure carries significant implications across various sectors:

Impact on Investors

Investors rely heavily on ESG data to make informed decisions and assess the environmental and social risks associated with their investments. The halt to mandatory reporting significantly impacts responsible investing strategies.

- The decreased transparency makes it more challenging for investors to assess environmental and social risks, potentially leading to misallocation of capital.

- The lack of consistent and reliable data could erode investor confidence in Canadian companies and the Canadian market as a whole.

- This could lead to a decrease in investment in companies committed to sustainable practices.

Effects on Corporate Governance

The halt could weaken corporate governance practices and discourage corporate responsibility initiatives. Companies may be less inclined to invest in sustainability efforts if there's no mandatory reporting requirement.

- A potential decline in corporate efforts towards diversity and environmental sustainability is a direct consequence.

- The implications for long-term strategic planning and risk management are substantial, as companies may prioritize short-term gains over long-term sustainability.

- This could damage Canada's reputation as a responsible and sustainable investment destination.

International Comparisons

Compared to other countries actively implementing robust ESG reporting regulations, Canada's decision to halt mandatory disclosure puts it at a disadvantage.

- The European Union, for example, has implemented comprehensive ESG reporting requirements, setting a high benchmark for global sustainability standards.

- Canada’s move could signal a retreat from global sustainability initiatives and impact its attractiveness as a destination for foreign investment committed to ESG principles.

- This could lead to a loss of international competitiveness and hinder Canada's progress towards its climate goals.

Potential Future Developments

While the halt to mandatory disclosure is a setback, several potential future developments could shape the landscape of ESG reporting in Canada:

Revised Regulatory Framework

A revised regulatory framework could address the concerns raised while still promoting ESG disclosure. This might involve:

- Phased implementation of regulations, allowing businesses more time to adapt.

- A voluntary system with incentives for companies to adopt robust ESG reporting practices.

- Greater emphasis on standardization and harmonization of reporting frameworks.

Role of Industry Self-Regulation

Industry associations could play a vital role in developing voluntary standards and promoting responsible reporting practices. This could involve:

- Collaboration with stakeholders to establish robust and credible ESG reporting frameworks.

- Creating industry best practices and guidelines to enhance transparency and consistency.

- Promoting the benefits of ESG reporting to encourage greater adoption by companies.

Continued Advocacy for Transparency

Advocacy from investors, civil society organizations, and other stakeholders remains crucial for driving greater transparency in corporate reporting. This could include:

- Increased pressure on companies to voluntarily adopt robust ESG reporting practices.

- Continued lobbying efforts to advocate for the reintroduction of mandatory reporting with improved safeguards.

- Promoting public awareness of the importance of ESG factors in investment decisions.

Conclusion

The halt of mandatory diversity and climate disclosure in Canada is a complex issue with far-reaching implications. Political backlash, concerns about data reliability, and economic impacts all contributed to this decision. The potential consequences for investors, corporate governance, and Canada's international standing are significant. However, the future of ESG reporting in Canada remains uncertain. A revised regulatory framework, industry self-regulation, and continued advocacy for transparency are all potential pathways forward. Staying informed about developments in Canadian diversity and climate disclosure regulations and participating in the ongoing debate surrounding ESG reporting and corporate social responsibility is crucial. Engage with the issue and advocate for policies that support sustainable business practices and transparency, ensuring Canada remains a leader in responsible corporate governance.

Featured Posts

-

Is Jack O Connell Joining The Cast Of Godzilla X Kong 3

Apr 25, 2025

Is Jack O Connell Joining The Cast Of Godzilla X Kong 3

Apr 25, 2025 -

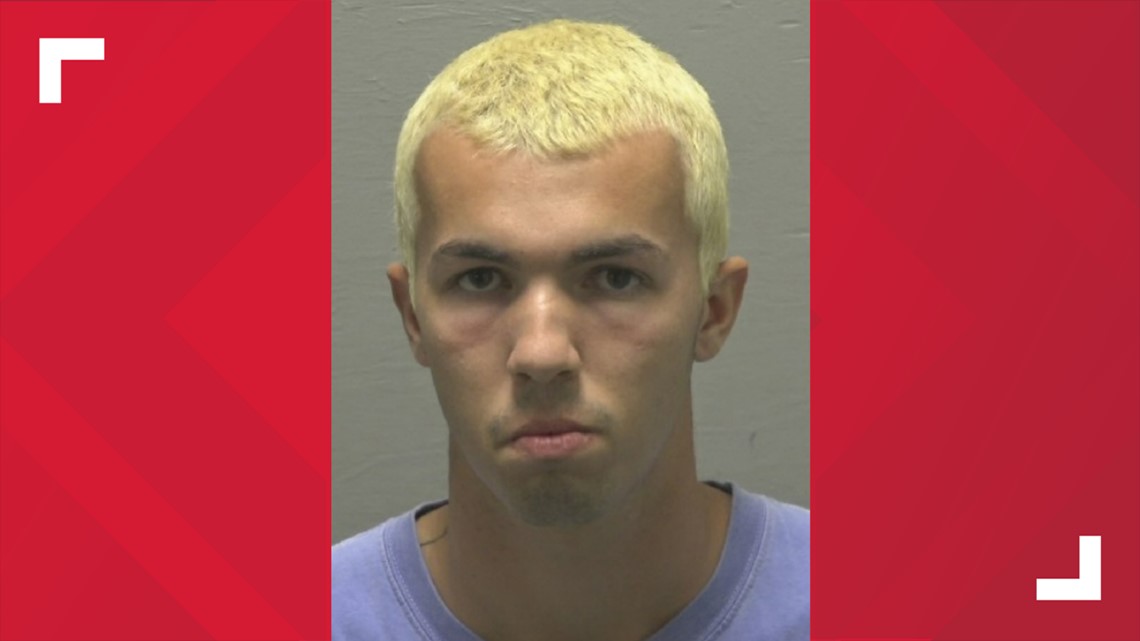

Former Charlottesville Weatherman Charged With Sexual Extortion

Apr 25, 2025

Former Charlottesville Weatherman Charged With Sexual Extortion

Apr 25, 2025 -

Injusticia En El Caso Malouf La Familia Roque Reclama Contra La Condena De Q6 Millones

Apr 25, 2025

Injusticia En El Caso Malouf La Familia Roque Reclama Contra La Condena De Q6 Millones

Apr 25, 2025 -

Parents Applauded Sherwood Ridge Primary Schools Anzac Day Religious Observance Policy

Apr 25, 2025

Parents Applauded Sherwood Ridge Primary Schools Anzac Day Religious Observance Policy

Apr 25, 2025 -

New Godzilla X Kong 3 Casting News Jack O Connell

Apr 25, 2025

New Godzilla X Kong 3 Casting News Jack O Connell

Apr 25, 2025