Canadian Tire Acquires Hudson's Bay Assets For $30 Million

Table of Contents

H2: Details of the Acquisition

H3: Assets Acquired: The specifics of the acquired assets remain somewhat opaque, with official statements from both companies lacking precise details. However, reports suggest the $30 million deal primarily involves strategically located real estate holdings. This likely includes:

- A select number of prime retail locations across Canada, potentially in high-traffic areas with strong customer demographics. The exact number and locations remain undisclosed, pending finalization of the acquisition.

- Potentially existing lease agreements, offering immediate revenue streams and minimizing upfront investment required for leasehold improvements.

- Possibly some related intellectual property, although this aspect of the deal has received limited public attention.

H3: Acquisition Price and Financing: The $30 million price tag has sparked debate among industry analysts. Some suggest it's a shrewd investment, given the potential value of the acquired real estate. Others question the lack of detailed information surrounding the deal. Canadian Tire has not publicly disclosed the specific funding mechanism, although it's likely a combination of existing cash reserves and potentially short-term financing. The seemingly low price might be due to the specific assets involved or strategic concessions by the Hudson's Bay Company.

H3: Timeline and Closing Date: The acquisition was announced on [Insert Date of Announcement], with expectations of a final closing date by [Insert Expected Closing Date]. The delay suggests ongoing due diligence and legal processes related to the transfer of assets.

H2: Strategic Implications for Canadian Tire

H3: Expansion and Market Share: This acquisition provides Canadian Tire with a significant opportunity to expand its physical retail presence and broaden its customer reach. Acquiring prime retail locations allows Canadian Tire to:

- Increase its retail space, potentially leading to a greater selection of products and improved customer experiences.

- Gain access to new customer demographics and markets, potentially driving overall revenue growth.

- Capitalize on synergies with existing Canadian Tire operations, potentially reducing costs through streamlined logistics and purchasing.

H3: Competitive Advantages: By securing strategic real estate, Canadian Tire strengthens its competitive position against key rivals like Walmart and Lowe's. This move potentially disrupts the established market dynamics, offering Canadian Tire a chance to increase market share. The prime locations will allow Canadian Tire to better compete for customers in key areas.

H3: Long-Term Growth Strategy: This acquisition aligns with Canadian Tire's long-term strategy of diversifying its retail footprint and becoming a more prominent player in the Canadian market. This expansion could become a key component of Canadian Tire's efforts to attract a new generation of customers. The acquired assets are likely strategically positioned to complement existing locations and support future expansion plans.

H2: Impact on Hudson's Bay Company

H3: Financial Implications: For Hudson's Bay, the sale of these assets generates $30 million in revenue, improving its overall financial position. This divestment likely reflects Hudson's Bay’s focus on streamlining its operations and concentrating its resources on its core business segments.

H3: Future Strategic Direction: This sale signals Hudson's Bay's ongoing strategic shift, focusing its efforts and investments on its key brands and assets. This divestiture allows Hudson's Bay to reallocate resources toward more profitable areas of its business.

H2: Industry Analysis and Expert Opinions

H3: Retail Industry Trends: The acquisition reflects ongoing trends in the Canadian retail landscape, including a focus on omnichannel strategies and a need for strategic real estate holdings to maintain a strong physical presence. The acquisition demonstrates a commitment to bricks-and-mortar retail despite the rise of e-commerce.

H3: Analyst Commentary: [Insert quotes and analysis from reputable industry analysts]. Analysts generally view the acquisition as a strategic move for Canadian Tire, although there's some debate surrounding the long-term impact and the precise value of the acquired assets. The lack of transparency has also prompted calls for increased disclosure from both companies.

3. Conclusion:

Canadian Tire's $30 million acquisition of select Hudson's Bay assets represents a significant development in the Canadian retail sector. The deal provides Canadian Tire with an opportunity to expand its retail footprint, strengthen its competitive position, and bolster its long-term growth strategy. While details remain limited, the strategic implications for both companies are undeniable. For Hudson's Bay, this divestment contributes to financial restructuring and a refocusing of resources. This acquisition will undoubtedly reshape the Canadian retail landscape. Stay tuned for updates on this significant Canadian Tire acquisition and learn more about the evolving landscape of Canadian retail by following [link to relevant resources].

Featured Posts

-

Dashcam Footage Reveals Reckless E Scooter Use On Busy Auckland Southern Motorway

May 17, 2025

Dashcam Footage Reveals Reckless E Scooter Use On Busy Auckland Southern Motorway

May 17, 2025 -

Jalen Brunson Injury Report Assessing The Point Guards Status

May 17, 2025

Jalen Brunson Injury Report Assessing The Point Guards Status

May 17, 2025 -

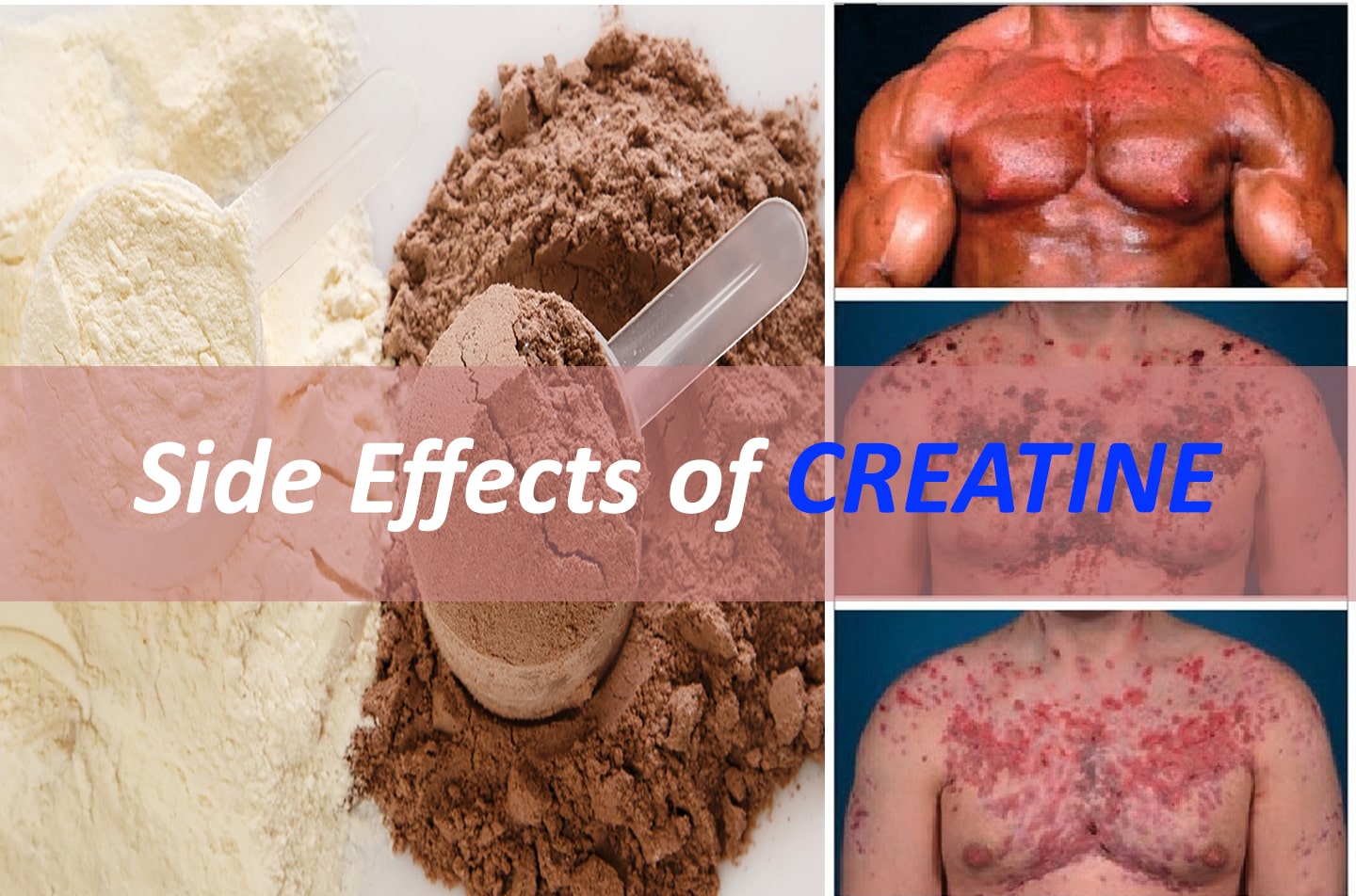

Creatine Benefits Side Effects And Who Should Use It

May 17, 2025

Creatine Benefits Side Effects And Who Should Use It

May 17, 2025 -

Golden State Valkyries Add Former Minnesota Lynx Standout

May 17, 2025

Golden State Valkyries Add Former Minnesota Lynx Standout

May 17, 2025 -

186 Milyon Dolar Novak Djokovic In Rekor Geliri Ve Basarilari

May 17, 2025

186 Milyon Dolar Novak Djokovic In Rekor Geliri Ve Basarilari

May 17, 2025