Canadian Tire-Hudson's Bay Merger: Opportunities And Challenges

Table of Contents

Synergies and Potential Opportunities

The potential benefits of a Canadian Tire and Hudson's Bay merger are substantial, stemming from the combined strengths of both retail giants. The combined entity would create a powerhouse in the Canadian retail sector, capable of leveraging its vast resources and expertise for significant gains.

Enhanced Market Share and Reach

A combined Canadian Tire and HBC would dramatically increase market share across various retail sectors. This expansion would be fueled by:

- Geographic Expansion: Leveraging the existing extensive store networks of both companies would provide unparalleled geographic reach across Canada, reducing reliance on specific regions and maximizing market penetration.

- Cross-selling Opportunities: The overlapping customer bases of Canadian Tire and HBC present significant opportunities for cross-selling. Canadian Tire's loyal customer base, known for their interest in home improvement and outdoor products, could be readily introduced to HBC's offerings, and vice-versa. For instance, HBC's higher-end customer base could be exposed to Canadian Tire's automotive and sporting goods offerings.

- Market Share Gains: Specific product categories stand to benefit significantly. For example, the merger could lead to substantial increases in market share for home goods, sporting goods, and apparel. This would solidify their position against key competitors.

Supply Chain Optimization and Cost Savings

Significant cost savings and operational efficiencies are anticipated through the integration of supply chains and operations. This includes:

- Consolidated Distribution: Combining distribution networks will streamline logistics, reduce transportation costs, and improve delivery times.

- Increased Purchasing Power: The combined entity's increased purchasing volume will enable it to negotiate significantly better terms with suppliers, leading to lower input costs.

- Operational Streamlining: Eliminating redundancies in administrative functions and streamlining operations will generate substantial cost savings.

- Improved Inventory Management: Advanced inventory management systems can reduce waste and optimize stock levels, minimizing storage costs and preventing stockouts.

Brand Diversification and Expanded Product Portfolio

The merger offers an opportunity for both brands to diversify their product portfolios and attract new customer segments.

- Upscale Offerings: Canadian Tire could expand its product offerings into higher-end goods and services, capitalizing on HBC's expertise in luxury retail.

- New Customer Demographics: HBC's established luxury brands can attract a new, higher-income demographic to the combined entity's offerings.

- Reduced Sector Reliance: A more diverse product portfolio will reduce the risk associated with over-reliance on any single product sector, making the combined entity more resilient to economic fluctuations.

- Enhanced Brand Recognition: The merger could lead to increased brand recognition and customer loyalty, enhancing the overall value proposition of the combined entity.

Challenges and Potential Risks

While the potential benefits are substantial, the Canadian Tire-Hudson's Bay merger faces significant challenges and risks.

Integration Difficulties and Operational Hurdles

Merging two large organizations with distinct corporate cultures, operational systems, and management styles presents considerable integration challenges:

- Culture Clash: Integrating different corporate cultures and management styles can lead to internal conflicts and hinder efficiency.

- Operational Disruption: The merger process itself could disrupt existing operations, potentially leading to temporary losses in productivity and revenue.

- IT System Integration: Integrating disparate IT systems can be technically complex and time-consuming, posing risks to data security and operational continuity.

- Employee Relations: Restructuring and potential layoffs are likely, which could negatively impact employee morale and productivity.

- Customer Alienation: Changes in branding, service offerings, or store layouts could alienate existing customers of either company.

Regulatory Scrutiny and Antitrust Concerns

The merger will likely face intense regulatory scrutiny and potential antitrust concerns:

- Antitrust Investigations: Regulators will examine the merger for potential anti-competitive effects and may require divestitures or other concessions to approve the deal.

- Market Dominance: Concerns about the combined entity achieving excessive market dominance in certain product categories are likely.

- Regulatory Compliance: Navigating the complex regulatory frameworks and compliance requirements will require significant resources and expertise.

Economic Downturn and Consumer Spending

The success of the merger hinges on favorable economic conditions and consistent consumer spending:

- Economic Vulnerability: The combined entity will be vulnerable to economic downturns and shifts in consumer spending patterns.

- Inflationary Pressure: Rising inflation and interest rates could dampen consumer demand, affecting sales and profitability.

- E-commerce Competition: The rise of e-commerce presents a persistent challenge, requiring the combined entity to adapt and compete effectively in the online marketplace.

Conclusion

The Canadian Tire-Hudson's Bay merger presents a compelling opportunity to create a dominant force in the Canadian retail landscape. However, realizing this potential requires meticulous planning, effective integration strategies, and a proactive approach to mitigating the considerable risks involved. The success of this merger will significantly shape the future of Canadian retail, impacting consumers, competitors, and the broader economy. Overcoming the integration challenges and navigating the regulatory hurdles will be crucial for achieving the anticipated synergies and creating a truly formidable retail powerhouse.

Call to Action: Stay informed about the unfolding developments of the Canadian Tire-Hudson's Bay merger and its impact on the Canadian retail landscape. Follow us for future updates and analysis on this transformative event. Learn more about the potential opportunities and challenges surrounding this important Canadian Tire and Hudson's Bay merger.

Featured Posts

-

Porsches Strategic Challenge Reconciling Ferrari And Mercedes Brand Identities

May 21, 2025

Porsches Strategic Challenge Reconciling Ferrari And Mercedes Brand Identities

May 21, 2025 -

The Traverso Family A Photographic Legacy At Cannes

May 21, 2025

The Traverso Family A Photographic Legacy At Cannes

May 21, 2025 -

D Wave Quantum Qbts Stock Performance Thursdays Market Activity

May 21, 2025

D Wave Quantum Qbts Stock Performance Thursdays Market Activity

May 21, 2025 -

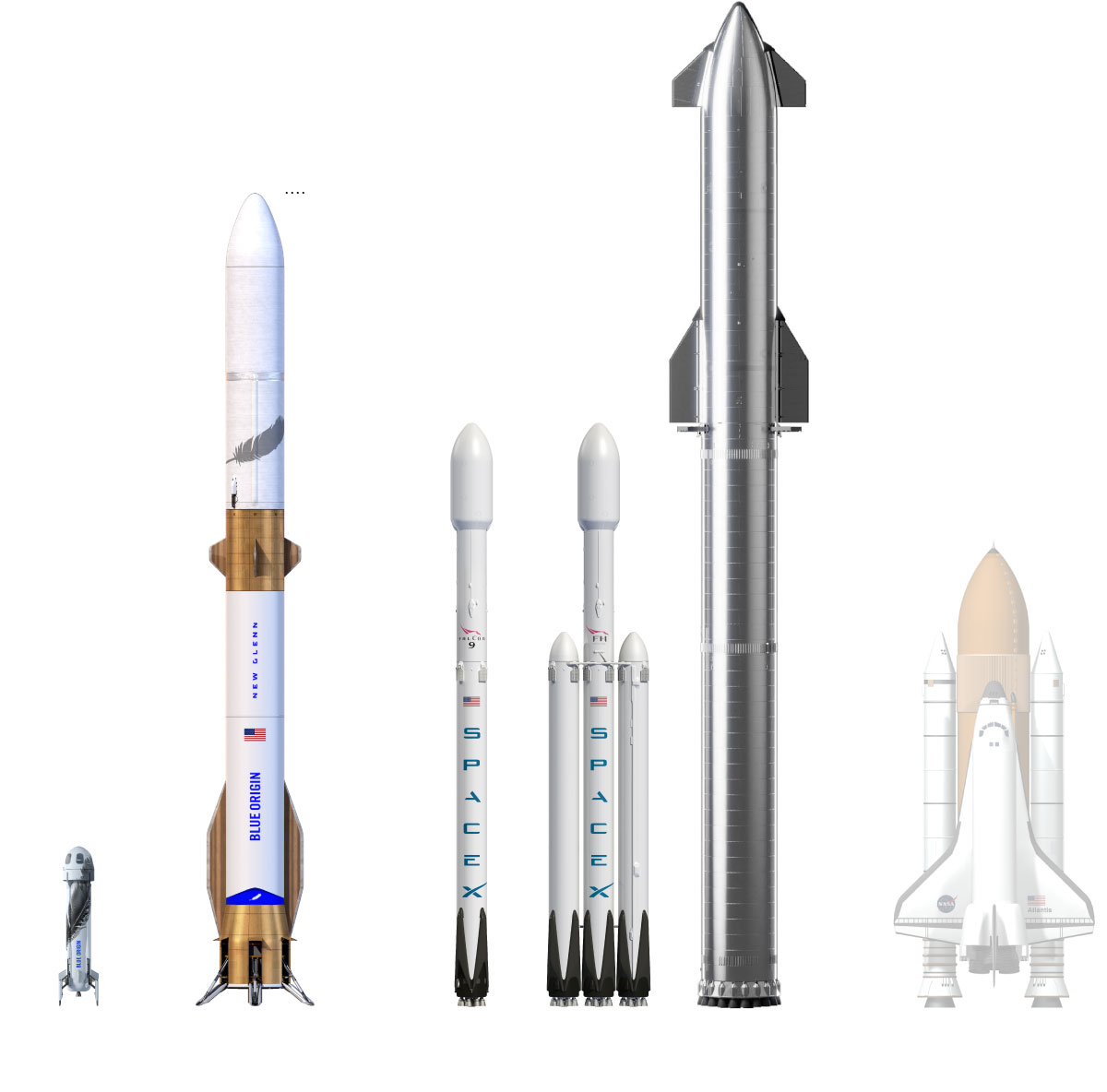

Blue Origin Rocket Launch Postponed Vehicle Subsystem Malfunction

May 21, 2025

Blue Origin Rocket Launch Postponed Vehicle Subsystem Malfunction

May 21, 2025 -

Peppa Pig Mums Big Gender Reveal Sparks Viral Discussion

May 21, 2025

Peppa Pig Mums Big Gender Reveal Sparks Viral Discussion

May 21, 2025