Carney's Economic Transformation: A Generational Shift?

Table of Contents

The Rise of Sustainable Finance under Carney's Leadership

Carney's leadership has been instrumental in pushing the sustainable finance agenda to the forefront of global economic discourse. His advocacy for integrating environmental, social, and governance (ESG) factors into financial decision-making has profoundly influenced the financial landscape. Key aspects of this transformation include:

-

ESG Investing and Green Finance: Carney championed the incorporation of ESG factors into investment strategies, driving the growth of the green finance sector and encouraging responsible investment practices. This has led to a significant increase in capital flowing towards sustainable projects and businesses.

-

The Task Force on Climate-related Financial Disclosures (TCFD): The establishment of the TCFD, under Carney's leadership, has been pivotal in improving corporate transparency regarding climate-related risks and opportunities. This initiative has significantly enhanced the ability of investors and stakeholders to assess the climate resilience of companies, leading to improved risk management.

-

Central Bank Influence: Carney stressed the crucial role of central banks in promoting sustainable finance and managing climate-related financial risks. This has spurred a growing number of central banks to integrate climate considerations into their monetary policy frameworks and supervisory practices.

-

Challenges and Criticisms: Despite significant progress, challenges remain. Concerns around "greenwashing," the difficulty in standardizing ESG reporting, and the need for more robust regulatory frameworks continue to be debated. Critics question the effectiveness of voluntary initiatives and call for stricter regulations to ensure genuine progress towards a sustainable financial system.

Addressing Climate Change as a Systemic Risk

Carney consistently highlighted climate change as a major threat to global financial stability, framing it not as a peripheral concern, but as a systemic risk requiring urgent attention. His emphasis on this issue has led to several significant developments:

-

Climate Risk Management: The integration of climate-related risks into stress testing and regulatory frameworks is gaining momentum. Financial institutions are increasingly required to assess and disclose their exposure to climate-related risks, including transition risks (risks associated with the shift to a low-carbon economy) and physical risks (risks associated with extreme weather events).

-

Carbon Pricing Mechanisms: Carney has been a vocal advocate for effective carbon pricing mechanisms, such as carbon taxes or emissions trading systems, as essential tools for driving decarbonization and internalizing the cost of carbon emissions. The debate surrounding the optimal design and implementation of such mechanisms remains ongoing.

-

Central Bank Role in Mitigation: Central banks are now actively involved in assessing and mitigating climate-related risks. This involves monitoring climate-related financial risks, influencing lending practices towards sustainable activities, and potentially even using monetary policy tools to incentivize the transition to a low-carbon economy.

Impact on Economic Policy and Regulation

Carney's influence extends beyond the realm of finance; his ideas have significantly shaped the broader landscape of economic policy and financial regulation.

-

Monetary Policy and Sustainability: Central banks are starting to incorporate sustainability concerns into their monetary policy frameworks. This may involve adjusting lending practices to favor green investments or incorporating climate-related scenarios into macroeconomic forecasts.

-

Fiscal Policy and Climate Action: The integration of climate considerations into fiscal policy decisions is becoming increasingly important. Governments are incorporating climate-related targets into their fiscal strategies and designing policies to incentivize green investments and technologies.

-

Regulatory Challenges and Future Frameworks: Implementing a truly sustainable economic model presents significant regulatory challenges. Harmonizing regulations across jurisdictions, addressing data gaps, and creating effective enforcement mechanisms are crucial for success. The development of future regulatory frameworks will be significantly influenced by the lessons learned from Carney's initiatives.

A Generational Shift or Incremental Change?

Whether Carney's contributions represent a generational shift or incremental change is a matter of ongoing debate. While his work has undoubtedly accelerated the integration of climate considerations into mainstream economics and finance, many challenges remain. His legacy is complex: while he significantly advanced sustainable finance and the recognition of climate risk, fully integrating these considerations into economic policy and regulation is still a work in progress. The lasting impact will depend on the extent to which future leaders build upon his foundations.

Conclusion

This article explored the substantial contributions of Mark Carney to the evolving field of sustainable finance and the integration of climate considerations into economic policy. We analyzed his key initiatives and their impact on the global economy, evaluating whether these efforts constitute a genuine generational shift. The analysis reveals a complex picture, with significant advancements accompanied by ongoing challenges.

Understanding Carney's economic transformation is crucial for anyone interested in the future of finance and sustainable development. Further research and critical discussion are needed to fully grasp the long-term implications of this significant shift. Continue exploring the topic of Carney's economic transformation and its potential to reshape the global economy for future generations.

Featured Posts

-

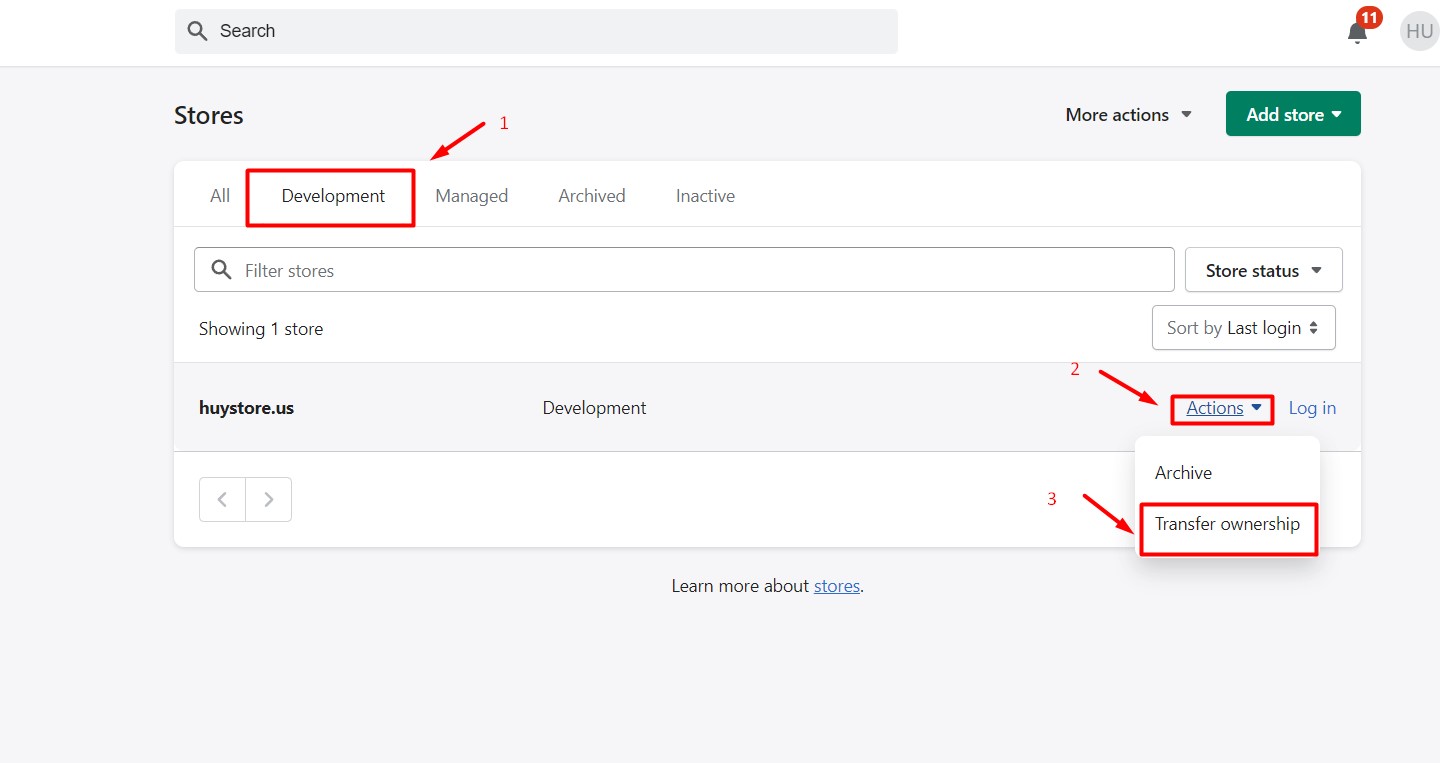

Understanding The Shift To A Lifetime Revenue Share For Shopify Developers

May 04, 2025

Understanding The Shift To A Lifetime Revenue Share For Shopify Developers

May 04, 2025 -

Stepfather Charged With Murder After Alleged Torture And Starvation Of 16 Year Old Stepson

May 04, 2025

Stepfather Charged With Murder After Alleged Torture And Starvation Of 16 Year Old Stepson

May 04, 2025 -

Security Row Prince Harry Says King Charles Has Cut Him Off

May 04, 2025

Security Row Prince Harry Says King Charles Has Cut Him Off

May 04, 2025 -

Kivinin Kabugunu Yemek Guevenli Mi Ayrintili Bilgi Ve Oeneriler

May 04, 2025

Kivinin Kabugunu Yemek Guevenli Mi Ayrintili Bilgi Ve Oeneriler

May 04, 2025 -

Cutout Bodysuit And Tights Angelinas Style Echoes Bianca Censori

May 04, 2025

Cutout Bodysuit And Tights Angelinas Style Echoes Bianca Censori

May 04, 2025