Celtics' $6.1 Billion Sale To Private Equity: What It Means For The Future

Table of Contents

The Impact of Private Equity Ownership on the Celtics

The Celtics sale to private equity signifies a departure from traditional ownership models and introduces a new era for the franchise. This shift promises both exciting possibilities and potential challenges.

Financial Implications

Private equity's substantial financial resources could dramatically alter the Celtics' trajectory. The infusion of capital could lead to significant improvements across various aspects of the franchise.

- Increased spending on free agents: The Celtics may become more aggressive in pursuing top-tier talent in free agency, bolstering their roster and increasing their competitiveness.

- Stadium renovations and infrastructure improvements: Upgrades to TD Garden and the team's training facilities are likely, enhancing the fan experience and player development.

- Exploring international markets: Private equity firms often possess global networks, opening doors for the Celtics to expand their brand and revenue streams internationally.

- Enhanced fan engagement strategies: Expect innovative digital strategies and improved fan interaction to maximize engagement and revenue generation. This could include enhanced mobile apps, personalized content, and interactive experiences.

Operational Changes

Private equity's data-driven approach to business could revolutionize the Celtics' operations. Expect a shift towards more sophisticated analytical tools and strategies.

- Improved player scouting and development: Advanced analytics could optimize player recruitment and development, identifying and nurturing future stars.

- Strategic use of analytics in game planning: Data-driven insights could inform coaching decisions, leading to more effective game strategies and improved on-court performance.

- Increased efficiency in back-office operations: Streamlining administrative processes and improving operational efficiency could lead to cost savings and increased profitability.

The Broader Implications for the NBA

The Celtics sale sets a significant precedent for the NBA, potentially reshaping the league's landscape and influencing future transactions.

Rising Team Valuations

The $6.1 billion price tag dramatically raises the benchmark for NBA franchise valuations. This could have ripple effects across the league.

- Increased investor interest in NBA teams: The Celtics sale validates the NBA as a lucrative investment, attracting further interest from private equity firms and other high-net-worth individuals.

- Potential for future mega-deals: Expect other NBA teams to command increasingly higher valuations in future sales, mirroring the Celtics' record-breaking transaction.

- Impact on franchise valuations across the league: The Celtics sale will likely drive up valuations across the NBA, potentially leading to increased franchise values and overall league revenue.

Changes in Team Ownership Models

This transaction marks a significant shift towards private equity ownership in professional sports, potentially altering traditional team governance structures.

- Increased influence of private equity in sports: Expect to see a continued trend of private equity firms acquiring sports franchises, driven by the potential for high returns on investment.

- Potential for increased focus on financial returns: While winning is still paramount, private equity owners may place a greater emphasis on maximizing financial returns, influencing strategic decisions.

- Impact on traditional ownership structures: The shift towards private equity ownership challenges the established model of family-owned or long-term community-based ownership in professional sports.

Fan Perspectives and Concerns Regarding the Celtics Sale

While the Celtics sale promises potential benefits, fan concerns are valid and require addressing. Maintaining fan loyalty and engagement is crucial for long-term success.

Ticket Prices and Accessibility

A primary concern revolves around the potential for increased ticket prices, impacting fan accessibility to games.

- Impact on affordability for average fans: Rising ticket prices could make attending games financially challenging for many loyal fans, potentially reducing attendance.

- Potential for increased season ticket prices: Season ticket holders may face significant price increases, impacting their ability to continue supporting the team.

- Strategies for maintaining fan accessibility: The new ownership needs to implement strategies to ensure that games remain accessible to a broad range of fans, including affordable ticket options and family-friendly initiatives.

Maintaining Team Identity and Culture

Preserving the Celtics' rich history and unique team culture is paramount. This requires a delicate balance between financial success and maintaining the team's legacy.

- Balancing profitability with team tradition: The new owners must demonstrate a commitment to preserving the Celtics' identity and traditions, even as they pursue financial goals.

- Community engagement strategies: Continued engagement with the Boston community is essential to maintain the strong bond between the team and its fanbase.

- The importance of maintaining the team's legacy: Respecting the Celtics' history and heritage is crucial to maintaining fan loyalty and attracting new generations of supporters.

Conclusion

The $6.1 billion Celtics sale to private equity marks a pivotal moment in the franchise's history and the NBA as a whole. While the sale promises increased investment and potentially improved on-court performance, it also raises valid concerns regarding fan accessibility and the preservation of the team’s unique culture. Understanding the implications of this historic Celtics sale is crucial for fans, investors, and the NBA as a whole. Stay informed on future developments regarding this landmark Celtics sale and its ongoing impact on the league. Follow the ongoing saga of the Celtics sale for the latest updates and analysis.

Featured Posts

-

Resumen Del Partido Belgica 0 1 Portugal Goles Y Jugadas Clave

May 16, 2025

Resumen Del Partido Belgica 0 1 Portugal Goles Y Jugadas Clave

May 16, 2025 -

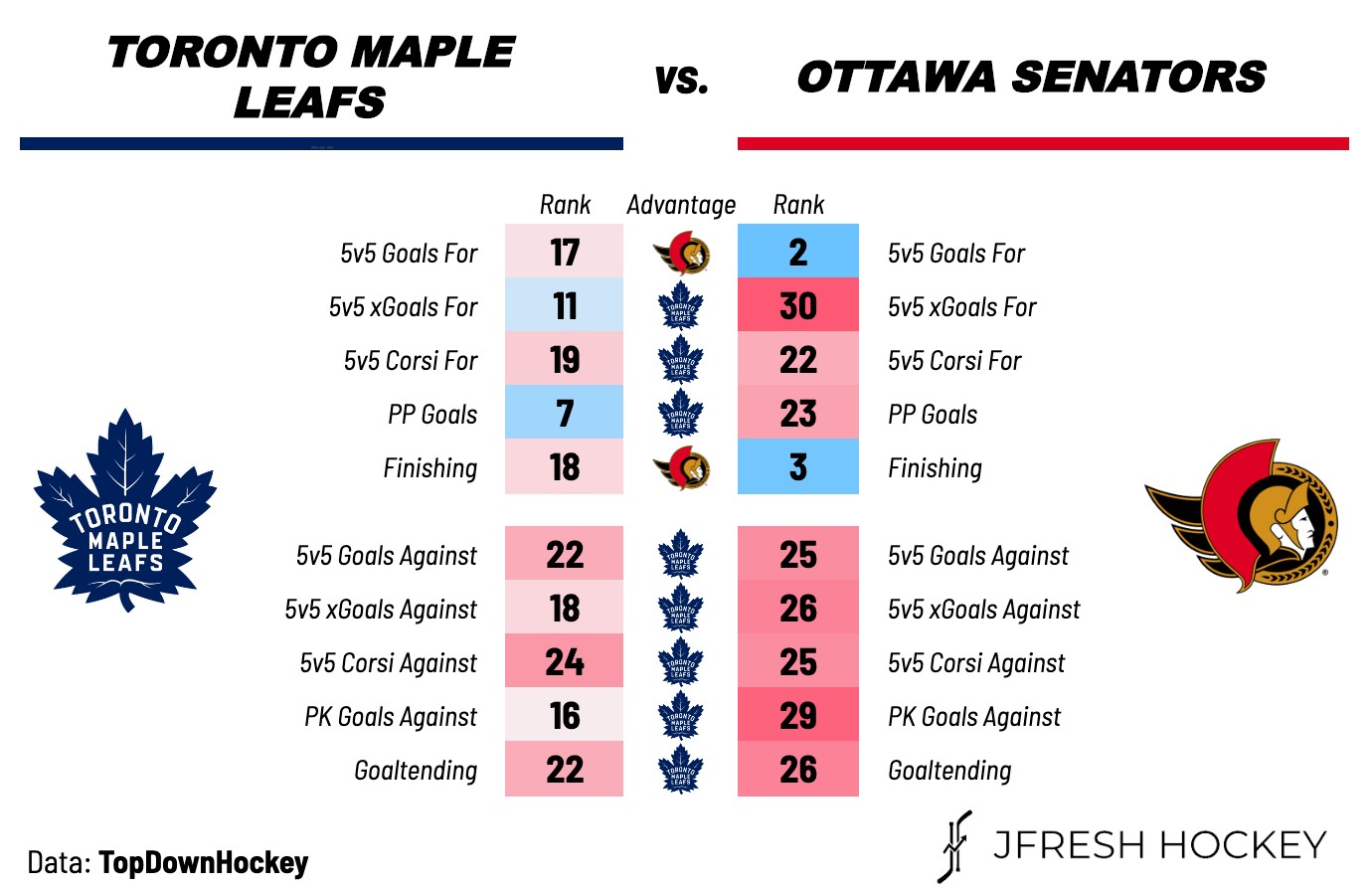

How To Stream Toronto Maple Leafs Vs Ottawa Senators Game 4 Free Live Nhl Playoffs

May 16, 2025

How To Stream Toronto Maple Leafs Vs Ottawa Senators Game 4 Free Live Nhl Playoffs

May 16, 2025 -

Athletic Club De Bilbao Stay Updated With Vavel Usas Comprehensive Coverage

May 16, 2025

Athletic Club De Bilbao Stay Updated With Vavel Usas Comprehensive Coverage

May 16, 2025 -

Full 2025 Padres Baseball Broadcast Schedule Revealed

May 16, 2025

Full 2025 Padres Baseball Broadcast Schedule Revealed

May 16, 2025 -

Nba Playoffs Prediction 76ers Vs Celtics Who Will Advance

May 16, 2025

Nba Playoffs Prediction 76ers Vs Celtics Who Will Advance

May 16, 2025