Celtics Sale To Private Equity: A $6.1 Billion Deal Sparks Fan Uncertainty

Table of Contents

The $6.1 Billion Deal: Details and Implications

Who Bought the Celtics and What Does it Mean?

- Buyer: Bain Capital, a prominent global private equity firm, spearheaded the acquisition.

- Background: Bain Capital boasts a long history of successful investments across various sectors, including significant experience in sports ownership. They have a reputation for strategic, long-term investments, although this is their first foray into NBA ownership on this scale.

- Investment Strategy: Bain Capital's investment strategy often involves leveraging operational expertise to improve portfolio companies’ performance. This approach could bring significant improvements to the Celtics' organizational structure and operational efficiency.

- Potential Conflicts of Interest: Given Bain Capital's diverse investment portfolio, potential conflicts of interest need careful consideration. Transparency in their management of the Celtics will be crucial to maintaining fan trust.

- Other Sports Investments: While this is a major NBA entry, Bain Capital’s past investments in sports-related businesses provide a framework for understanding their potential approach to Celtics management. The scale of this deal, however, indicates a significant commitment to the NBA and the Celtics brand.

- Financial Structure: The deal's financial structure remains undisclosed, but industry analysts suggest a combination of equity and debt financing is likely, given the massive valuation. This structure will significantly impact the long-term financial health and stability of the franchise. The valuation itself positions the Celtics amongst the most valuable NBA teams, reflecting their strong brand recognition and consistent success.

Impact on Celtics Operations: Immediate and Long-Term

- Team Management: Changes to the team's front office and management structure are anticipated. While the existing management team may initially remain, future changes are probable as Bain Capital implements its vision for the franchise.

- Coaching Staff: The coaching staff could also see adjustments, particularly if Bain Capital prioritizes a specific coaching philosophy or strategic approach.

- Player Recruitment: The influx of capital could lead to a more aggressive approach to player recruitment, potentially attracting higher-profile free agents and facilitating better draft picks.

- Increased Investment: Significant investments in player salaries and team infrastructure are likely, potentially including improvements to the Celtics' training facilities, scouting department, and analytics capabilities.

- Alignment with Fan Expectations: Bain Capital's stated commitment to maintaining the Celtics' winning culture and strong fan base will need to translate into tangible actions. Transparency and communication will be vital in achieving this goal.

- Long-Term Financial Implications: The deal's financial implications are far-reaching. While increased revenue is expected, the impact on long-term profitability and financial stability will be shaped by the management's strategic decisions, and the overall economic climate.

Fan Concerns and Reactions to the Celtics Sale

Ticket Prices and Accessibility

- Increased Prices: A common concern among fans is the potential for significantly increased ticket prices, making games less accessible to longtime supporters and casual fans alike.

- Historical Precedent: Ownership changes in other sports franchises have often resulted in escalating ticket costs, raising anxieties among Celtics fans about the potential for similar price hikes.

- Mitigation Strategies: To alleviate affordability concerns, the new ownership could implement strategies such as offering discounted tickets for season ticket holders, introducing more affordable seating options, and creating innovative fan engagement programs.

Impact on Team Culture and Fan Experience

- Changes to Team Identity: Fans worry about the potential dilution of the Celtics' unique identity and traditions under new ownership. Concerns about changes to team branding, gameday atmosphere, and community engagement initiatives are valid.

- Fan Engagement: Maintaining the strong connection between the Celtics and their passionate fanbase is paramount. The new owners need to actively engage with fans, solicit feedback, and implement initiatives that foster a sense of community and belonging.

- Preserving Traditions: The success of the Celtics partly stems from their rich history and established traditions. It is crucial for the new owners to respect and preserve these aspects of the team's culture.

The Future of the Boston Celtics Under New Ownership

Potential for Success on and Off the Court

- Increased On-Court Success: The significant financial resources brought by Bain Capital could translate into increased on-court success. Investments in player development, improved scouting, and strategic player acquisitions could elevate the team’s competitiveness.

- Long-Term Strategic Vision: The new ownership's long-term strategic vision for the Celtics will ultimately shape the team's trajectory. Success will depend on their ability to make sound strategic decisions and build a winning culture.

Legal and Regulatory Considerations

- League Approval: The sale was subject to approval by the NBA, indicating a compliance with the league’s regulations.

- Antitrust Regulations: While generally not a major concern in single-team sales, any potential anti-competitive practices would be subject to regulatory scrutiny.

Conclusion

The $6.1 billion sale of the Boston Celtics to private equity represents a pivotal moment in the franchise's history, sparking both excitement and apprehension among fans. The new ownership brings substantial financial resources and the potential for on-court success, yet concerns about ticket prices, fan experience, and the preservation of team culture remain valid. Keeping a close eye on the new owners' actions and engaging in discussions surrounding the Celtics sale is essential for fans to gauge the long-term implications. The future of the Celtics rests on the shoulders of this new leadership, and the years ahead will determine whether this momentous transaction ultimately benefits the team and its loyal fanbase. Stay informed, participate in the conversation, and continue to support your beloved Boston Celtics.

Featured Posts

-

Partido Almeria Eldense Transmision En Directo Por La Liga Hyper Motion

May 16, 2025

Partido Almeria Eldense Transmision En Directo Por La Liga Hyper Motion

May 16, 2025 -

Analyzing The Probability Of A Wilson Muncy Reunion In 2025

May 16, 2025

Analyzing The Probability Of A Wilson Muncy Reunion In 2025

May 16, 2025 -

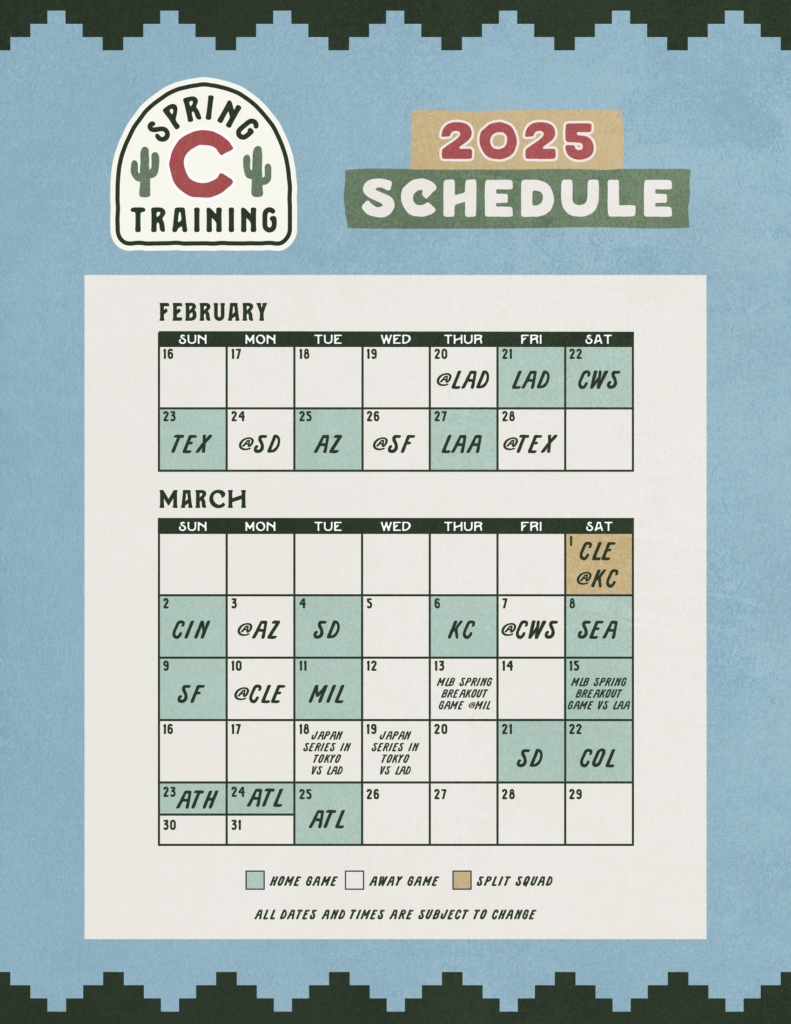

Cubs Vs Padres Spring Training Preview Mesa March 4th 2 05 Ct

May 16, 2025

Cubs Vs Padres Spring Training Preview Mesa March 4th 2 05 Ct

May 16, 2025 -

Relive The Classic Nhl 25s Arcade Mode Returns This Week

May 16, 2025

Relive The Classic Nhl 25s Arcade Mode Returns This Week

May 16, 2025 -

Golden State Warriors Jimmy Butler Leads Charge In Victory Against Houston Rockets

May 16, 2025

Golden State Warriors Jimmy Butler Leads Charge In Victory Against Houston Rockets

May 16, 2025