Cenovus CEO Downplays Merger Speculation, Prioritizes Internal Expansion

Table of Contents

Cenovus CEO's Statement on Merger and Acquisition Activity

While a direct quote from the CEO is not available at this time (replace with actual quote if available), the overall messaging has clearly indicated a reluctance to pursue major mergers currently. The tone was not a complete dismissal, but rather a cautious and strategic "no comment" regarding specific M&A discussions, suggesting a focus on internal initiatives. This stance follows a period of significant market consolidation in the Canadian energy sector, leading to speculation about Cenovus's future role.

Several factors likely contributed to the speculation. The recent success of other energy companies through strategic acquisitions, coupled with Cenovus's strong financial position, fuelled market rumors. However, the CEO's emphasis on internal growth suggests a different strategic direction.

- Specific reasons for not pursuing mergers: The company likely cited the high valuations of potential acquisition targets, the inherent risks and integration challenges associated with large M&A deals, and the desire to maintain operational control and focus.

- Previous M&A activity: Cenovus has engaged in M&A activity in the past, but its recent statements indicate a shift towards a more measured approach, focusing on internal expansion rather than large-scale acquisitions. (Include specific examples of past M&A if available).

- Competitor activity: Several competitors have recently engaged in significant mergers, highlighting the consolidation trend in the industry and adding further fuel to the speculation surrounding Cenovus's strategic direction.

Focus on Internal Growth and Organic Expansion

Cenovus's current internal expansion plans primarily focus on maximizing the value of its existing assets and strategically developing new resources. This strategy involves:

- Investment in existing oil sands operations: This includes optimizing production processes, upgrading facilities, and improving efficiency to enhance profitability.

- Exploration and development of new resources: Cenovus is actively exploring and developing new oil and gas reserves within its existing portfolio, reducing reliance on external acquisitions.

- Technological advancements and efficiency improvements: Implementing innovative technologies to enhance operational efficiency, reduce costs, and minimize environmental impact is a core element.

- Expansion into renewable energy sources: Cenovus is also exploring opportunities in renewable energy, aiming to diversify its portfolio and align with broader sustainability goals.

The rationale behind this internal growth strategy is multifaceted:

-

Cost-effectiveness: Internal expansion is generally more cost-effective than acquisitions, as it avoids the premium often associated with buying established companies.

-

Better control over growth trajectory and risk management: Organic growth allows for better control over the pace and direction of expansion, mitigating the risks associated with integrating acquired companies.

-

Alignment with long-term strategic goals: This strategy aligns with Cenovus's long-term goals of sustainable growth and profitability, emphasizing operational excellence and responsible resource development.

-

Specific projects and initiatives: [Insert specific details of ongoing projects and initiatives].

-

Expected timelines and financial projections: [Include projected timelines and financial projections, if available].

-

Potential risks and challenges: Challenges could include fluctuating commodity prices, regulatory hurdles, and the potential for unforeseen operational issues.

Analysis of the Financial Implications

Choosing internal expansion over mergers has significant financial implications:

- Capital expenditure requirements: Internal expansion requires significant capital investment in existing and new projects, impacting cash flow and potentially increasing debt levels.

- Return on investment projections: Cenovus needs to demonstrate a strong return on investment (ROI) for its internal projects to justify this strategic shift. Detailed financial modelling is crucial.

- Impact on shareholder value: The success of the internal expansion strategy will directly impact shareholder value, with positive results leading to increased stock prices and improved investor confidence.

Compared to mergers, internal expansion carries different risks and rewards. While acquisitions can offer immediate scale and market share gains, they come with high integration costs and potential for unexpected challenges. Internal expansion is less risky but requires a longer-term perspective and a commitment to operational excellence.

- Key financial metrics: Key metrics to monitor include production volume, operating costs, capital expenditures, and free cash flow.

- Impact on debt levels and credit ratings: Increased capital expenditures may impact debt levels and credit ratings, requiring careful financial management.

- Investor sentiment: Investor reaction to Cenovus's strategy will be crucial and will depend on the demonstrated success of internal expansion projects and the company's ability to deliver on its promises.

The Role of Commodity Prices in Cenovus's Decision

Current and projected oil prices significantly influence Cenovus's decision-making. High commodity prices can support higher capital expenditures for internal expansion, while low prices could make such investments less attractive. Global energy market volatility introduces additional risk.

- Price forecasts: Price forecasts and their associated uncertainties need to be incorporated into the financial projections for the internal expansion strategy.

- Hedging strategies: Cenovus employs various hedging strategies to mitigate the impact of price volatility on its operations and financial performance.

- Sensitivity analysis: Sensitivity analysis examining how different price scenarios impact project profitability is crucial in justifying the internal expansion approach.

Conclusion: Cenovus's Future: Internal Growth over Mergers

Cenovus's CEO has clearly prioritized internal expansion over mergers and acquisitions, driven by financial prudence, effective risk management, and alignment with long-term strategic goals. This strategy, while potentially slower than acquisitions, offers better control and reduces the inherent risks associated with integrating large companies. The success of this approach, however, depends on careful financial management, successful execution of internal projects, and the ability to navigate the challenges of a volatile energy market.

Stay informed about Cenovus Energy's progress in its internal expansion strategy and its impact on the energy market. Follow us for further updates on Cenovus's internal expansion and future merger and acquisition activity.

Featured Posts

-

Une Nouvelle Ere Pour Les Diables Rouges De La Rtbf

May 26, 2025

Une Nouvelle Ere Pour Les Diables Rouges De La Rtbf

May 26, 2025 -

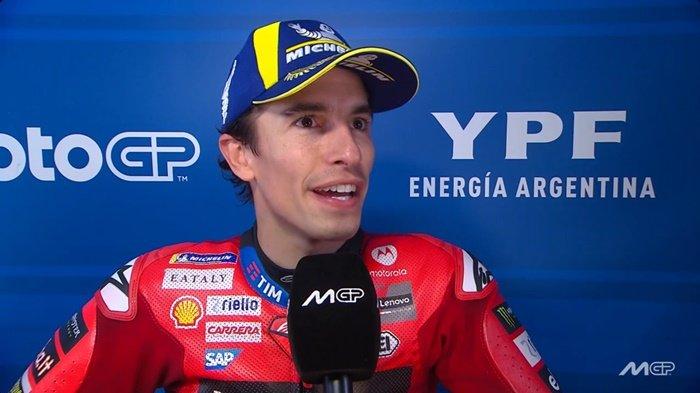

Update Klasemen Moto Gp Pasca Kemenangan Sprint Race Marquez Di Argentina 2025

May 26, 2025

Update Klasemen Moto Gp Pasca Kemenangan Sprint Race Marquez Di Argentina 2025

May 26, 2025 -

Moto Gp Argentina 2025 Di Trans7 Jadwal Race Dan Kualifikasi

May 26, 2025

Moto Gp Argentina 2025 Di Trans7 Jadwal Race Dan Kualifikasi

May 26, 2025 -

Jadwal And Info Siaran Langsung Moto Gp Argentina 2025 Di Trans7

May 26, 2025

Jadwal And Info Siaran Langsung Moto Gp Argentina 2025 Di Trans7

May 26, 2025 -

Hoka Cielo X1 2 0 A Detailed Review Of Its Lightweight Design And Speed

May 26, 2025

Hoka Cielo X1 2 0 A Detailed Review Of Its Lightweight Design And Speed

May 26, 2025