Cenovus Rejects MEG Bid, Emphasizes Strategy Of Organic Growth

Table of Contents

Cenovus's Rationale for Rejecting the MEG Bid

Cenovus's decision to spurn MEG Energy's offer wasn't impulsive; it was a calculated move based on a thorough evaluation of the proposed deal and a long-term vision for the company.

Insufficient Value Proposition

Cenovus argued that the MEG bid significantly undervalued the company and its assets. The offer failed to provide a sufficient premium reflecting Cenovus’s strong performance and future growth potential. Based on prevailing share prices and industry valuation multiples at the time of the bid, Cenovus's management concluded that the offer did not adequately reflect the intrinsic value of the company.

- Insufficient premium offered: The offered price did not reflect the market's perception of Cenovus's future prospects.

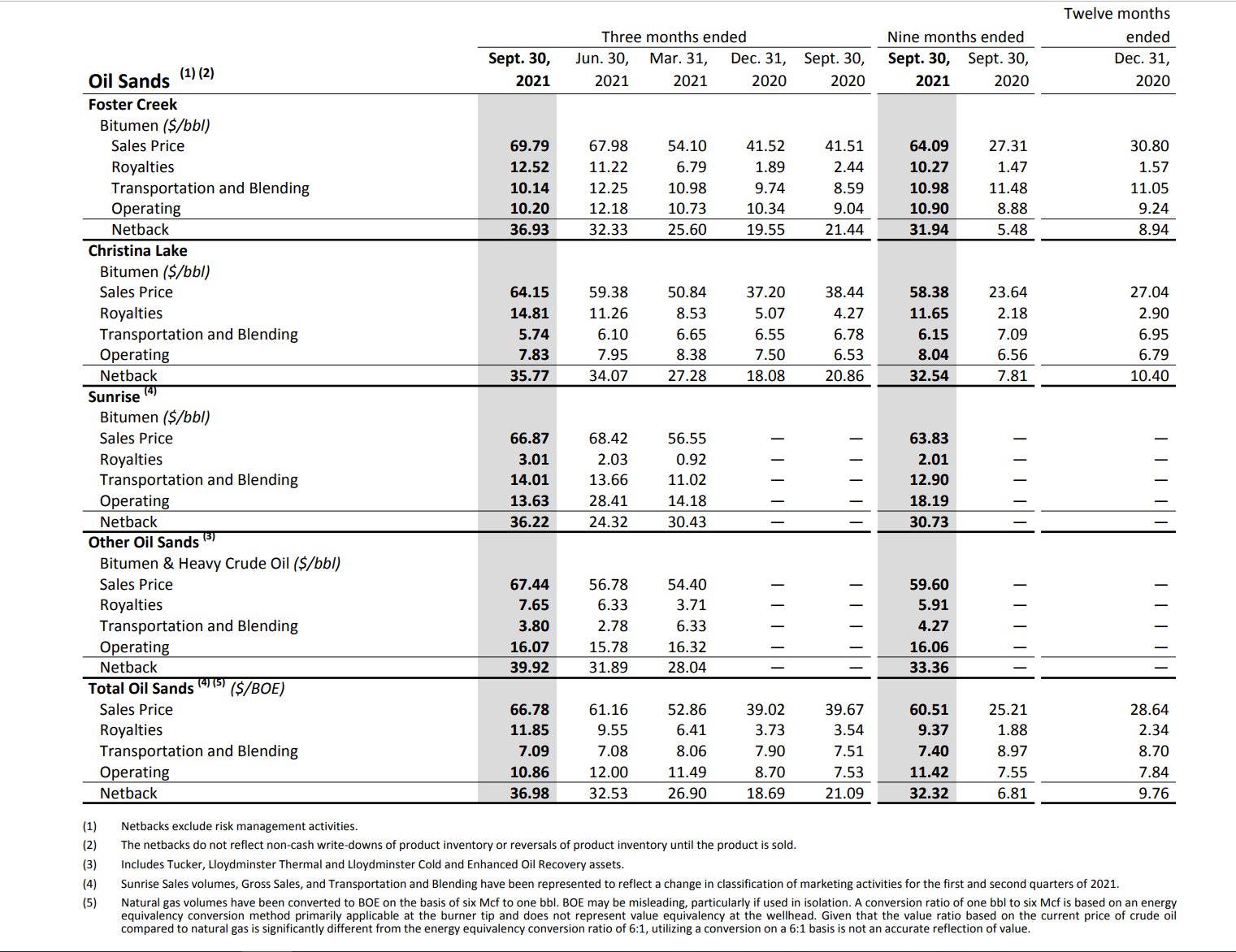

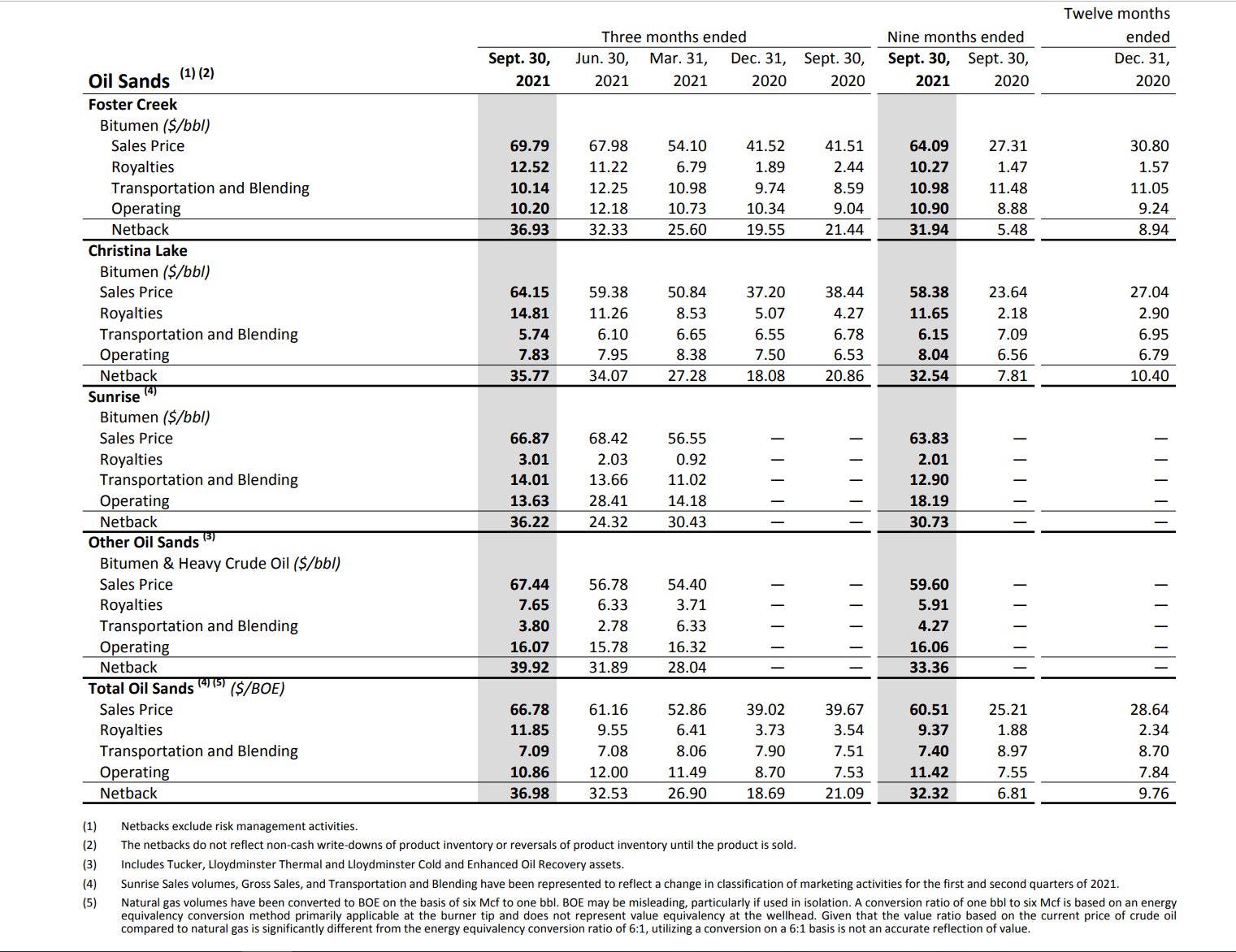

- Undervalued assets: MEG's bid did not appropriately account for the value of Cenovus's substantial oil sands holdings and other key assets.

- Better opportunities for shareholder value creation through organic growth: Cenovus's internal assessment indicated that pursuing organic growth would generate superior returns for shareholders compared to the proposed acquisition.

- Perceived inadequacy of synergies: While potential synergies between the two companies were considered, Cenovus determined that these were not substantial enough to justify accepting the bid.

Focus on Organic Growth Strategy

Cenovus's rejection underscores its steadfast commitment to its long-term organic growth strategy. This approach focuses on internal expansion, operational efficiency improvements, and strategic investments to unlock the full potential of its existing assets and future exploration ventures.

- Investment in existing oil sands projects: Cenovus plans to increase production and improve efficiency at its existing oil sands operations. This includes optimizing extraction processes and implementing advanced technologies.

- Exploration and production initiatives: The company is actively exploring new opportunities to expand its reserves and production capacity, focusing on areas with high growth potential.

- Technology upgrades for improved efficiency and environmental performance: Cenovus is investing heavily in technology to enhance operational efficiency, reduce its environmental footprint, and improve ESG performance. This includes initiatives to reduce greenhouse gas emissions and improve water management.

Maintaining Financial Discipline

Cenovus's financial prudence played a crucial role in its decision. The company is committed to maintaining a strong balance sheet, disciplined capital allocation, and a healthy credit rating. Rejecting the bid aligns perfectly with this strategy.

- Maintaining strong credit rating: By rejecting the bid, Cenovus avoids taking on additional debt that could jeopardize its strong credit rating.

- Strategic capital allocation: Cenovus prefers to allocate capital to its organic growth initiatives, which it believes offer a higher return on investment compared to an acquisition.

- Prioritizing shareholder returns through dividends or buybacks: The company remains committed to delivering value to shareholders through consistent dividends and potential share buyback programs.

Cenovus's Organic Growth Strategy in Detail

Cenovus’s organic growth strategy is multifaceted and ambitious, with several key components:

Expansion of Existing Assets

Cenovus aims to significantly enhance production and profitability from its current assets. This will be achieved through multiple avenues:

- Optimization of production processes: Implementing operational efficiencies to maximize output from existing facilities.

- Technological improvements: Investing in new technologies to enhance extraction rates and reduce operating costs.

- Exploration of adjacent reserves: Exploring and developing reserves surrounding existing projects to extend their lifespan and increase output. Specific projects and anticipated output increases are expected to be announced in future company updates.

Exploration and New Projects

Cenovus continues to actively explore new opportunities for growth. This includes:

- Exploration licenses: Securing new exploration licenses in promising regions.

- Partnerships and joint ventures: Collaborating with other companies to share the risks and rewards of new projects.

- Potential future projects and their expected impact: Details on specific projects are often kept confidential during the exploration and development phases but will be announced in future releases.

ESG Initiatives and Sustainability

Cenovus is firmly committed to incorporating environmental, social, and governance (ESG) factors into its growth strategy. This commitment is not only ethically sound but also increasingly important to investors and stakeholders:

- Carbon reduction targets: The company has set ambitious targets to reduce its carbon emissions.

- Investment in renewable energy: Cenovus is exploring opportunities to diversify its energy portfolio into renewable sources.

- Community engagement initiatives: The company is committed to being a responsible corporate citizen and actively engages with the communities where it operates.

Market Reaction and Investor Sentiment

The market's reaction to Cenovus’s decision has been mixed, reflecting the inherent uncertainty involved in long-term growth strategies versus the immediate gains from acquisitions.

Share Price Performance

The immediate impact on Cenovus's share price following the announcement of the rejected bid and the renewed commitment to organic growth is varied. While some initial negative reaction was observed, long-term projections are positive reflecting confidence in the company’s strategic vision. (Include charts and graphs here to illustrate share price movement).

Analyst Opinions

Analyst opinions are similarly diverse. While some analysts have expressed skepticism about the long-term viability of Cenovus’s organic growth strategy in the face of a volatile energy market, others are optimistic about the company's ability to execute its plan successfully and deliver superior returns to shareholders. (Include quotes from relevant analysts to further support the analysis).

Conclusion

Cenovus's rejection of MEG Energy’s bid represents a strategic pivot towards a long-term organic growth strategy. This decision reflects a commitment to financial discipline, operational excellence, and sustainable growth. While the path ahead is not without its challenges, the company's clear vision, robust resources, and commitment to shareholder value creation position it well for future success. By prioritizing internal expansion, technological innovation, and a focus on ESG principles, Cenovus is betting on its ability to generate superior returns for its investors over the long term. Learn more about Cenovus's strategic vision and understand the benefits of Cenovus's organic growth approach – invest in Cenovus's future with confidence.

Featured Posts

-

New Arrivals Jenson And The Fw 22 Extended

May 25, 2025

New Arrivals Jenson And The Fw 22 Extended

May 25, 2025 -

Pertimbangan Investasi Di Mtel And Mbma Studi Kasus Msci Small Cap Index

May 25, 2025

Pertimbangan Investasi Di Mtel And Mbma Studi Kasus Msci Small Cap Index

May 25, 2025 -

Trump Flexes Political Muscle To Secure Republican Deal

May 25, 2025

Trump Flexes Political Muscle To Secure Republican Deal

May 25, 2025 -

Nemecke Firmy Rusia Tisice Pracovnych Miest Prehlad Aktualnej Situacie

May 25, 2025

Nemecke Firmy Rusia Tisice Pracovnych Miest Prehlad Aktualnej Situacie

May 25, 2025 -

Todays Frankfurt Stock Market Dax Under 24 000

May 25, 2025

Todays Frankfurt Stock Market Dax Under 24 000

May 25, 2025