CEO Warnings: Trump Tariff Uncertainty Shakes The US Economy

Table of Contents

Impact on Supply Chains and Manufacturing

The unpredictable implementation and wavering nature of Trump tariffs created significant disruptions to established global supply chains. Companies, unprepared for the fluctuating costs and sudden changes, struggled to adapt their sourcing strategies, leading to widespread economic ripple effects.

Disrupted Global Trade Flows

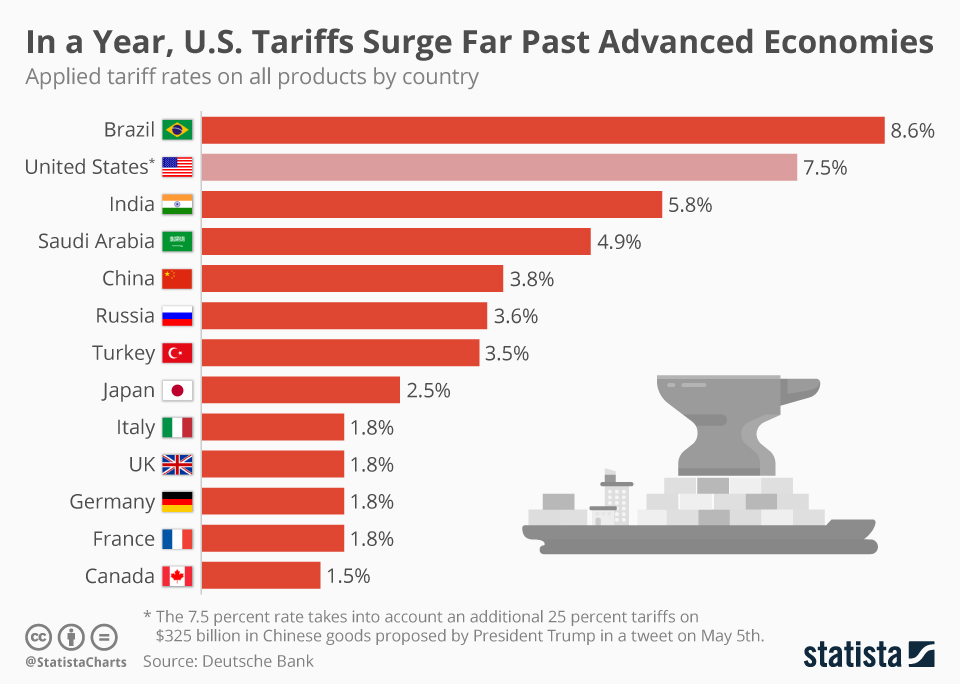

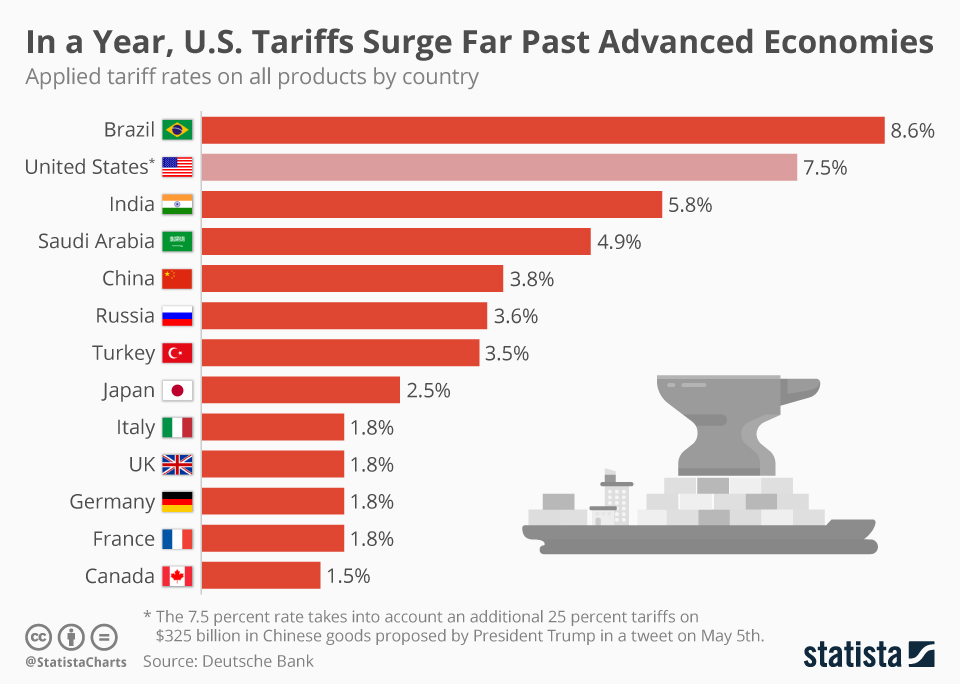

Tariffs imposed during the Trump administration dramatically altered global trade flows. The intended protectionist measures backfired, creating unforeseen challenges for businesses reliant on international trade.

- Increased production costs: Tariffs added significant costs to imported goods, increasing the price of raw materials and finished products.

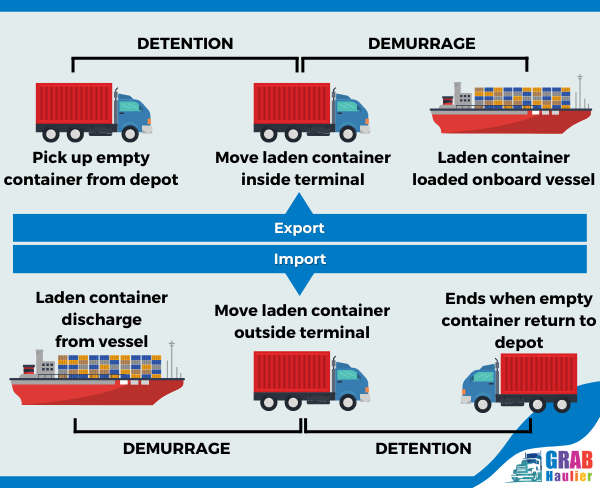

- Delays in shipments: Navigating new trade regulations and increased customs inspections caused substantial delays in shipments, disrupting production schedules and impacting just-in-time inventory management.

- Difficulty finding alternative suppliers: Businesses scrambled to find alternative suppliers outside of affected regions, a costly and time-consuming process that often compromised quality and efficiency.

- Relocation of manufacturing facilities: Faced with escalating costs and uncertainty, some companies were forced to relocate manufacturing facilities to countries with more favorable trade policies, leading to job losses in the US.

Reduced US Manufacturing Competitiveness

While the tariffs aimed to bolster domestic manufacturing, the opposite effect occurred for many US manufacturers. Retaliatory tariffs from other countries and the increased costs of imported components significantly reduced their competitiveness in global markets.

- Loss of market share: Higher prices for US-made goods led to a loss of market share to competitors in countries with lower tariffs or no tariffs at all.

- Reduced exports: Retaliatory tariffs imposed by other countries significantly reduced US exports, impacting businesses that relied heavily on international sales.

- Plant closures: Faced with decreased competitiveness and profitability, some US manufacturers were forced to close plants and lay off workers.

- Job losses in manufacturing sectors: The combination of reduced competitiveness and plant closures resulted in significant job losses within various manufacturing sectors across the US.

Investor Uncertainty and Reduced Investment

The unpredictable nature of Trump's tariff policies created a climate of uncertainty that severely impacted investor confidence, both domestically and internationally. This uncertainty discouraged investment and hindered economic growth.

Diminished Business Confidence

The constant threat of new tariffs or changes in existing policies led to a sharp decline in business confidence. Businesses became hesitant to commit to long-term projects, fearing that sudden shifts in trade rules could render their investments unprofitable.

- Decreased capital expenditures: Businesses reduced investments in new equipment, technology, and expansion projects due to the risk associated with tariff changes.

- Postponement of expansion plans: Companies delayed or canceled expansion plans, opting for a wait-and-see approach to assess the long-term impact of trade policies.

- Reluctance to hire new employees: Uncertainty about future market conditions led businesses to postpone hiring, hindering job creation and economic growth.

- Negative impact on GDP growth: The decrease in investment and consumer spending significantly contributed to slower GDP growth.

Stock Market Volatility

The ongoing uncertainty surrounding tariffs contributed significantly to volatility in the US stock market. Investors, anxious about the long-term economic outlook, reacted to each new tariff announcement or policy change.

- Fluctuations in stock prices: Stock prices experienced significant fluctuations, reflecting the uncertainty and anxiety surrounding trade policy.

- Decreased market capitalization: The overall value of US companies declined as investors reacted negatively to the uncertainty.

- Loss of investor confidence: The unpredictable nature of trade policy eroded investor confidence in the US economy, leading to capital flight and reduced investment.

Rising Prices and Inflationary Pressures

Tariffs, by their very nature, increase the cost of imported goods, directly impacting consumer prices and exacerbating inflationary pressures. This disproportionately affects low-income households.

Increased Consumer Costs

The tariffs imposed during the Trump administration led to higher prices for a wide range of imported consumer goods, significantly impacting consumer purchasing power and increasing the cost of living.

- Higher prices for consumer goods: Consumers faced increased prices for everything from clothing and electronics to furniture and automobiles.

- Reduced disposable income: Higher prices for essential goods and services reduced consumers' disposable income, limiting their ability to spend on other items.

- Increased inflation: The increased cost of imported goods contributed to a rise in overall inflation, eroding the purchasing power of the dollar.

- Squeezed consumer spending: Reduced disposable income and increased inflation led to a decrease in consumer spending, negatively impacting economic growth.

Impact on Low-Income Households

The impact of increased prices disproportionately affected low-income households, who have less financial flexibility to absorb higher costs.

- Reduced access to essential goods and services: Higher prices for essential goods and services limited access for low-income families, impacting their quality of life.

- Increased financial strain on vulnerable populations: The combined effects of increased prices and reduced purchasing power placed an undue financial strain on already vulnerable populations.

Conclusion

The warnings from CEOs regarding the lingering effects of Trump-era tariff uncertainty paint a stark picture for the US economy. The disruptions to supply chains, reduced investment, and inflationary pressures highlight the significant and lasting consequences of unpredictable trade policies. To mitigate the negative impacts and promote a stable and predictable economic environment, a careful and considered approach to future trade negotiations is paramount. We need to move towards a more stable and transparent approach to Trump Tariffs and avoid repeating the mistakes of the past. The future health of the US economy hinges on a more measured and predictable trade policy. Ignoring the lessons learned from this period of Tariff Uncertainty would be a grave error.

Featured Posts

-

87 Month Sentence Sought For George Santos By Department Of Justice

Apr 26, 2025

87 Month Sentence Sought For George Santos By Department Of Justice

Apr 26, 2025 -

New Us Port Fees 70 Million Hit For Auto Carrier

Apr 26, 2025

New Us Port Fees 70 Million Hit For Auto Carrier

Apr 26, 2025 -

Finding The Answers For Todays Nyt Spelling Bee February 3rd Puzzle 337

Apr 26, 2025

Finding The Answers For Todays Nyt Spelling Bee February 3rd Puzzle 337

Apr 26, 2025 -

Green Bay Hosts Nfl Drafts First Round Thursdays Top Picks

Apr 26, 2025

Green Bay Hosts Nfl Drafts First Round Thursdays Top Picks

Apr 26, 2025 -

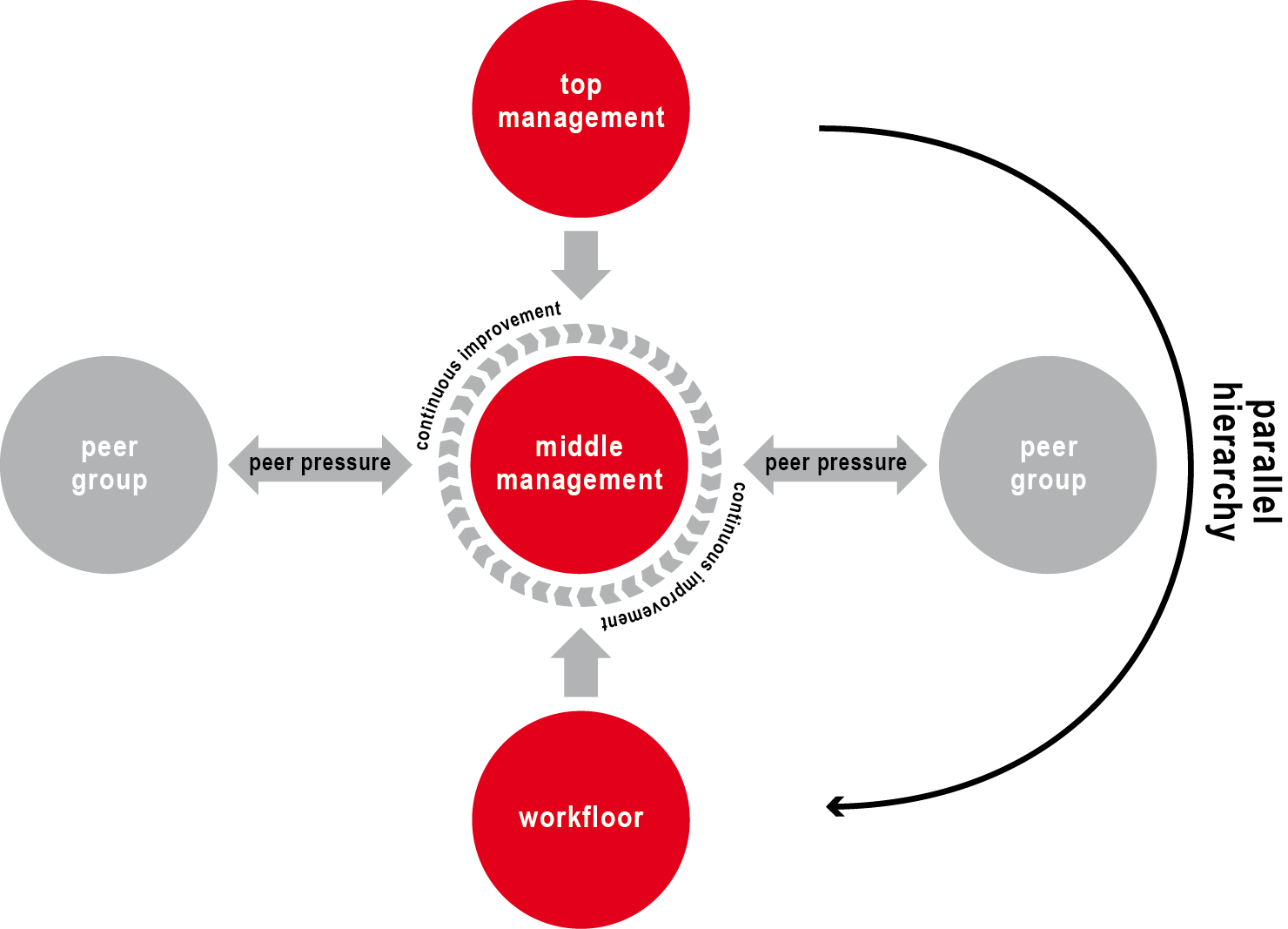

Why Invest In Middle Management A Strategic Approach To Business Growth

Apr 26, 2025

Why Invest In Middle Management A Strategic Approach To Business Growth

Apr 26, 2025

Latest Posts

-

Epstein Files Pam Bondi Confirms Readiness For Public Release

May 10, 2025

Epstein Files Pam Bondi Confirms Readiness For Public Release

May 10, 2025 -

Trumps Attorney General Delivers Stark Message To Political Foes

May 10, 2025

Trumps Attorney General Delivers Stark Message To Political Foes

May 10, 2025 -

Pam Bondi Announces Record Breaking Fentanyl Seizure

May 10, 2025

Pam Bondi Announces Record Breaking Fentanyl Seizure

May 10, 2025 -

Analysis The Attorney Generals Warning And Its Implications For Trumps Opponents

May 10, 2025

Analysis The Attorney Generals Warning And Its Implications For Trumps Opponents

May 10, 2025 -

Attorney Generals Threat To Trumps Opponents Sparks Controversy

May 10, 2025

Attorney Generals Threat To Trumps Opponents Sparks Controversy

May 10, 2025