Challenges Ahead: The Next Fed Chair Faces A Trump-Shaped Economy

Table of Contents

Inflationary Pressures and Monetary Policy Dilemmas

The current inflationary environment presents a significant dilemma for the incoming Fed Chair. This "Trump-shaped economy" is grappling with the consequences of past economic decisions.

Navigating the Legacy of Fiscal Stimulus

The Trump administration's significant tax cuts and increased government spending created a substantial fiscal stimulus package. While boosting short-term growth, this approach has contributed to the current inflationary pressures.

- Increased national debt: The substantial increase in the national debt during this period has created long-term fiscal challenges and limits the government's ability to respond to future economic downturns.

- Potential for future inflationary spikes: The lingering effects of this stimulus could lead to further inflationary spikes in the future, requiring continued vigilance and proactive monetary policy adjustments.

- Challenges in unwinding fiscal stimulus: Reducing the impact of this stimulus without causing a significant economic contraction presents a complex and delicate challenge for policymakers.

Balancing Growth and Price Stability

The next Fed Chair faces the incredibly difficult task of controlling inflation without triggering a recession. This requires a precise calibration of monetary policy tools.

- Interest rate hikes: Raising interest rates is a primary tool to combat inflation, but aggressive hikes risk slowing economic growth and potentially causing a recession.

- Quantitative tightening: Reducing the Fed's balance sheet through quantitative tightening further complicates the situation, potentially impacting liquidity and market stability.

- Potential for stagflation: The risk of stagflation – a period of slow economic growth coupled with high inflation – is a real concern, requiring careful navigation of monetary policy.

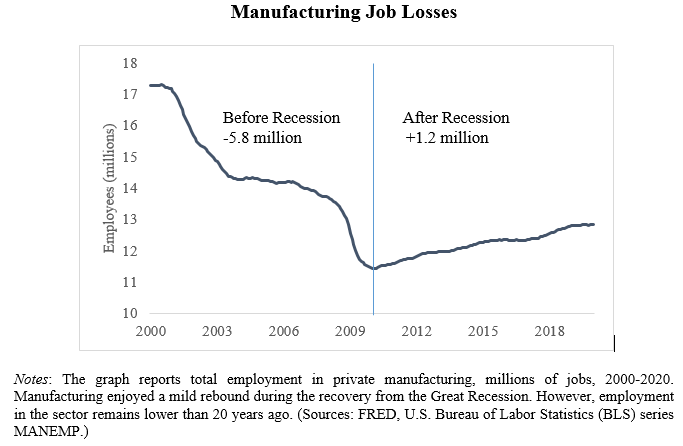

- Impact on employment: Monetary policy decisions directly impact employment levels, creating a difficult trade-off between controlling inflation and preserving job growth.

Global Economic Uncertainty and its Impact

Global economic uncertainty, partially shaped by the Trump administration's trade policies, further complicates the economic outlook.

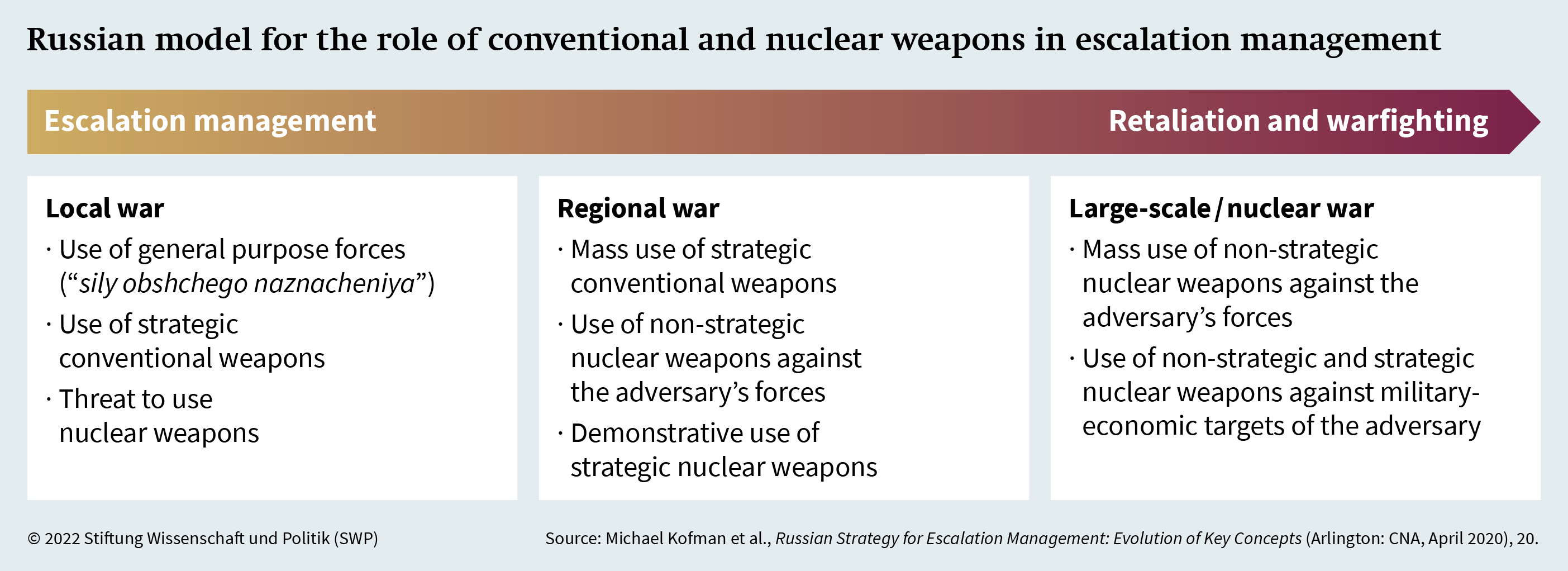

- Geopolitical risks: Increased geopolitical tensions and instability contribute to uncertainty in global markets, impacting investor confidence and potentially triggering further inflationary pressures.

- Energy prices: Global energy price fluctuations, exacerbated by geopolitical events, directly impact inflation and complicate monetary policy decisions.

- Global inflation: Global inflationary pressures put upward pressure on US inflation, requiring the Fed to consider international economic conditions in its policy decisions.

- Impact on US markets: Global economic uncertainty and volatility translate into increased risk and uncertainty in US financial markets.

Long-Term Structural Changes and Economic Inequality

Beyond immediate inflationary concerns, the "Trump-shaped economy" presents several long-term structural challenges.

The Impact of Deregulation on Financial Markets

The Trump administration's focus on deregulation had significant implications for financial markets.

- Increased risk-taking: Reduced regulatory oversight may have encouraged increased risk-taking by financial institutions, potentially increasing the likelihood of future financial crises.

- Potential for future financial crises: A less regulated environment could lead to increased systemic risk and vulnerability to future financial shocks.

- Regulatory oversight challenges: Re-establishing appropriate levels of regulation and oversight will be crucial in mitigating future risks.

Exacerbation of Income Inequality

Trump-era policies contributed to an exacerbation of income inequality, creating significant social and economic consequences.

- Wage stagnation: While some segments of the economy experienced growth, many workers experienced wage stagnation, widening the gap between the rich and the poor.

- Wealth concentration: Tax policies and deregulation may have contributed to increased wealth concentration at the top, further fueling income inequality.

- Social unrest: High levels of income inequality can lead to social unrest and political instability, creating further challenges for economic policymakers.

- Impact on economic growth: Extreme income inequality can hinder long-term economic growth by reducing aggregate demand and limiting opportunities for a significant portion of the population.

Trade Wars and Their Lingering Effects

The trade wars initiated during the Trump presidency have left a lasting impact on the US economy.

- Supply chain vulnerabilities: Disruptions to global supply chains have created vulnerabilities and increased costs for businesses and consumers.

- Reduced international cooperation: Strained international relationships complicate efforts to address global economic challenges.

- Impact on trade relationships: Repairing damaged trade relationships and restoring trust will require significant diplomatic efforts.

Political Pressures and the Independence of the Fed

The next Fed Chair will need to navigate a politically charged environment while upholding the independence of the Federal Reserve.

Maintaining the Fed's Independence

Preserving the Fed's independence from political influence is crucial for its long-term credibility and effectiveness.

- Political pressure to manipulate interest rates: The Fed must resist political pressure to manipulate interest rates for short-term political gains.

- Importance of evidence-based decision-making: Monetary policy decisions must be based on sound economic analysis and data, not political considerations.

- Long-term credibility of the Fed: Maintaining the Fed's independence is essential for its long-term credibility and effectiveness in managing the economy.

Navigating a Politically Charged Environment

Implementing effective monetary policy in a highly polarized political climate presents significant challenges.

- Congressional oversight: The Fed is subject to Congressional oversight, requiring careful communication and justification of its policy decisions.

- Public criticism: The Fed's decisions are subject to intense public scrutiny and criticism, demanding transparency and clear communication.

- Potential for political interference in monetary policy decisions: The Fed must actively resist any attempts at political interference in its decision-making process.

Conclusion

The next Fed Chair faces an unprecedented challenge in managing the complex "Trump-shaped economy." The intertwined issues of inflation, economic inequality, and political pressures demand a nuanced and strategic approach. Successfully balancing economic growth with price stability while navigating the long-term consequences of recent policy choices will require exceptional skill, judgment, and political acumen. Understanding the legacy of this "Trump-shaped economy" and its implications for the future is crucial for every citizen. Stay informed about the ongoing economic challenges and the decisions of the Federal Reserve. Learn more about the Fed and its policies to better understand the impact on your financial well-being.

Featured Posts

-

Mission Impossible Dead Reckoning Part Two Full Trailer Breakdown

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Full Trailer Breakdown

Apr 26, 2025 -

Mission Impossible Tom Cruises Riskiest Stunt Yet

Apr 26, 2025

Mission Impossible Tom Cruises Riskiest Stunt Yet

Apr 26, 2025 -

Auto Carriers 70 Million Port Fee Problem In The Us

Apr 26, 2025

Auto Carriers 70 Million Port Fee Problem In The Us

Apr 26, 2025 -

Golds Record High Understanding The Trade War Impact On Bullion

Apr 26, 2025

Golds Record High Understanding The Trade War Impact On Bullion

Apr 26, 2025 -

Manchester Uniteds Osimhen Pursuit A Financial Tightrope

Apr 26, 2025

Manchester Uniteds Osimhen Pursuit A Financial Tightrope

Apr 26, 2025

Latest Posts

-

French Minister Urges More Aggressive Eu Action Against Us Tariffs

May 09, 2025

French Minister Urges More Aggressive Eu Action Against Us Tariffs

May 09, 2025 -

Eus Response To Us Tariffs French Minister Advocates For Stronger Action

May 09, 2025

Eus Response To Us Tariffs French Minister Advocates For Stronger Action

May 09, 2025 -

French Minister Calls For Stronger Eu Response To Us Tariffs

May 09, 2025

French Minister Calls For Stronger Eu Response To Us Tariffs

May 09, 2025 -

Shared Nuclear Deterrence A French Ministers Vision For Europe

May 09, 2025

Shared Nuclear Deterrence A French Ministers Vision For Europe

May 09, 2025 -

Europes Nuclear Shield A French Ministers Perspective

May 09, 2025

Europes Nuclear Shield A French Ministers Perspective

May 09, 2025