Chime IPO: Digital Banking Startup Reveals Rising Revenue Ahead Of Public Offering

Table of Contents

Chime's Impressive Revenue Growth Fuels IPO Expectations

Chime's phenomenal revenue growth is the primary driver behind the excitement surrounding its IPO. While specific figures are often kept confidential until closer to the offering, reports indicate significant year-over-year increases. This rapid expansion is a result of several key factors:

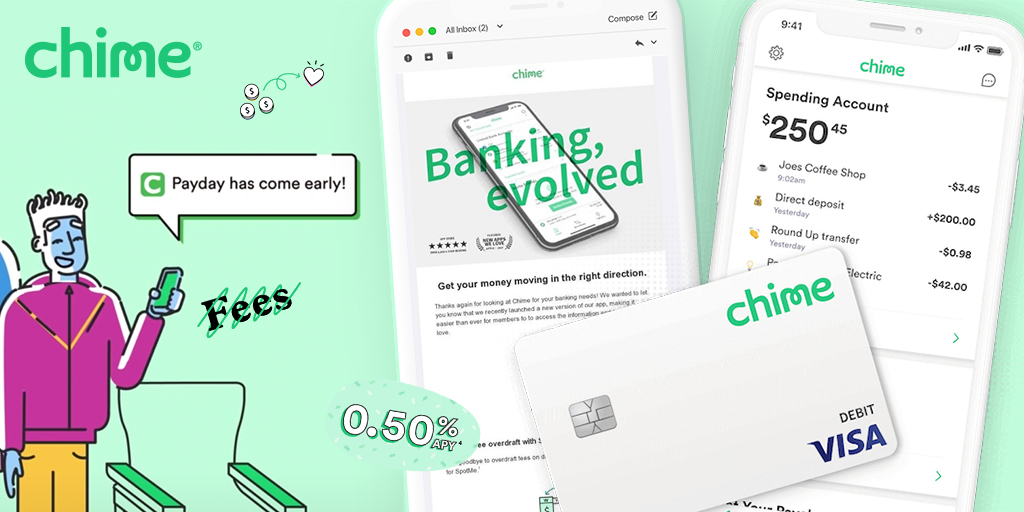

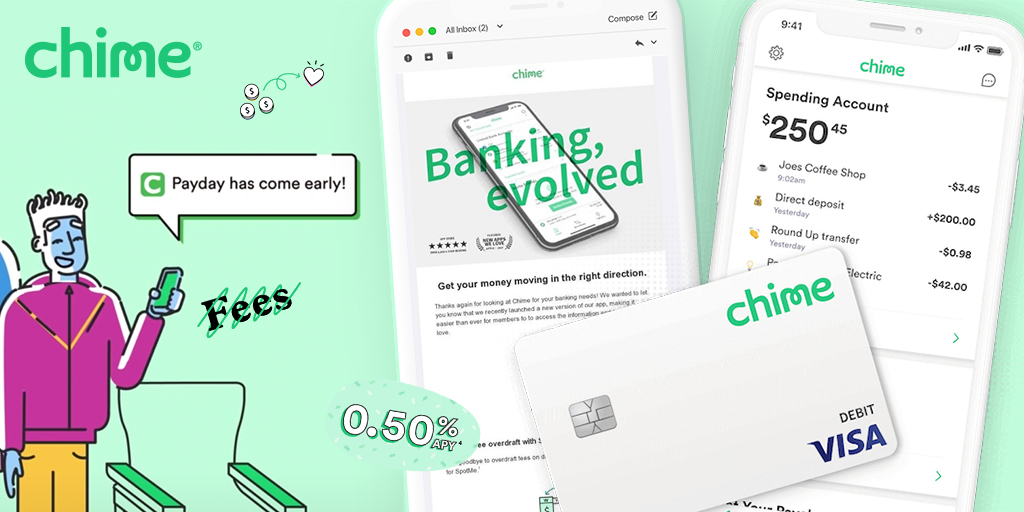

- Increased Customer Base: Chime has successfully attracted a massive customer base, appealing to a demographic often underserved by traditional banks. Their user-friendly app and innovative features have been crucial to this success.

- New Product Offerings: Beyond basic banking services, Chime has introduced features like early direct deposit access and credit-building tools, enhancing its value proposition and driving further customer engagement.

- Effective Marketing: Targeted marketing campaigns have effectively reached their desired demographic, increasing brand awareness and driving customer acquisition.

Comparing Chime's growth to competitors in the digital banking space reveals a significant lead. While other players are experiencing growth, Chime's trajectory is exceptionally steep.

- Specific revenue figures from financial reports: (Note: Insert actual figures when available from official Chime reports). This section should be updated with precise data as it becomes publicly available.

- Key product features driving growth (e.g., no overdraft fees): The absence of traditional banking fees is a major draw for Chime customers, significantly improving the overall value proposition.

- Market share statistics compared to traditional banks: (Note: Insert relevant market share data when available). This data will illustrate Chime's disruptive influence on the traditional banking sector.

- Growth in specific customer demographics: (Note: Include demographic information illustrating the target market and growth within specific segments). This data will help illustrate the strategic focus and success of Chime’s marketing efforts.

Chime's Business Model and Competitive Advantages

Chime's business model differs significantly from traditional banks. It operates primarily through a mobile-first approach, minimizing overhead costs and offering services entirely digitally. This allows them to offer fee-free services that are highly attractive to cost-conscious consumers. Key competitive advantages include:

- Fee-free services: The absence of overdraft fees, monthly maintenance fees, and other common banking charges is a major selling point.

- User-friendly mobile app: A simple, intuitive app provides an excellent user experience, differentiating Chime from more complex traditional banking platforms.

- Strong customer acquisition strategies: Effective marketing and a referral program contribute to Chime's rapid growth.

However, Chime also faces potential challenges:

- Details on Chime's fee structure: While mostly fee-free, Chime does generate revenue through interchange fees and other avenues. This needs to be transparently communicated.

- Description of the mobile banking app features: The user interface, functionality, security measures, and unique features should be highlighted.

- Analysis of their customer acquisition cost: Understanding the cost of acquiring new customers is vital for assessing the long-term sustainability of the business model.

- Potential risks like regulatory changes or competition: Increased competition and evolving regulatory landscapes present significant risks that must be carefully considered.

Investor Sentiment and Valuation of the Chime IPO

The anticipated valuation of Chime's IPO is a subject of considerable speculation, with estimates varying widely amongst analysts. Several factors influence this valuation, including its rapid revenue growth, large customer base, and strong brand recognition. Investor sentiment appears largely positive, anticipating strong demand for Chime stock.

- Estimated IPO valuation range: (Note: Insert estimated valuation range when available from credible financial sources). This is a crucial piece of information for potential investors.

- Analyst predictions regarding Chime stock performance: (Note: Include a summary of predictions from reputable financial analysts). This will give investors an idea of the expected performance post-IPO.

- Key investor names and their stake in Chime: (Note: List prominent investors and their involvement if publicly available). This can enhance credibility and investor confidence.

- Analysis of potential risks for investors: Potential risks such as competition, regulatory changes, and economic downturns should be discussed transparently.

The Future of Chime and its Impact on the Fintech Landscape

Chime's future growth plans include expanding its product offerings and potentially entering new markets. This could include further development of lending services and expansion into international markets. The Chime IPO has the potential to significantly impact the fintech industry by accelerating innovation and further challenging traditional banking models.

- Future product development plans (e.g., lending services): Details about planned new products and services will showcase Chime’s future growth strategy.

- Expansion into new markets or customer segments: Identifying new target demographics or geographical areas will illustrate Chime’s ambitious expansion plans.

- Potential impact on traditional banking institutions: Analyzing how Chime's success could force traditional banks to adapt and innovate is crucial.

- Predictions for future fintech industry trends: Chime's success could influence the direction of the fintech industry and inspire similar innovations.

Conclusion: Chime IPO – A Potential Game Changer in Digital Banking

The Chime IPO represents a significant moment for the fintech industry. Chime's impressive revenue growth, innovative business model, and strong competitive advantages position it for substantial success in the public market. The company's potential impact on traditional banking and the broader fintech landscape is undeniable. Staying updated on the Chime IPO and its developments is crucial for anyone interested in the future of digital banking and investing in promising fintech companies. For more information, be sure to follow the latest news and research the Chime stock price, Chime IPO date, and Chime investor relations materials.

Featured Posts

-

Startups And The Ipo Hurdle Exploring All Options

May 14, 2025

Startups And The Ipo Hurdle Exploring All Options

May 14, 2025 -

Premier League Star A Target For Arsenal Ornsteins Report

May 14, 2025

Premier League Star A Target For Arsenal Ornsteins Report

May 14, 2025 -

Mlb 2025 Winners And Losers A Post 30 Game Analysis

May 14, 2025

Mlb 2025 Winners And Losers A Post 30 Game Analysis

May 14, 2025 -

Man United To Open Talks With Bellinghams Younger Brother

May 14, 2025

Man United To Open Talks With Bellinghams Younger Brother

May 14, 2025 -

Ilta Sanomat Eurojackpot Voitonumerot Ja Tulokset

May 14, 2025

Ilta Sanomat Eurojackpot Voitonumerot Ja Tulokset

May 14, 2025