Chime's US IPO Filing: A Look At The Fintech Startup's Revenue Growth

Table of Contents

Chime's Revenue Model: Understanding the Sources of Growth

Chime's financial success is built upon a diversified revenue model, ensuring stability and potential for expansion. Let's break down the key components:

Fee Income from Subscription Services:

Chime's core revenue stream originates from its subscription-based services, Chime Plus and Chime Extra. These premium offerings provide users with enhanced features and benefits, generating recurring revenue.

- Chime Plus and Chime Extra subscriptions: These plans offer features like early direct deposit, fee reimbursements, and higher overdraft limits, attracting users willing to pay for added convenience and financial control.

- Detailed breakdown of fees: The IPO filing likely details the specific fees associated with each plan, allowing for a precise analysis of their contribution to overall revenue. This level of detail will be crucial for investors assessing the profitability of Chime's subscription model.

- Analysis of subscription growth rates: The IPO filing will showcase the growth rate of Chime's subscription base, a critical indicator of the success and scalability of this revenue stream. Rapid growth in subscribers directly translates to increased revenue.

- Comparison to competitor subscription models: Analyzing Chime's subscription pricing and features against competitors like Current or Robinhood will illuminate its competitive positioning and pricing strategy. This comparison helps determine if Chime offers a compelling value proposition compared to similar offerings in the market.

Interchange Fees and Other Revenue Streams:

Beyond subscriptions, Chime generates revenue through interchange fees and other financial product partnerships. These alternative revenue streams add further layers of stability and growth potential.

- Interchange fees from debit card transactions: Every debit card purchase generates a small fee for Chime from the merchant's bank. The volume of transactions processed directly impacts this revenue stream.

- Revenue from partnerships and other financial products: Chime may collaborate with other companies to offer additional services, like credit building tools or investment accounts, potentially generating further revenue.

- Growth trends in these revenue streams: Examining the historical and projected growth trends for interchange fees and partnerships provides a complete picture of Chime's revenue diversification and future earnings potential.

- The significance of these alternative revenue streams for overall growth: These secondary revenue channels provide crucial diversification, mitigating risk associated with reliance on a single revenue source. They also offer avenues for further expansion and product innovation.

Analyzing Chime's Growth Trajectory: Key Performance Indicators (KPIs)

Chime's remarkable growth is underpinned by strategic user acquisition and impressive revenue growth rates.

User Acquisition and Growth:

Chime's success hinges on its ability to attract and retain customers. Its mobile-first approach and straightforward account opening process have contributed significantly to its rapid growth.

- Focus on mobile-first approach and ease of account opening: Chime's user-friendly mobile app and streamlined onboarding process make it easy for new customers to sign up, facilitating rapid user acquisition.

- Effective marketing strategies, user acquisition cost analysis: The IPO filing should detail Chime's marketing expenditures and their effectiveness in acquiring new users. Analyzing user acquisition cost (CAC) is critical for evaluating the efficiency of their marketing efforts.

- Customer retention rates and their impact on long-term revenue: High customer retention rates are vital for sustained revenue growth. Chime's ability to retain users demonstrates the value and appeal of its services.

- Comparison to competitor user acquisition costs and retention rates: Benchmarking Chime's user acquisition and retention metrics against competitors provides valuable insights into its relative efficiency and effectiveness in the market.

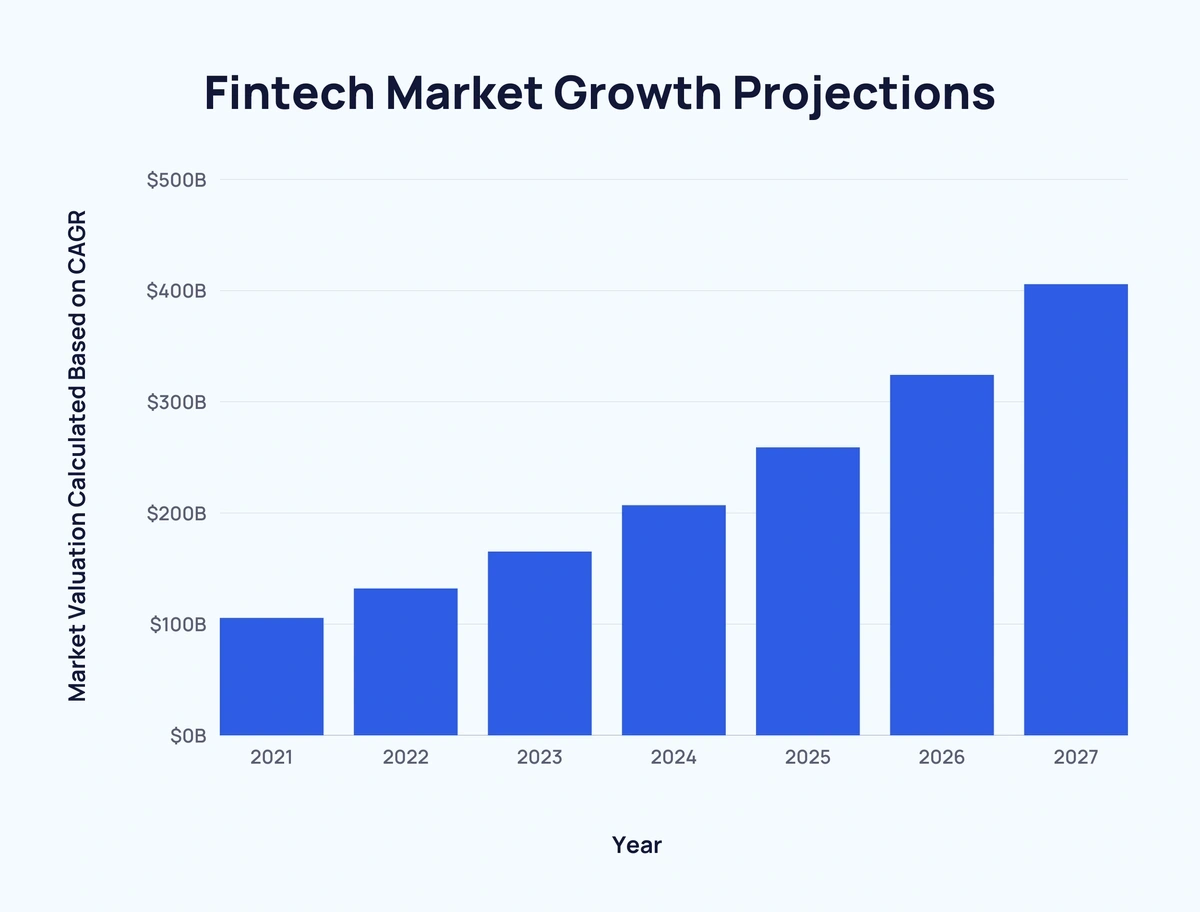

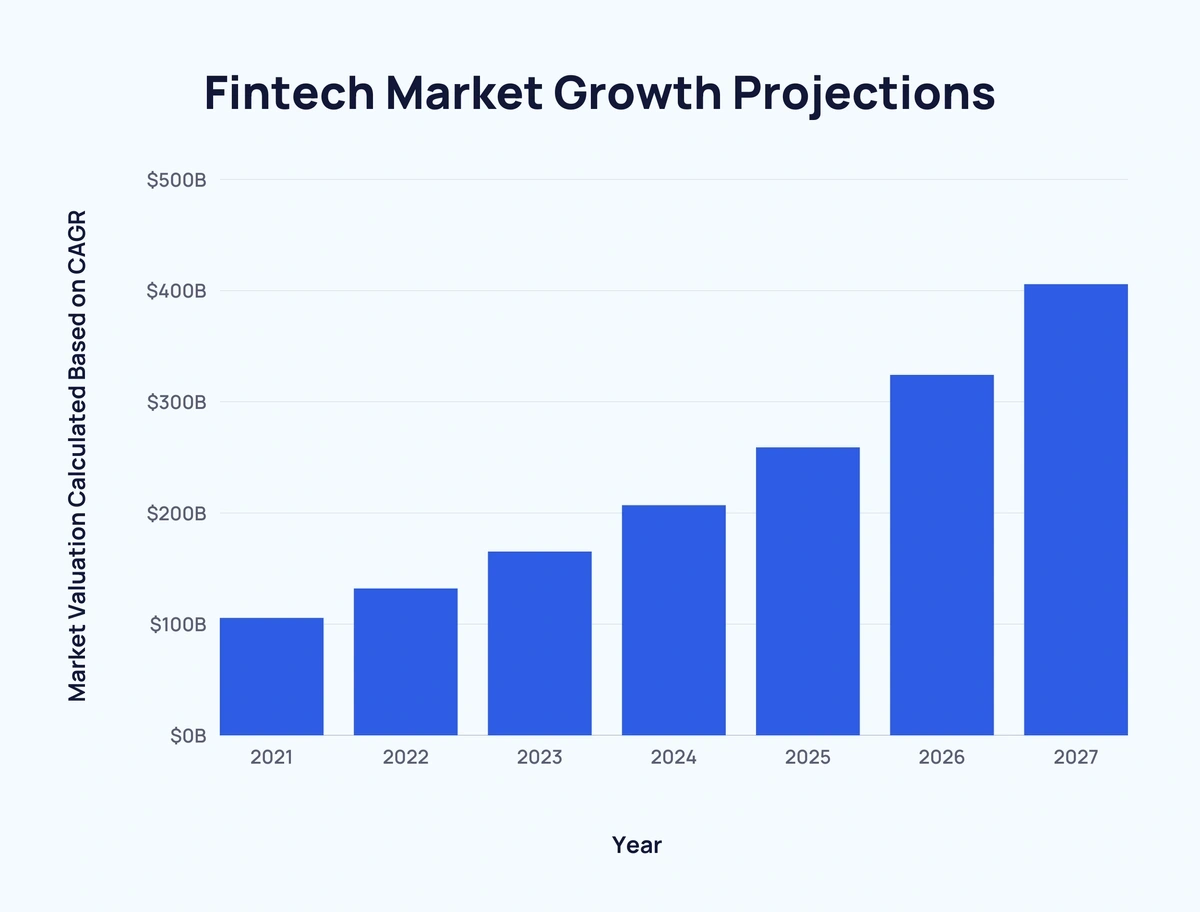

Revenue Growth Rates and Projections:

Analyzing Chime's past performance and future projections is essential for evaluating its investment potential.

- Year-over-year revenue growth percentages from the IPO filing: The IPO filing will prominently feature Chime's historical revenue growth rates, showcasing its financial performance.

- Key factors contributing to revenue growth: Understanding the factors driving revenue growth, such as increased subscriptions, higher transaction volumes, and successful partnerships, is crucial for predicting future performance.

- Analysis of projected revenue growth presented in the IPO filing: The IPO filing will likely contain projections for future revenue growth, providing investors with an outlook on the company's potential.

- Comparison to projections of competitor growth: Comparing Chime's projected growth rates to those of its competitors reveals its anticipated market position and competitive edge.

Competitive Landscape and Future Outlook: Navigating the Fintech Industry

Chime operates in a dynamic and competitive fintech landscape. Understanding its position within this environment is crucial for assessing its future prospects.

Key Competitors and Market Share:

Chime faces competition from established players and emerging fintech startups.

- Identification and analysis of key competitors (e.g., Robinhood, Current): Identifying and analyzing direct competitors helps understand Chime's competitive advantages and disadvantages.

- Comparison of Chime's market share and growth rate with competitors: Assessing Chime's market share and growth relative to competitors provides context for its performance and future growth potential.

- Discussion of Chime's competitive advantages and disadvantages: Chime's unique strengths, such as its mobile-first approach and focus on underserved customers, need to be weighed against its weaknesses, such as potential regulatory challenges.

Potential Challenges and Risks:

Despite its impressive growth, Chime faces several potential challenges and risks.

- Regulatory risks and compliance challenges in the financial sector: The financial industry is heavily regulated, and navigating compliance requirements can present significant challenges.

- Increased competition from established and new fintech players: The fintech market is constantly evolving, and new competitors may emerge, intensifying competition.

- Potential economic downturns and their impact on user spending: Economic downturns can impact consumer spending, potentially affecting Chime's revenue streams.

- Risks associated with reliance on specific revenue streams: Over-reliance on any single revenue stream can increase vulnerability to market fluctuations and changes in consumer behavior.

Conclusion:

Chime's IPO filing offers a valuable insight into the fintech startup's impressive revenue growth. By analyzing its diverse revenue streams, focusing on key performance indicators, and understanding its place in the competitive landscape, we can gain a clearer picture of Chime's financial health and future prospects. While challenges exist, Chime's focus on user acquisition, innovative product offerings, and strong growth trajectory suggest significant potential for continued success. Stay informed about Chime's progress as they navigate the public markets and continue to shape the future of fintech. Further research into Chime's IPO filing and subsequent financial reports is recommended for a comprehensive understanding of the company's financial performance and Chime's revenue growth.

Featured Posts

-

Federer Na Avlju E Povratak Ljubav Prema Publitsi Ga Vra A Na Teren

May 14, 2025

Federer Na Avlju E Povratak Ljubav Prema Publitsi Ga Vra A Na Teren

May 14, 2025 -

Captain America Brave New World 4 K Blu Ray Steelbook Now Available For Pre Order

May 14, 2025

Captain America Brave New World 4 K Blu Ray Steelbook Now Available For Pre Order

May 14, 2025 -

Gk Barry Opens Up About Loose Women Challenges And A Surprising Ally

May 14, 2025

Gk Barry Opens Up About Loose Women Challenges And A Surprising Ally

May 14, 2025 -

Disneys Snow White Remake Addressing The Biggest Issue

May 14, 2025

Disneys Snow White Remake Addressing The Biggest Issue

May 14, 2025 -

When Is Captain America Brave New World Streaming On Disney

May 14, 2025

When Is Captain America Brave New World Streaming On Disney

May 14, 2025

Latest Posts

-

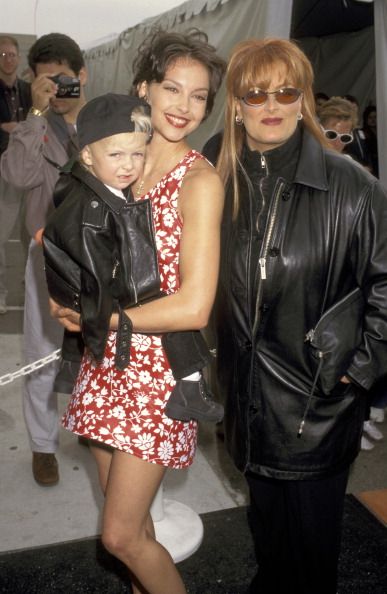

Wynonna Judd And Ashley Judd A Family Docuseries Unveils Untold Stories

May 14, 2025

Wynonna Judd And Ashley Judd A Family Docuseries Unveils Untold Stories

May 14, 2025 -

Wynonna And Ashley Judds Docuseries Intimate Family Portrait

May 14, 2025

Wynonna And Ashley Judds Docuseries Intimate Family Portrait

May 14, 2025 -

The Judd Family A Docuseries Unveiling Untold Stories

May 14, 2025

The Judd Family A Docuseries Unveiling Untold Stories

May 14, 2025 -

Judd Sisters Reveal All New Docuseries Explores Family Life

May 14, 2025

Judd Sisters Reveal All New Docuseries Explores Family Life

May 14, 2025 -

Wynonna And Ashley Judd Open Up Intimate Family Stories In New Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up Intimate Family Stories In New Docuseries

May 14, 2025