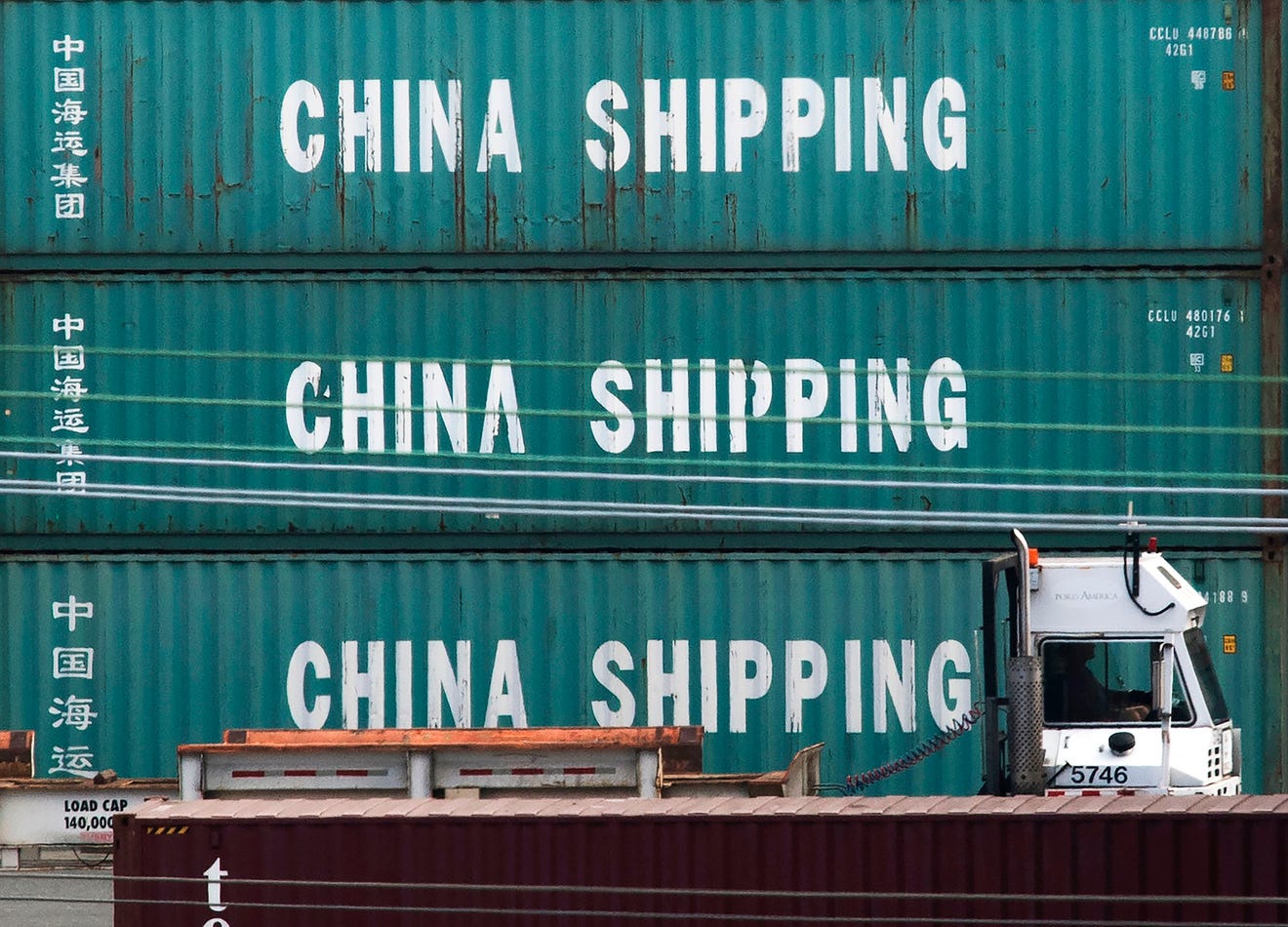

China Seeks Middle East LPG To Offset US Import Tariffs

Table of Contents

Rising US Tariffs on LPG Imports into China

The imposition of US tariffs on LPG imported into China has dramatically altered the landscape of the Chinese LPG market. These tariffs, implemented as part of the broader trade dispute, have significantly increased the cost of US LPG, making it less competitive compared to alternatives.

- Tariff Rates and Implementation: Specific tariff rates have fluctuated, but generally resulted in a substantial increase in the price of US LPG entering China. The implementation timeline saw a gradual increase in tariffs over several phases, leading to uncertainty and market volatility.

- Impact on Chinese Consumers and Industries: The increased cost of LPG has been passed on to Chinese consumers, impacting household budgets, particularly in sectors reliant on LPG for cooking and heating. Industries that utilize LPG as a feedstock or fuel have also experienced increased production costs, affecting competitiveness.

- Previous Reliance on US LPG: Before the tariffs, the US was a significant supplier of LPG to China, representing a considerable share of the Chinese LPG import market. This reliance on a single major source left China vulnerable to trade disruptions. Statistics illustrating the previous dependence on US imports would highlight the scale of the shift now underway.

The Middle East: A Viable Alternative for China's LPG Needs

The Middle East possesses substantial LPG production capacity and export potential, making it a natural alternative for China to source LPG. Several countries in the region are major LPG exporters, providing a diversified supply source to mitigate the risks associated with reliance on a single supplier.

- Key Middle Eastern Exporters: Saudi Arabia, Qatar, and the UAE are prominent LPG exporters with the infrastructure and capacity to meet a significant portion of China's growing demand. Other countries in the region also contribute to the overall supply.

- Geographical Advantages and Logistics: The relatively close proximity of Middle Eastern LPG producing nations to China offers logistical advantages. Seaborne transportation routes are well-established, providing efficient and cost-effective shipping options.

- Infrastructure: Existing port facilities and expanding pipeline networks in both the Middle East and China facilitate the smooth flow of LPG imports. Continued investment in infrastructure further enhances the efficiency and capacity of this trade route.

Economic Implications of Shifting LPG Sources

The shift in LPG sourcing presents significant economic implications for both the Middle East and China.

- Economic Benefits for Middle Eastern Countries: Increased demand from China translates into increased revenue and economic growth for Middle Eastern LPG producers. This boosts their economies and strengthens their position in the global energy market.

- Impact on Global LPG Prices: The increased demand from China, coupled with potential supply constraints in certain regions, could exert upward pressure on global LPG prices. This impacts consumers and industries worldwide.

- Challenges for Middle Eastern Producers: Meeting the significantly increased demand from China requires Middle Eastern producers to expand their production capacity and logistics infrastructure to avoid potential bottlenecks and delays.

Geopolitical Ramifications of China's Energy Diversification Strategy

China's move to diversify its LPG sources is not just an economic decision; it's a key element of its broader energy security strategy.

- China's Energy Security Strategy: Diversification of energy sources and trade partners reduces dependence on any single country and enhances China's resilience to geopolitical risks and trade disputes.

- Impact on US-China Relations: The shift away from US LPG imports further strains US-China trade relations and highlights the increasing decoupling in various sectors.

- Strengthening Ties with Middle Eastern Producers: Increased LPG trade strengthens economic and political ties between China and Middle Eastern nations, fostering closer collaboration in the energy sector.

- Implications for Other Nations: This shift in LPG trade dynamics impacts other LPG-producing and consuming nations, potentially leading to adjustments in their own energy strategies and trade relationships.

Future Outlook for China's Middle East LPG Imports

The future outlook for China Middle East LPG imports is positive, with significant growth projected over the coming years.

- Growth Projections: Analysis of China's energy demand and the capacity of Middle Eastern producers suggests a steady increase in LPG imports from the region. Specific figures would depend on various factors like economic growth and global energy markets.

- Long-Term Contracts and Partnerships: The development of long-term contracts and strategic partnerships between China and Middle Eastern nations would further solidify this trade relationship and provide greater certainty for both sides.

- Impact of Future Trade Policies and Geopolitical Events: Future trade policies and geopolitical events will undoubtedly influence the trajectory of China's Middle East LPG imports, making continuous monitoring crucial.

- Technological Advancements: Technological advancements in LPG transportation and storage will play a role in optimizing the efficiency and cost-effectiveness of LPG trade between China and the Middle East.

Conclusion

The increased US tariffs on LPG imports have triggered a significant shift in China's energy strategy, leading to a surge in China Middle East LPG imports. This move has profound economic and geopolitical consequences, impacting global LPG prices, energy security, and international relations. The strengthening of ties between China and Middle Eastern energy producers highlights the complex interplay between trade, energy security, and international politics. This dynamic will undoubtedly continue to evolve, shaping the future of global energy markets. Stay informed about the evolving dynamics of China's energy policy and its implications for global LPG trade. Follow our updates on China Middle East LPG imports and understand the crucial role of this energy trade in shaping the future global energy landscape.

Featured Posts

-

The Bold And The Beautiful Spoilers Finns Promise To Liam On Wednesday April 23

Apr 24, 2025

The Bold And The Beautiful Spoilers Finns Promise To Liam On Wednesday April 23

Apr 24, 2025 -

Faa Study Focuses On Las Vegas Airport Collision Concerns

Apr 24, 2025

Faa Study Focuses On Las Vegas Airport Collision Concerns

Apr 24, 2025 -

Pope Francis Signet Ring Its Fate After His Death And The Significance Of The Ritual

Apr 24, 2025

Pope Francis Signet Ring Its Fate After His Death And The Significance Of The Ritual

Apr 24, 2025 -

Negotiation Possible Trump Administration Responds To Harvards Lawsuit

Apr 24, 2025

Negotiation Possible Trump Administration Responds To Harvards Lawsuit

Apr 24, 2025 -

Harvard Lawsuit Trump Administration Shows Willingness To Negotiate

Apr 24, 2025

Harvard Lawsuit Trump Administration Shows Willingness To Negotiate

Apr 24, 2025

Latest Posts

-

The Epstein Files Pam Bondis Response To James Comers Claims

May 10, 2025

The Epstein Files Pam Bondis Response To James Comers Claims

May 10, 2025 -

Pam Bondi And James Comer Clash Over Epstein Files

May 10, 2025

Pam Bondi And James Comer Clash Over Epstein Files

May 10, 2025 -

The Daily Fox News Briefings Analyzing The Us Attorney Generals Role

May 10, 2025

The Daily Fox News Briefings Analyzing The Us Attorney Generals Role

May 10, 2025 -

Fox News And The Us Attorney General Unpacking The Daily Dialogue

May 10, 2025

Fox News And The Us Attorney General Unpacking The Daily Dialogue

May 10, 2025 -

James Comers Epstein Files Tirade Pam Bondis Response

May 10, 2025

James Comers Epstein Files Tirade Pam Bondis Response

May 10, 2025